Minnesota Lease of Hotel

Description

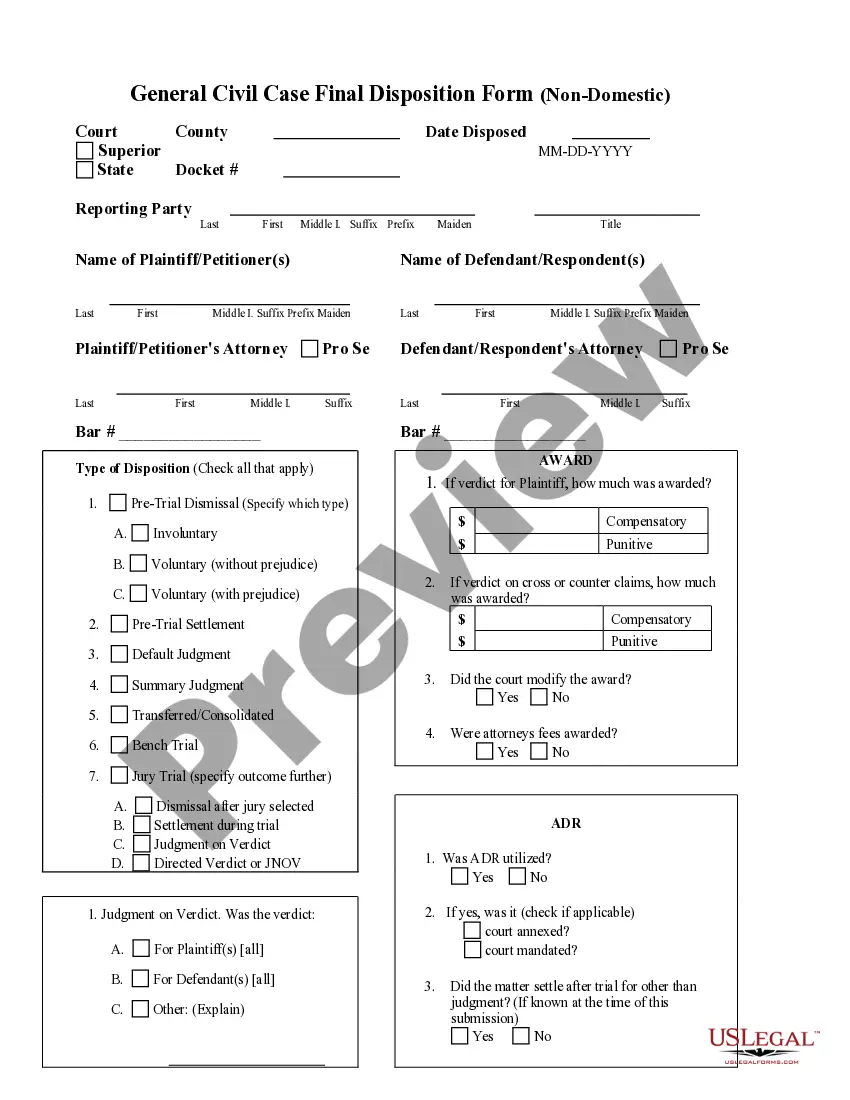

How to fill out Lease Of Hotel?

If you wish to finalize, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the website's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Select the pricing plan you prefer and enter your information to sign up for an account.

Finalize the transaction. You can use your Visa or MasterCard or PayPal account to complete the purchase.

- Utilize US Legal Forms to find the Minnesota Lease of Hotel within just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Acquire option to get the Minnesota Lease of Hotel.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to review the form's details. Don't forget to read the description.

- Step 3. If you are dissatisfied with the type, use the Search field at the top of the screen to find other forms in the legal form template.

- Step 4. Once you find the form you need, click on the Purchase now option.

Form popularity

FAQ

Yes, a lease is valid in Minnesota even if it is not notarized. A signature from both parties indicates mutual consent to the terms outlined in the lease. However, getting the lease notarized can help reduce potential disputes, as it adds a layer of authenticity. Using resources like US Legal Forms can help you create a solid lease agreement that meets your needs.

When signing a lease, you typically need identification, proof of income, and a security deposit. For a Minnesota Lease of Hotel, both parties should review the lease terms and conditions thoroughly. It's also advisable to obtain a copy of the signed lease for your records. Understanding all the requirements can help facilitate a smooth leasing process.

Yes, a handwritten lease agreement can be legally binding in Minnesota, provided it contains the essential elements of a contract. This includes agreement from both parties on terms such as rent amount, duration, and other responsibilities. However, clarity is key, so ensure that the document is clear and comprehensive. To avoid complications, consider using official templates available from US Legal Forms.

In Minnesota, the hotel tax typically includes a sales tax and a local lodging tax, which may vary by location. The combined rate generally hovers around 10 percent, but certain cities or counties may have additional assessments. When entering a Minnesota Lease of Hotel, be aware of these taxes as they can affect your operating costs. Staying informed can help you budget more effectively.

In Minnesota, an assignment of lease does not always need to be notarized, but doing so can provide added security. Notarization offers verification of the identities of involved parties and confirms their agreement. Although it may not be legally required, having a notarized document can prevent disputes. Always consult legal resources or professionals for your specific situation.

Yes, you can write your own lease agreement for a Minnesota Lease of Hotel. While it is possible to create a lease from scratch, ensure that you include all necessary terms and conditions. It's essential to follow Minnesota state laws to protect your interests. Using a template from a trusted source, like US Legal Forms, can simplify this process.

Hotels in Minnesota are primarily regulated by the Minnesota Department of Health and local government entities, which oversee compliance with health and safety codes. These regulations ensure that hotels maintain standards, providing a safe environment for guests. Familiarizing yourself with these regulations is crucial when entering into a Minnesota Lease of Hotel.

Hotel leases allow lessees to operate the hotel while paying rent to the owner, usually outlined in a detailed agreement. This structure enables the lessee to manage day-to-day operations without owning the property outright. It's essential to understand the specific terms of the lease to ensure compliance and success in the hospitality industry.

You can obtain a commercial lease by identifying a property and contacting the owner or real estate agent representing it. Next, prepare your financial documentation, including your credit score and business plan, to demonstrate your qualifications. Once terms are negotiated, you can sign the lease agreement and commence operations.

Typically, a credit score of 650 or higher is preferred for a Minnesota Lease of Hotel, but requirements can vary by landlord. A stronger credit score signals reliability to landlords, increasing your chances of approval. It's beneficial to improve your credit score before applying to secure favorable lease terms.