Minnesota Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

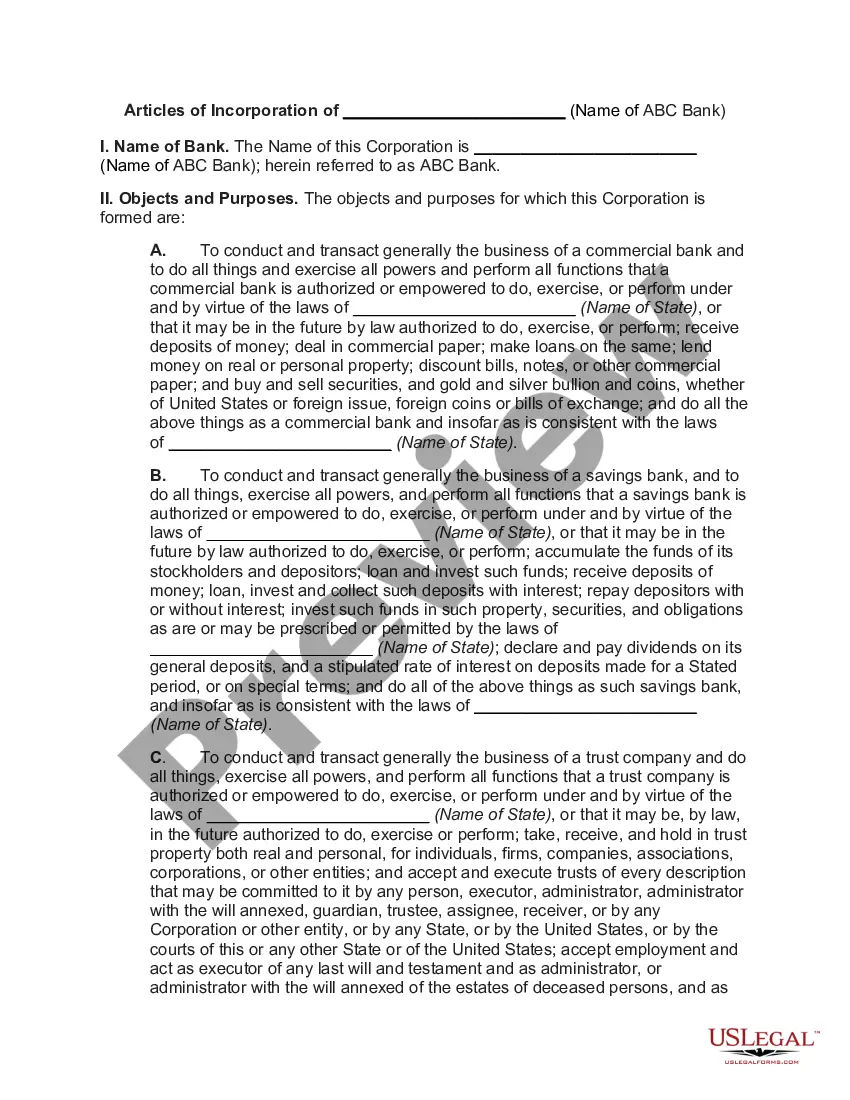

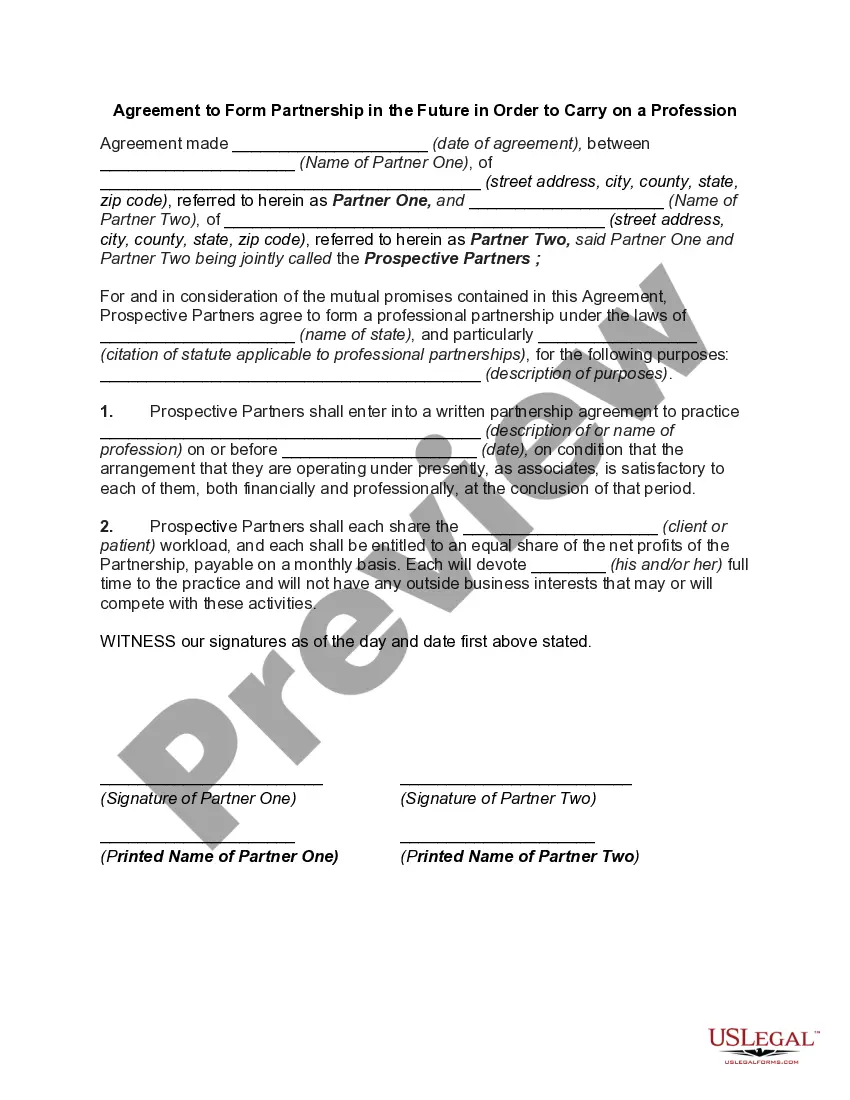

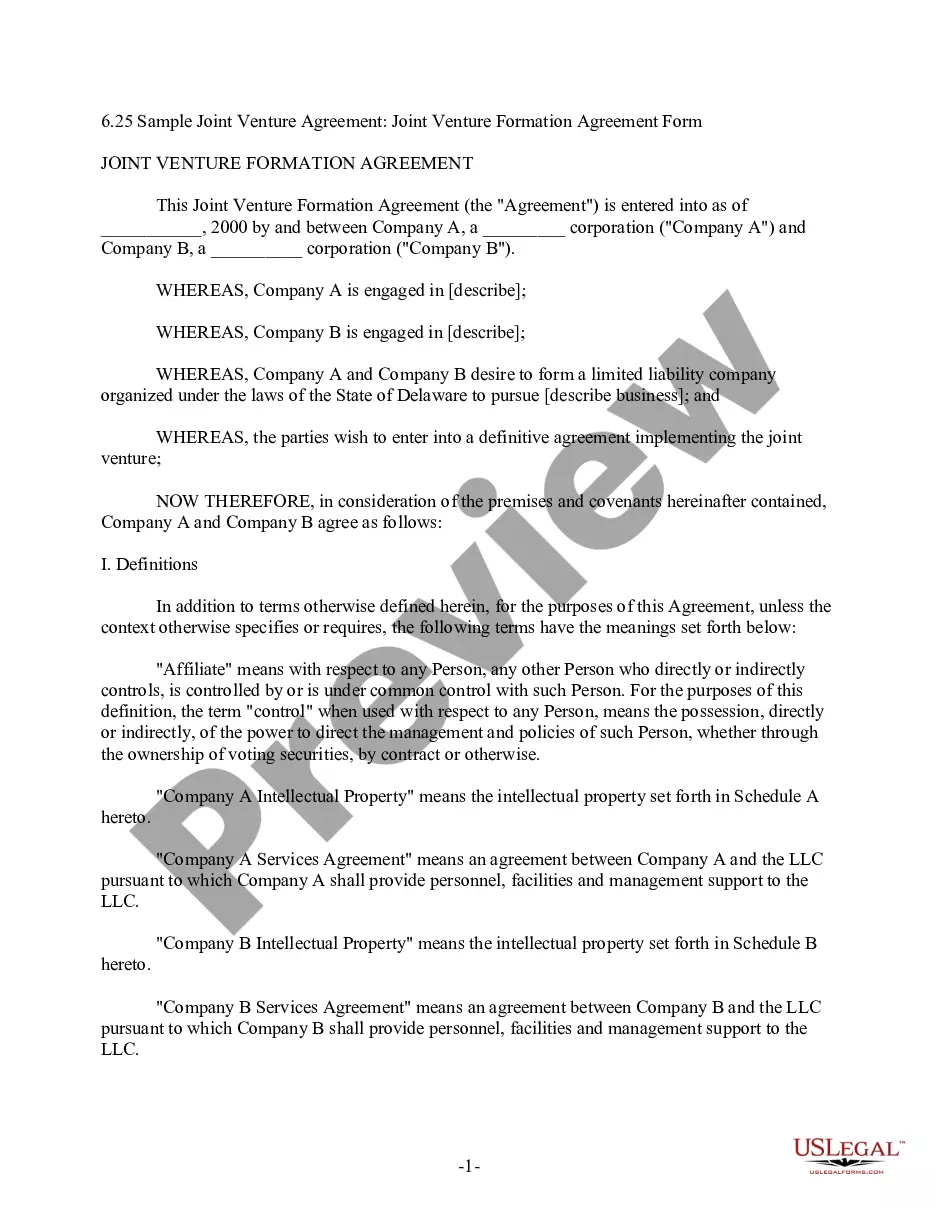

The proper form and necessary content of articles or certificates of incorporation for a nonprofit corporation depend largely on the requirements of the state nonprofit corporation act in the state of incorporation. Typically nonprofit corporations have no capital stock and therefore have members, not stockholders. Because federal tax-exempt status will be sought for most nonprofit corporations, the articles or certificate of incorporation must be carefully drafted to include specific language designed to ensure qualification for tax-exempt status.

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

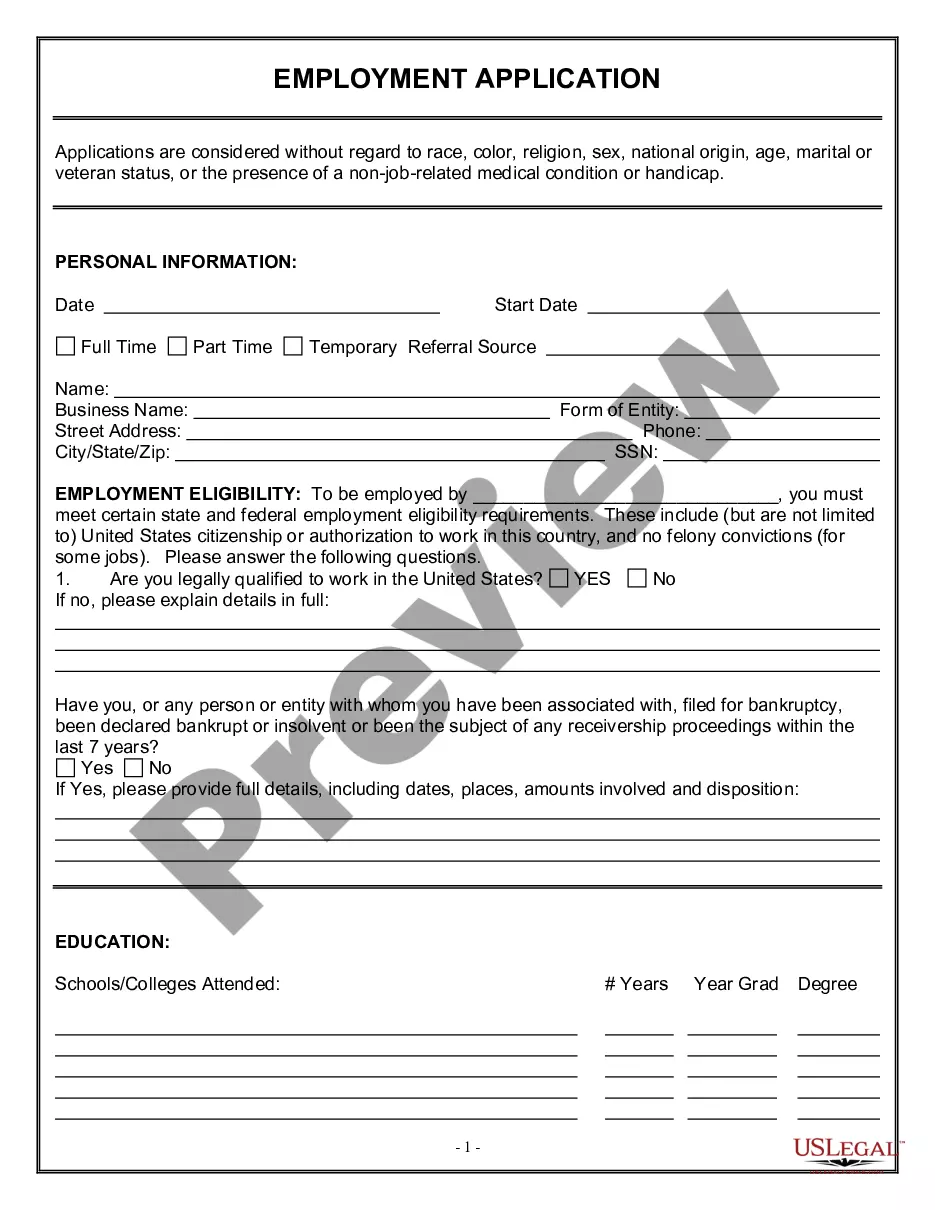

If you wish to total, down load, or print authorized file templates, use US Legal Forms, the largest assortment of authorized kinds, which can be found on the Internet. Take advantage of the site`s simple and practical research to discover the documents you will need. Different templates for organization and individual uses are sorted by classes and states, or keywords and phrases. Use US Legal Forms to discover the Minnesota Articles of Incorporation, Not for Profit Organization, with Tax Provisions with a few click throughs.

When you are previously a US Legal Forms client, log in to your profile and click on the Download key to get the Minnesota Articles of Incorporation, Not for Profit Organization, with Tax Provisions. You can also accessibility kinds you formerly delivered electronically inside the My Forms tab of the profile.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have chosen the form for the proper town/land.

- Step 2. Take advantage of the Review method to look over the form`s articles. Do not overlook to see the information.

- Step 3. When you are not happy with the form, use the Search area at the top of the display to discover other versions of the authorized form design.

- Step 4. After you have identified the form you will need, select the Buy now key. Select the pricing program you like and add your references to sign up on an profile.

- Step 5. Approach the purchase. You should use your credit card or PayPal profile to complete the purchase.

- Step 6. Pick the structure of the authorized form and down load it on your own product.

- Step 7. Complete, change and print or indication the Minnesota Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

Every authorized file design you get is yours permanently. You possess acces to each and every form you delivered electronically within your acccount. Go through the My Forms section and choose a form to print or down load yet again.

Compete and down load, and print the Minnesota Articles of Incorporation, Not for Profit Organization, with Tax Provisions with US Legal Forms. There are millions of professional and express-distinct kinds you can utilize for your organization or individual demands.

Form popularity

FAQ

Are Nonprofits Taxed? Nonprofit organizations are exempt from federal income taxes under subsection 501(c) of the Internal Revenue Service (IRS) tax code. A nonprofit organization is an entity that engages in activities for both public and private interest without pursuing the goal of commercial or monetary profit.

Nonprofits may also be exempt from property and sales tax in Minnesota. These exemptions are not automatically based on 501(c)(3) determination. If an organization is applying for exemption for the first time, it must secure the application from and apply to its county assessor (or in some cases, a city assessor).

Furthermore, services are not taxable unless specifically included by law. Examples of taxable services include lodging, laundry and cleaning services, pet grooming, lawn care, digital downloads, and telecommunications. A remote seller is a retailer that does not have a physical presence in the state.

Minnesota law exempts certain nonprofit organizations from paying Sales and Use Tax. To get this exemption, an organization must apply to the Minnesota Department of Revenue for authorization, known as Nonprofit Exempt Status.

As per the internal revenue code, 501(c)3 is a nonprofit organization for religious, charitable, scientific, and educational purposes. Donations to 501(c)3 are tax-deductible. Whereas on the other hand, 501(c)4 is a social welfare group, and donations to 501(c)4 are not tax-deductible.

How to Start a Nonprofit in Minnesota Name Your Organization. ... Recruit Incorporators and Initial Directors. ... Appoint a Registered Agent. ... Prepare and File Articles of Incorporation. ... File Initial Report. ... Obtain an Employer Identification Number (EIN) ... Store Nonprofit Records. ... Establish Initial Governing Documents and Policies.

The IRS may initiate an audit if it feels fundraising expenses are not in proper proportion to fundraising income. Most nonprofit organizations are aware that the IRS frowns on unusually high executive compensation.

Any nonprofit group or organization, unless exempt, located in Minnesota must register with the Minnesota Attorney General. Any non-exempt nonprofit, in any state, intending to solicit in Minnesota must also register, along with anyone intending to solicit in Minnesota on behalf of a nonprofit.