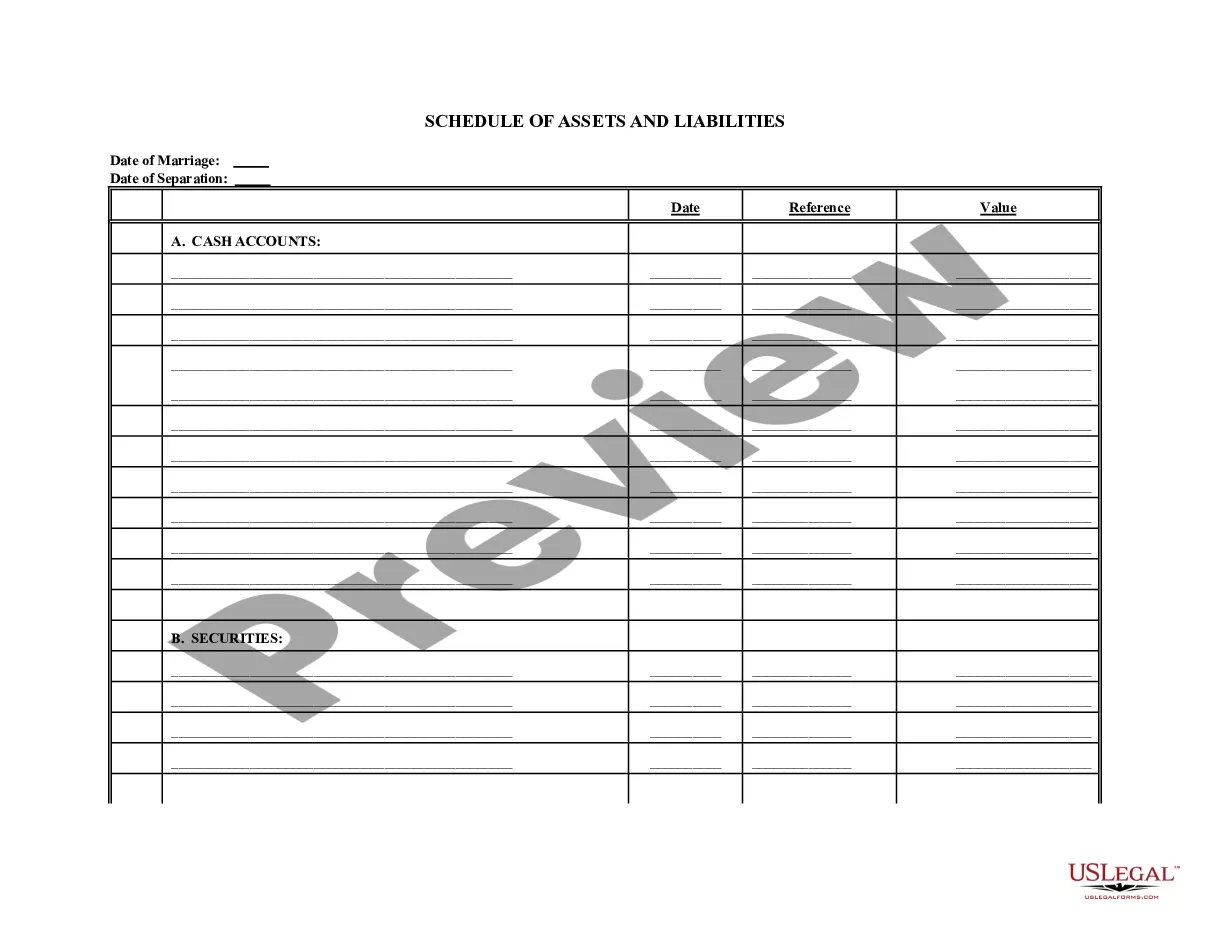

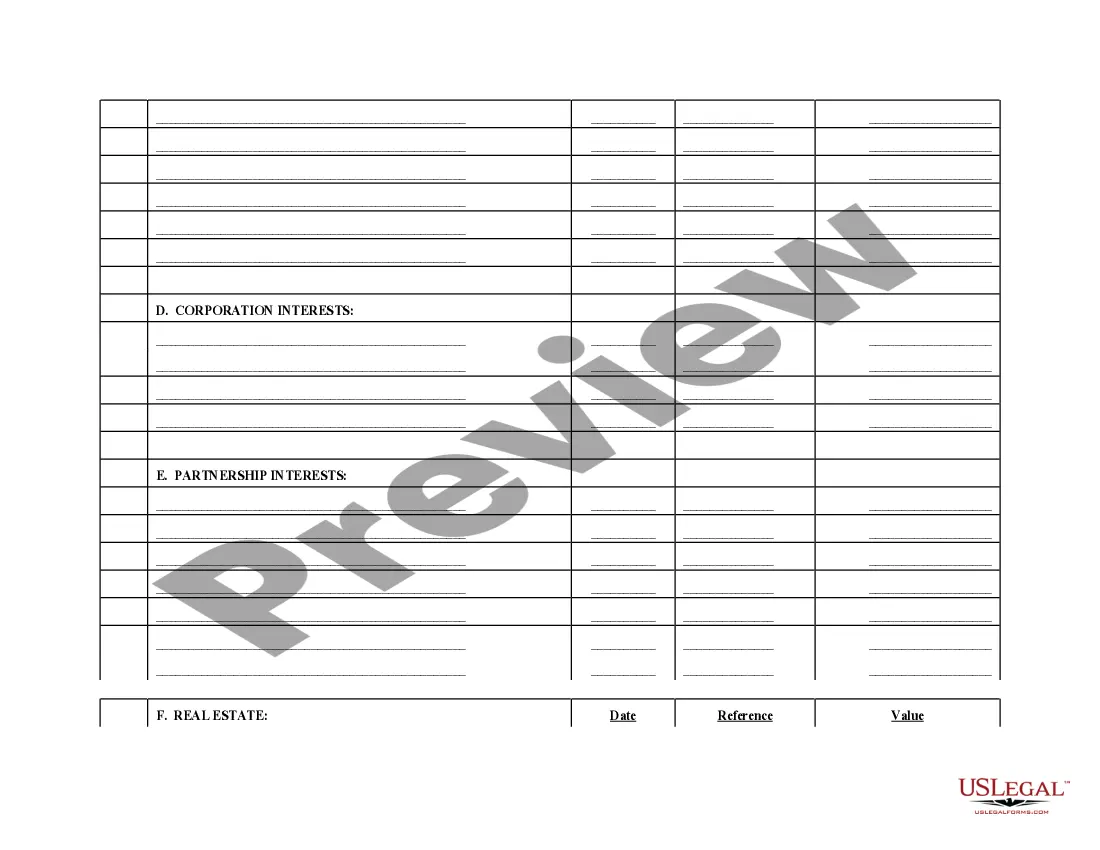

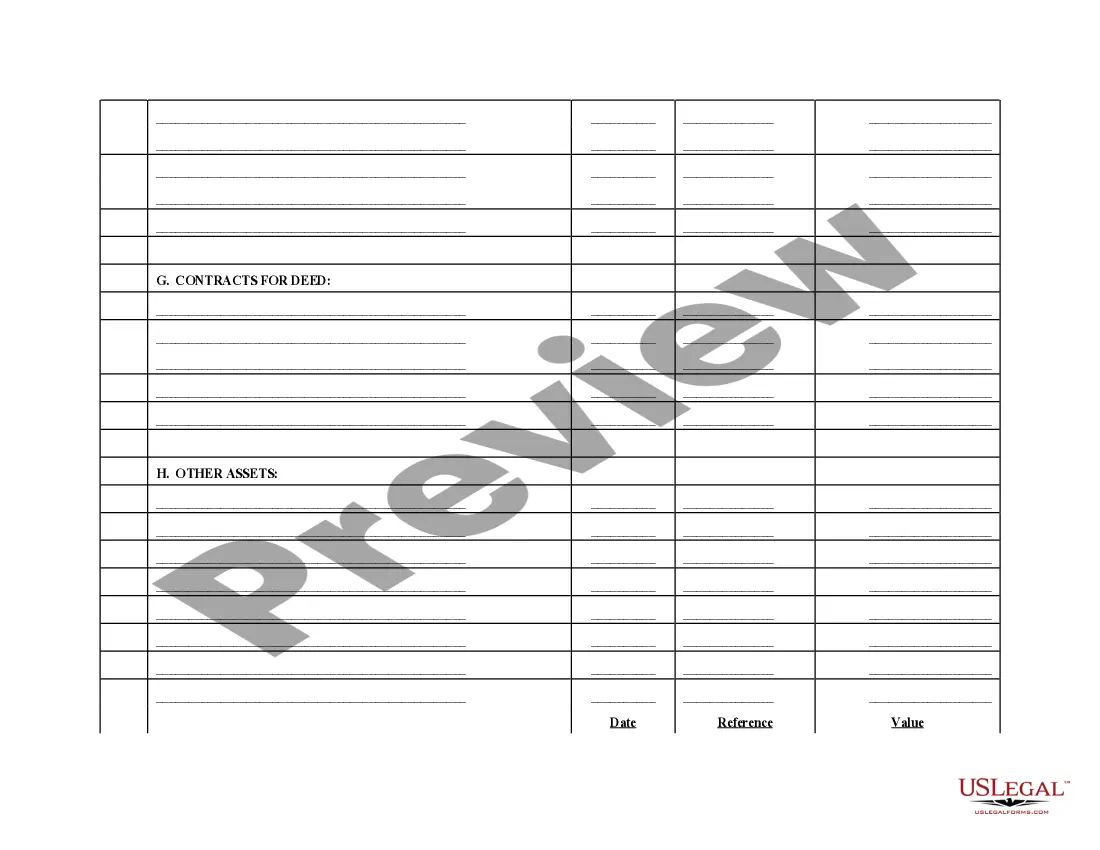

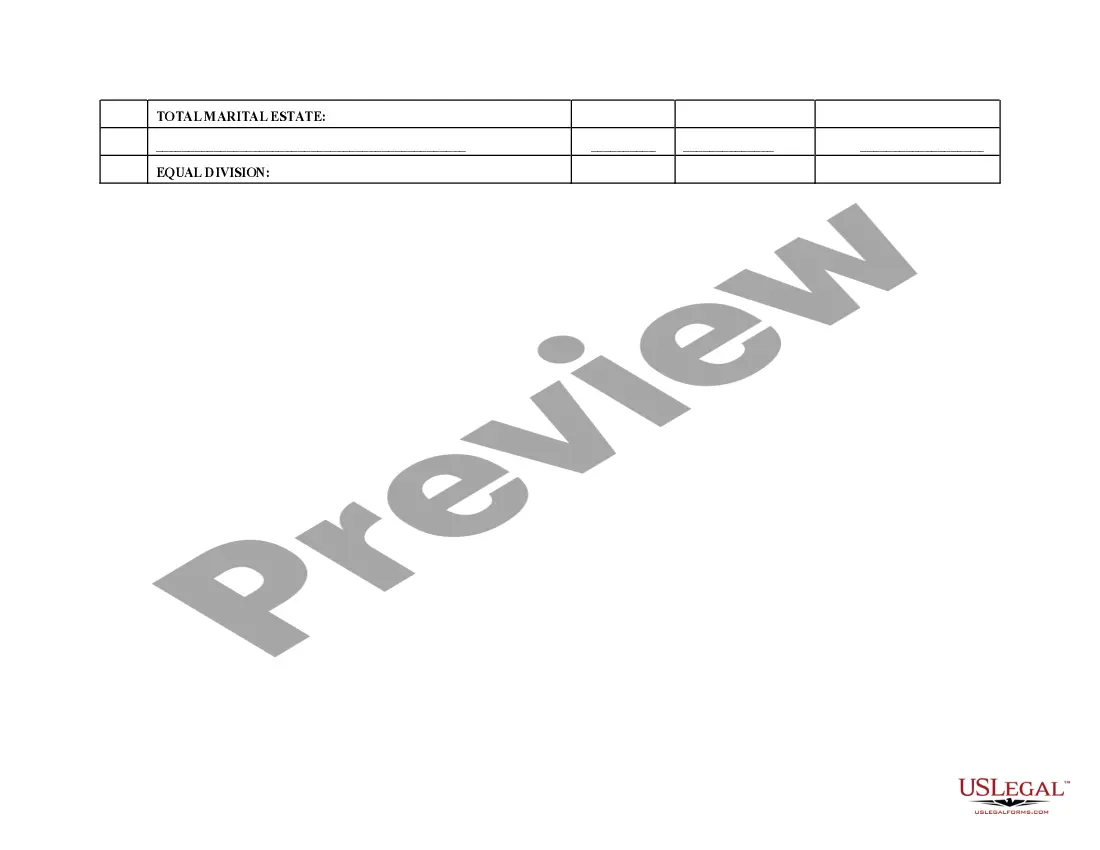

Minnesota Schedule of Assets and Liabilities

Description

How to fill out Minnesota Schedule Of Assets And Liabilities?

Obtain any type from 85,000 legal documents including the Minnesota Schedule of Assets and Liabilities online with US Legal Forms. Each template is created and refreshed by state-licensed attorneys.

If you already possess a subscription, Log In. Once you are on the form’s page, click the Download button and navigate to My documents to retrieve it.

If you haven’t subscribed yet, adhere to the instructions below.

With US Legal Forms, you’ll always have immediate access to the suitable downloadable template. The platform provides access to documents and categorizes them to make your search easier. Utilize US Legal Forms to acquire your Minnesota Schedule of Assets and Liabilities swiftly and effortlessly.

- Verify the state-specific prerequisites for the Minnesota Schedule of Assets and Liabilities you wish to utilize.

- Examine the description and preview the example.

- When you’re confident the template is what you require, simply click Buy Now.

- Choose a subscription plan that aligns well with your financial plan.

- Establish a personal account.

- Make a payment in one of two convenient methods: by credit card or through PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- Once your reusable form is downloaded, print it out or save it to your device.

Form popularity

FAQ

The schedule of assets and liabilities is a financial statement that lists all your assets alongside your liabilities. This helps provide a complete picture of your financial health and is an essential component of tax filings, including the Minnesota Schedule of Assets and Liabilities. Understanding this schedule can aid in better financial management. For a comprehensive overview, consider using UsLegalForms for expert guidance.

Schedule 1 and Schedule 3 refer to additional forms that may accompany your main tax return. Schedule 1 is used to report additional income and adjustments, while Schedule 3 typically includes nonrefundable credits. Both schedules can influence your overall tax calculations, including those related to the Minnesota Schedule of Assets and Liabilities. Utilizing resources like UsLegalForms can help clarify these requirements.

The schedule of assets and liabilities in an Individual Tax Return (ITR) serves a similar purpose as in business tax filings. It presents a comprehensive view of your financial standing, listing both assets and liabilities. This information is crucial for tax assessment and helps in maintaining financial integrity. Familiarizing yourself with the Minnesota Schedule of Assets and Liabilities can enhance your understanding of your financial responsibilities.

Minnesota Form M3 is a tax form specifically designed for corporations and partnerships to report their income and expenses. It requires detailed information about your financial situation, including the Minnesota Schedule of Assets and Liabilities. This form is vital for ensuring compliance with state tax laws. For a smoother filing experience, UsLegalForms can provide the necessary templates and guidance.

The balance sheet is typically found on Schedule L of a tax return. This schedule outlines your assets and liabilities in a structured format, which aligns with the Minnesota Schedule of Assets and Liabilities. Completing this accurately is crucial for a clear financial overview. For assistance, consider using UsLegalForms to guide you through the process.

Nonprofits in Minnesota must file specific forms depending on their income and activities. They generally need to submit Form 990 or Form M3, along with the Minnesota Schedule of Assets and Liabilities, to report their financial status. This ensures transparency and compliance with state regulations. Utilizing services like UsLegalForms can simplify this process and ensure accuracy.

Common Minnesota tax mistakes often include failing to report all income, miscalculating deductions, and not utilizing available credits. Many taxpayers overlook the Minnesota Schedule of Assets and Liabilities, which can lead to discrepancies in financial reporting. Additionally, not filing on time can result in penalties. Being aware of these pitfalls can help ensure accurate tax submissions.

The schedule of assets and liabilities in an income tax return provides a detailed account of your financial position. It lists all your assets, such as real estate and bank accounts, alongside your liabilities, including loans and mortgages. This information helps the tax authorities assess your financial health. Understanding the Minnesota Schedule of Assets and Liabilities is essential for accurate reporting.

A schedule of assets and liabilities is a detailed document that lists all your assets alongside your liabilities. This document helps provide a clear financial picture, which is crucial in legal situations like bankruptcy or divorce. The Minnesota Schedule of Assets and Liabilities is specifically designed to meet local requirements. Using USLegalForms can help you create a compliant and organized schedule that accurately reflects your financial status.

Filing your assets and liabilities involves submitting the completed forms to the appropriate court or financial institution. Ensure that you have accurately filled out the Minnesota Schedule of Assets and Liabilities, as this document is critical for various legal and financial processes. If you are unsure about the filing process, USLegalForms can provide you with the necessary resources to guide you through.