Minnesota Collection Letter

What this document covers

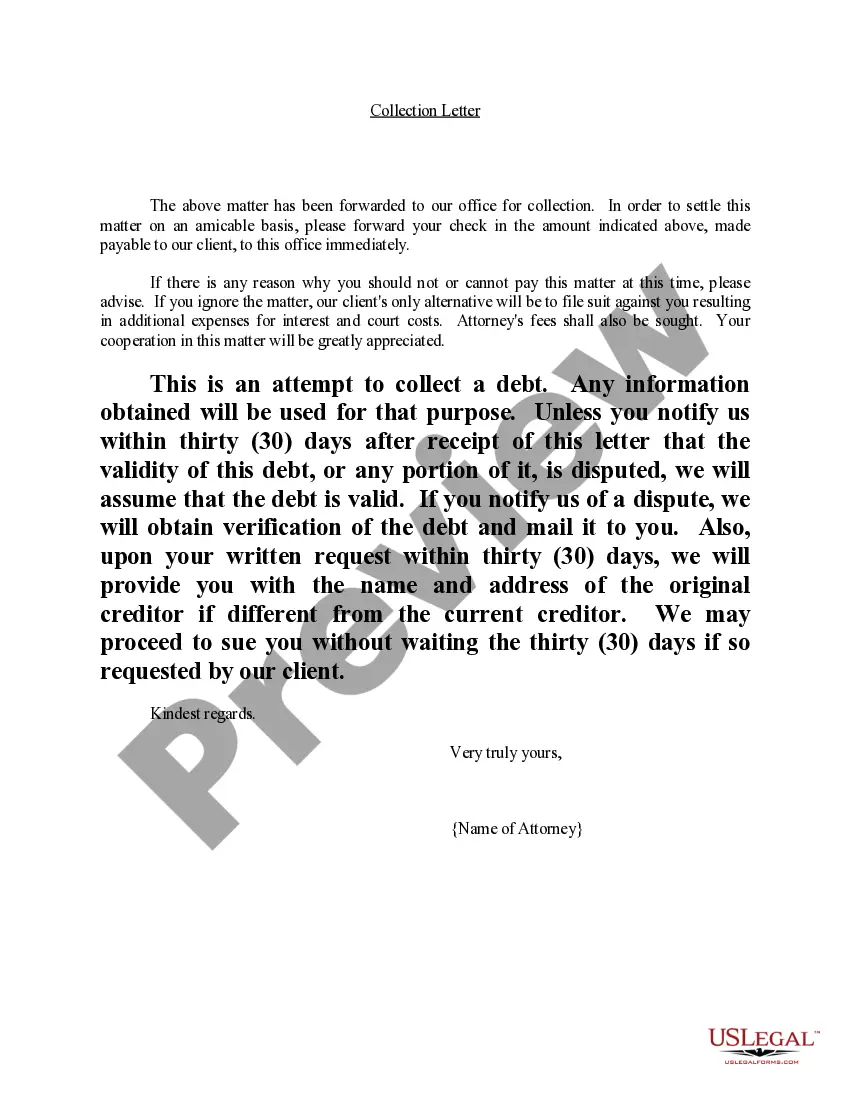

The Collection Letter is a standard legal document used by attorneys to notify a debtor about an outstanding debt. This form serves as a formal request for payment and is compliant with the Fair Debt Collection Act. It provides clear communication regarding the debt owed, the consequences of non-payment, and the steps the debtor can take to dispute the validity of the debt.

What’s included in this form

- Introduction outlining the purpose of the letter and the amount owed.

- Instructions for payment submission.

- Notification of potential consequences for non-payment, including legal action.

- Information on disputing the debt's validity.

- Request for the original creditor's details if applicable.

Situations where this form applies

This Collection Letter should be used when a creditor wishes to formally request payment from a debtor. It is typically issued after initial reminders or informal requests have failed. This letter serves to document the debt and initiate the collection process before legal action is considered.

Intended users of this form

- Creditors seeking to collect outstanding debts.

- Attorneys representing clients in debt collection matters.

- Businesses that provide credit or services on account.

- Individuals acting on behalf of themselves or others to recover debts.

How to complete this form

- Fill in the debtor's name and address accurately.

- Specify the amount of debt owed in the appropriate section.

- Include any relevant dates, such as the date of the letter or the due date for payment.

- Provide clear instructions on how the debtor should remit payment.

- Sign the letter with the attorneyâs name and firm information.

Does this form need to be notarized?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include accurate debtor information.

- Not providing adequate payment instructions.

- Leaving out crucial information about dispute rights.

- Using unclear language that may confuse the debtor.

Benefits of using this form online

- Immediate access to a professionally drafted form.

- Ability to customize the letter to suit specific circumstances.

- Convenient downloading and printing options for immediate use.

- Peace of mind knowing the form adheres to legal standards.

Key takeaways

- The Collection Letter is vital for initiating formal debt collection.

- It informs debtors of their rights and responsibilities under the Fair Debt Collection Act.

- Completing the letter carefully can help avoid common mistakes in communication.

- Using this form can streamline the debt recovery process effectively.

Looking for another form?

Form popularity

FAQ

In Minnesota, a debt generally becomes uncollectible after six years, depending on the type of debt. This means that creditors can no longer pursue legal action to collect it. By understanding this timeline, you can better strategize your financial plans and debt management.

To obtain a debt letter, you can request a Minnesota Collection Letter directly from the creditor or collection agency handling your account. It's important to ask for this letter if you have not received one, as it contains valuable information about the debt. Having this documentation can assist you in managing your obligations and making informed decisions.

Yes, collection agencies must send you a debt validation letter after they contact you about an unpaid debt. This letter, often referred to as a Minnesota Collection Letter, provides essential details about the debt, including the amount owed and the original creditor. Receiving this information helps you verify the debt and understand your options.

In Minnesota, the statute of limitations typically allows creditors six years to collect most debts. After this period, the debt becomes uncollectible, meaning creditors cannot take legal action. It's essential to understand this timeframe, as it can influence how you manage your finances and any outstanding debts.

Collection laws in Minnesota regulate how creditors can collect debts. These laws protect consumers from unfair practices and require lenders to provide written notification, often in the form of a Minnesota Collection Letter. Understanding these laws can help you navigate your rights and responsibilities when dealing with debt.

The statute of limitations for bringing a lawsuit for breach of contract under Minnesota law is six (6) years. This means that a creditor or debt collector can sue you anytime within six (6) years from the date of your last purchase or last payment, whichever was later.

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.

You'll get notices and possibly calls seeking payment. At some point, usually after 180 days, the creditor such as a credit card company, bank or medical provider gives up on trying to collect. The original creditor may then sell the debt to a collections agency to recoup losses.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means that a debt collector may still attempt to pursue it, but they can't typically take legal action against you.

The time limits for civil claims and other actions in Minnesota vary from two years for personal injury claims to 10 years for judgments. Fraud, injury to personal property, and trespassing claims have a six-year statute of limitations, as do both written and oral contracts.