Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement

Description

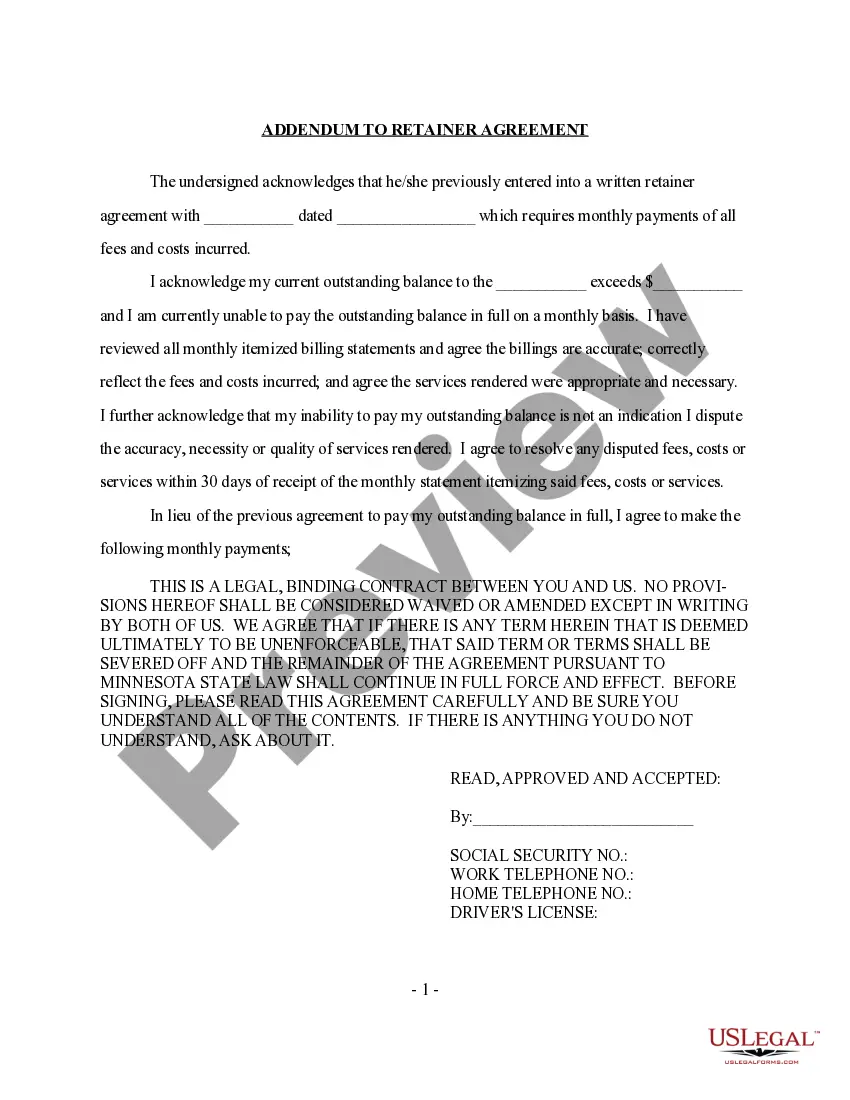

How to fill out Minnesota Restructuring Of Monthly Payments For Past-Due Retainer Agreement?

Access any template from 85,000 legal documents, including the Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement, online with US Legal Forms. Each template is composed and refreshed by state-certified lawyers.

If you already possess a subscription, Log In. When you are on the form’s page, click on the Download button and navigate to My documents to retrieve it.

If you have not yet subscribed, follow the steps outlined below.

With US Legal Forms, you will always have instant access to the suitable downloadable template. The platform grants you access to documents and categorizes them to streamline your search. Utilize US Legal Forms to acquire your Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement quickly and effortlessly.

- Review the state-specific guidelines for the Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement you intend to utilize.

- Browse the description and view the sample.

- Once you are assured the template meets your requirements, simply click Buy Now.

- Choose a subscription plan that suits your financial needs.

- Establish a personal account.

- Make a payment in one of two convenient methods: by credit card or through PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- Once your reusable template is ready, print it out or save it to your device.

Form popularity

FAQ

In Minnesota, a debt typically becomes uncollectible after six years, which aligns with the state's statute of limitations for most debts. Once this period has passed, creditors cannot take legal action to collect the debt. Knowing this can empower you to handle your finances and consider options like the Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement. It’s a proactive step towards managing your debts and avoiding future complications.

After ten years, most debts in Minnesota become barred from collection due to the statute of limitations. This means that creditors can no longer legally pursue you for these debts. However, it’s important to note that a debt can still impact your credit report for up to seven years. Understanding the implications of the Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement can help you make informed decisions about your financial future.

In Minnesota, debt collectors generally have six years to pursue most debts. This period starts from the date of the last payment or the last acknowledgment of the debt. It's essential for individuals to understand this timeline, especially when considering the Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement. Being informed helps you manage your financial obligations more effectively.

To reach the Minnesota Department of Revenue Collections, you can call their main line at 1-800-657-3570. This number is vital for those seeking information regarding the Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement. When you call, be ready with your details to ensure a smooth conversation. Remember, having the right information can help you navigate your financial responsibilities effectively.

The Minnesota Department of Revenue payment plan allows individuals to manage their tax obligations over time. This plan can provide relief for those facing financial difficulties and helps in restructuring monthly payments for past-due amounts. By enrolling in this plan, you can avoid penalties and interest, making it easier to settle your retainer agreement effectively. If you need assistance with the Minnesota restructuring of monthly payments for past-due retainer agreements, consider using the US Legal Forms platform for guidance and support.

The new medical debt law in Minnesota introduces important changes to how medical debts are managed, focusing on protecting consumers. It allows individuals to restructure their monthly payments for past-due retainer agreements. This means you can negotiate more manageable payment plans without the stress of overwhelming debt. If you're facing challenges with medical debts, consider exploring the Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement to find a solution that works for you.