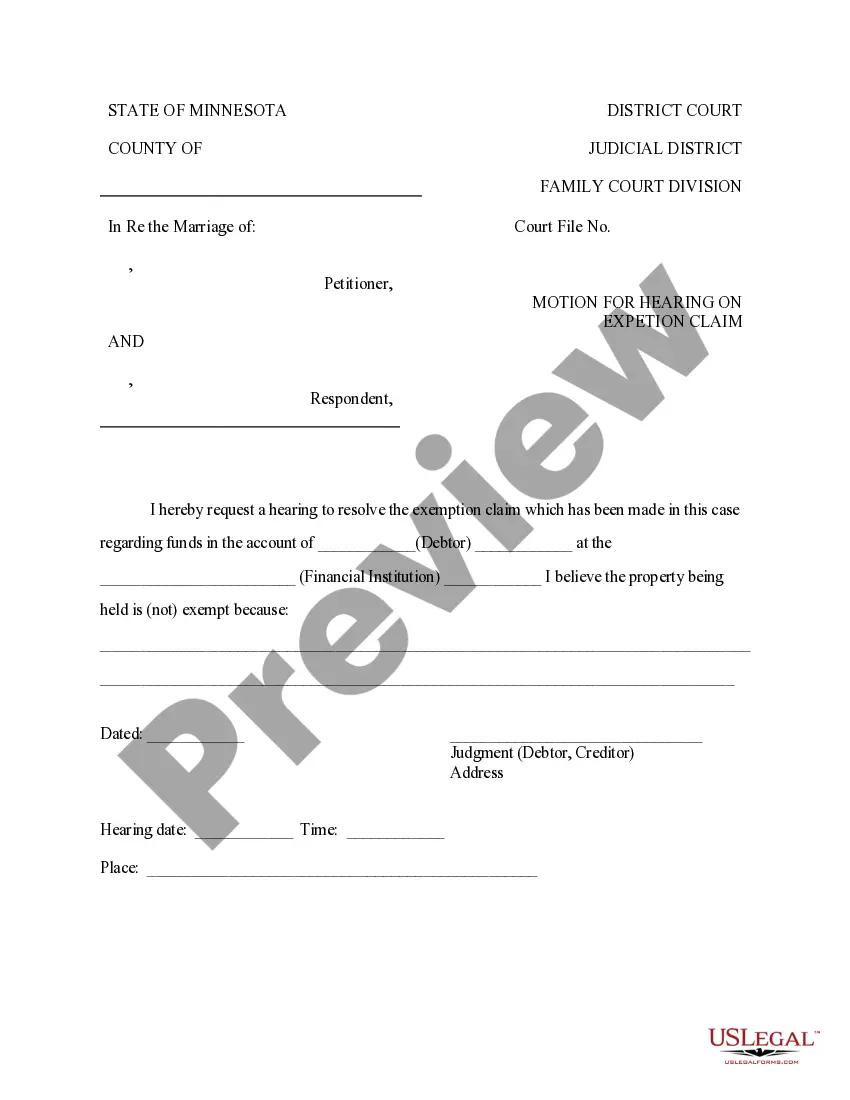

Minnesota Motion by Debtor for Hearing on Exemption Claim

Description

How to fill out Minnesota Motion By Debtor For Hearing On Exemption Claim?

Have any form from 85,000 legal documents such as Minnesota Motion by Debtor for Hearing on Exemption Claim on-line with US Legal Forms. Every template is drafted and updated by state-accredited attorneys.

If you have already a subscription, log in. When you are on the form’s page, click on the Download button and go to My Forms to access it.

In case you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Minnesota Motion by Debtor for Hearing on Exemption Claim you would like to use.

- Look through description and preview the template.

- As soon as you are sure the template is what you need, just click Buy Now.

- Choose a subscription plan that actually works for your budget.

- Create a personal account.

- Pay out in a single of two appropriate ways: by bank card or via PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- As soon as your reusable form is ready, print it out or save it to your device.

With US Legal Forms, you’ll always have instant access to the appropriate downloadable template. The service will give you access to forms and divides them into categories to simplify your search. Use US Legal Forms to get your Minnesota Motion by Debtor for Hearing on Exemption Claim easy and fast.

Form popularity

FAQ

A motion hearing in Minnesota involves the court reviewing a request made by a party, in this case, the debtor, regarding their exemption claims. Specifically, when you file a Minnesota Motion by Debtor for Hearing on Exemption Claim, you ask the court to examine and rule on what assets you can protect from creditors. This process is important as it helps you clarify your legal rights and protect your financial interests. Platforms like US Legal Forms can assist you in preparing the necessary documents for this motion, ensuring you present your case effectively.

The Rule of 60 essentially means that individuals have the right to seek relief from a final judgment under certain conditions. It serves as a safeguard to ensure that justice is upheld, allowing a party to address significant issues that may have impacted their case. When considering a Minnesota Motion by Debtor for Hearing on Exemption Claim, understanding the implications of Rule 60 can be crucial.

A Rule 60 motion allows individuals to request a court to reconsider a judgment or order due to specific circumstances. This could include new evidence or issues of fairness that were not previously addressed. If you find yourself needing to challenge a ruling related to a Minnesota Motion by Debtor for Hearing on Exemption Claim, a Rule 60 motion could be an effective option.

To file a claim of exemption regarding wage garnishment in Minnesota, you must submit the appropriate forms to the court. This process involves clearly stating your reasons for the exemption and providing any supporting documentation. Using the resources on the uslegalforms platform, you can find the necessary forms and guidance to support your Minnesota Motion by Debtor for Hearing on Exemption Claim.

A Rule 60 motion in Minnesota is a request to the court to reconsider or set aside a previous judgment or order. This motion can be filed based on new evidence, fraud, or other significant reasons that warrant a change. If you're facing challenges with a Minnesota Motion by Debtor for Hearing on Exemption Claim, a Rule 60 motion may provide a path for relief.

Rule 60 in Minnesota provides a framework for parties to seek relief from a judgment or order. This rule allows individuals to address errors or unforeseen circumstances that may affect the outcome of their case. It plays a crucial role in various legal scenarios, including those involving a Minnesota Motion by Debtor for Hearing on Exemption Claim.

The rule of practice 521 in Minnesota outlines the procedures for filing motions related to claims of exemption. Primarily, it focuses on how debtors can assert their rights when facing garnishment or similar actions. Understanding this rule is essential for anyone considering a Minnesota Motion by Debtor for Hearing on Exemption Claim.

In Minnesota, you typically have 14 days from the date you receive notice of a garnishment to file a claim of exemption. It is crucial to act promptly to protect your rights. If you are considering a Minnesota Motion by Debtor for Hearing on Exemption Claim, knowing this timeframe is essential. USLegalForms can provide you with the necessary tools to ensure timely filing.

In court, an exemption refers to a legal protection that allows a debtor to keep certain property or income from being seized by creditors. This legal concept ensures that individuals can maintain their basic living standards despite financial difficulties. When filing a Minnesota Motion by Debtor for Hearing on Exemption Claim, you assert your right to these protections. Resources from USLegalForms can help clarify this process.

Filing a claim of exemption with the court involves drafting a motion that outlines your exemption rights and submitting it to the appropriate court. You should include supporting documents that verify your claims. Utilizing a Minnesota Motion by Debtor for Hearing on Exemption Claim can be an effective way to address garnishment issues. USLegalForms can assist you in preparing this documentation accurately.