Minnesota Direct Deposit Form for Employees

Description

How to fill out Direct Deposit Form For Employees?

You are able to devote several hours on the Internet looking for the authorized record web template that fits the state and federal requirements you need. US Legal Forms provides 1000s of authorized kinds which are evaluated by professionals. You can easily acquire or produce the Minnesota Direct Deposit Form for Employees from my services.

If you already have a US Legal Forms bank account, it is possible to log in and click on the Download button. Next, it is possible to comprehensive, change, produce, or indication the Minnesota Direct Deposit Form for Employees. Every single authorized record web template you get is your own property for a long time. To acquire another version associated with a purchased develop, check out the My Forms tab and click on the related button.

Should you use the US Legal Forms web site for the first time, stick to the straightforward recommendations beneath:

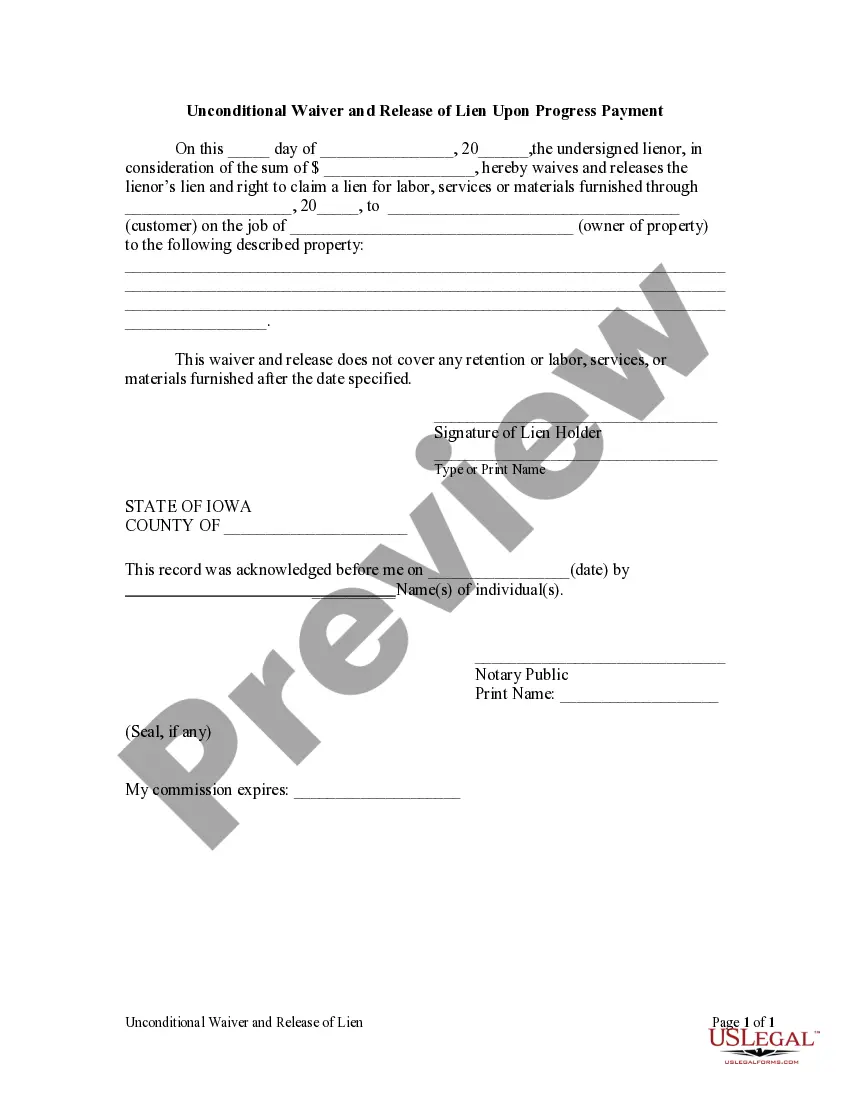

- Initially, make certain you have selected the best record web template to the region/city of your choosing. Browse the develop outline to make sure you have picked the appropriate develop. If accessible, take advantage of the Review button to search throughout the record web template too.

- In order to locate another variation in the develop, take advantage of the Search industry to discover the web template that meets your requirements and requirements.

- When you have discovered the web template you would like, click on Purchase now to continue.

- Choose the prices program you would like, type your qualifications, and register for an account on US Legal Forms.

- Total the financial transaction. You can use your credit card or PayPal bank account to fund the authorized develop.

- Choose the format in the record and acquire it in your gadget.

- Make alterations in your record if needed. You are able to comprehensive, change and indication and produce Minnesota Direct Deposit Form for Employees.

Download and produce 1000s of record layouts using the US Legal Forms website, that offers the largest assortment of authorized kinds. Use specialist and condition-certain layouts to deal with your company or individual requires.

Form popularity

FAQ

Minnesota: Private sector employers in Minnesota can enroll employees in direct deposit; however, employees may opt out by written notification to the employer. Therefore, mandatory direct deposit is not permissible in Minnesota.

One of the options you can use to pay unbanked employees is to use Pay Cards. Pay cards work like debit cards. Like direct deposit, payroll cards are a form of electronic payment. Each payday, the employee's net wages are deposited directly into the pay card.

A direct deposit authorization form is a form that employees fill out to authorize their employer to deposit money straight into their bank account.

Generally, banks charge a setup fee for direct deposit, ranging from $50 to $149 on average, ing to the National Federation of Independent Business (NFIB). Some banks charge ongoing monthly fees for direct deposit, but most do not. Additionally, some banks charge various transaction fees.

The employer provides the form to the employee to fill out usually upon hire (since the option for direct deposit is an expectation of employees these days). The form is where the employee gives you permission for direct deposit and provides the bank information that you'll need to send them money.

Direct deposit isn't difficult. If you use payroll software to run payroll, you can deposit wages into employee bank accounts in a few simple steps. Enter and approve payroll before sending it to their financial institution. Then, you're done.

Steps on How to Set Up Direct Deposit for Your Employees Decide on a payroll provider. If you don't have one set up already, you'll need a payroll provider that offers direct deposit services. ... Connect with your bank. ... Collect information from your employees. ... Create a payroll schedule. ... Run payroll.