Minnesota Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

How to fill out Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

Have you ever been in a situation where you require documentation for either business or specific purposes consistently.

There are numerous legal document templates accessible online, but finding forms you can trust is challenging.

US Legal Forms provides a vast array of form templates, including the Minnesota Acknowledgment by Charitable or Educational Institution of Receipt of Gift, which are designed to meet state and federal requirements.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes.

The service offers well-crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Minnesota Acknowledgment by Charitable or Educational Institution of Receipt of Gift template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/county.

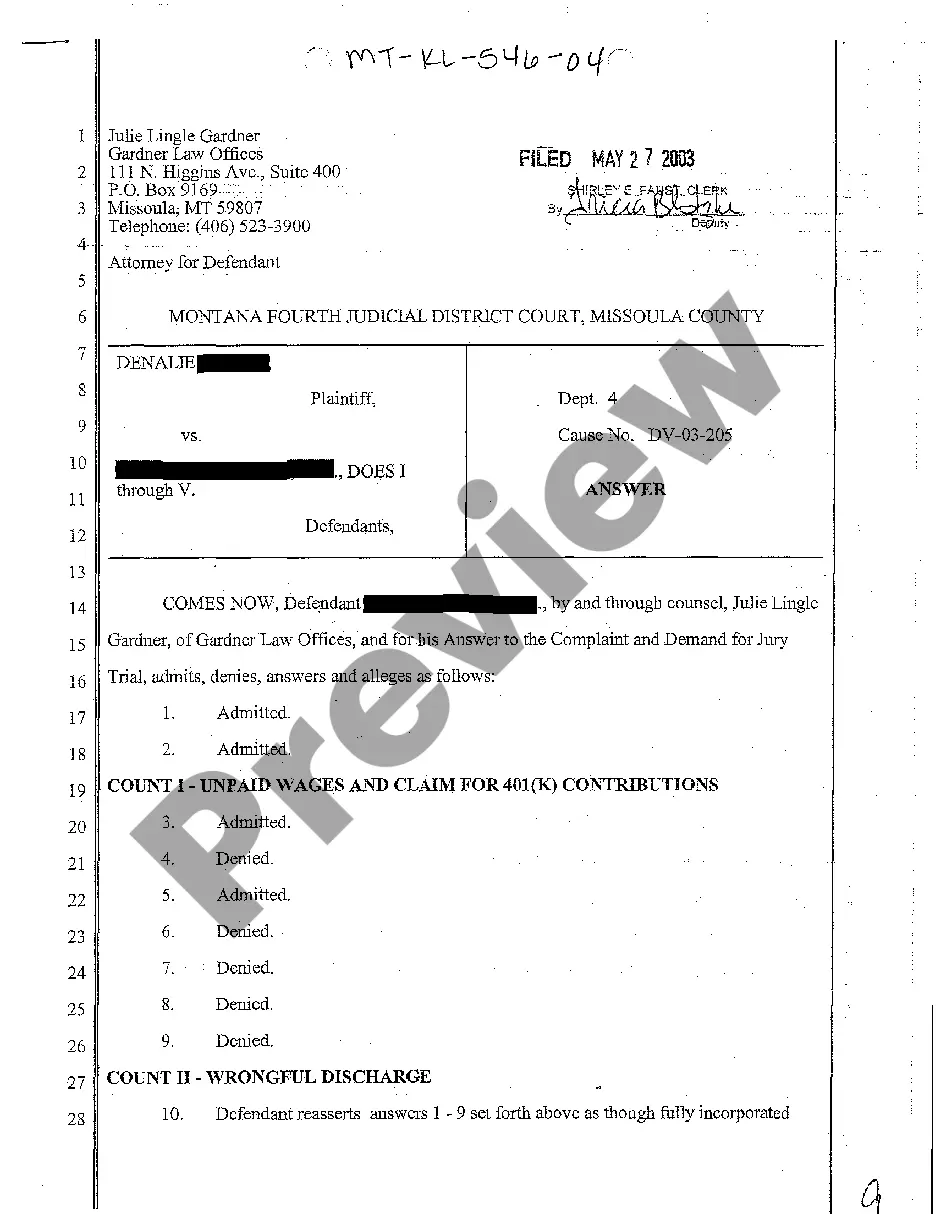

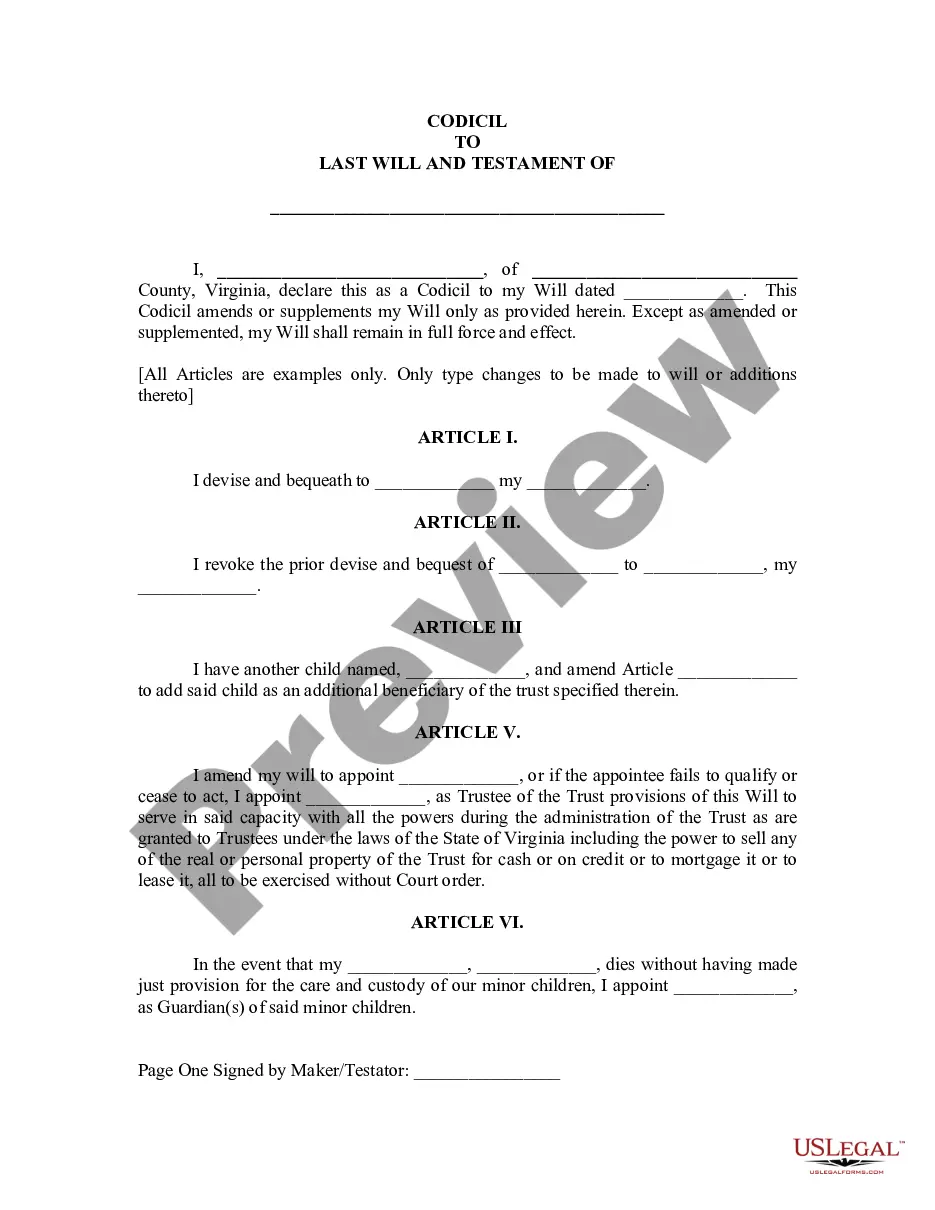

- Utilize the Review button to examine the form.

- Read the details to confirm you have selected the right form.

- If the form is not what you're looking for, use the Search box to find the form that suits your needs and requirements.

- Once you find the appropriate form, click Get now.

- Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- Select a suitable format and download your copy.

- Access all the form templates you have purchased in the My documents menu. You can obtain an additional copy of the Minnesota Acknowledgment by Charitable or Educational Institution of Receipt of Gift at any time if needed. Click on the desired form to download or print the document template.

Form popularity

FAQ

Yes, donation acknowledgment letters are generally required for tax purposes, especially for contributions over a certain amount. The IRS mandates that charitable organizations provide donors with a written acknowledgment for gifts exceeding $250. This ensures that donors can claim their contributions on their tax returns. By using a Minnesota Acknowledgment by Charitable or Educational Institution of Receipt of Gift, organizations can simplify this process and promote transparency.

An example of an acknowledgment letter would start by thanking the donor for their generous contribution. It would include the date of the donation, the amount, and a brief description of how the funds will be used. For instance, a letter could state, 'Thank you for your donation of $500 on January 15, 2023, to support our educational programs.' This type of Minnesota Acknowledgment by Charitable or Educational Institution of Receipt of Gift conveys appreciation and provides necessary documentation for tax purposes.

A gift acknowledgment is a written confirmation from a charitable organization that it has received a donation. This acknowledgment often includes essential details about the gift, such as the donor's name, the donation amount, and the date of the contribution. By providing a Minnesota Acknowledgment by Charitable or Educational Institution of Receipt of Gift, organizations ensure that they honor the generosity of their donors while adhering to legal guidelines.

A gift acknowledgement letter is a formal document that confirms a donor's contribution to a charitable or educational institution. It typically includes details such as the date of the gift, the amount donated, and information about the organization. This letter acts as a receipt for the donor, substantiating their contribution for tax deductions. Utilizing a Minnesota Acknowledgment by Charitable or Educational Institution of Receipt of Gift ensures compliance with state regulations.

An acknowledgment letter serves to officially recognize the receipt of a donation. It provides the donor with confirmation of their gift and its intended use, ensuring clarity and trust. This letter is also important for tax purposes, as it may be required by the IRS for charitable contributions. By issuing a Minnesota Acknowledgment by Charitable or Educational Institution of Receipt of Gift, organizations foster goodwill with their supporters.

The gift law in Minnesota outlines the regulations regarding the acceptance and acknowledgment of gifts by charitable and educational institutions. This law ensures that organizations provide a proper Minnesota Acknowledgment by Charitable or Educational Institution of Receipt of Gift to their donors. It helps maintain transparency and accountability in the donation process. Understanding these laws can help both donors and organizations navigate charitable giving more effectively.

To register charitable solicitation in Minnesota, you need to complete the registration process with the Minnesota Attorney General's Office. This requires submitting a registration form along with supporting documents, including your organization’s bylaws and financial statements. Once registered, you can provide the Minnesota Acknowledgment by Charitable or Educational Institution of Receipt of Gift to your donors. For a more streamlined approach, consider using USLegalForms, which offers resources and templates to guide you through the registration process.

Acknowledging the receipt of a donation involves sending a thank-you letter or email to the donor. In your acknowledgment, include details such as the donation amount, the purpose of the gift, and a reminder that the donation is tax-deductible under the Minnesota Acknowledgment by Charitable or Educational Institution of Receipt of Gift. This not only shows appreciation but also reinforces the donor's connection to your cause. Utilizing templates from USLegalForms can simplify the process and help you maintain compliance.

To give a receipt for a charitable donation, you should include essential details such as the donor's name, the date of the donation, the amount donated, and a statement indicating that the gift is tax-deductible. Make sure to mention the Minnesota Acknowledgment by Charitable or Educational Institution of Receipt of Gift to confirm compliance with state regulations. You can use templates available on platforms like USLegalForms to ensure you meet all legal requirements. Providing a clear and professional receipt fosters trust and encourages future donations.

To acknowledge a gift from a donor-advised fund, first identify the donor and the fund's name. Your acknowledgment should express gratitude for the donation and clarify that the funds were received through the donor-advised fund. It is important to state that no goods or services were exchanged for the contribution. This approach meets the requirements of the Minnesota Acknowledgment by Charitable or Educational Institution of Receipt of Gift, ensuring that both you and the donor adhere to best practices.