Minnesota Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Consumer Loan Application - Personal Loan Agreement?

If you wish to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the most extensive range of legal forms available online.

Take advantage of the site’s simple and convenient search to find the documents you require.

A selection of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have identified the form you need, click the Purchase now option. Choose the pricing plan you prefer and enter your details to sign up for an account.

Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Use US Legal Forms to acquire the Minnesota Consumer Loan Application - Personal Loan Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Acquire option to retrieve the Minnesota Consumer Loan Application - Personal Loan Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow these steps.

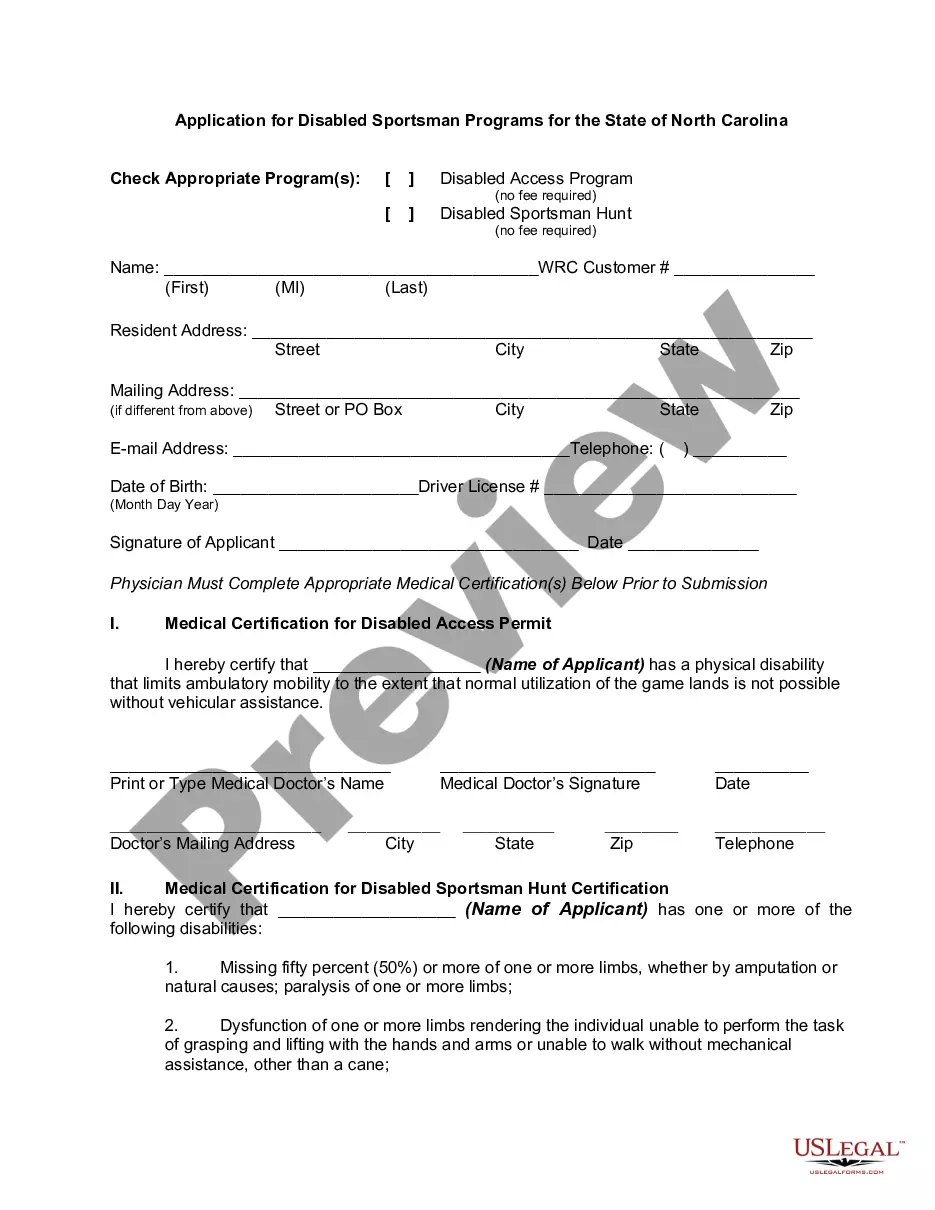

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to browse the form’s content. Don’t forget to read the details.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

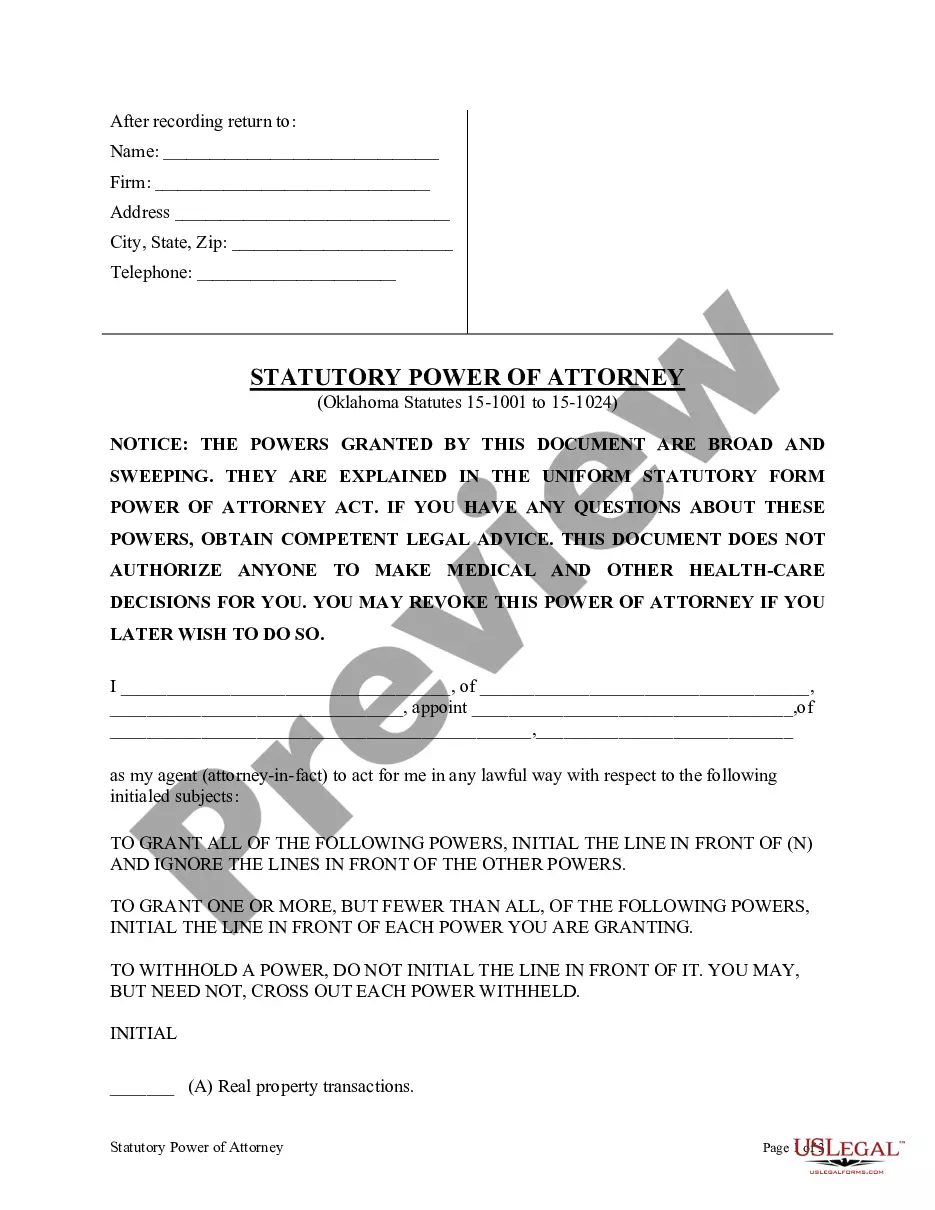

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

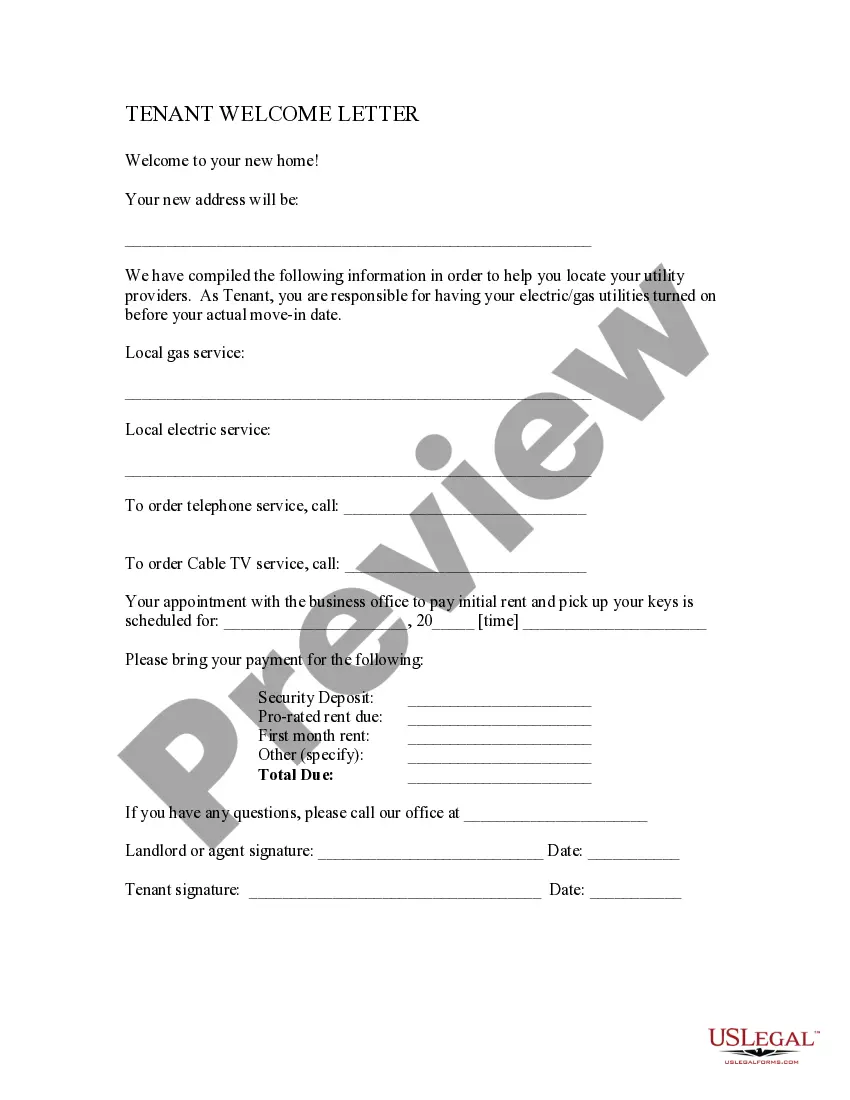

A loan agreement should accompany any loan of money. For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

They are designed to set expectations for a loan so that both the borrower and the lender understand the terms. A personal loan agreement can be referred to if there are questions about repayment, and it can be used to legally enforce terms if one party doesn't adhere to them.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.

A consumer credit contract is a formal written agreement to borrow money, or pay something off over time, for personal use. You pay interest and fees for the use of the bank or finance company's money. One or more of your assets might secure the loan. Examples include: vehicle finance to buy a car, van, or boat.

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.