Minnesota Credit Cardholder's Report of Lost or Stolen Credit Card

Description

How to fill out Credit Cardholder's Report Of Lost Or Stolen Credit Card?

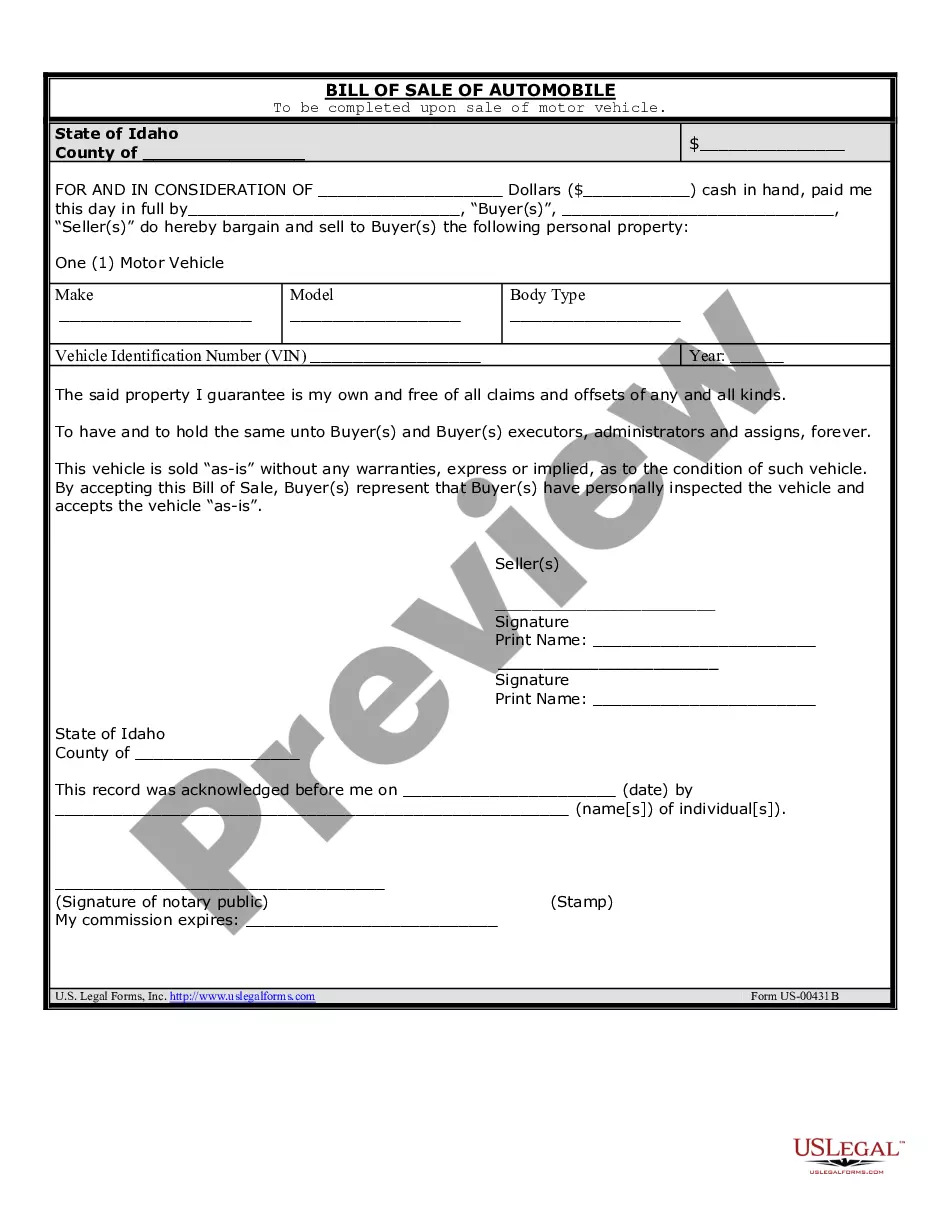

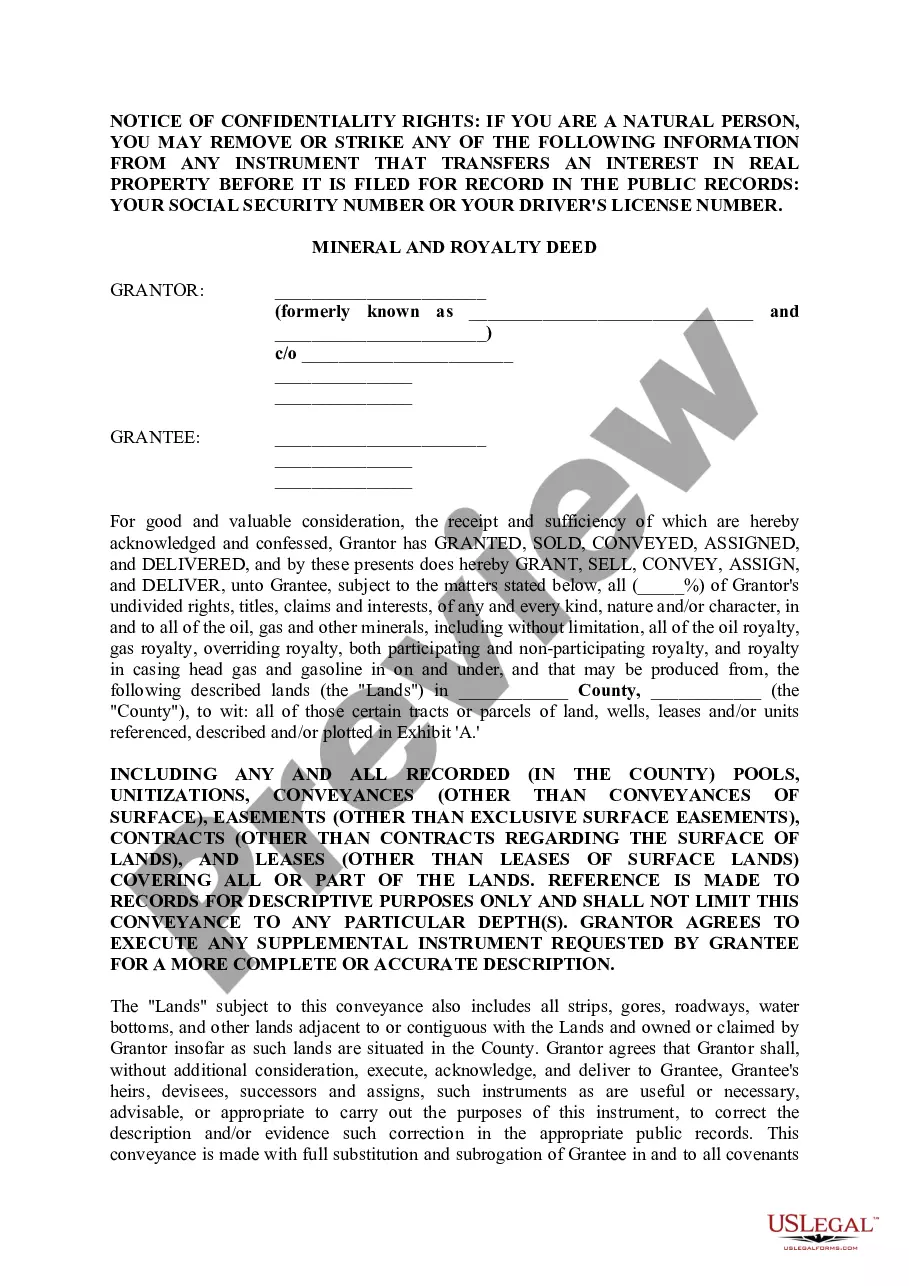

Are you currently in a position the place you need papers for sometimes enterprise or individual purposes almost every day time? There are plenty of legal record web templates available on the net, but discovering ones you can rely is not simple. US Legal Forms offers a huge number of form web templates, much like the Minnesota Credit Cardholder's Report of Lost or Stolen Credit Card, which are created in order to meet state and federal demands.

Should you be previously informed about US Legal Forms web site and have your account, basically log in. Following that, you may acquire the Minnesota Credit Cardholder's Report of Lost or Stolen Credit Card format.

If you do not provide an profile and would like to start using US Legal Forms, abide by these steps:

- Obtain the form you need and make sure it is for your right city/area.

- Utilize the Review key to review the shape.

- See the outline to ensure that you have chosen the appropriate form.

- In case the form is not what you`re trying to find, use the Lookup area to discover the form that meets your needs and demands.

- Whenever you obtain the right form, click on Purchase now.

- Choose the prices program you want, fill in the desired information and facts to create your account, and pay money for the transaction utilizing your PayPal or charge card.

- Select a convenient document structure and acquire your version.

Get each of the record web templates you possess purchased in the My Forms menu. You can aquire a additional version of Minnesota Credit Cardholder's Report of Lost or Stolen Credit Card any time, if required. Just click the needed form to acquire or produce the record format.

Use US Legal Forms, one of the most considerable variety of legal forms, to conserve some time and stay away from faults. The assistance offers skillfully produced legal record web templates that can be used for a range of purposes. Create your account on US Legal Forms and initiate making your life easier.

Form popularity

FAQ

Call ? or get on the mobile app ? and report the loss or theft to the bank or credit union that issued the card as soon as possible. Federal law says you're not responsible to pay for charges or withdrawals made without your permission if they happen after you report the loss. It's important to act fast.

Call the number on the back of the card and tell the credit card company that you found it. They'll contact the card's owner for you. It's possible that the card was already reported as lost anyway, and the card company will issue a new card with a new number.

When you report the lost credit card, the issuer will most likely cancel your old card number in an effort to prevent any unauthorized charges and then send you a new card with a new number. But it could take a few days for the replacement card to arrive.

Notify your bank or credit union. As soon as you're reasonably certain you won't find your card, contact your bank or credit union and request a replacement. Typically, you can do this by phone or by visiting a branch location. Your lost card will be canceled, and it may take up to seven days to receive a new one.

How to place: Contact any one of the three credit bureaus ? Equifax, Experian, and TransUnion. You don't have to contact all three. The credit bureau you contact must tell the other two to place a fraud alert on your credit report.

When you report a card as lost or stolen, your credit card company will deactivate or cancel your current credit card number. The card number previously assigned to you will no longer be active and you will be mailed a replacement credit card with a new number.

5 steps to take immediately if your credit card is lost or stolen How to report credit card fraud. ... Contact your credit card issuer. ... Change your login information. ... Monitor your credit card statement. ... Review your credit report and dispute any fraud on it. ... Protect yourself from future credit card fraud. ... Bottom line.

When you lose your credit card, you can avoid an impact to your finances by reporting the card lost or missing immediately. In general, a lost or stolen credit card will have no impact on your credit score. In most cases, you will not be held responsible for charges on a lost or stolen card.