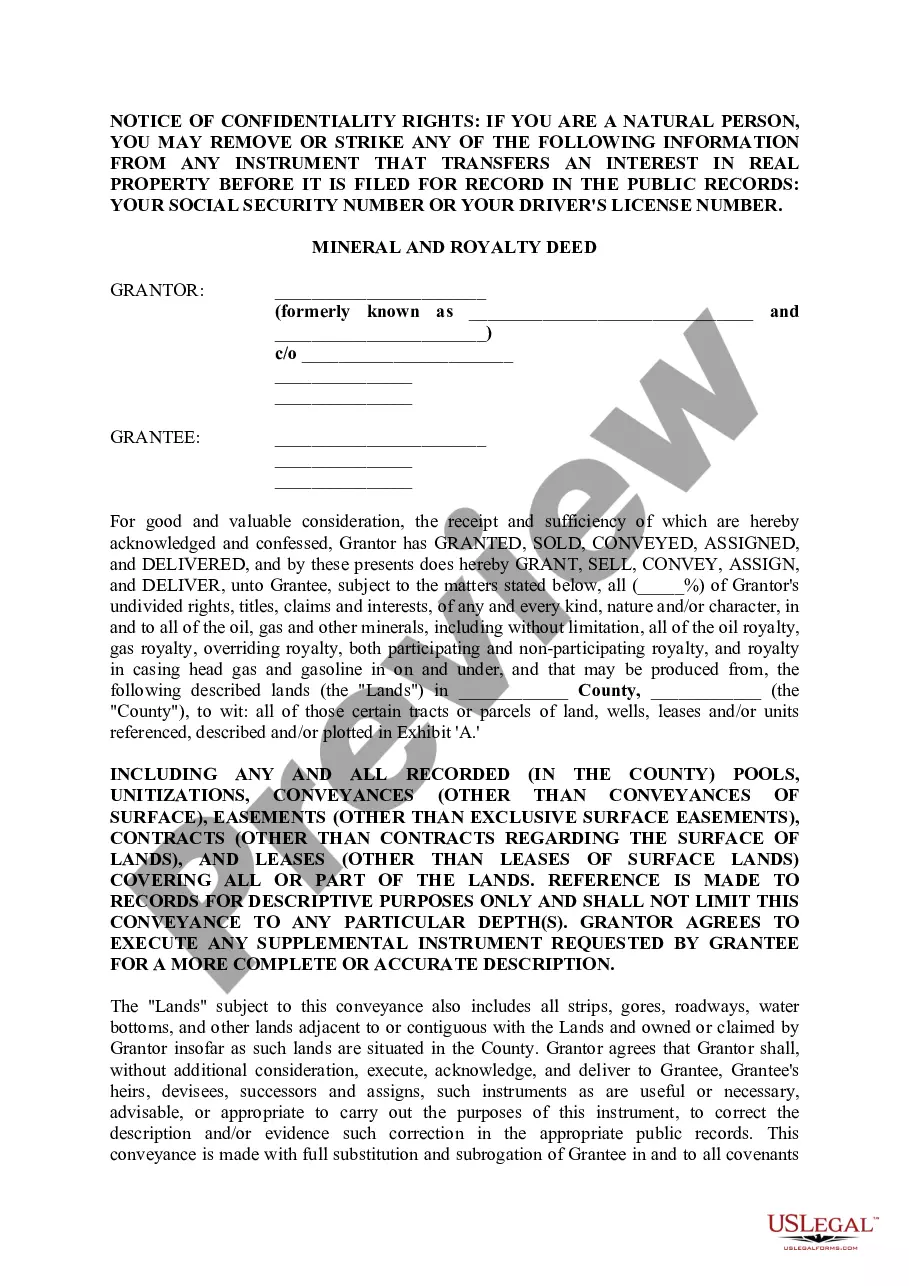

Idaho Mineral and Royalty Deed

Description

agreement.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Idaho Mineral And Royalty Deed?

Utilize US Legal Forms to obtain a printable Idaho Mineral and Royalty Deed. Our court-acceptable forms are crafted and frequently updated by experienced attorneys.

Ours is the most extensive Forms library available online, providing affordable and precise samples for individuals, attorneys, and small to medium-sized businesses.

The templates are organized into state-specific categories, and several can be previewed prior to downloading.

US Legal Forms provides thousands of legal and tax documents and packages for personal and business requirements, including the Idaho Mineral and Royalty Deed. Over three million users have successfully used our service. Choose your subscription plan and acquire high-quality documents in just a few clicks.

- Ensure you have the correct form pertaining to the state where it is required.

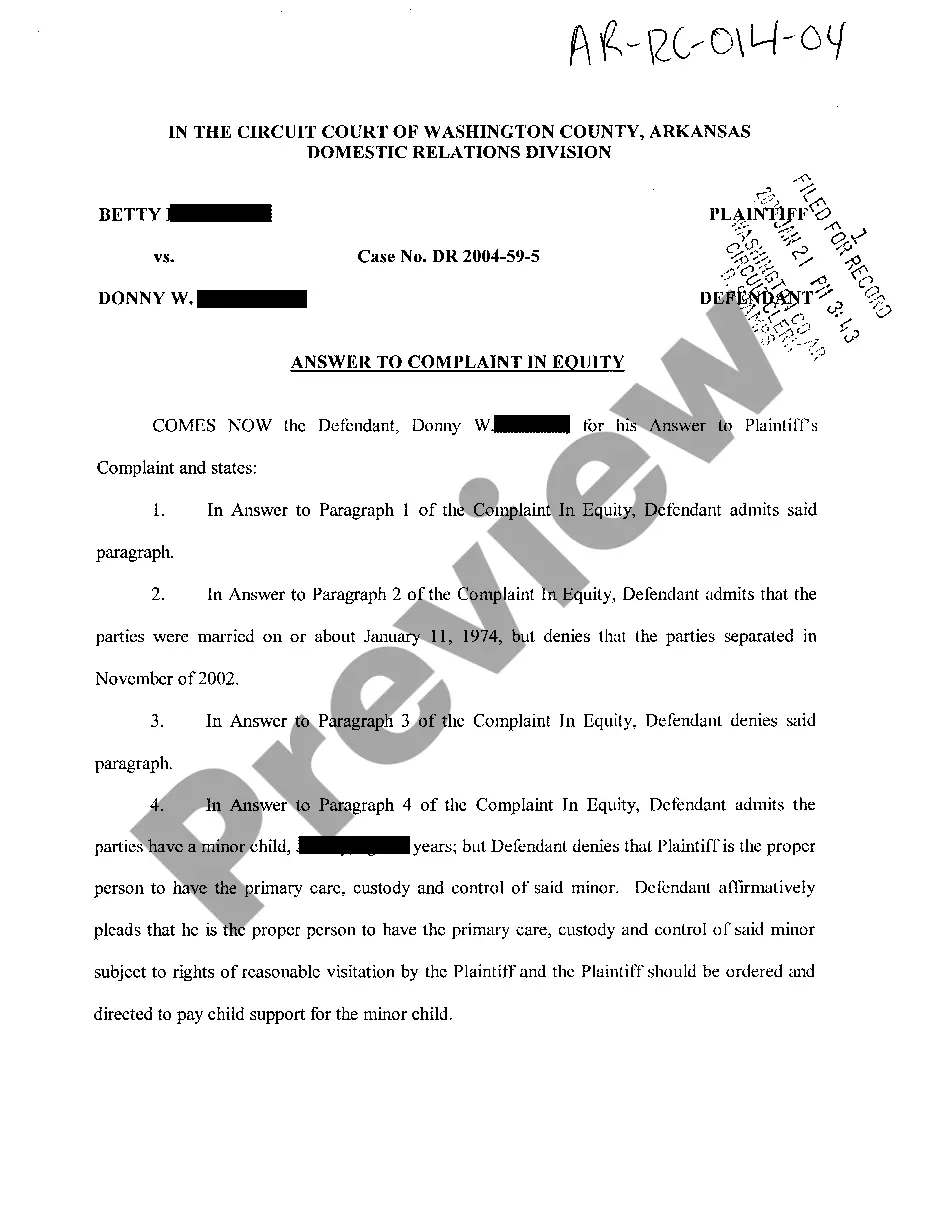

- Examine the form by reviewing the description and using the Preview feature.

- Click Buy Now if it’s the template you desire.

- Create your account and pay via PayPal or credit card.

- Download the document to your device and feel free to reuse it multiple times.

- Utilize the Search engine if you wish to locate another document template.

Form popularity

FAQ

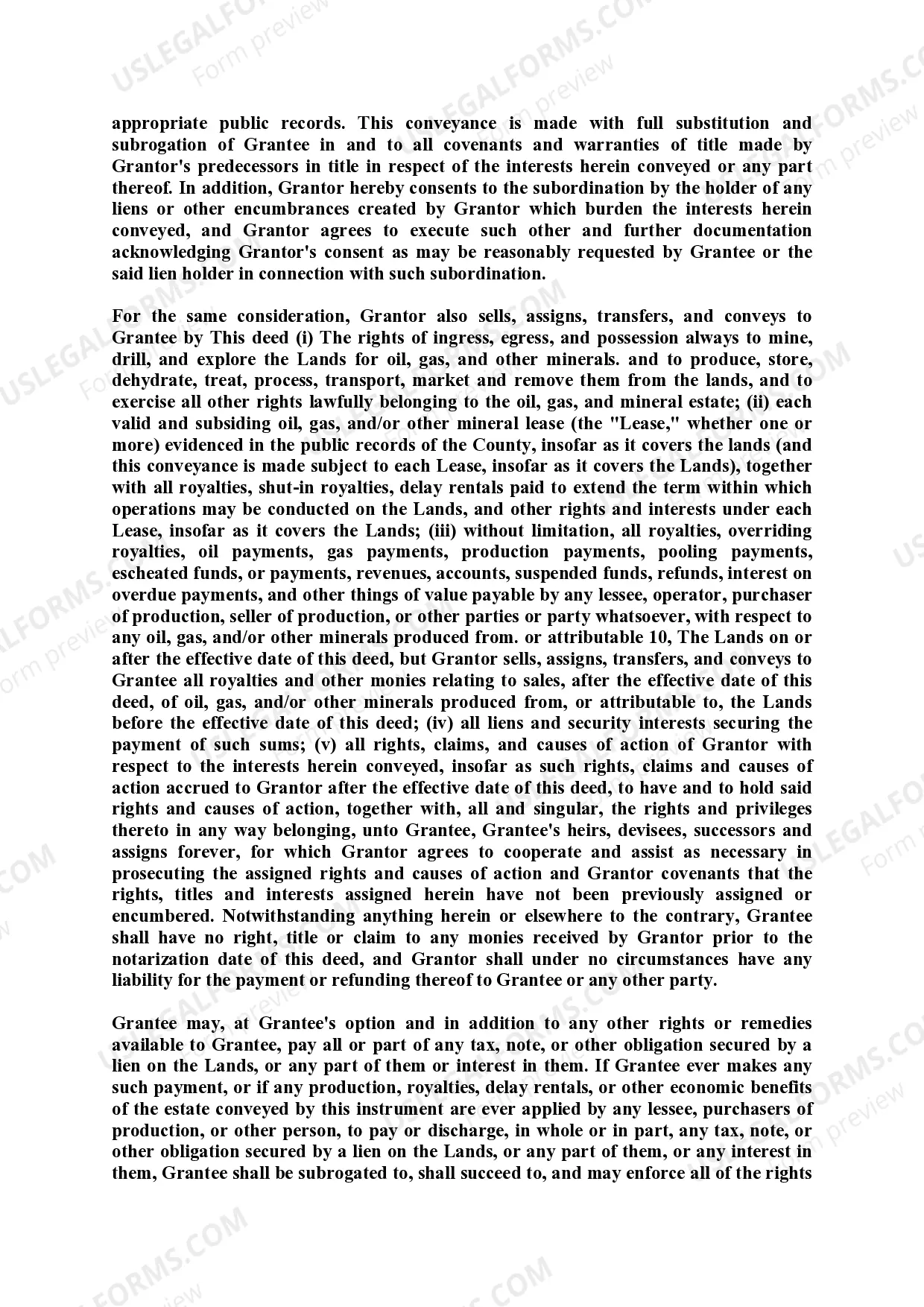

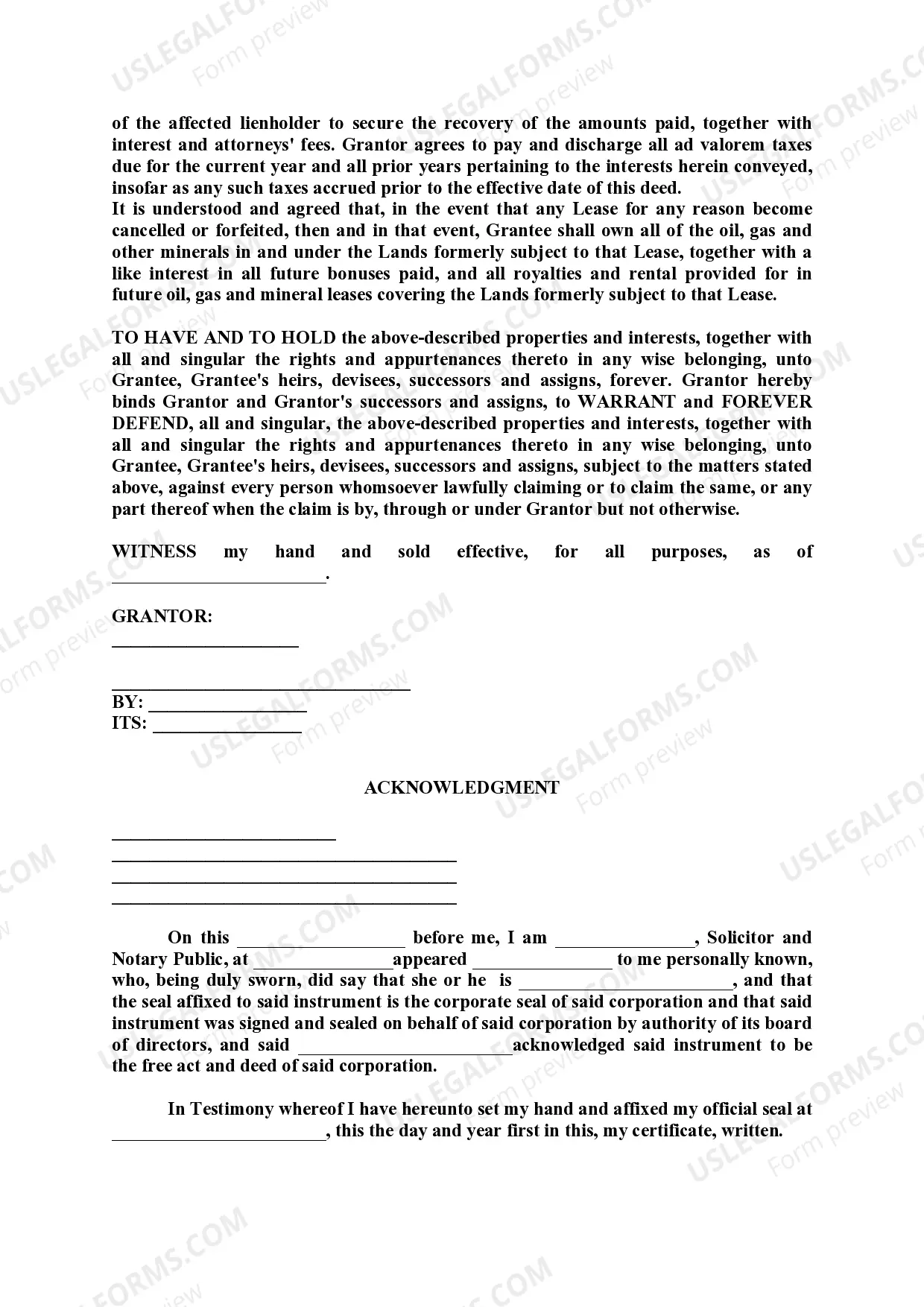

When an individual owns mineral rights, they possess the legal rights to extract and sell any minerals located beneath the land. This can include valuable resources like oil, gas, and metals. Owning these rights does not mean they own the surface land, but they can profit from the minerals extracted below it. Understanding Idaho Mineral and Royalty Deeds can help clarify ownership and potential benefits.

Mineral rights can be complex. By law, property falls into two categories real or personal. Real property includes land and whatever is permanently attached to land, found on it either by nature, (water, trees, or minerals) or by man (buildings, fences, bridges, roads).

One important factor you must keep in mind is that if real estate contains mineral rights, simply buying the property doesn't make you the owner of them. Since mineral rights can be sold separately from the land itself, even if you own the land, someone else may hold ownership of what's below it.

Mineral interests and royalty interests both involve ownership of the minerals under the ground. The main difference between the two is that the owner of a mineral interest has the right to execute leases and collect bonus payments and the owner of royalty interests does not execute leases or collect bonus payments.

In Idaho, the Bureau of Land Management manages mineral rights on 3.4 million acres it doesn't have surface rights to. But millions of acres also are owned by private parties, and many of those people do not own anything deeper than a plow can till.

A mineral deed form is a legal document, regarding the ownership of the minerals below the surface of the earth.A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

Mineral rights don't come into effect until you begin to dig below the surface of the property. But the bottom line is: if you do not have the mineral rights to a parcel of land, then you do not have the legal ability to explore, extract, or sell the naturally occurring deposits below.

In the United Kingdom, the ownership of oil, gas, gold and silver is held by the Crown Estate. Exploitation of these resources is overseen and run by the Crown Estate. The ownership and licensing of unworked coal and coal mines in the United Kingdom is managed by the Coal Authority.

Mineral rights are often sold separately from the land they are on. You may have title to the mineral rights on a property you own, or a previous owner may have sold or leased them in which case, they may not be yours to sell. But there is no need to abandon the idea of monetizing your mineral reserves!