Minnesota Authority to Borrow Money - Resolution Form - Corporate Resolutions

Description

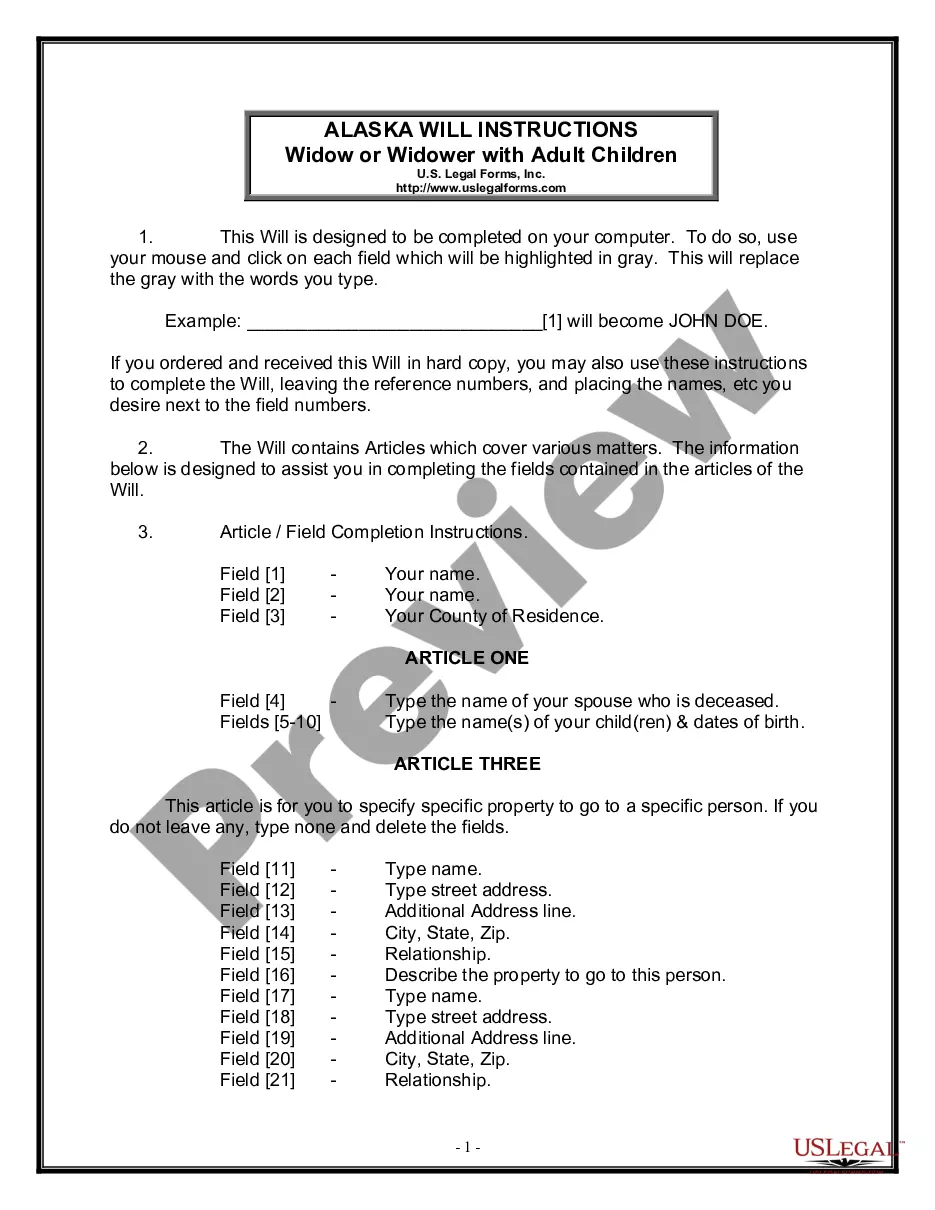

How to fill out Authority To Borrow Money - Resolution Form - Corporate Resolutions?

Are you presently in a situation where you need documents for perhaps business or personal purposes almost every day.

There are numerous lawful document templates accessible online, but finding forms that you can trust is not easy.

US Legal Forms provides thousands of document templates, including the Minnesota Authority to Borrow Money - Resolution Form - Corporate Resolutions, that are designed to comply with federal and state regulations.

Choose the payment plan you prefer, fill in the required information to create your account, and complete your purchase using your PayPal or credit card.

Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can download an additional copy of the Minnesota Authority to Borrow Money - Resolution Form - Corporate Resolutions anytime if needed. Simply click on the desired form to download or print the document template. Use US Legal Forms, the most comprehensive selection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the Minnesota Authority to Borrow Money - Resolution Form - Corporate Resolutions template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/region.

- Utilize the Review button to examine the form.

- Check the details to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find a form that meets your needs.

- Once you find the appropriate form, click Get now.

Form popularity

FAQ

A corporate resolution for signing authority is a formal document that grants specific individuals the power to sign documents on behalf of the company. This resolution outlines the scope of their authority and specifies the types of agreements they can enter into. It is important to have this documented, especially when engaging in significant financial transactions like seeking loans.

A written resolution should clearly list its title and introductory details, such as the date and parties involved. Follow this with a concise description of the matter at hand. Ensure the document includes the decision being made, followed by signature lines for the authorized individuals to approve and enact the resolution.

To write a resolution, start with a title that clearly states its purpose. Next, identify the parties involved and provide the date. Include a statement of facts that supports the need for the resolution, followed by a clear statement of the decision or action the organization intends to take. Finally, ensure the resolution is signed by the appropriate individuals, making it official.

A corporate resolution to open a business bank account is a document that clearly shows the bank who has the authority to start an account on behalf of your corporation. If this information isn't specifically covered in your Articles of Incorporation or bylaws, your bank may require a resolution.

A Corporate Resolution a written statement made by the board of directors detailing which officers are authorized to act on behalf of the corporation. It is also a record of any major decision made by shareholders or a board of directors during a meeting.

A corporate resolution that authorizes borrowing on a line of credit is often referred to a borrowing resolution. This resolution indicates that the members (LLC) or Board of Directors (Corporation) have held a meeting and conducted a vote allowing the company to borrow a specific loan amount.

Loan Resolution means that certain Resolution, adopted by the Board of the City on March 8, 2021, authorizing a loan under a loan agreement between the Borrower and the Issuer to finance the Project.

A resolution might outline the officers that are authorized to act (trade, assign, transfer or hedge securities and other assets) on behalf of the corporation. The resolution would outline who is authorized to open a bank account, withdraw money, and write checks.

Examples of Actions that Need Corporate ResolutionsApproval of new board members and officers.Acceptance of the corporate bylaws.Creation of a corporate bank account.Designating which board members and officers can access the bank account.Documentation of a shareholder decision.Approval of hiring or firing employees.More items...

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.