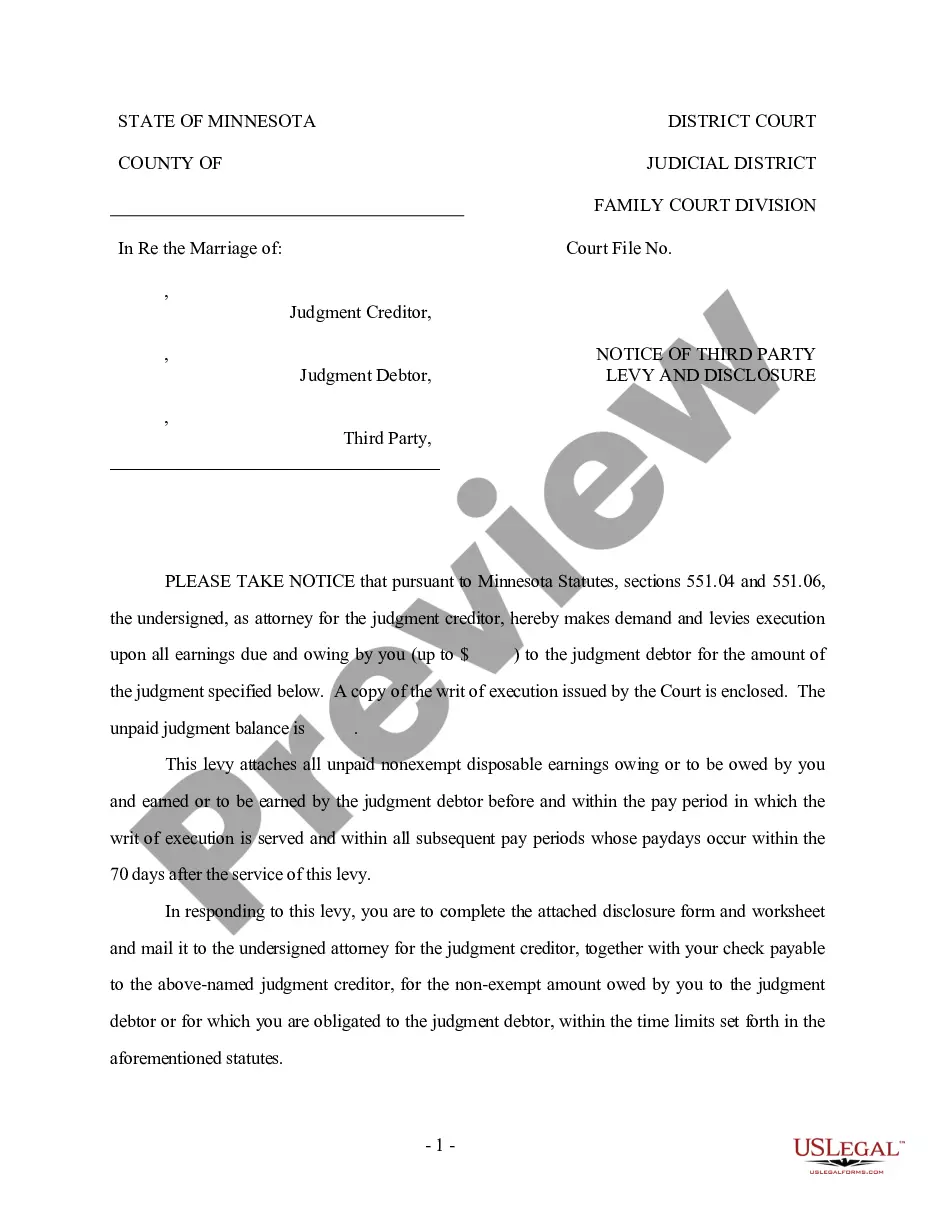

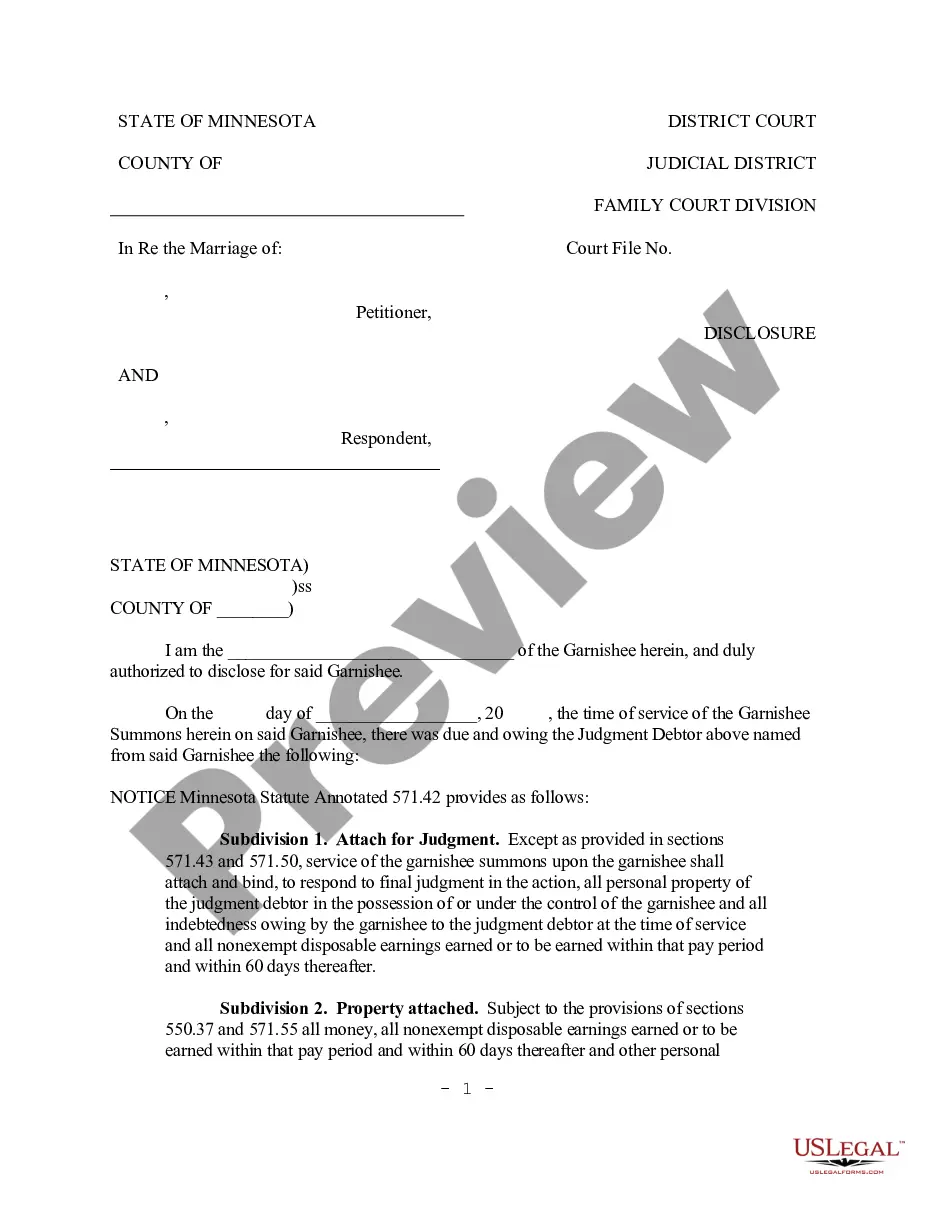

Minnesota Notice of Third Party Levy and Disclosure - Garnishment

Description

How to fill out Minnesota Notice Of Third Party Levy And Disclosure - Garnishment?

Obtain any version from 85,000 lawful documents like Minnesota Notice of Third Party Levy and Disclosure - Garnishment online with US Legal Forms. Each template is crafted and refreshed by state-certified legal experts.

If you already possess a subscription, sign in. Once you're on the form’s page, click the Download button and navigate to My documents to access it.

If you have not subscribed yet, follow the instructions below.

With US Legal Forms, you'll consistently have immediate access to the correct downloadable sample. The platform offers you access to forms and categorizes them to enhance your search. Utilize US Legal Forms to acquire your Minnesota Notice of Third Party Levy and Disclosure - Garnishment quickly and effortlessly.

- Verify the state-specific criteria for the Minnesota Notice of Third Party Levy and Disclosure - Garnishment you intend to utilize.

- Browse the description and preview the sample.

- Once you are certain the sample meets your needs, simply click Buy Now.

- Choose a subscription plan that fits your financial plan.

- Establish a personal account.

- Make a payment using one of two suitable methods: by card or via PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- After your reusable template is downloaded, print it out or save it to your device.

Form popularity

FAQ

Generally, any creditor can garnish your wages. But some creditors must meet more requirements before doing so. Specifically, most must file a lawsuit and obtain a money judgment and court order before garnishing your wages. However, not all creditors need a court order.

Regular creditors cannot garnish your wages without first suing you in court and obtaining a money judgment. That means that if you owe money to a credit card company, doctor, dentist, furniture company, or the like, you don't have to worry about garnishment unless those creditors sue you in court.

To start the wage garnishment process, file a Writ of Execution with the sheriff in that county. This authorizes the sheriff to inform the debtor's employer that a portion of his employee's wages need to be withheld from his paycheck each pay period until the debt is settled.

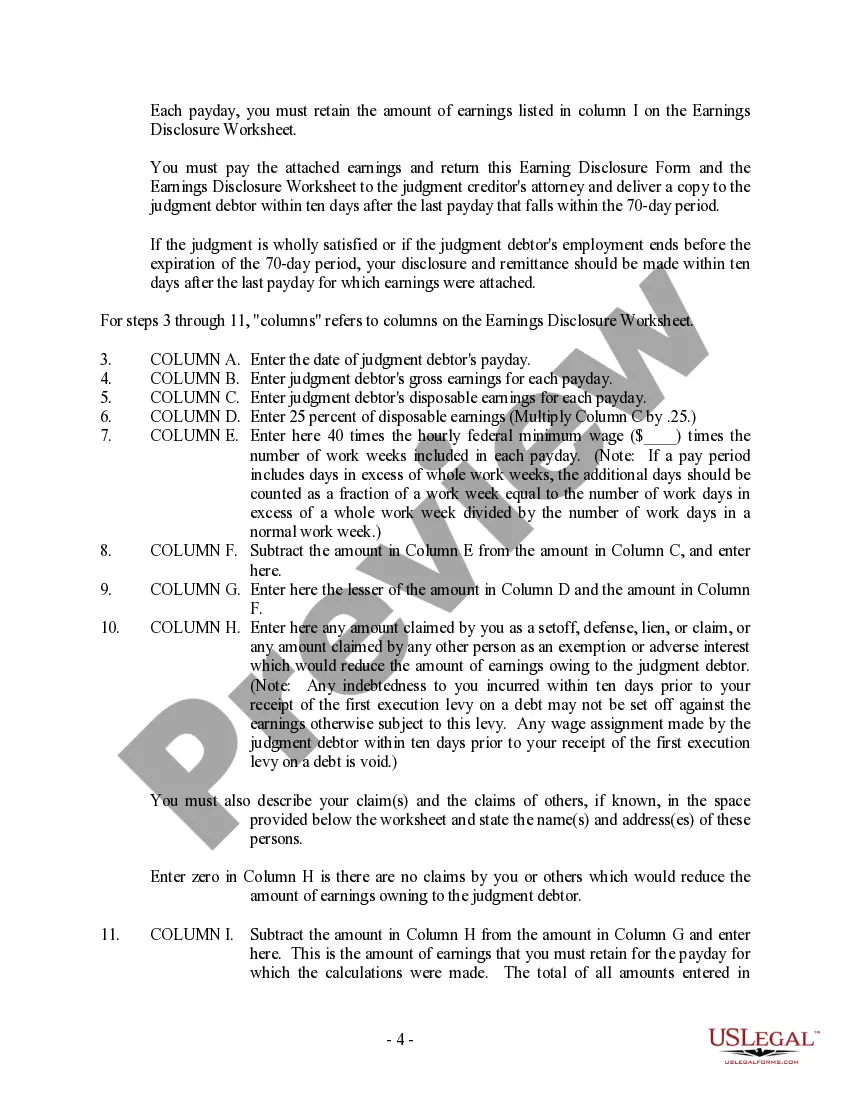

If you have won a court judgment against someone with a decent job, you may be able to intercept up to 25% of his or her wages to satisfy your judgment. This process, permitted in nearly every state, is called a wage garnishment.

But the $1,400 stimulus checks can be garnished for unpaid private debts, such as medical bills or credit card debts, provided they are subject to a court order, according to Christine Hines, legislative director at the National Association of Consumer Advocates.

The federal benefits that are exempt from garnishment include: Social Security Benefits. Supplemental Security Income (SSI) Benefits. Veterans' Benefits.

With the second stimulus check, your payment was protected from bank garnishment and from private creditors and debt collectors, according to the text of the law.Federal law allows only state and federal government agencies to take your refund as payment toward a debt, not individual or private creditors.

You can sue for wrongful garnishment You can sue even if you owe the debt. If you win the case, you get: (1) $1,000 in statutory damages; (2) any provable actual damages--such as out-of-pocket loss or emotional distress; (3) the collector has to pay your attorney fees; and (4) the collector has to pay your court costs.

Currently, there are only nine community property states in the United States: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, and Washington.And since wages are considered community property if you have unpaid debts that result in judgments against you, your spouses' wages can be garnished also.