Professional Corporation Package for Minnesota

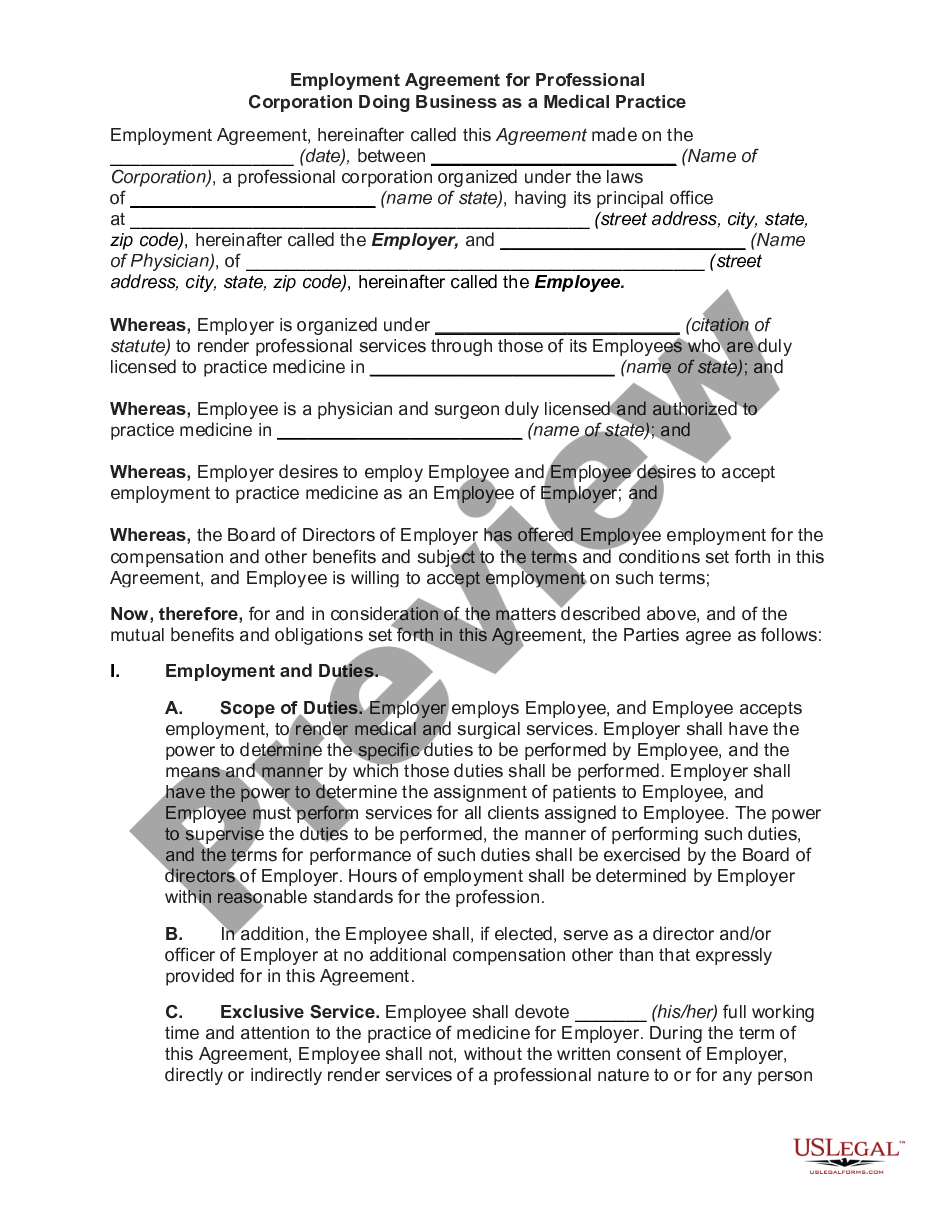

Description

How to fill out Professional Corporation Package For Minnesota?

Amid countless paid and complimentary samples available online, you cannot be guaranteed of their trustworthiness. For instance, who created them or whether they possess the expertise to handle what you need them for.

Stay calm and take advantage of US Legal Forms! Explore Professional Corporation Package for Minnesota templates crafted by experienced attorneys and sidestep the costly and time-consuming task of searching for a lawyer and then compensating them to draft a document for you that you can acquire independently.

If you already hold a subscription, Log In to your account and locate the Download button adjacent to the form you seek. You will also have access to all of your previously downloaded documents in the My documents section.

Download the form in the desired format. Once you’ve registered and purchased your subscription, you can use your Professional Corporation Package for Minnesota as frequently as you wish or for as long as it remains active in your area. Edit it with your preferred offline or online editor, complete it, sign it, and make a physical copy of it. Achieve more for less with US Legal Forms!

- If you are utilizing our service for the first time, adhere to the steps below to obtain your Professional Corporation Package for Minnesota swiftly.

- Ensure that the document you view is valid in the state of your residence.

- Examine the template by reading the instructions for using the Preview function.

- Click Buy Now to initiate the ordering process or search for another sample using the Search field found in the header.

- Choose a pricing plan and establish an account.

- Pay for the subscription with your credit/debit card or Paypal.

Form popularity

FAQ

Forming a corporation in Minnesota involves several key steps. First, choose a distinctive name for your corporation that meets state regulations. Then, file the Articles of Incorporation with the Minnesota Secretary of State, paying attention to the requirements for corporate governance. To ease this process, you can use our Professional Corporation Package for Minnesota, which includes all necessary resources and documents to help you establish your business efficiently.

To form a professional corporation, start by selecting a unique name that complies with Minnesota's naming requirements. Next, prepare and file the Articles of Incorporation with the Minnesota Secretary of State, ensuring you include the necessary details about your business. After that, create corporate bylaws to outline the management structure. Lastly, consider our Professional Corporation Package for Minnesota, which simplifies this process and provides you with all the essential documents.

The primary difference between an incorporated business and a professional corporation lies in the nature of the services provided. An incorporated business can operate in various sectors, while a professional corporation is specifically for licensed professionals providing designated services. Understanding these distinctions can help you choose the right structure for your business, and a Professional Corporation Package for Minnesota can guide you through this decision.

A professional corporation qualifies as a business entity formed by licensed professionals to provide specific services, such as medical or legal services. It must comply with state laws and regulations governing professional practices. This structure offers certain benefits, including limited liability protection for its owners, making a Professional Corporation Package for Minnesota an attractive option for professionals.

No, an LLC cannot be a professional corporation. While both structures provide liability protection, a professional corporation is specifically designed for licensed professionals, such as doctors and lawyers. If you wish to operate as a professional entity in Minnesota, consider forming a professional corporation using a Professional Corporation Package for Minnesota.

Starting a PCA business in Minnesota requires you to form a professional corporation, secure the necessary licenses, and develop a business plan. You will also need to understand the regulations governing personal care assistants in the state. A Professional Corporation Package for Minnesota can assist you in navigating these requirements efficiently.

Creating a professional corporation involves several steps, including selecting a business name, filing the articles of incorporation with the Minnesota Secretary of State, and obtaining any necessary licenses. You may also need to draft corporate bylaws and hold an initial meeting to appoint directors. Using a Professional Corporation Package for Minnesota can streamline this process and ensure compliance with all legal requirements.

The Minnesota corporate tax rate is currently set at 9.8% for most corporations. This rate applies to taxable income earned by corporations in Minnesota. If you are considering forming a corporation, our Professional Corporation Package for Minnesota can help you navigate tax implications and ensure your compliance with state regulations. Understanding the tax landscape is crucial for your business's financial health.

The primary difference between a corporation and a professional corporation lies in the nature of their business activities. A professional corporation is specifically designed for licensed professionals, such as doctors and lawyers, allowing them to limit personal liability for business debts while adhering to ethical standards. In contrast, a standard corporation can engage in various business activities without these specific professional regulations. Understanding these distinctions can help you decide on the right structure, and the Professional Corporation Package for Minnesota can assist you in making an informed choice.

Setting up a professional corporation can lead to several disadvantages. First, there are higher formation and ongoing maintenance costs compared to other business structures. Additionally, you may face stricter regulatory requirements and increased scrutiny from licensing boards. It is essential to weigh these factors against the benefits when considering the Professional Corporation Package for Minnesota.