Minnesota Sample Letter for Re-Request of Execution of Petition For Authority to Sell Property of Estate etc.

Description

How to fill out Sample Letter For Re-Request Of Execution Of Petition For Authority To Sell Property Of Estate Etc.?

Are you currently inside a situation the place you require paperwork for both business or person uses nearly every day? There are plenty of lawful file layouts available on the net, but locating ones you can trust is not easy. US Legal Forms offers thousands of kind layouts, much like the Minnesota Sample Letter for Re-Request of Execution of Petition For Authority to Sell Property of Estate etc., that are composed to fulfill state and federal requirements.

Should you be already informed about US Legal Forms web site and get your account, merely log in. Afterward, you can acquire the Minnesota Sample Letter for Re-Request of Execution of Petition For Authority to Sell Property of Estate etc. template.

Should you not come with an bank account and want to start using US Legal Forms, abide by these steps:

- Discover the kind you want and make sure it is to the correct city/area.

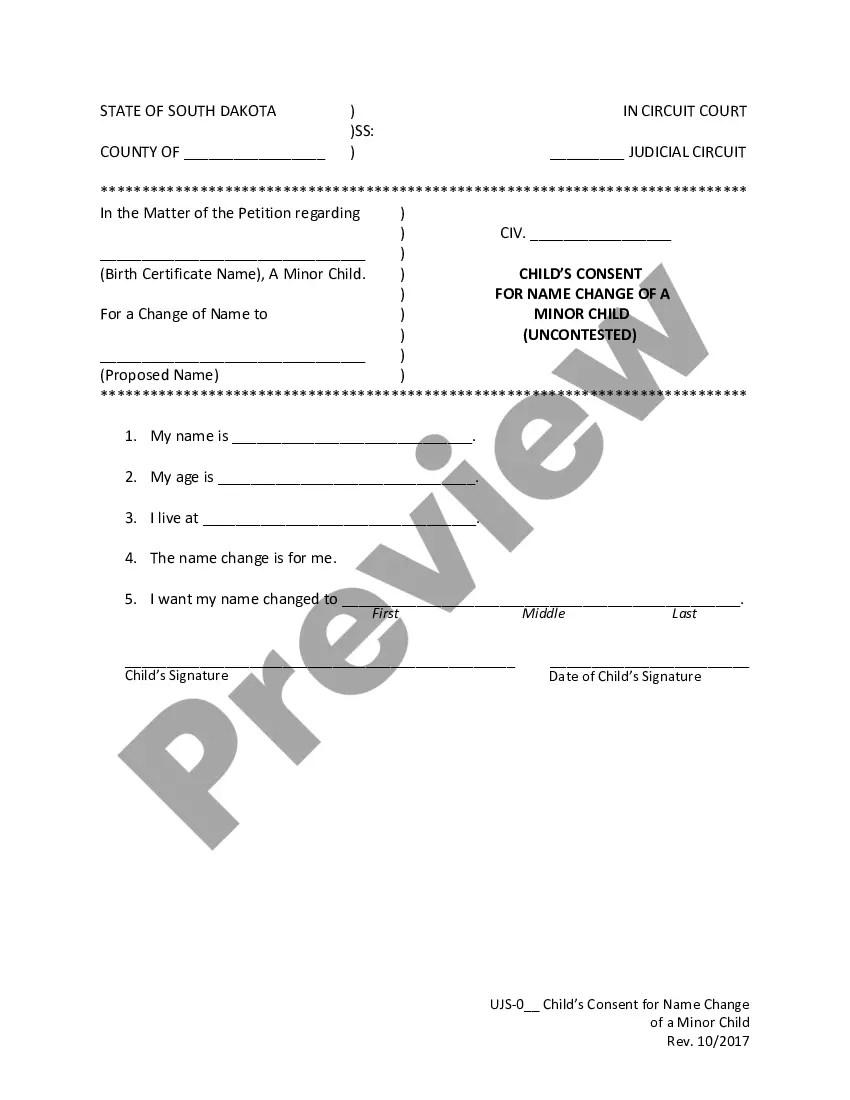

- Take advantage of the Review switch to analyze the form.

- Read the description to actually have chosen the correct kind.

- In the event the kind is not what you are looking for, make use of the Lookup industry to find the kind that meets your needs and requirements.

- Whenever you find the correct kind, click on Acquire now.

- Select the rates prepare you would like, submit the desired details to generate your account, and pay money for the transaction utilizing your PayPal or charge card.

- Pick a hassle-free document structure and acquire your duplicate.

Locate all of the file layouts you may have purchased in the My Forms menus. You may get a additional duplicate of Minnesota Sample Letter for Re-Request of Execution of Petition For Authority to Sell Property of Estate etc. any time, if necessary. Just select the necessary kind to acquire or print the file template.

Use US Legal Forms, by far the most considerable selection of lawful varieties, to save time and avoid errors. The services offers appropriately manufactured lawful file layouts which can be used for a range of uses. Produce your account on US Legal Forms and commence making your daily life easier.

Form popularity

FAQ

Non-Probate Assets bank or brokerage accounts that are held jointly or with a payable-on-death beneficiary designation to a surviving person; investment or retirement accounts or insurance policies that have a designated beneficiary other than the decedent that survives the decedent; or. property held in a trust.

Inheritance Rights Law in MN The surviving spouse usually will inherit the whole estate, unless there is a will that provides otherwise. Even if there is a will the partially or entirely disinherits a spouse, the surviving spouse may elect their statutory share.

If your personal property exceeds $75,000 or you own real estate in your name alone, your estate must be probated.

Trusts. One of the most popular ways to avoid probate is by having a revocable living trust as part of your estate plan.

There's no easy way to say how long Minnesota probate should take, but one year is a good rule of thumb. An estate that includes a clear will and beneficiaries who can get along may take less than a year whereas one that involves taxes, challenges, multiple attorneys, or other complications can drag on much longer.

Minnesota law allows people to establish living trusts to avoid probate for most every asset that you own. This includes real estate, vehicles, bank accounts, art collections, and more. In order to create a living trust, a trust document needs to be established. This is similar to a will.

If your personal property exceeds $75,000 or you own real estate in your name alone, your estate must be probated.

One of the most common ways to avoid probate is to create a living trust. Through a living trust, the person writing the trust (grantor) must "fund the trust" by putting the assets they choose into it. The grantor retains control over the trust's property until their death or incapacitation.