Minnesota Sale of Goods, Short Form

Description

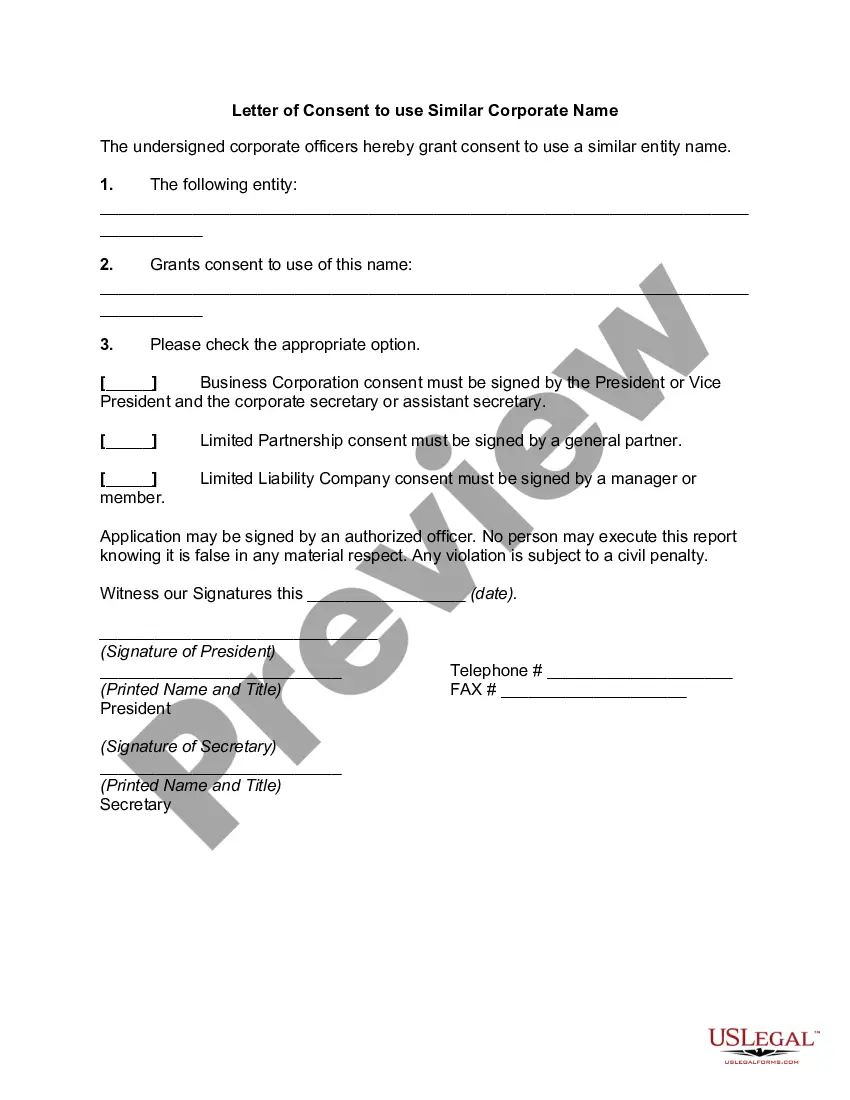

How to fill out Sale Of Goods, Short Form?

Are you located in a setting where you require documentation for both professional and personal applications almost every day.

There are numerous licensed form templates accessible online, but acquiring versions you can trust isn’t straightforward.

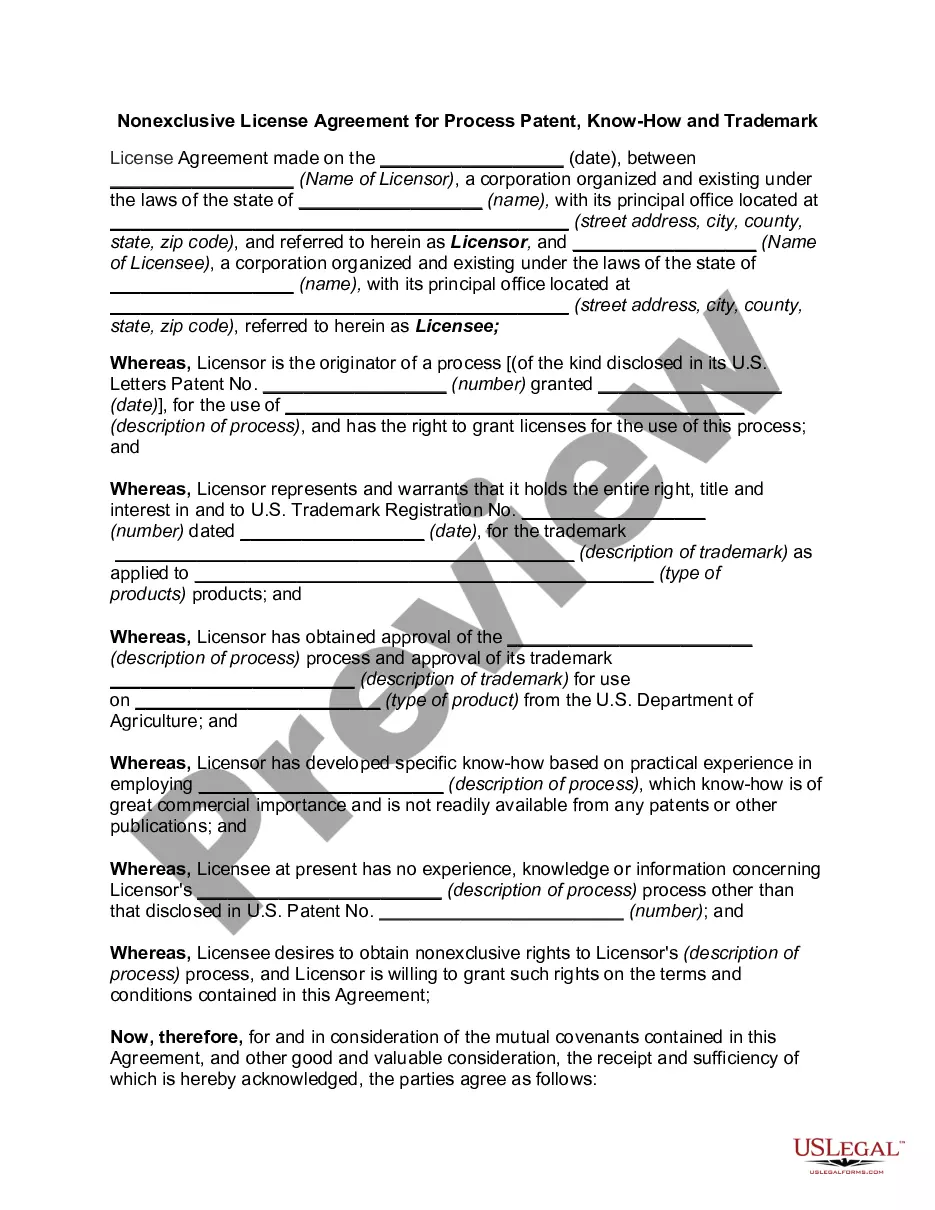

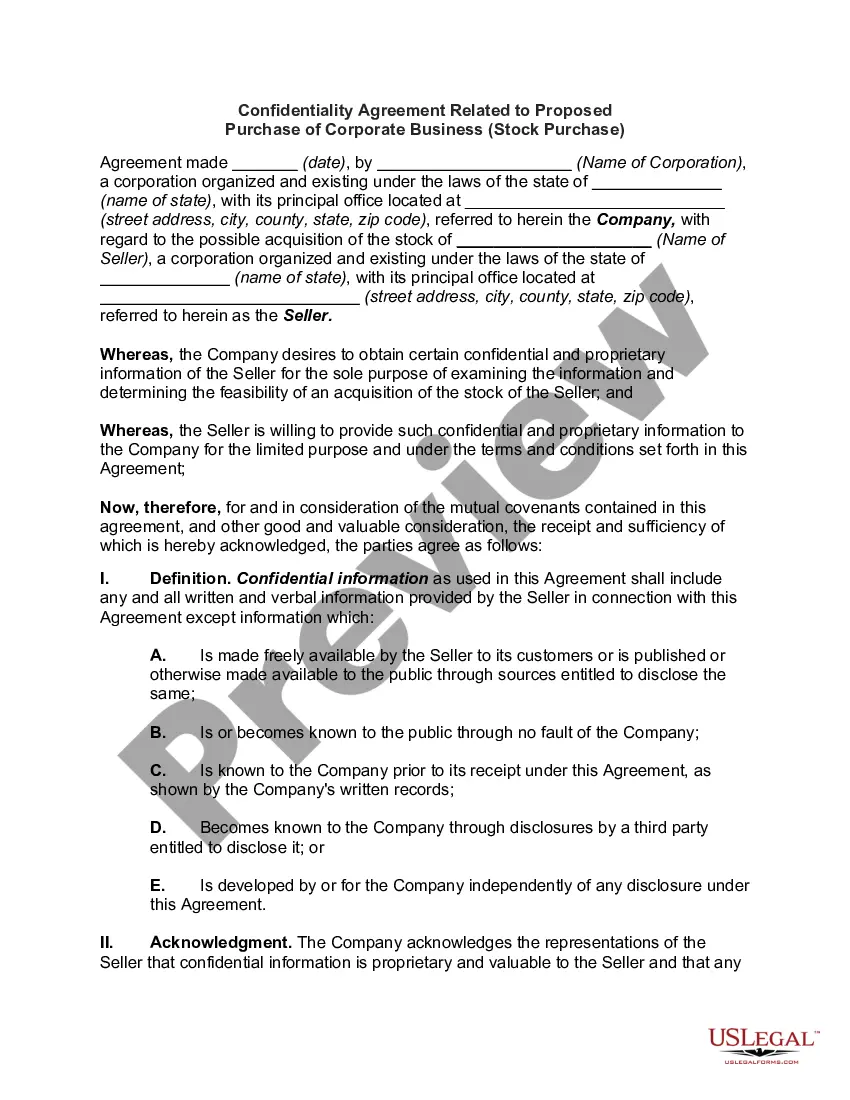

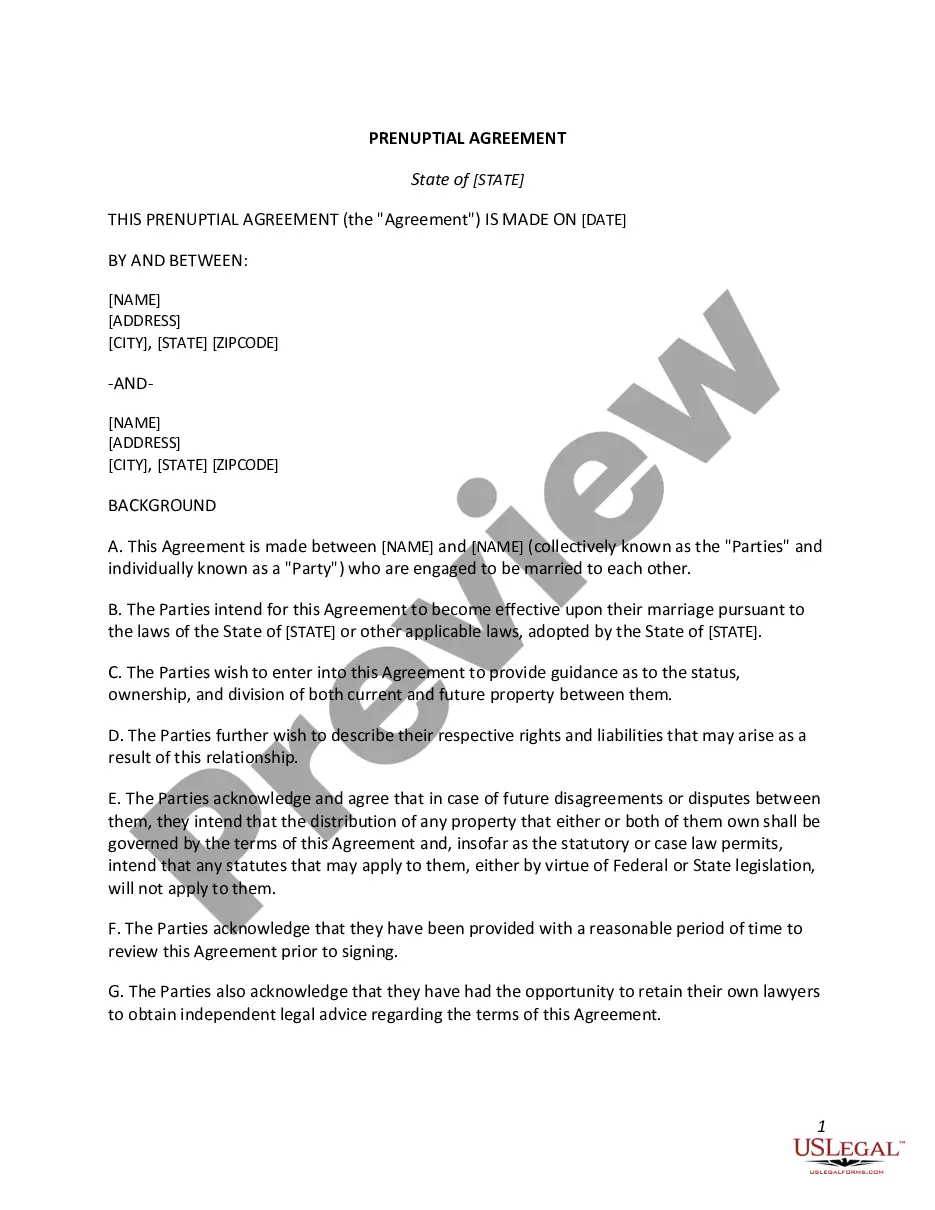

US Legal Forms offers thousands of document templates, including the Minnesota Sale of Goods, Short Form, which are crafted to meet federal and state requirements.

Once you locate the correct form, click Acquire now.

Select the payment plan you prefer, fill in the required information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you will be able to download the Minnesota Sale of Goods, Short Form template.

- If you do not possess an account and wish to start utilizing US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

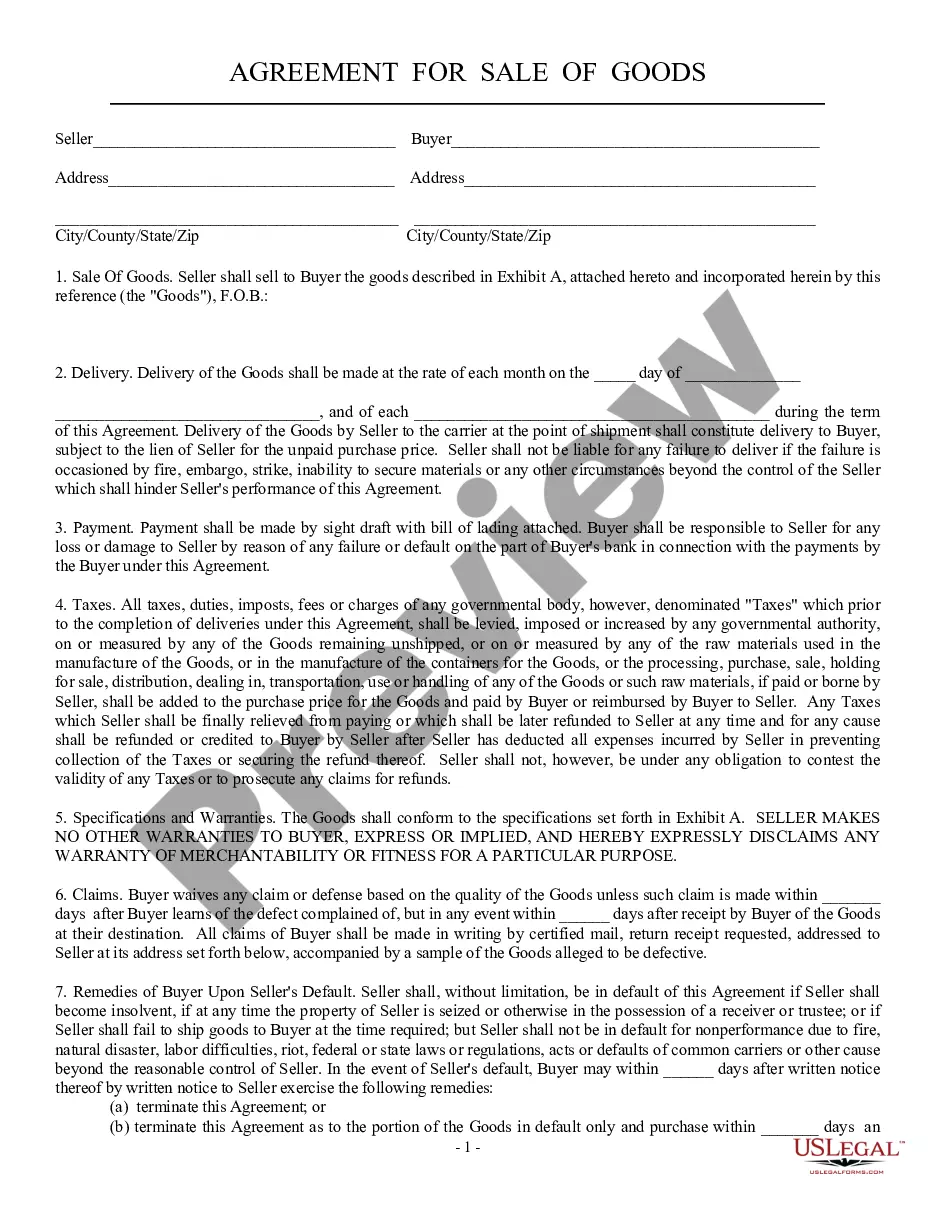

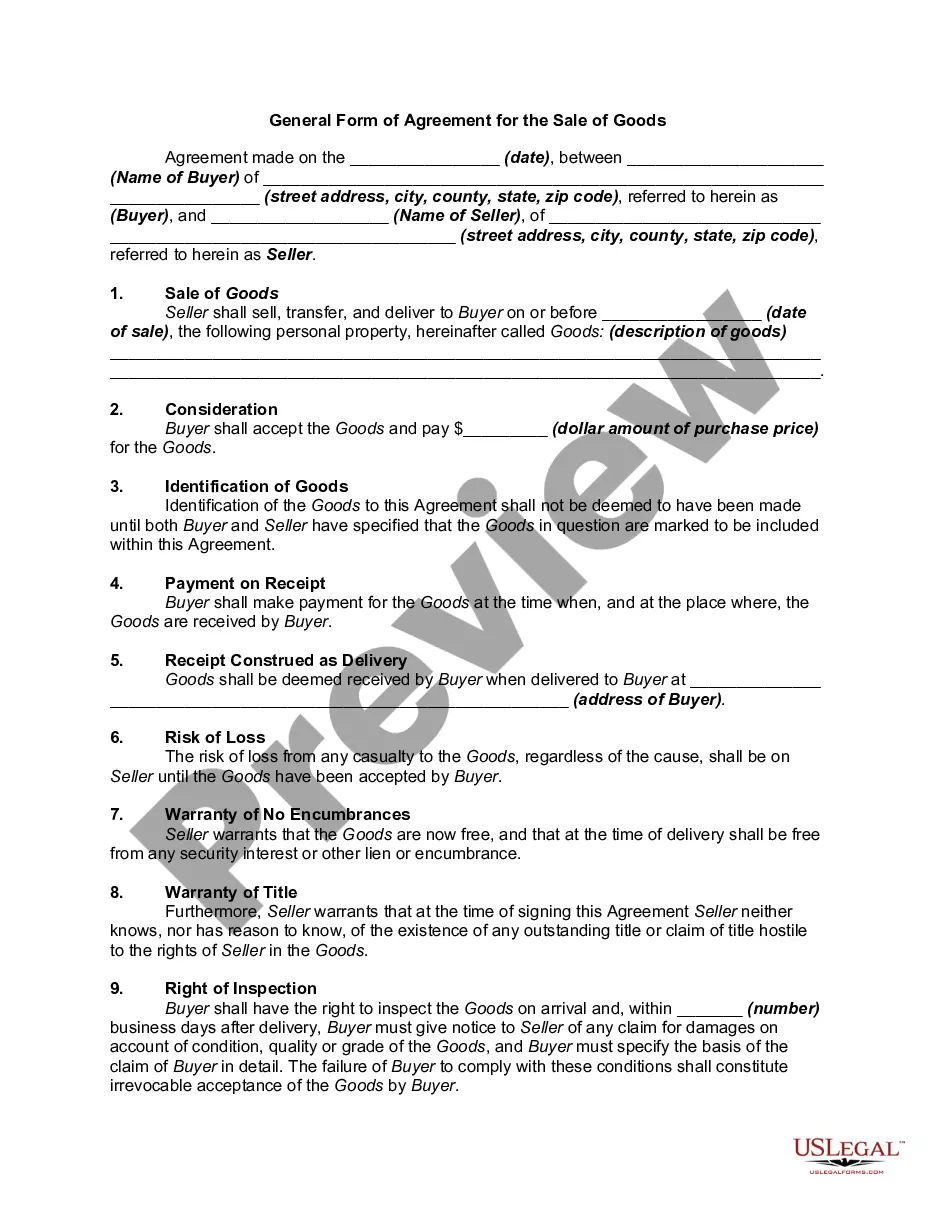

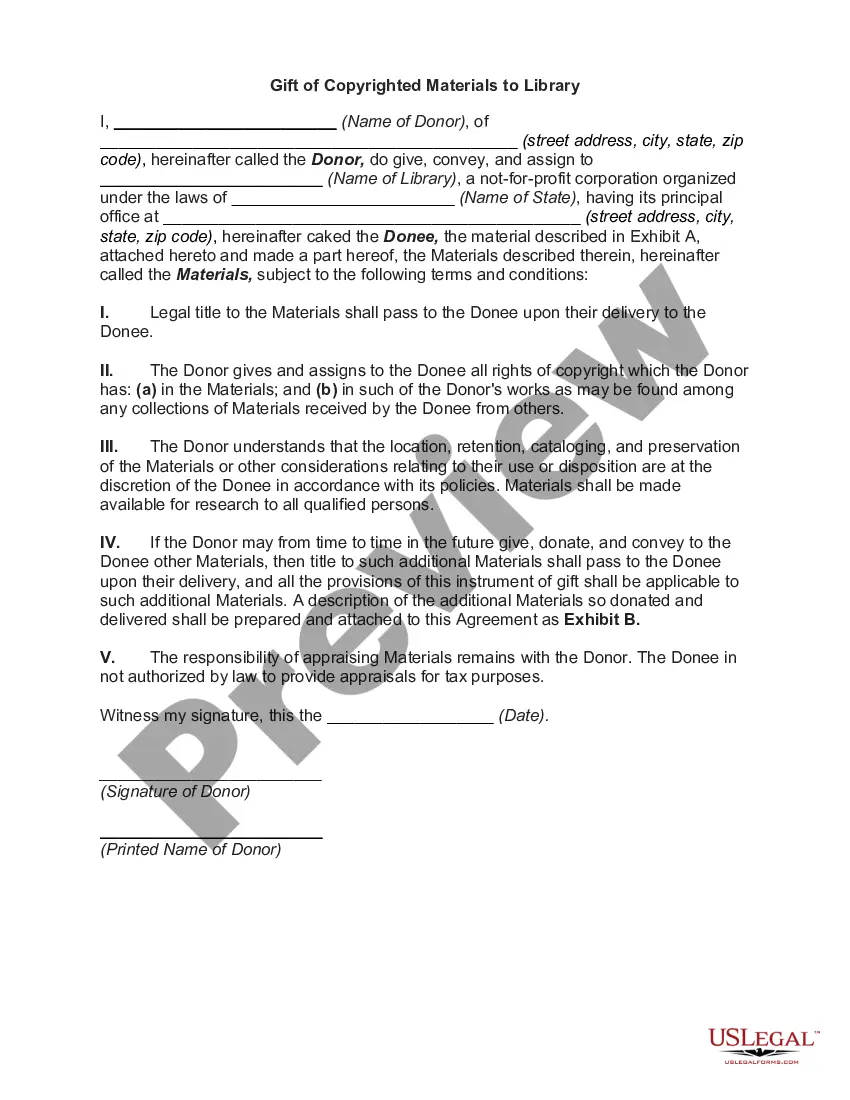

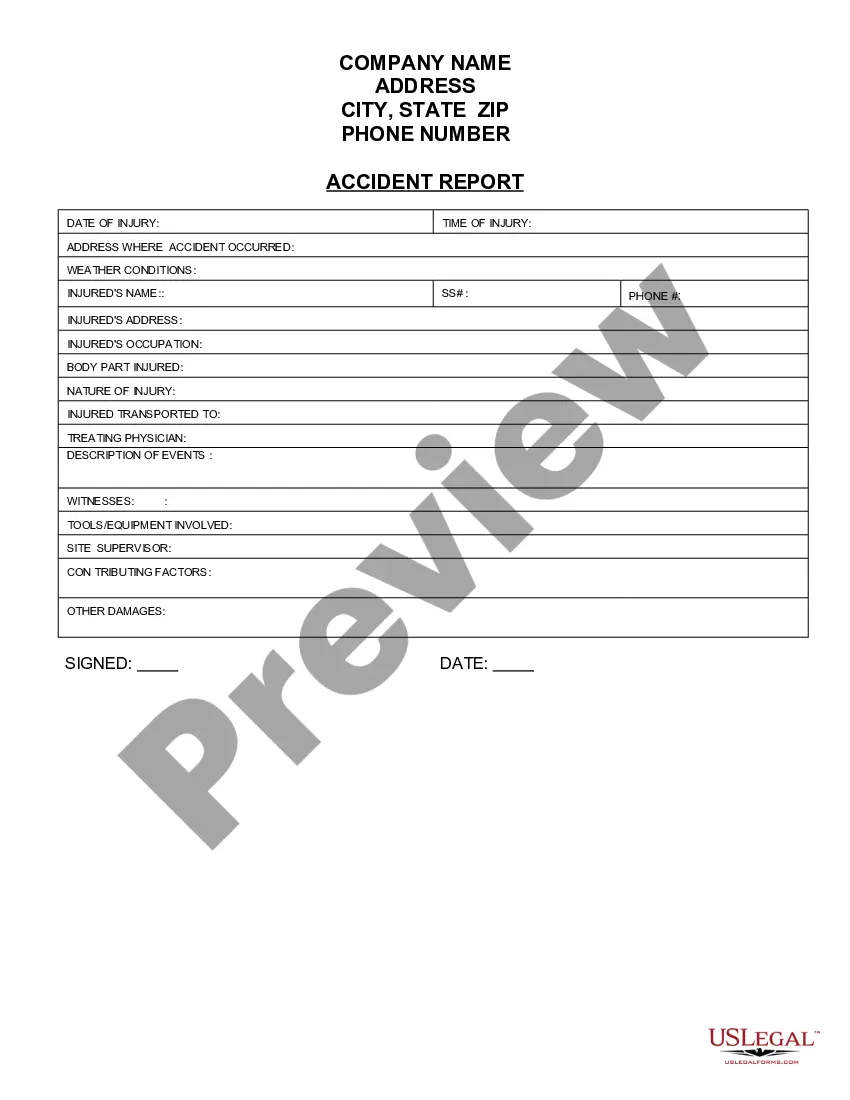

- Use the Review button to scrutinize the document.

- Examine the details to ensure you have selected the appropriate form.

- If the form is not what you're looking for, utilize the Lookup field to find the form that fits your needs.

Form popularity

FAQ

To obtain a US sales tax exemption certificate, you first need to identify the specific requirements of the state where you operate, such as Minnesota. Generally, a completed application and proof of tax-exempt status are necessary. It's important to ensure that your documentation aligns with the Minnesota Sale of Goods, Short Form. For further assistance and detailed templates, uslegalforms is a reliable resource to simplify this process.

Acquiring a resale certificate in Minnesota requires you to demonstrate that you will resell goods in the regular course of your business. Typically, you will need to fill out a resale certificate form which can be obtained from the Minnesota Department of Revenue. This form is essential for making purchases without paying sales tax, as it aligns with the Minnesota Sale of Goods, Short Form. Consider using uslegalforms for a streamlined application process.

To get your exemption certificate, start by confirming your eligibility under the Minnesota Sale of Goods, Short Form. Then, complete the required forms from the Minnesota Department of Revenue. After submission, keep track of your application status to ensure you receive your certificate promptly. The uslegalforms platform can assist you with templates and guidance throughout this process.

Obtaining a sales tax exemption certificate in Minnesota involves a few steps. First, you will need to fill out the appropriate application form provided by the Minnesota Department of Revenue. This process may include providing supporting documents that justify your exemption under the Minnesota Sale of Goods, Short Form. Once completed, submit your application for approval.

To qualify as a tax exempt individual in Minnesota, you typically need to provide proof of your tax-exempt status. This often includes documentation that proves your organization or use of goods falls under specific exemptions. The Minnesota Sale of Goods, Short Form, might apply depending on the nature of your transactions. It's important to understand the specific criteria set by the Minnesota Department of Revenue.

To determine the 7% tax of $100, you would multiply 100 by 0.07. This results in a tax of $7, which means the total payment would be $107. Understanding these calculations is essential for the Minnesota Sale of Goods, Short Form, ensuring you apply the correct tax rates.

In Minnesota, sales tax is reported via the Department of Revenue. You will need to file a sales tax return, usually on a monthly, quarterly, or annual basis, depending on your total sales. Keeping detailed records simplifies this process, especially when using services like USLegalForms to track your sales and taxes efficiently. This is particularly important when dealing with the Minnesota Sale of Goods, Short Form.

Minnesota sales encompass a range of transactions involving goods and services within the state. This includes retail sales, online sales, and other business-to-business dealings. Understanding Minnesota sales is key for compliance, as it involves accurately collecting sales tax as per the Minnesota Sale of Goods, Short Form. Leveraging platforms like uslegalforms can simplify documentation and compliance for businesses in this arena.

Minnesota is widely known for its beautiful lakes, vibrant culture, and strong economy. The state boasts a reputation for outdoor activities, a thriving arts scene, and the Mall of America. Additionally, its businesses, including those involved in the Minnesota Sale of Goods, Short Form, contribute significantly to the economy. Embracing Minnesota’s unique features can enhance your business presence and appeal.

The sales tax rate for Minnesota is currently 6.875%, applicable to the sale of most goods and some services. This rate can vary if local jurisdictions impose additional taxes. It’s crucial for businesses to stay compliant by accurately calculating sales tax when selling goods in Minnesota. Information related to the Minnesota Sale of Goods, Short Form can help you navigate these regulations seamlessly.