Organizational Minutes for a Minnesota Professional Corporation

Description

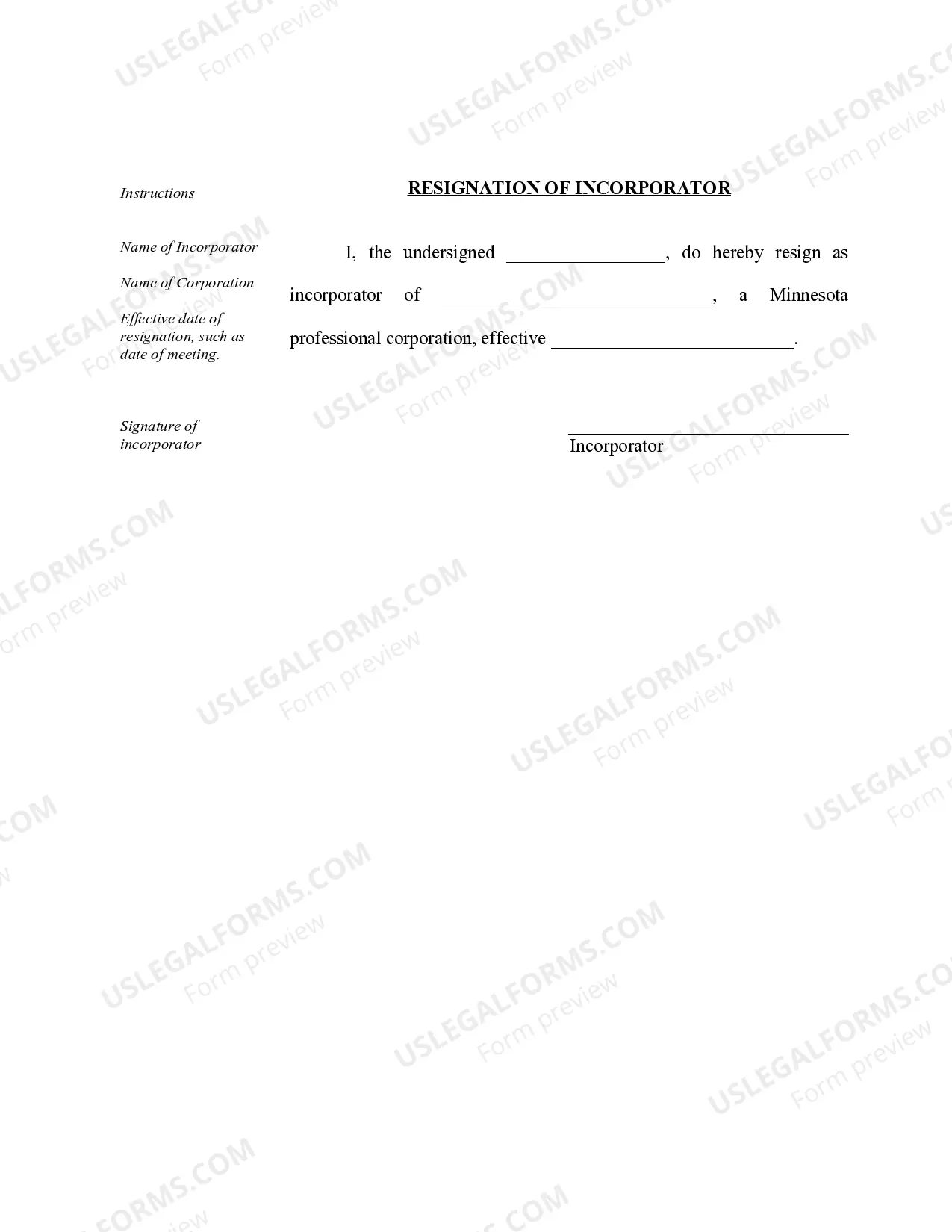

How to fill out Organizational Minutes For A Minnesota Professional Corporation?

Obtain any type from 85,000 legal records including Organizational Minutes for a Minnesota Professional Corporation online with US Legal Forms. Each template is crafted and refreshed by state-licensed lawyers.

If you already possess a subscription, Log In. When you're on the form’s page, click on the Download button and navigate to My documents to gain access to it.

If you have not yet subscribed, follow the instructions outlined below.

With US Legal Forms, you will consistently have instant access to the appropriate downloadable example. The platform grants you access to documents and categorizes them to simplify your search. Utilize US Legal Forms to acquire your Organizational Minutes for a Minnesota Professional Corporation quickly and effortlessly.

- Verify the state-specific criteria for the Organizational Minutes for a Minnesota Professional Corporation you wish to utilize.

- Examine the description and preview the example.

- Once you are assured the example meets your needs, simply click Buy Now.

- Choose a subscription plan that fits your financial situation.

- Establish a personal account.

- Pay using one of two suitable methods: by card or through PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- After your reusable template is downloaded, print it out or save it to your device.

Form popularity

FAQ

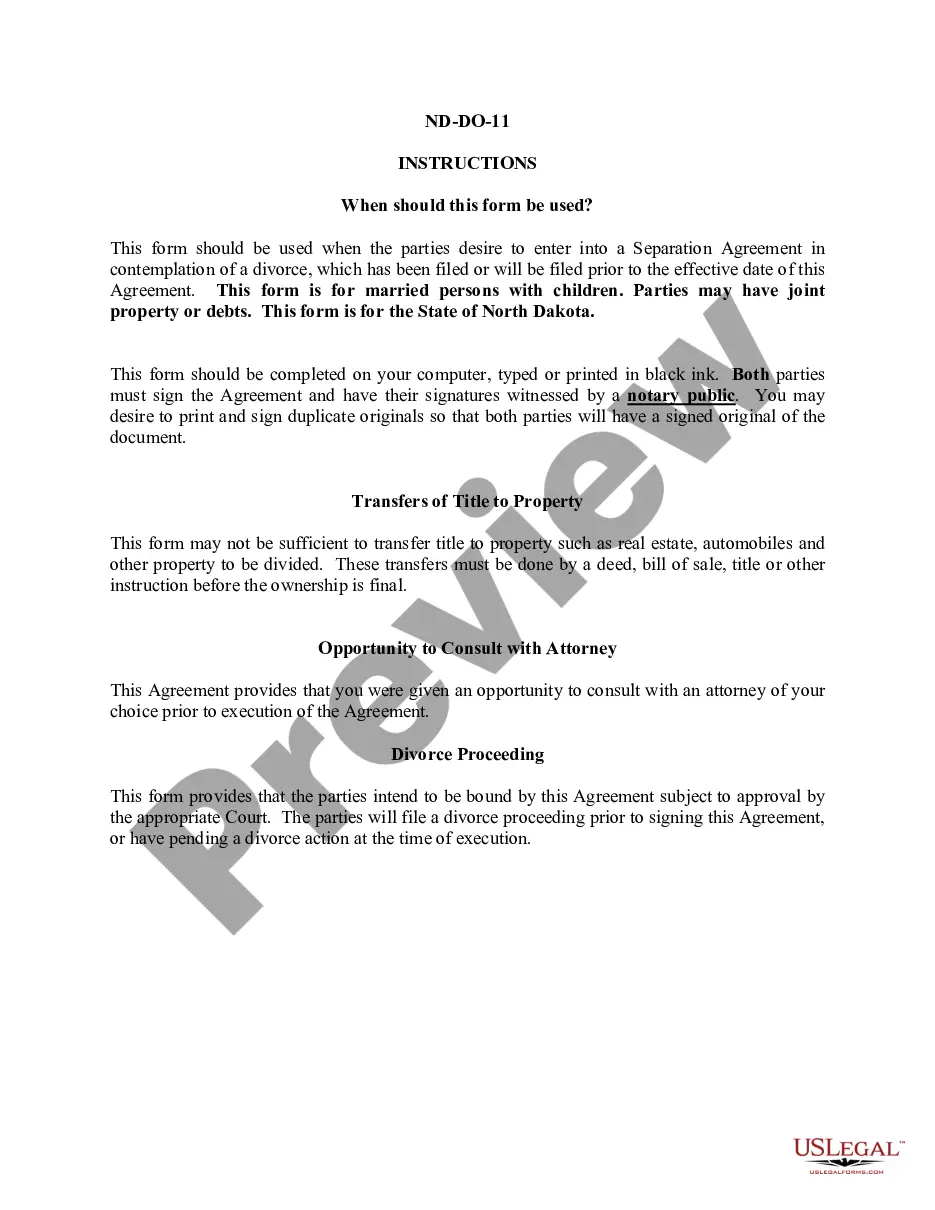

To form an S Corporation in Minnesota, start by choosing a unique name for your business and filing the Articles of Incorporation with the MN SOS. Afterward, you must draft and adopt organizational minutes for your Minnesota professional corporation, which outline the initial structure and operations. Next, file Form 2553 with the IRS to elect S Corporation status. For a smooth process, consider using a platform like uslegalforms to access templates and guidance tailored to your corporate needs.

The Minnesota Secretary of State (MN SOS) provides various services to help businesses, including filing documents for organizational minutes for a Minnesota professional corporation. They assist with the registration of new entities, maintain records, and offer guidance on compliance requirements. Additionally, the MN SOS offers resources for understanding business structures and ongoing filing obligations. Utilizing these services can simplify the management of your corporation’s legal documentation.

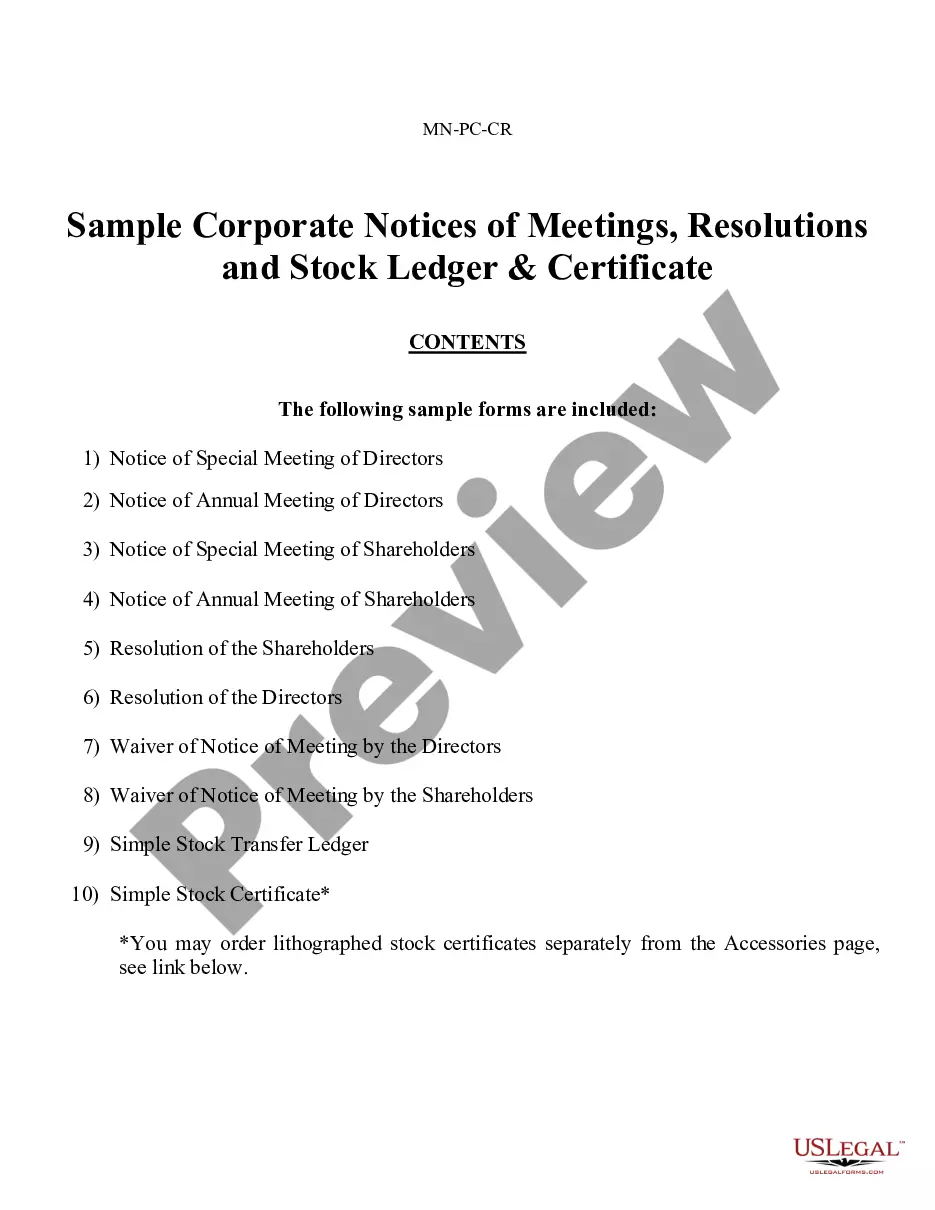

Corporate meeting minutes should include the date, time, and location of the meeting, along with a list of attendees and absentees. Moreover, the minutes should summarize key discussions, decisions made, and any actions assigned, reflecting the Organizational Minutes for a Minnesota Professional Corporation. It's important to capture resolutions and voting outcomes to maintain an accurate record. With US Legal Forms, you can access templates that guide you through this process, ensuring your minutes are both comprehensive and compliant.

Yes, meeting minutes are essential for an S Corporation, as they help maintain formal records of corporate decisions and actions. These Organizational Minutes for a Minnesota Professional Corporation serve to document discussions held during meetings, ensuring transparency and compliance with state laws. By keeping accurate minutes, you also protect your corporation's legal status and facilitate smoother operations. Utilizing a reliable platform like US Legal Forms can simplify this process and ensure you meet all requirements.

In most cases, corporate minutes do not need to be notarized. However, it is crucial to retain them as part of your corporate records. For organizational minutes for a Minnesota Professional Corporation, keeping them accurate and organized can help establish credibility and facilitate future corporate actions.

The legal requirements for meeting minutes can vary by state, but generally, they must accurately reflect the discussions and decisions made during the meeting. For a Minnesota Professional Corporation, it is essential to include the names of those present, motions made, and results of votes. Adhering to these requirements helps protect your corporation’s legal standing.

Creating meeting minutes for a corporation involves documenting the date, time, and location of the meeting, as well as the attendees. You should record the key discussions, decisions made, and any action items assigned. Using a template for organizational minutes for a Minnesota Professional Corporation can simplify this process and ensure you capture all necessary details.

Yes, corporations are required to maintain meeting minutes. These minutes serve as a formal record of the decisions made and actions taken during meetings. Organizational minutes for a Minnesota Professional Corporation help ensure compliance with state laws and provide transparency for shareholders and stakeholders.