Minnesota Affidavit for Collection of Personal Property for Small Estates

Definition and meaning

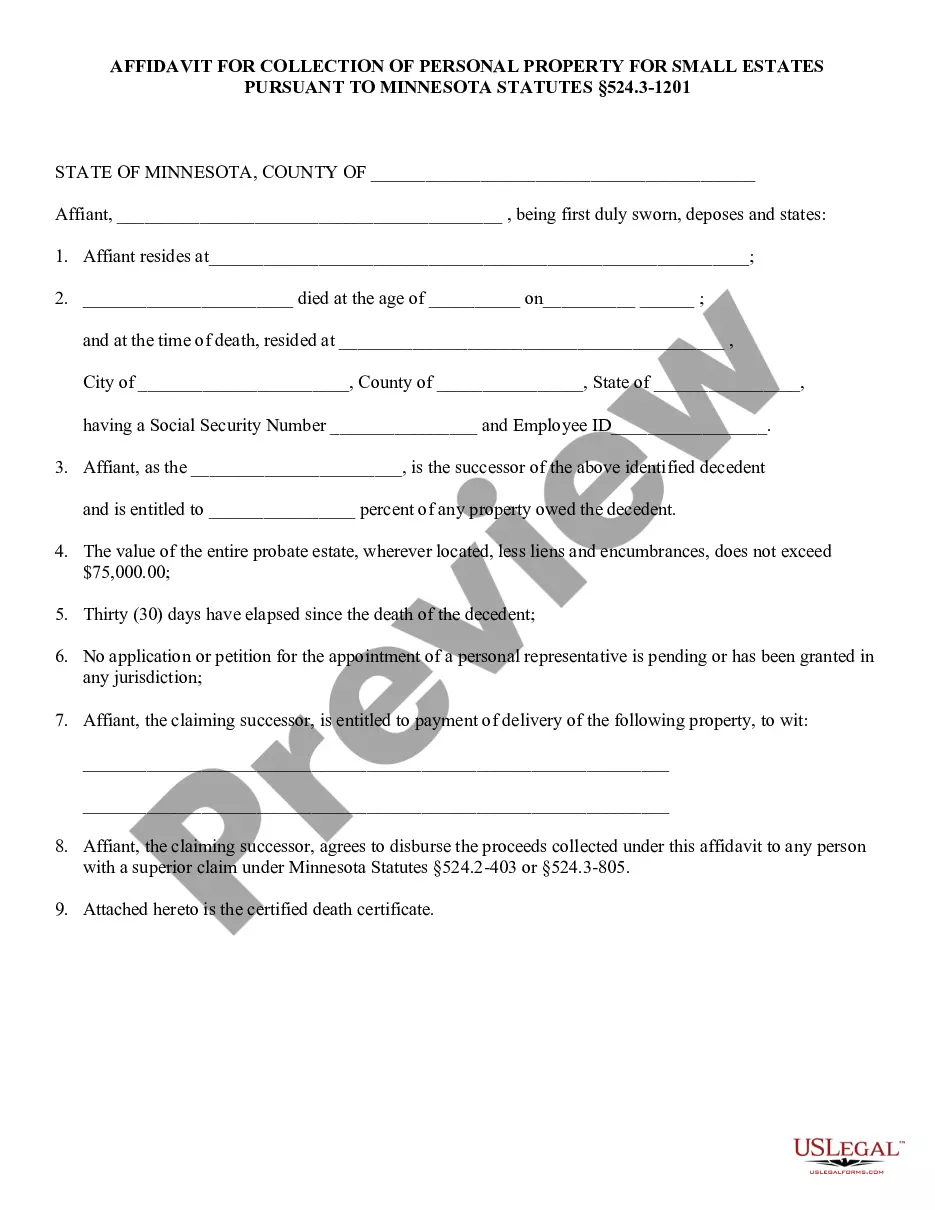

The Minnesota Affidavit for Collection of Personal Property for Small Estates is a legal document that allows a successor of a deceased person to collect personal property without going through formal probate. This affidavit is used when the total value of the deceased's estate is below a specified amount, which is currently set at $75,000, excluding any liens or encumbrances.

How to complete a form

To complete the Minnesota Affidavit for Collection of Personal Property for Small Estates, follow these steps:

- Provide your name and address as the affiant.

- Include the deceased person’s name, age at the time of death, and date of death.

- State the deceased's residence details at the time of death.

- Indicate your relationship to the deceased, verifying your entitlement to the property.

- Confirm that the total probate estate does not exceed the threshold amount.

- State that at least thirty days have passed since the death.

- Declare that no petition for a personal representative is pending.

- Specify the property you are claiming.

- Attach a certified copy of the deceased’s death certificate.

Who should use this form

This affidavit is essential for individuals who are successors or heirs entitled to collect personal property from a small estate. It is particularly useful for those managing estates that do not require extensive probate processes due to their limited value. If you are unsure whether your estate qualifies, it is advisable to consult with a legal professional.

Legal use and context

The Minnesota Affidavit for Collection of Personal Property for Small Estates is governed by Minnesota Statutes Section 524.3-1201. It enables individuals to access the deceased's personal assets directly without the need for lengthy and potentially costly probate proceedings. This form serves as a means of efficiently managing smaller estates while still adhering to state laws.

Key components of the form

Key components of the Minnesota Affidavit for Collection of Personal Property for Small Estates include:

- Affiant's identification and relationship to the deceased.

- Details of the deceased's estate and confirmation of its value.

- A statement regarding the elapsed time since the death.

- Declaration of no pending probate actions.

- A list of the property being claimed.

- Attachment of a certified death certificate.

Benefits of using this form online

Using the Minnesota Affidavit for Collection of Personal Property for Small Estates online offers several benefits:

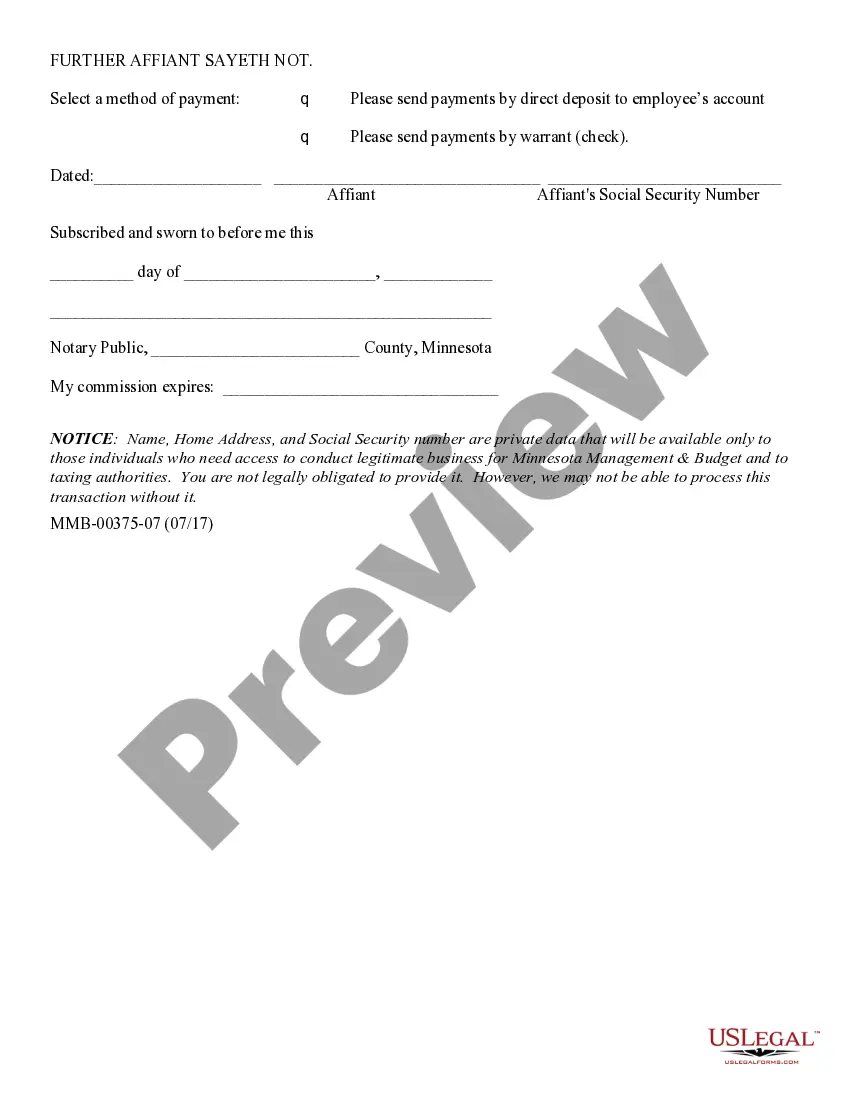

- Convenience of accessing and completing the form from any location.

- Reduced risk of errors with user-friendly guidance.

- Immediate availability of resources and support.

- Simplified printing and saving processes for your records.

Common mistakes to avoid when using this form

When completing the Minnesota Affidavit for Collection of Personal Property for Small Estates, avoid these common mistakes:

- Failing to provide accurate information about the deceased.

- Not attaching the required certified death certificate.

- Overlooking the relationship to the deceased, which establishes entitlement.

- Not confirming the total estate value is under the required limit.

Form popularity

FAQ

Minnesota Small Estate Affidavit - EXPLAINED - YouTube YouTube Start of suggested clip End of suggested clip Before we go where can you find legal documents. Online click the button to the right for aMoreBefore we go where can you find legal documents. Online click the button to the right for a minnesota small state affidavit.

A. See Minnesota Statutes, section 524.3-1201. The affidavit can collect the decedent's personal property in safe deposit boxes, interests in multiple-party accounts, and debts owed to the decedent. See Minnesota Statutes, sections 524.3-1201, 55.10, and 524.6-207.

Minnesota small estate affidavit is a legal form used in estates valued and under $75,000. Minnesota statute 524.3-1201 tells us that this dollar amount is the threshold level by which an estate in Minnesota does or does not need to be probated.

Under Minnesota statute, where as estate is valued at not more than $75,000, an interested party may, thirty (30) days after the death of the decedent, issue a small estate affidavit to collect any debts owed to the decedent.

How to Write (1) Name Of Minnesota Deceased.(2) County Of Minnesota Deceased.(3) Name of Minnesota Petitioner.(4) Address Of Minnesota Petition. (5) Date Of Minnesota Decedent Death.(6) Basis For Minnesota Petitioner Claim.(7) Minnesota Decedent Estate Assets.(8) Signature Date Of Minnesota Petitioner.

An heir can use a small-estate affidavit if the estate's worth is below the $75,000 limit set by Minnesota law.

Affidavit of No-Probate (PS2071) is used by one or more heirs at law (adult children, parents, siblings), who affirm they have the authority to represent all heirs and that the estate is not subject to probate. The applicant's signature must be notarized or witnessed.

An affidavit for collection is a procedure that transfers assets of estates that would otherwise be probated and that have a net value of under $75,000. With the affidavit, there is no court appearance, no personal representative appointed, and no mailed notification to interested parties.