Minnesota Dissolution when Shares have NOT been Issued is a process used to dissolve a corporation that has not issued any shares of stock. It involves a vote of the directors of the corporation, followed by filing articles of dissolution with the Minnesota Secretary of State. There are two types of Minnesota Dissolution when Shares have NOT been Issued: voluntary dissolution and involuntary dissolution. Voluntary dissolution occurs when the directors of the corporation vote unanimously to dissolve the corporation without any outside influence. Involuntary dissolution occurs when the corporation has not complied with certain statutory requirements, such as filing annual reports or paying franchise taxes. In either case, the directors must file articles of dissolution with the Minnesota Secretary of State in order to legally dissolve the corporation.

Minnesota Dissolution when Shares have NOT been Issued

Description

How to fill out Minnesota Dissolution When Shares Have NOT Been Issued?

Preparing formal documentation can be quite stressful unless you have convenient fillable templates at your disposal. With the US Legal Forms online repository of official forms, you can be assured that the blanks you receive align with federal and state laws and have been reviewed by our experts. Therefore, if you need to fill out Minnesota Dissolution when Shares have NOT been Issued, our service is the optimal place to acquire it.

Acquiring your Minnesota Dissolution when Shares have NOT been Issued from our service is as easy as pie. Previously authorized users with an active subscription simply need to Log In and click the Download button after locating the correct template. Subsequently, if necessary, users can utilize the same form from the My documents section of their account. Yet, even if you are not familiar with our service, registering with a valid subscription will only take a few minutes. Here’s a brief guide for you.

Haven’t you experienced US Legal Forms yet? Sign up for our service today to obtain any official document swiftly and effortlessly whenever you need to, and keep your paperwork organized!

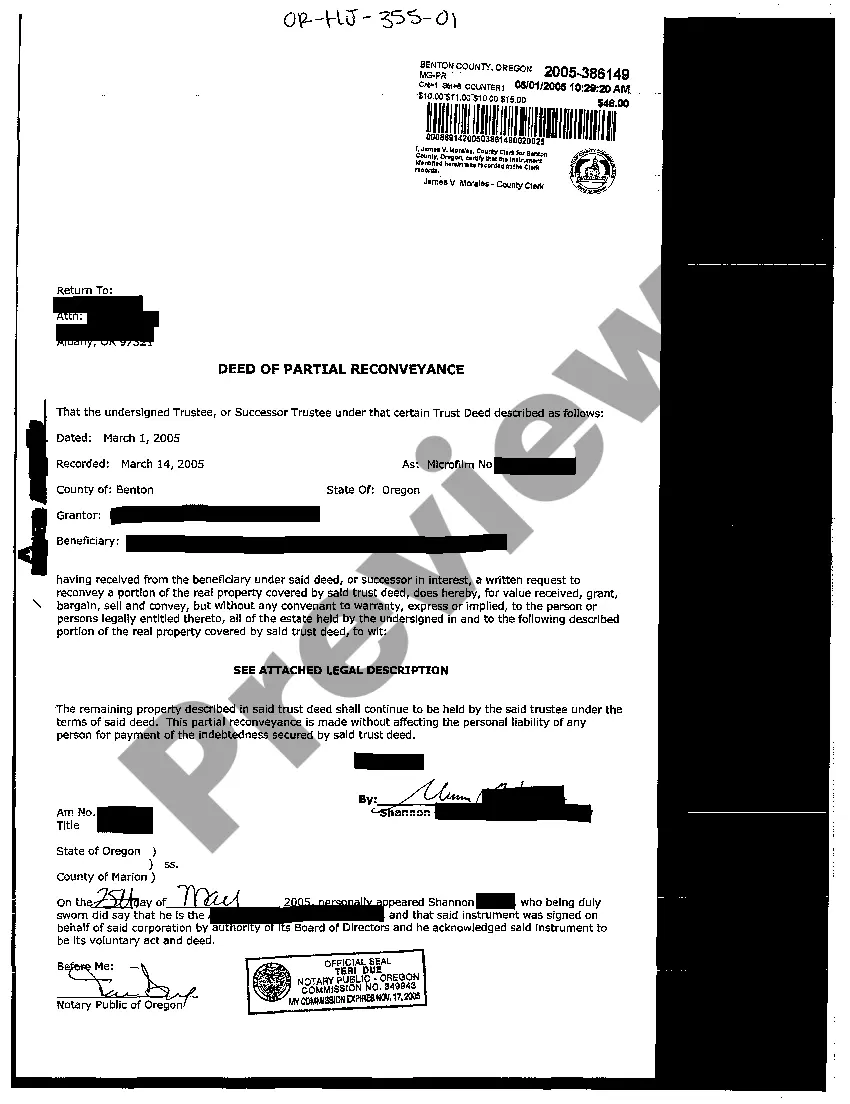

- Document compliance confirmation. You should carefully review the content of the form you wish to ensure it meets your requirements and complies with your state legal standards. Previewing your document and examining its general overview will assist you in this process.

- Alternative search (optional). If you encounter any discrepancies, explore the library via the Search tab above until you find an appropriate template, and click Buy Now when you identify the one you need.

- Account setup and form acquisition. Establish an account with US Legal Forms. After verifying your account, Log In and select your desired subscription plan. Make a payment to continue (options for PayPal and credit card are available).

- Template retrieval and additional usage. Choose the file format for your Minnesota Dissolution when Shares have NOT been Issued and click Download to save it on your device. Print it to complete your documents manually, or utilize a feature-rich online editor to prepare a digital version more quickly and efficiently.

Form popularity

FAQ

Yes, Minnesota does allow a partner to dissociate from a partnership without dissolving it. This means that a partnership can continue operating even when one partner leaves. However, it's important to follow the correct legal processes to ensure that the partnership remains compliant. If you're facing this situation, US Legal Forms can provide the necessary documentation and guidance for your Minnesota dissolution when shares have not been issued.

After a corporate dissolution, shareholders are entitled to receive their fair share of any remaining assets. This distribution occurs only after all debts and obligations have been settled. It's essential to follow the proper legal procedures to ensure compliance and fairness. For assistance with Minnesota dissolution when shares have not been issued, consider utilizing US Legal Forms.

If a corporation is not dissolved, it continues to exist legally and may incur ongoing fees or penalties. This can lead to complications, such as tax obligations and potential legal issues with creditors. Therefore, it's important to consider a formal dissolution. Engaging with a service like US Legal Forms can guide you through the Minnesota dissolution when shares have not been issued.

To dissolve a Minnesota corporation, you need to file Articles of Dissolution with the Secretary of State. This process is straightforward and requires the corporation to be in good standing. Once filed, ensure all debts are settled and necessary notifications are sent out. This step is crucial for a smooth Minnesota dissolution when shares have not been issued.

If you do not file articles of dissolution, your corporation may continue to exist legally, leading to potential tax liabilities and legal obligations. This can complicate matters in the future, especially in Minnesota. Therefore, filing for a Minnesota dissolution when shares have not been issued is crucial to avoid ongoing responsibilities.

A letter of intent to dissolve a corporation is a formal document stating the intention to cease operations and dissolve the company. This letter typically outlines the reasons for dissolution and the planned steps moving forward. It is an important part of the process, especially for a Minnesota dissolution when shares have not been issued.

To dissolve a Minnesota corporation, you must file the articles of dissolution with the Minnesota Secretary of State. Additionally, it is important to address any remaining liabilities and notify any creditors. This ensures that you are compliant with state laws, making the Minnesota dissolution when shares have not been issued straightforward.

Dissolving a business refers to the legal process of closing the company, while terminating can imply ending operations without any formal process. In Minnesota, a dissolution ensures that all legal obligations are met. Understanding this difference is essential for a proper Minnesota dissolution when shares have not been issued.

Closing a C corporation involves several steps, starting with holding a board meeting to approve the dissolution. Next, you must file articles of dissolution with the Minnesota Secretary of State. Make sure to settle all debts and notify creditors. This process is crucial for a proper Minnesota dissolution when shares have not been issued.

To dissolve a corporation, you must prepare and file the necessary paperwork with the state. In Minnesota, this includes articles of dissolution, which state your intention to dissolve. Additionally, you should settle any outstanding debts and liabilities. Following these steps ensures a smooth Minnesota dissolution when shares have not been issued.