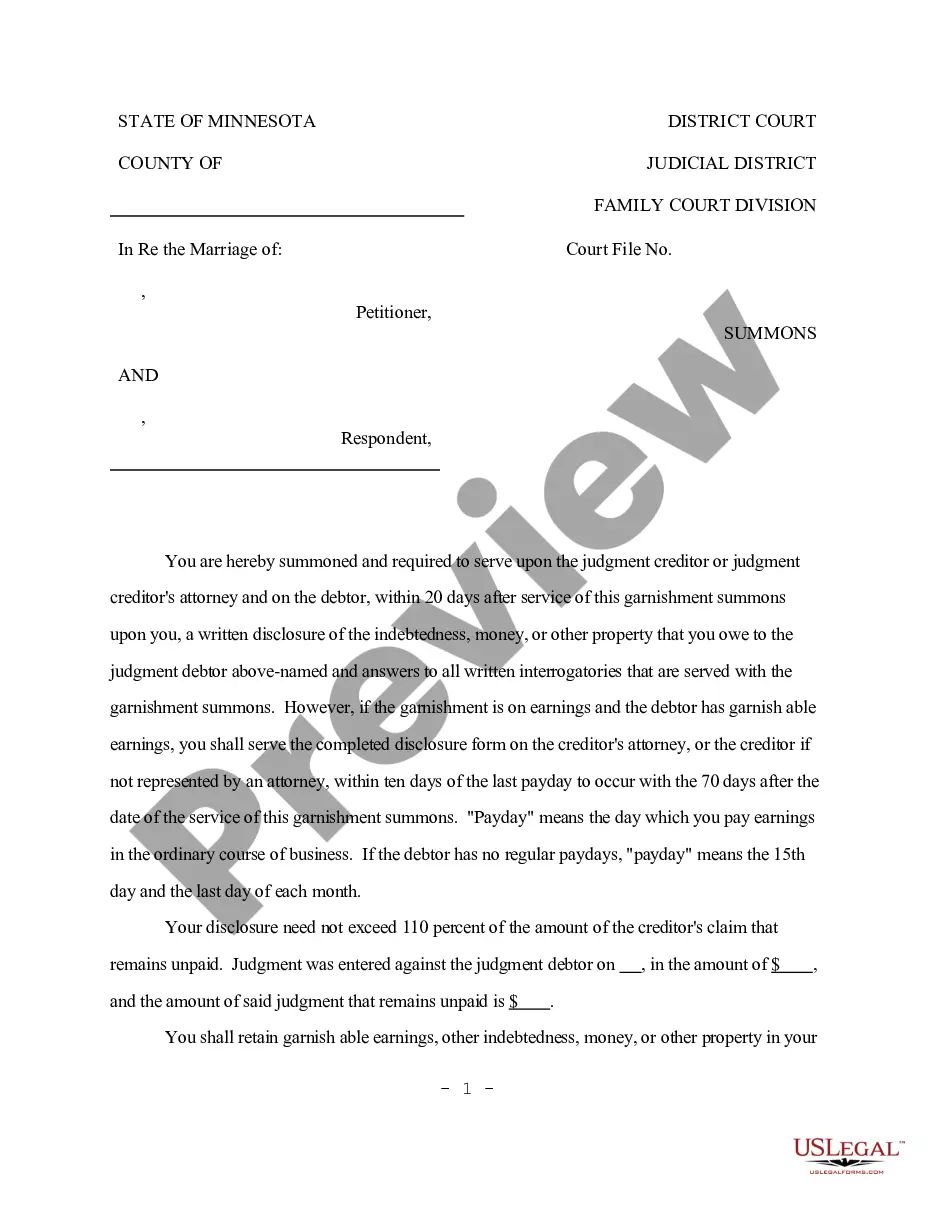

Minnesota Summons to Employer of Garnishee

Description

How to fill out Minnesota Summons To Employer Of Garnishee?

Obtain any template from 85,000 legal documents such as Minnesota Summons to Employer of Garnishee online with US Legal Forms. Each template is drafted and refreshed by state-certified attorneys.

If you hold a subscription, Log In. Once you are on the form’s page, click the Download button and navigate to My documents to access it.

If you haven’t subscribed yet, follow the guidelines outlined below.

With US Legal Forms, you’ll always have immediate access to the relevant downloadable template. The service provides you with access to documents and categorizes them to streamline your search. Utilize US Legal Forms to acquire your Minnesota Summons to Employer of Garnishee quickly and effortlessly.

- Review the state-specific prerequisites for the Minnesota Summons to Employer of Garnishee you intend to utilize.

- Examine the description and preview the template.

- Once you’re certain the template meets your needs, simply click Buy Now.

- Select a subscription plan that aligns with your financial situation.

- Establish a personal account.

- Make the payment in one of two convenient methods: by card or through PayPal.

- Choose a format to download the document in; you have two options (PDF or Word).

- Download the file to the My documents section.

- After your reusable document is downloaded, print it out or store it on your device.

Form popularity

FAQ

In Missouri, the garnishment rule allows creditors to collect debts by withholding a portion of a debtor's wages. The process typically involves serving a garnishment order on the employer, who must then comply with the order. It's important to note that Missouri has specific limits on the amount that can be garnished, unlike the Minnesota Summons to Employer of Garnishee, which may have different stipulations. For clarity and compliance, using resources from US Legal Forms can provide you with the necessary information and templates.

A notice of intent to garnish in Minnesota is a legal document that informs the debtor that their wages may be garnished to satisfy a debt. This notice is a crucial step in the garnishment process, allowing the debtor an opportunity to respond before the actual garnishment begins. Understanding the implications of this notice can help both employers and employees navigate the legal landscape effectively. For detailed guidance, consider exploring the templates available through US Legal Forms.

Yes, employers are required to notify employees of garnishment after receiving a Minnesota Summons to Employer of Garnishee. This notification should inform them about the garnishment process and any potential impact on their wages. Additionally, it is a good practice to keep employees informed about their rights and options regarding the garnishment. Utilizing resources from US Legal Forms can assist you in crafting this important communication.

To notify your employee of garnishment, you should send them a formal notice that includes the details of the Minnesota Summons to Employer of Garnishee. This notice should explain the reason for the garnishment and the amount to be withheld from their wages. It is essential to provide clear instructions on how they can address the garnishment if they have questions or concerns. Using a template from US Legal Forms can help ensure that your notification meets all legal requirements.

Yes, in Minnesota, you can be served by mail for certain legal documents, including a Minnesota Summons to Employer of Garnishee. However, there are specific procedures that must be followed to ensure that the service is valid. It is essential to consult with legal experts or services like US Legal Forms to clarify the requirements and ensure proper handling of your case.

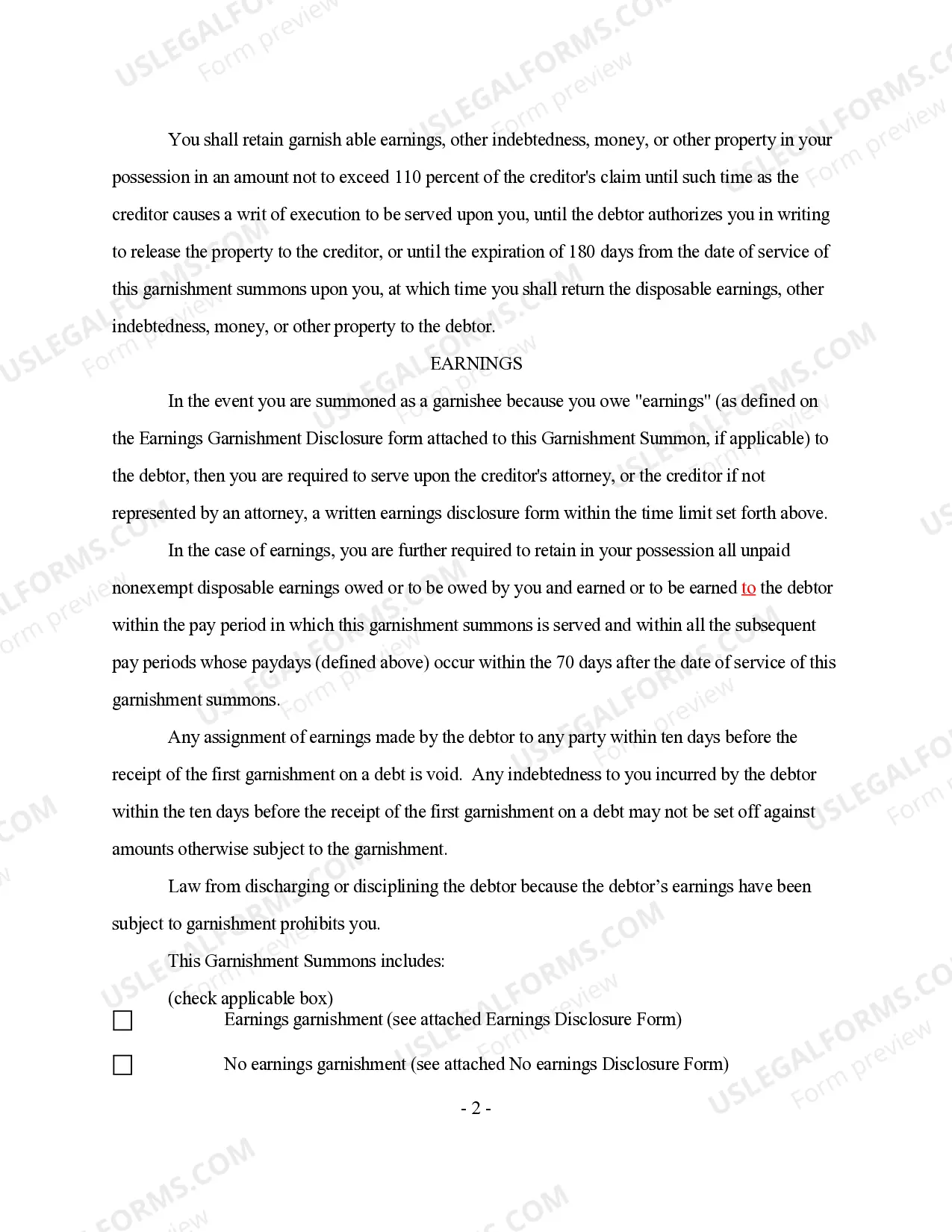

Minnesota garnishment rules stipulate how creditors can collect debts from your income. These rules include limits on the amount that can be garnished and the requirement for creditors to provide you with notice of the action. When you receive a Minnesota Summons to Employer of Garnishee, it is vital to understand your rights and obligations to ensure compliance and protect your finances.

Wage garnishment in Minnesota is regulated by state laws that protect a portion of your income. Under these rules, employers must follow specific guidelines when responding to a Minnesota Summons to Employer of Garnishee. For example, they must ensure that the garnished amount does not exceed legal limits and that they provide you with a notice of the garnishment.

Employers are notified of wage garnishment through a legal document known as a Minnesota Summons to Employer of Garnishee. This document is served to your employer, instructing them on how much to withhold from your paycheck. It is crucial for employers to comply with the garnishment order to avoid legal repercussions.

In Minnesota, the maximum amount that can be garnished from your paycheck typically depends on your disposable income. Generally, creditors can take 25% of your disposable earnings or the amount by which your weekly income exceeds 40 times the federal minimum wage, whichever is less. This is important to understand when dealing with a Minnesota Summons to Employer of Garnishee.

Upon receiving a Minnesota Summons to Employer of Garnishee, your first step should be to read the document carefully. Understand what the summons entails and the deadlines for your response. Next, gather any relevant information and consider seeking legal advice to clarify your situation. Resources available on US Legal Forms can help you find the right forms and support to respond appropriately.