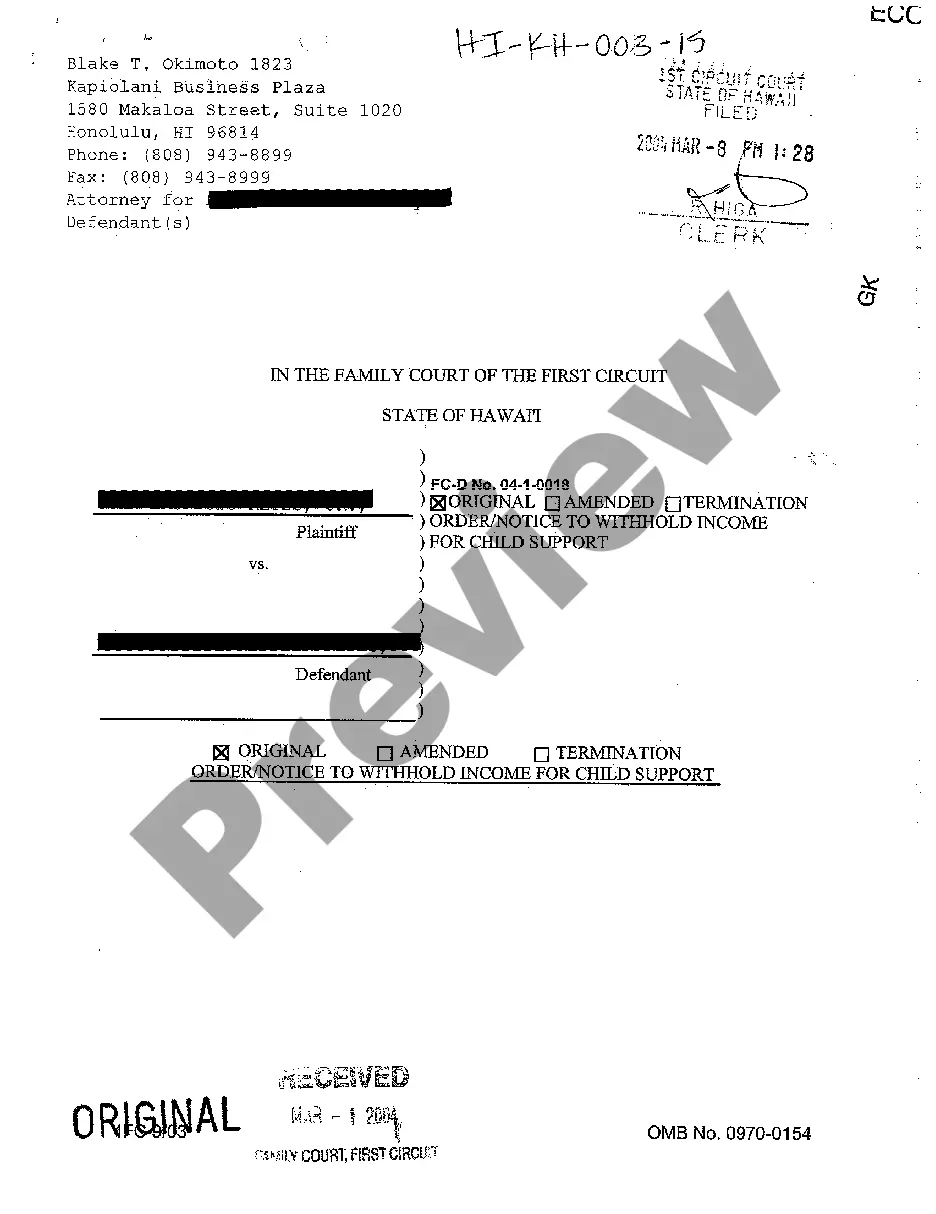

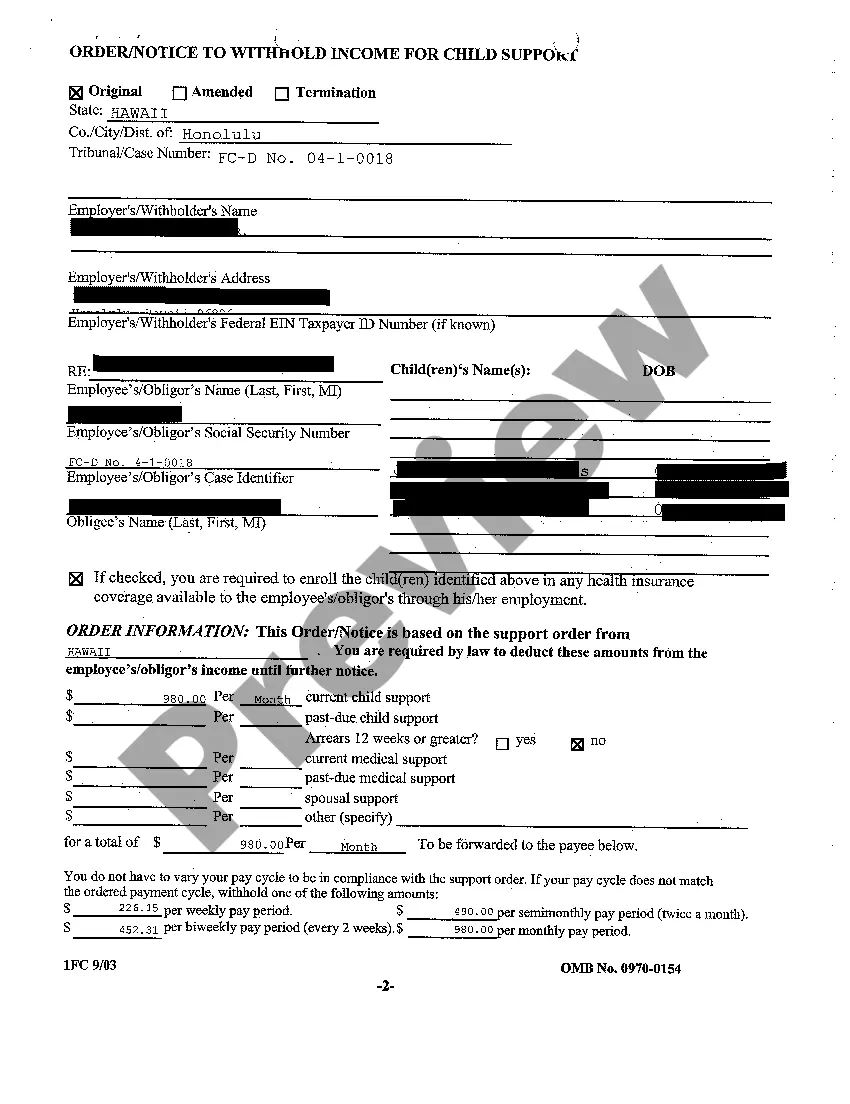

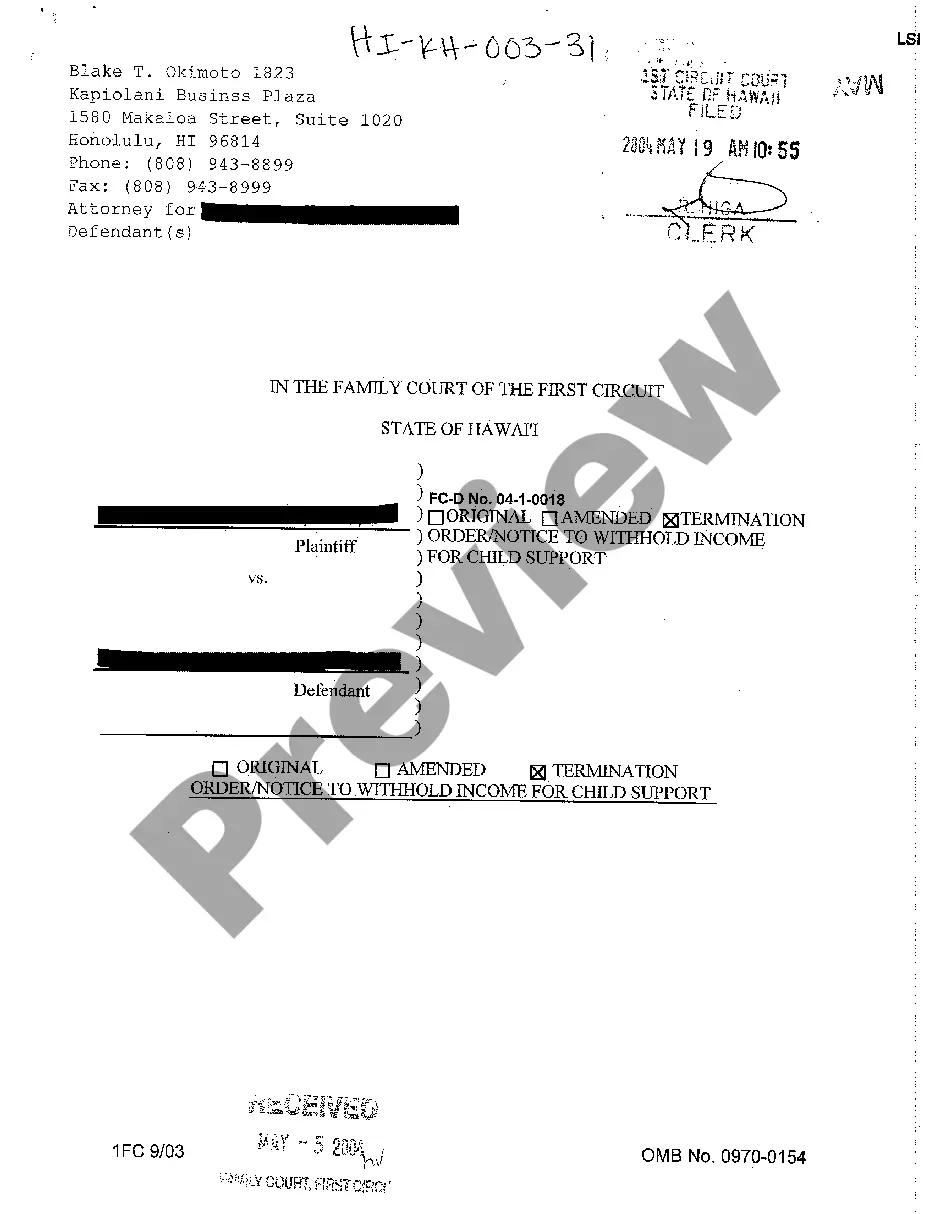

Hawaii Original Order - Notice to Withhold Income for Child Support

Description

How to fill out Hawaii Original Order - Notice To Withhold Income For Child Support?

Amidst numerous complimentary and paid templates available on the web, you cannot guarantee their correctness.

For instance, who designed them or if they possess the necessary expertise to handle what you require them for.

Stay composed and take advantage of US Legal Forms!

If you are using our website for the first time, follow the instructions below to acquire your Hawaii Original Order - Notice to Withhold Income for Child Support promptly.

- Uncover Hawaii Original Order - Notice to Withhold Income for Child Support samples created by experienced lawyers.

- and avoid the expensive and time-consuming task of searching for an attorney.

- and subsequently compensating them to produce a document for you that you can manage yourself.

- If you already possess a subscription, Log In to your account.

- and locate the Download button adjacent to the file you are seeking.

- You'll also be able to access all of your previously obtained samples in the My documents section.

Form popularity

FAQ

To stop child support in Hawaii, you must file a motion with the court requesting a termination of support. This process involves providing valid reasons, such as the child reaching the age of majority or changes in circumstances. It's crucial to follow the legal channels outlined in the Hawaii Original Order - Notice to Withhold Income for Child Support to ensure a smooth transition. For assistance with the paperwork and legal process, consider using US Legal Forms to access the necessary resources.

In Hawaii, child support typically continues until the child turns 18 years old or graduates from high school, whichever comes later. However, if the child is still in school and has not yet completed their education, the support may extend beyond the age of 18. It’s essential to adhere to the terms outlined in the Hawaii Original Order - Notice to Withhold Income for Child Support, as this dictates the specific obligations. Always consult a legal professional if you have questions about your individual situation.

In Hawaii, child support typically continues until the child turns 18, or until they graduate from high school, whichever occurs later. In some cases, support may extend if the child is disabled or if there are other special circumstances. It is important to reference the Hawaii Original Order - Notice to Withhold Income for Child Support to understand these guidelines clearly. For those navigating these regulations, US Legal Forms offers valuable resources to streamline the process.

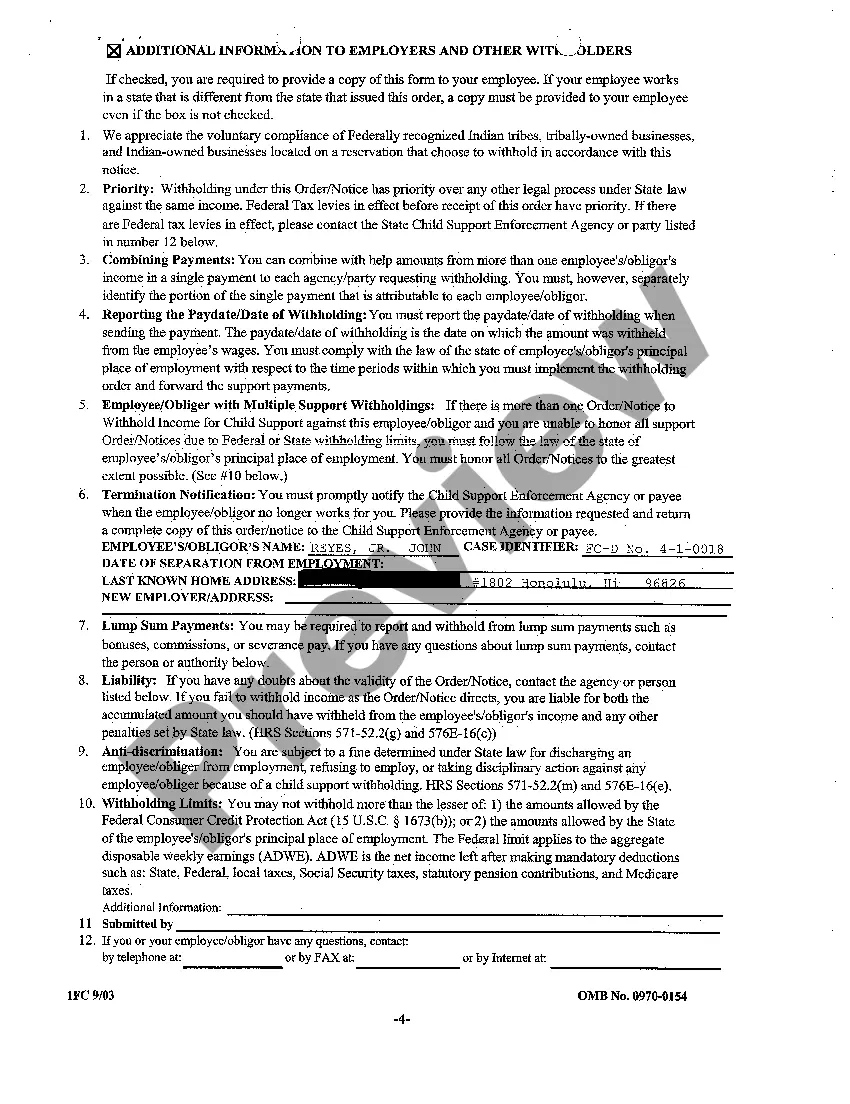

If an employer in Pennsylvania does not withhold child support as directed, they could be liable for the amount that should have been deducted. The employee may face additional legal actions, and the employer might face penalties imposed by the state. It is essential for employers to adhere to the Hawaii Original Order - Notice to Withhold Income for Child Support to avoid these consequences. Utilizing resources such as US Legal Forms can help clarify obligations and procedures.

In Pennsylvania, not paying child support can lead to severe legal repercussions, although it is not classified as a felony. Instead, parents may face civil contempt charges for failure to comply with the court's orders. This can result in wage garnishments, property liens, or even jail time in extreme cases. Understanding the implications of child support, such as the Hawaii Original Order - Notice to Withhold Income for Child Support, is crucial for compliance.

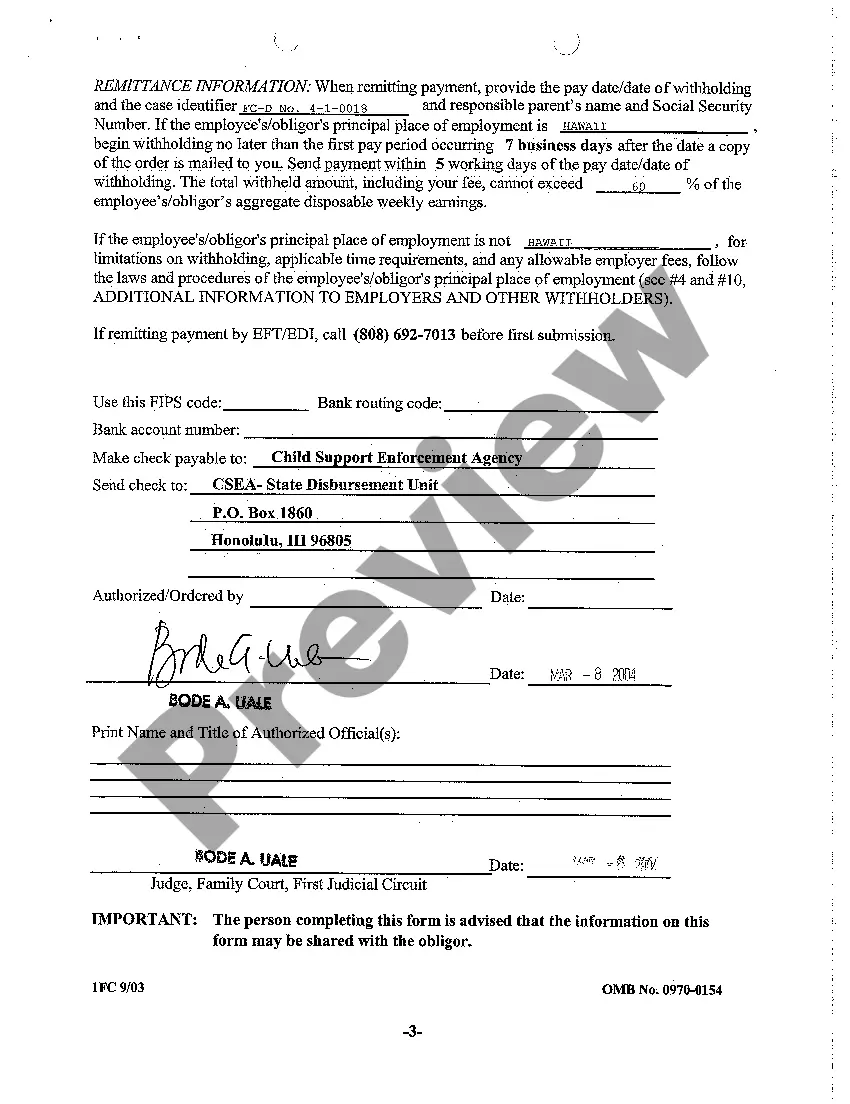

If an employer fails to withhold child support as mandated by the Hawaii Original Order - Notice to Withhold Income for Child Support, it can lead to serious consequences. The employee may face wage garnishments or legal actions initiated by the child support enforcement agency. Additionally, the employer may incur penalties for not complying with the court's order. Using a reliable platform like US Legal Forms can help ensure employers understand their obligations and avoid these pitfalls.

An income withholding order in Hawaii usually takes effect within a few weeks after the court issues it. Typically, employers are required to start withholding the designated amount from the supporting parent's wages shortly after receiving the order. Understanding the timeline can help you navigate the process of the Hawaii Original Order - Notice to Withhold Income for Child Support effectively.

Fathers cannot simply opt out of child support obligations in Hawaii. If a father seeks to change his payment responsibilities, he must file a request with the court to modify the existing order. Compliance with the Hawaii Original Order - Notice to Withhold Income for Child Support is essential for both parents to ensure the child's welfare.

Child support cannot be waived in Hawaii if it is court-ordered. The court's priority is to ensure the child's needs are met, so such waivers are typically not permitted. If you’re considering modifications related to the Hawaii Original Order - Notice to Withhold Income for Child Support, consult with a legal professional for advice.

In Hawaii, the statute of limitations for collecting child support is generally 10 years from the date the payment was due. This means that after 10 years, the custodial parent may no longer be able to go to court to collect unpaid support. Understanding these timelines is crucial, especially when dealing with the Hawaii Original Order - Notice to Withhold Income for Child Support.