This form can be used as a guide in preparing an agreement involving a close corporation or a Subchapter S corporation buying all of the stock of one of its shareholders.

Minnesota Agreement to Purchase Common Stock of a Shareholder by the Corporation with an Exhibit of a Bill of Sale and Assignment of Stock by Separate Instrument

Description

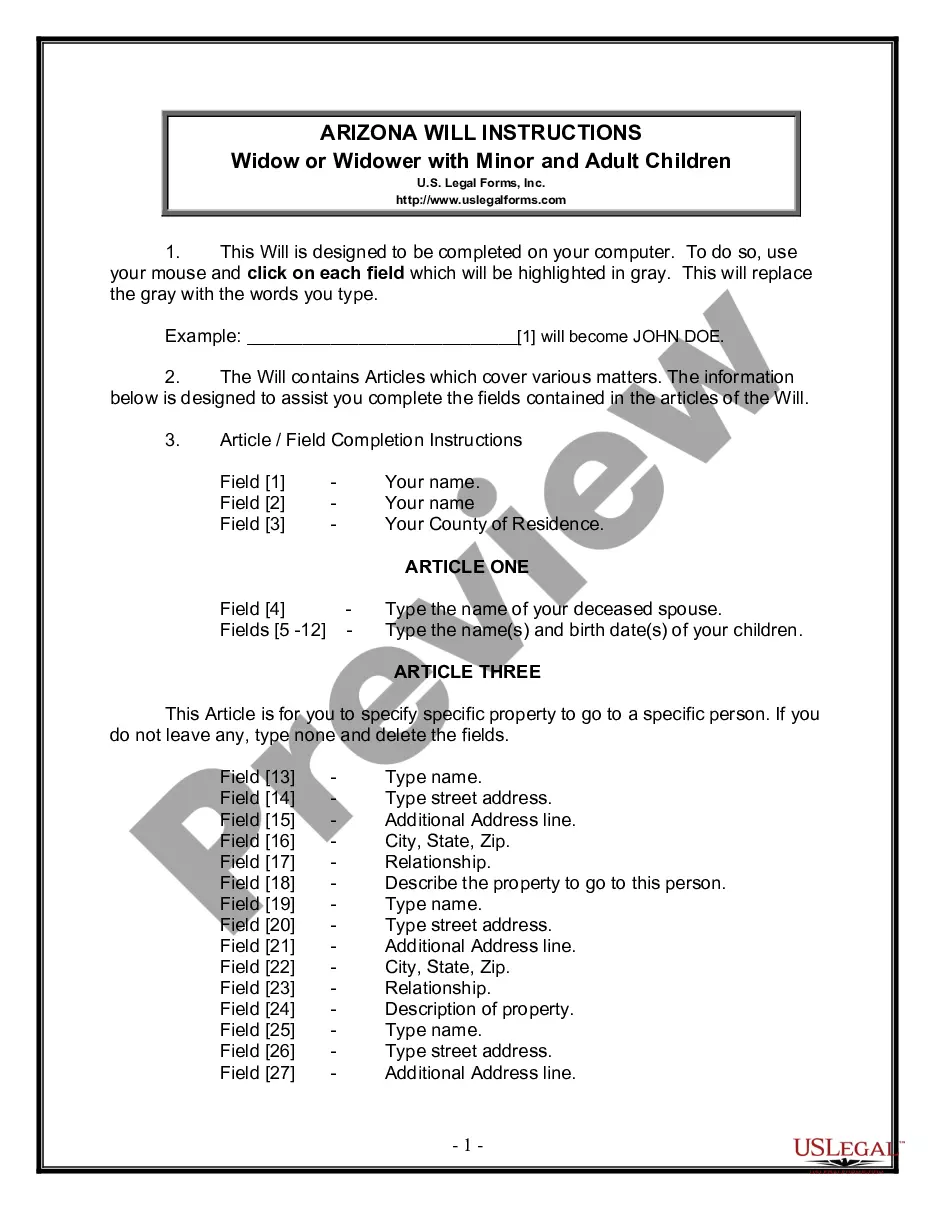

How to fill out Agreement To Purchase Common Stock Of A Shareholder By The Corporation With An Exhibit Of A Bill Of Sale And Assignment Of Stock By Separate Instrument?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a range of legal document formats that you can either download or print. By utilizing the website, you can discover countless forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of documents such as the Minnesota Agreement to Acquire Common Stock of a Shareholder by the Corporation along with an Exhibit of a Bill of Sale and Assignment of Stock by Separate Instrument within moments.

If you already have a monthly membership, Log In and acquire the Minnesota Agreement to Acquire Common Stock of a Shareholder by the Corporation with an Exhibit of a Bill of Sale and Assignment of Stock by Separate Instrument from the US Legal Forms collection. The Obtain option will be visible on every form you view. You will have access to all previously saved forms under the My documents section of your account.

Process the payment. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form onto your device. Fill out, modify, print, and sign the saved Minnesota Agreement to Acquire Common Stock of a Shareholder by the Corporation with an Exhibit of a Bill of Sale and Assignment of Stock by Separate Instrument. Every template you have added to your account does not expire and is yours indefinitely. So, to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Minnesota Agreement to Acquire Common Stock of a Shareholder by the Corporation with an Exhibit of a Bill of Sale and Assignment of Stock by Separate Instrument through US Legal Forms, one of the most extensive registries of legal document formats. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Verify you have selected the appropriate form for your jurisdiction/region.

- Click on the Review button to assess the content of the form.

- Examine the form details to ensure you have chosen the correct one.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Subsequently, select the payment plan you wish to choose and provide your information to register for the account.

Form popularity

FAQ

Yes, you can absolutely start a corporation alone in Minnesota. This type of business structure allows for a single owner, known as a sole shareholder. Ensure you understand the requirements, such as filing articles of incorporation and adhering to corporate formalities, which can be aided by resources like uslegalforms.

A secondary offering occurs when an investor sells their shares to the public on the secondary market after an initial public offering (IPO). Proceeds from an investor's secondary offering go directly into an investor's pockets rather than to the company.

What is a "secondary sale"? A secondary sale is a sale by an existing stockholder to a third-party purchaser, the proceeds of which benefit the selling stockholder. This is in contrast to a "primary" issuance, in which the company is selling its stock to an investor and using the proceeds for corporate purposes.

A secondary sale is the sale by an existing stockholder of shares in a private company to a third party that does not occur in connection with an acquisition of the company. When a lot of secondary sales happen together as part of the same transaction, it is sometimes referred to as a liquidity round.

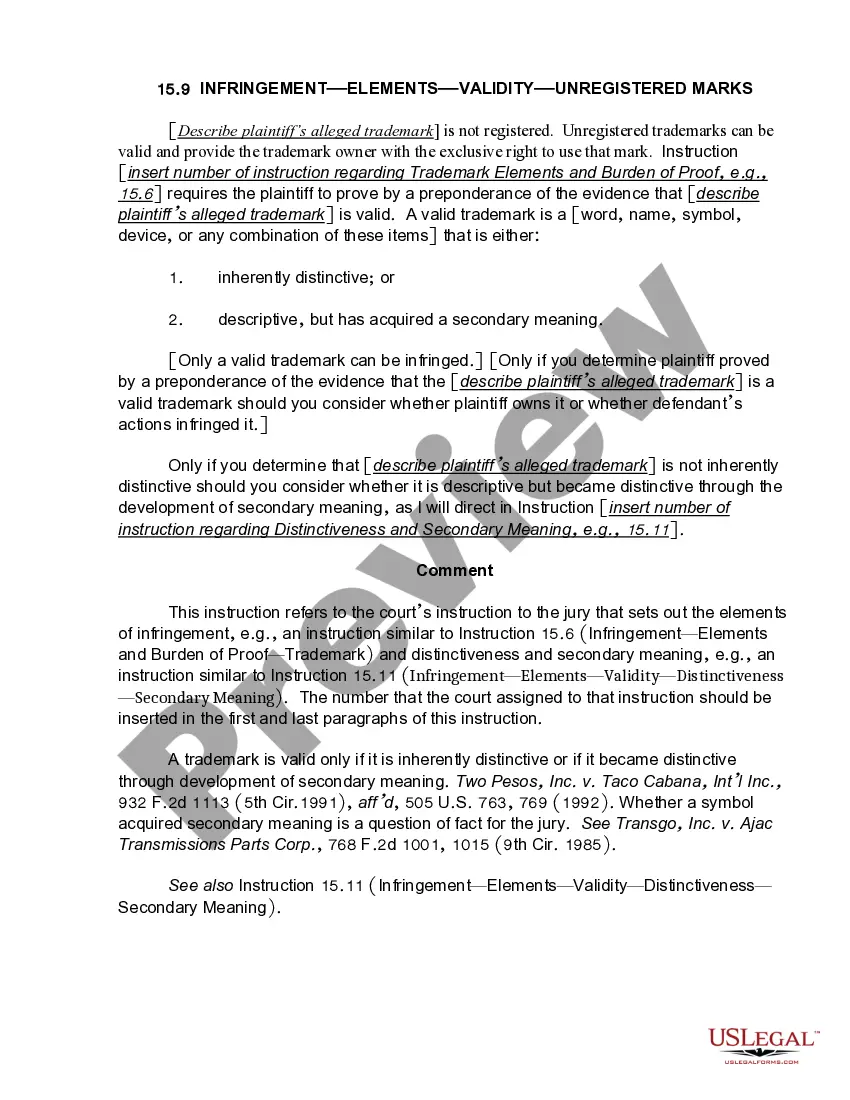

Stock purchase agreements are legal documents that lay out the terms and conditions for a sale of company stocks. They are legally binding contracts that create obligations and rights for all the parties involved.

The number and type of stock sold (i.e. common, preferred) the purchase price. when the transaction will take place. price per share.

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount. In a stock deal, the buyer purchases shares directly from the shareholder.

A secondary stock transaction is when an investor buys shares in a company directly from an existing stockholder (typically a founder, employee or existing investor). The funds paid go to the seller, not to the company.

A stock purchase agreement is an agreement that two parties sign when shares of a company are being bought or sold. These agreements are often used by small corporations who sell stock. Either the company or shareholders in the organization can sell stock to buyers.

Common Stock Agreement means an agreement between the Company and a Grantee evidencing the terms and conditions of an individual Common Stock grant. The Stock Grant agreement is subject to the terms and conditions of the Plan.