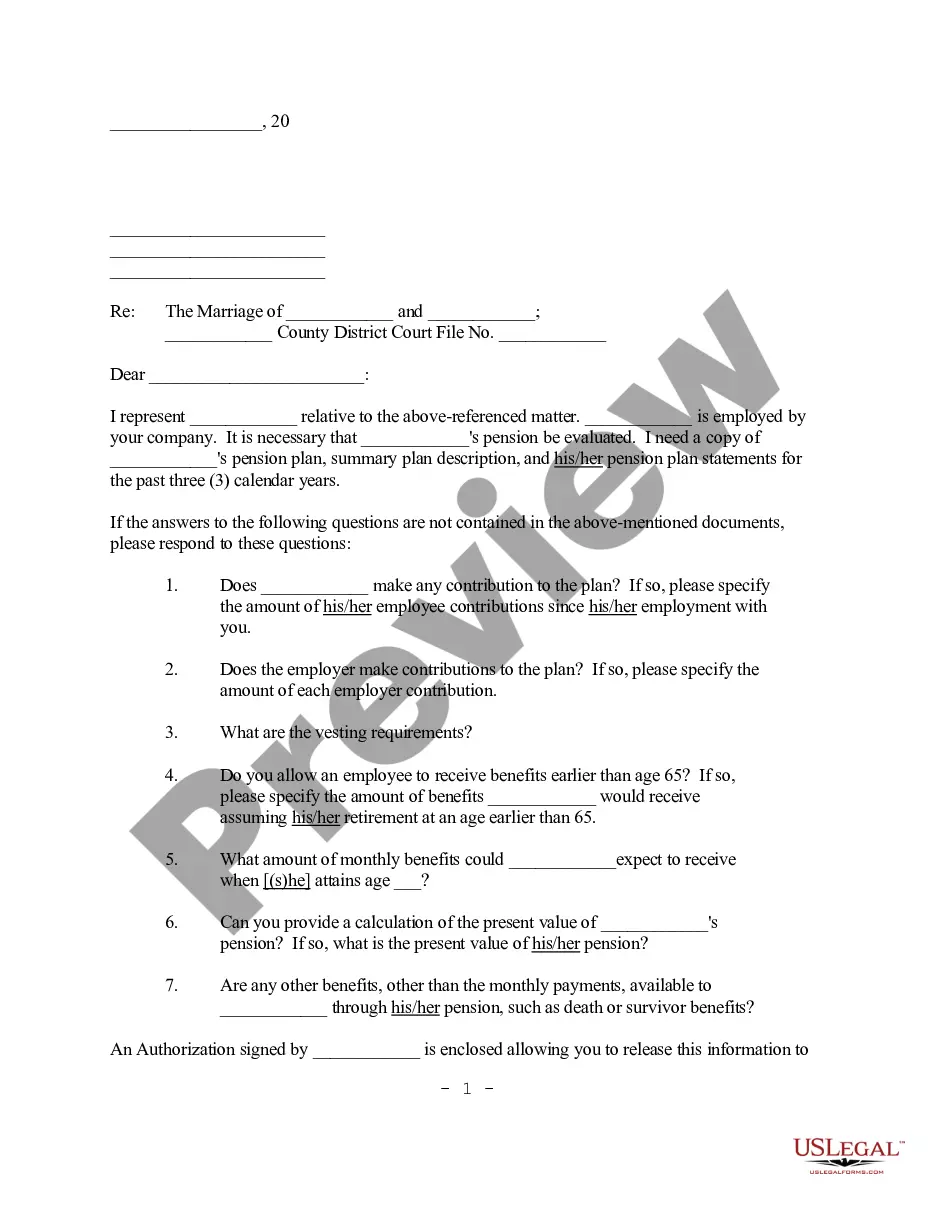

Minnesota Letter to Plan Administrator regarding Request for Summary Pension Plan Description

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota Letter To Plan Administrator Regarding Request For Summary Pension Plan Description?

Obtain any template from 85,000 legal documents such as the Minnesota Letter to Plan Administrator concerning Request for Summary Pension Plan Description online with US Legal Forms. Each template is crafted and revised by state-licensed legal experts.

If you already have a membership, sign in. Once you’re on the form’s page, click on the Download button and navigate to My documents to access it.

If you haven’t subscribed yet, follow the steps outlined below: Check the state-specific criteria for the Minnesota Letter to Plan Administrator regarding Request for Summary Pension Plan Description you wish to utilize. Review the description and preview the template. Once you’re assured the sample is what you require, simply click Buy Now. Choose a subscription plan that suits your finances. Establish a personal account. Make payment in one of two acceptable methods: by credit card or via PayPal. Select a format to download the document in; two options are available (PDF or Word). Download the document to the My documents tab. After your reusable form is downloaded, print it out or save it to your device.

- With US Legal Forms, you will consistently have prompt access to the appropriate downloadable template.

- The service grants you access to documents and organizes them into categories to simplify your search.

- Utilize US Legal Forms to acquire your Minnesota Letter to Plan Administrator regarding Request for Summary Pension Plan Description swiftly and effortlessly.

Form popularity

FAQ

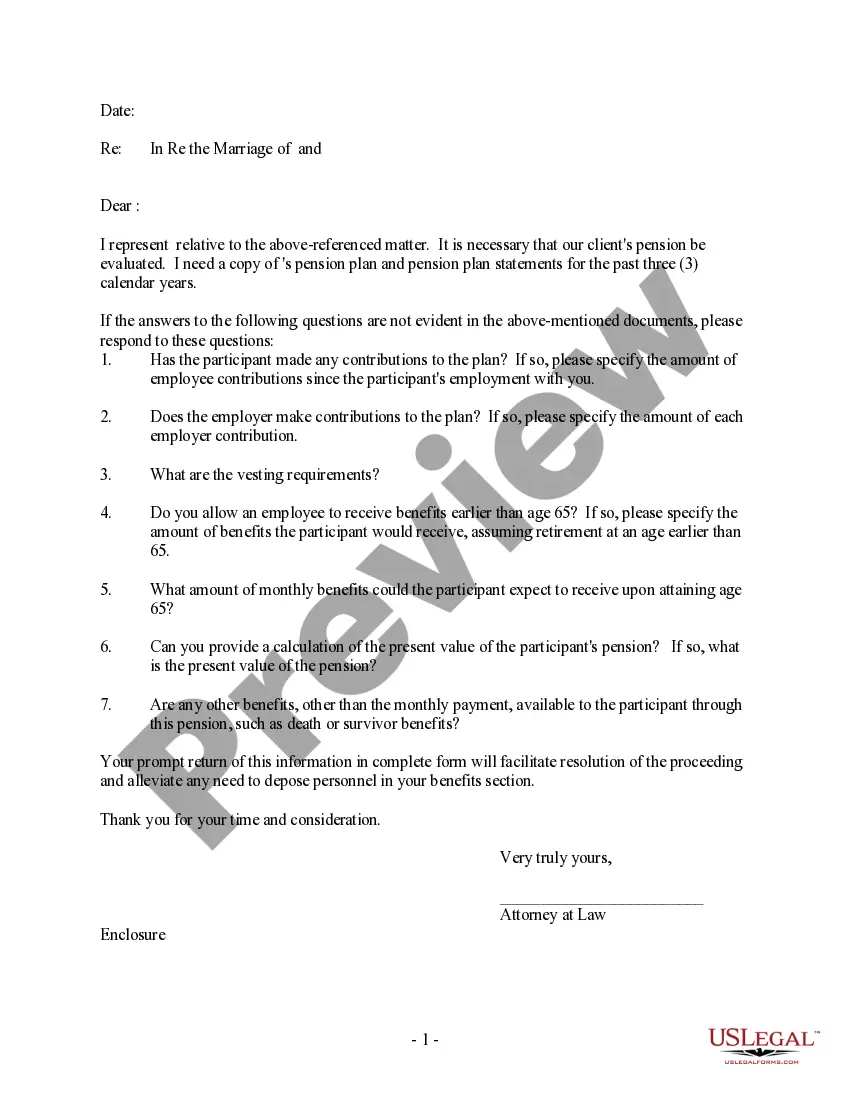

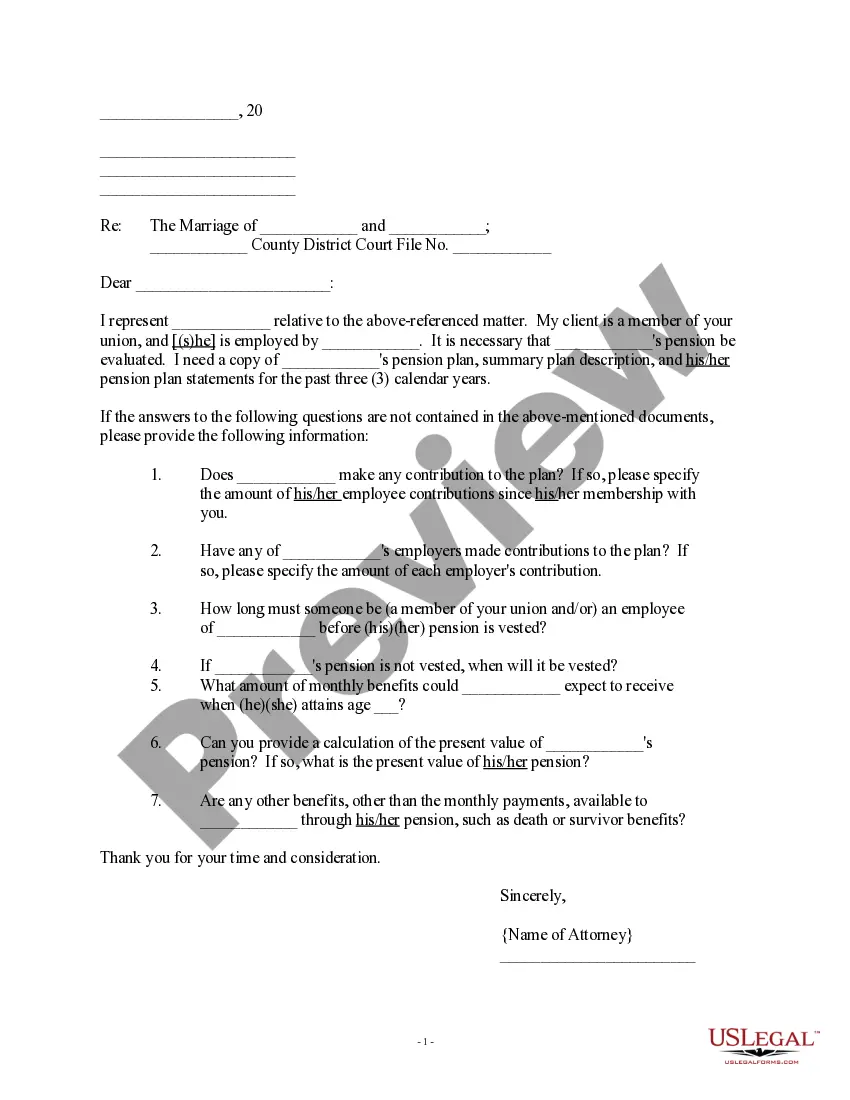

The summary plan description of a defined benefit plan outlines the benefits you will receive upon retirement, how they are calculated, and the conditions for eligibility. It also explains your rights as a plan participant. For a complete understanding, consider sending a Minnesota Letter to Plan Administrator regarding Request for Summary Pension Plan Description to get the detailed information you need.

Yes, pensions are required to have summary plan descriptions that provide essential information about the plan. These documents explain benefits, eligibility, and how to file a claim. If you need a copy, a Minnesota Letter to Plan Administrator regarding Request for Summary Pension Plan Description can be a helpful tool to ensure you receive the SPD.

A defined benefit retirement plan guarantees a specific payout at retirement, based on factors like salary history and duration of employment. This type of plan provides financial security, as it assures a consistent income in retirement. If you are assessing your options, consider requesting more details through a Minnesota Letter to Plan Administrator regarding Request for Summary Pension Plan Description.

To obtain your summary plan description, you can contact your plan administrator directly. It’s beneficial to include a Minnesota Letter to Plan Administrator regarding Request for Summary Pension Plan Description to specify your request. This letter can help expedite the process and ensure you receive the information you need regarding your benefits.

When writing a letter to your bank manager about your pension, begin with a polite greeting and clearly state your purpose. Include details about your pension account, and mention any specific requests or questions you have. You might also refer to your Minnesota Letter to Plan Administrator regarding Request for Summary Pension Plan Description to provide context to your inquiry.

To write an application letter for your pension, start by addressing it to the appropriate plan administrator. Clearly state your request for your pension benefits, including any relevant personal information. You may also want to mention the Minnesota Letter to Plan Administrator regarding Request for Summary Pension Plan Description to ensure your request is processed efficiently.

A summary plan description (SPD) is a document that outlines the important features of a pension plan. It details the benefits, rights, and obligations of both the employer and the employee. If you need to understand your benefits better, you can request the SPD through a Minnesota Letter to Plan Administrator regarding Request for Summary Pension Plan Description.

Yes, a summary plan description is required by law under the Employee Retirement Income Security Act (ERISA). This document provides essential information about the plan's benefits, rights, and obligations. If you need to request one, using a Minnesota Letter to Plan Administrator regarding Request for Summary Pension Plan Description can streamline the process. Ensuring you have this document is crucial for understanding your retirement benefits and making informed decisions.

To obtain a 401k summary plan description, you should start by contacting your plan administrator directly. You can send a Minnesota Letter to Plan Administrator regarding Request for Summary Pension Plan Description if you prefer a formal approach. This letter can help you clearly express your request and ensures you receive the necessary documentation. Additionally, you may find the summary plan description available on your employer’s benefits portal or human resources department.