Minnesota Assignment of Principal Obligation and Guaranty

Description

How to fill out Assignment Of Principal Obligation And Guaranty?

Have you been within a position where you require paperwork for both organization or individual purposes virtually every working day? There are plenty of lawful document layouts available on the net, but finding kinds you can depend on is not straightforward. US Legal Forms delivers a huge number of develop layouts, like the Minnesota Assignment of Principal Obligation and Guaranty, that are created to satisfy federal and state requirements.

Should you be previously acquainted with US Legal Forms website and also have a free account, just log in. Following that, you are able to acquire the Minnesota Assignment of Principal Obligation and Guaranty format.

If you do not have an bank account and need to begin using US Legal Forms, abide by these steps:

- Get the develop you want and ensure it is to the correct area/region.

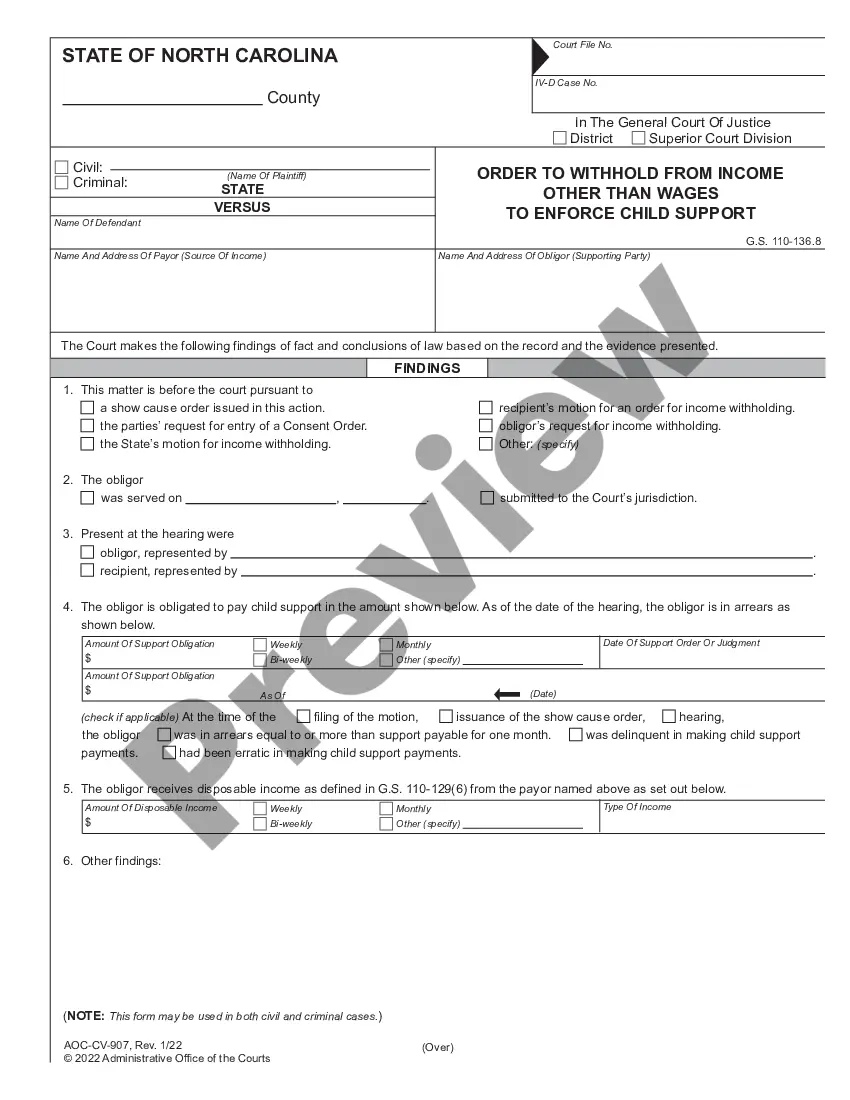

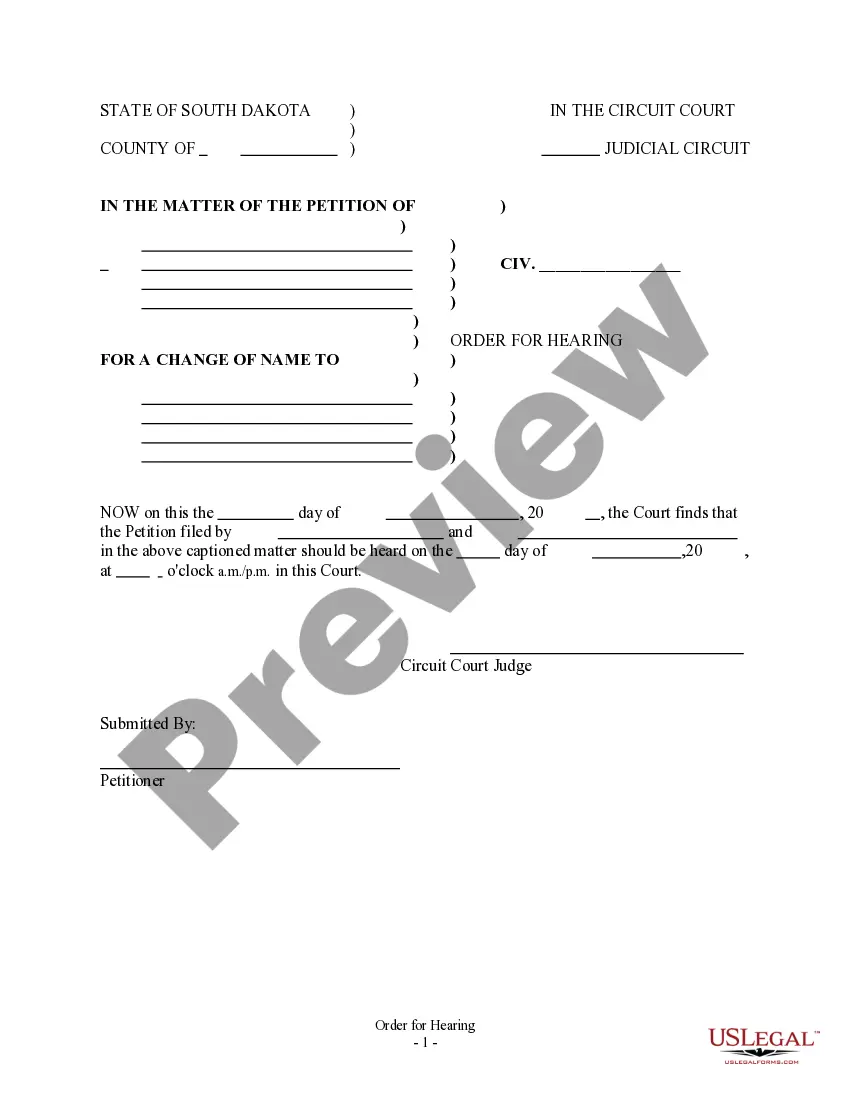

- Take advantage of the Review switch to check the shape.

- Look at the description to actually have chosen the proper develop.

- If the develop is not what you are looking for, utilize the Search discipline to find the develop that meets your requirements and requirements.

- If you get the correct develop, simply click Purchase now.

- Opt for the costs plan you desire, submit the desired info to create your money, and buy your order with your PayPal or Visa or Mastercard.

- Pick a convenient data file formatting and acquire your copy.

Find every one of the document layouts you might have bought in the My Forms food selection. You can get a further copy of Minnesota Assignment of Principal Obligation and Guaranty any time, if necessary. Just click the necessary develop to acquire or printing the document format.

Use US Legal Forms, by far the most substantial collection of lawful types, in order to save time as well as avoid blunders. The support delivers professionally manufactured lawful document layouts which can be used for an array of purposes. Create a free account on US Legal Forms and begin making your daily life a little easier.

Form popularity

FAQ

The driver of a vehicle intending to turn to the left within an intersection or into an alley, private road, or driveway shall yield the right-of-way to any vehicle approaching from the opposite direction which is within the intersection or so close thereto as to constitute an immediate hazard.

The Minnesota Common Interest Ownership Act, or MCIOA, governs the legal standing and obligations of townhome associations, primarily condominium associations, created on or after June 1, 1994. Townhome associations created before this date must opt into the MCIOA.

The due-on-sale (a.k.a "acceleration clause") gives the lender the right to call the loan due. It does not say that the loan must be called due, only that the lender has the option, if they so choose.

(1) The share of future appreciation of the mortgaged property which the lender or mortgagee may receive shall be limited to the proportionate amount produced by dividing the lesser of the acquisition cost or fair market value of the mortgaged property at the time the conventional loan is made into the original ...

(d) ?Interest rate or discount point agreement? or ?agreement? means a contract between a lender and a borrower under which the lender agrees, subject to the lender's underwriting and approval requirements, to make a loan at a specified interest rate or number of discount points, or both, and the borrower agrees to ...

Choice of law clause, also known as a governing law clause, that allows the contract parties to choose the substantive law of Minnesota to apply to the contract.

(a) The parties may agree in writing, either in the loan contract or credit sale contract or in a subsequent agreement, to a deferment of wholly unpaid installments. For precomputed loans and credit sale contracts, the manner of deferment charge shall be determined as provided for in this section.

Whether your contract allows for payments over time or simply includes a late fee for overdue payments, usury laws determine the maximum amount of interest you can charge. For most contracts in Minnesota, the interest rate for any debt must not exceed 6% unless a different rate is contracted for in writing.