Minnesota Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

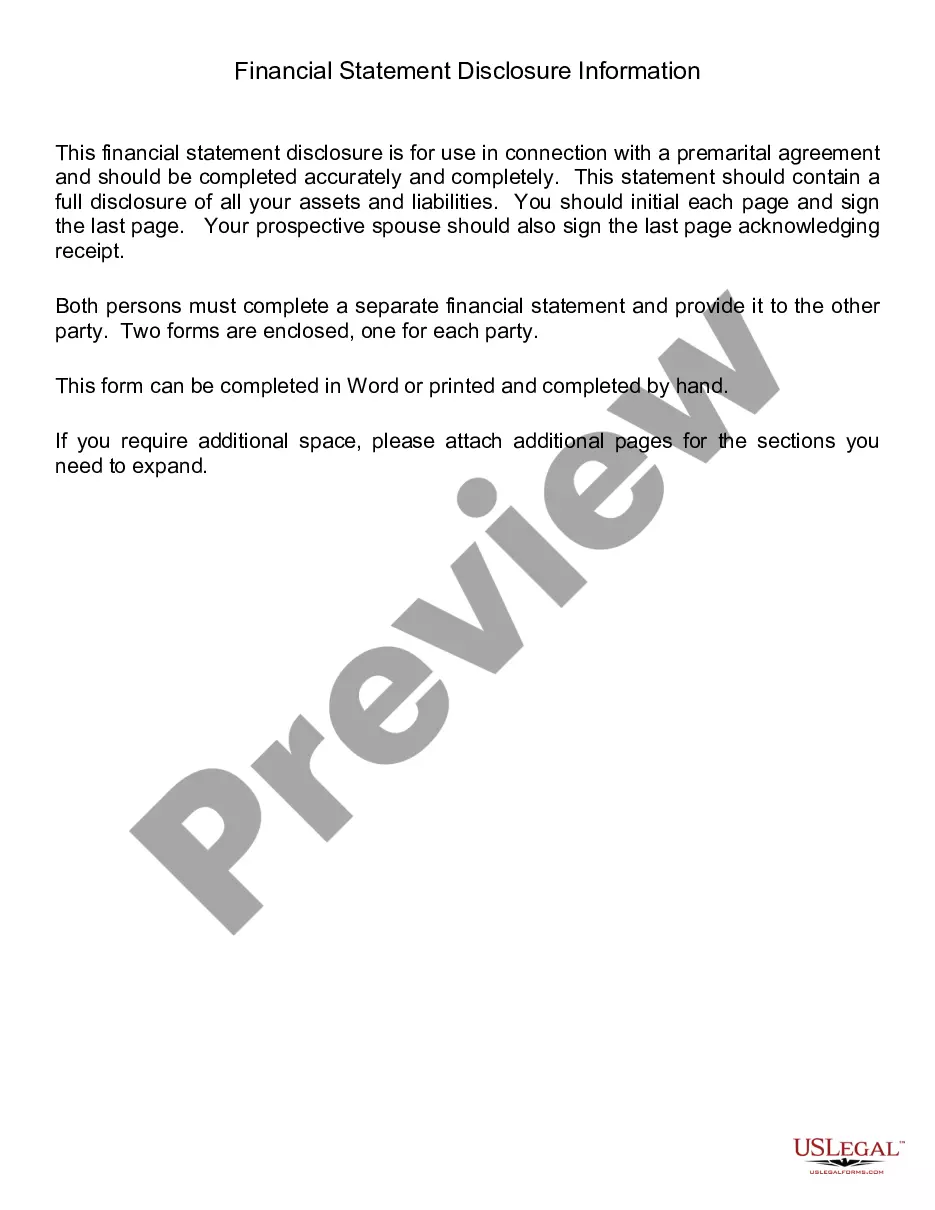

How to fill out Minnesota Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Obtain any version from 85,000 lawful documents such as Minnesota Financial Statements exclusively related to Prenuptial Premarital Agreement online with US Legal Forms. Each template is formulated and refreshed by state-accredited attorneys.

If you already possess a subscription, Log In. Once you’re on the document’s page, click the Download button and navigate to My documents to gain access to it.

If you haven't subscribed yet, adhere to the instructions below.

With US Legal Forms, you’ll consistently have swift access to the relevant downloadable sample. The service provides you with access to documents and categorizes them to ease your search. Utilize US Legal Forms to acquire your Minnesota Financial Statements exclusively related to Prenuptial Premarital Agreement quickly and efficiently.

- Verify the state-specific criteria for the Minnesota Financial Statements exclusively related to Prenuptial Premarital Agreement you need to utilize.

- Browse the description and preview the template.

- Once you are certain the template meets your requirements, simply click Buy Now.

- Select a subscription plan that genuinely suits your financial situation.

- Establish a personal account.

- Make payment in one of two suitable methods: via credit card or through PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- As soon as your reusable form is prepared, print it or save it to your device.

Form popularity

FAQ

A prenuptial agreement can potentially affect your tax situation, especially regarding asset division and income. While it does not directly change tax laws, it can influence how assets are treated during divorce, which may have tax implications. Understanding the role of Minnesota Financial Statements only in Connection with Prenuptial Premarital Agreement in these matters is important. Consulting a tax professional can provide insights tailored to your specific circumstances.

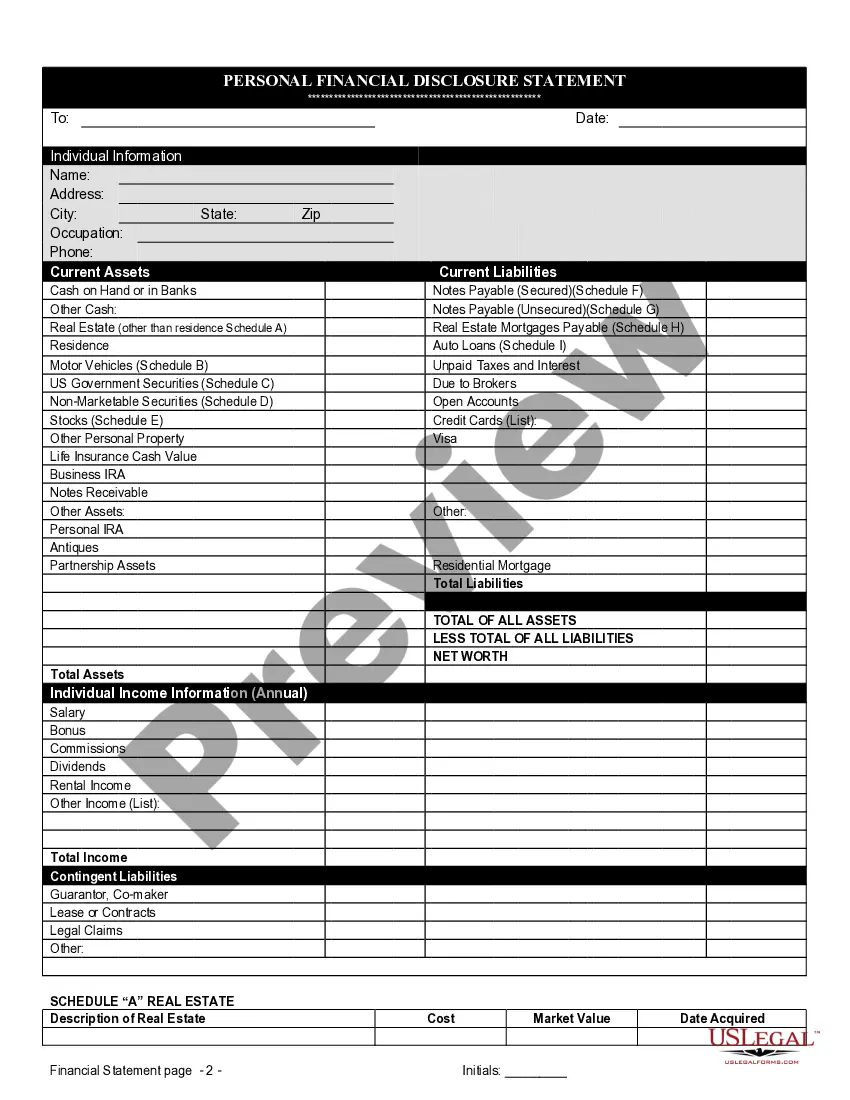

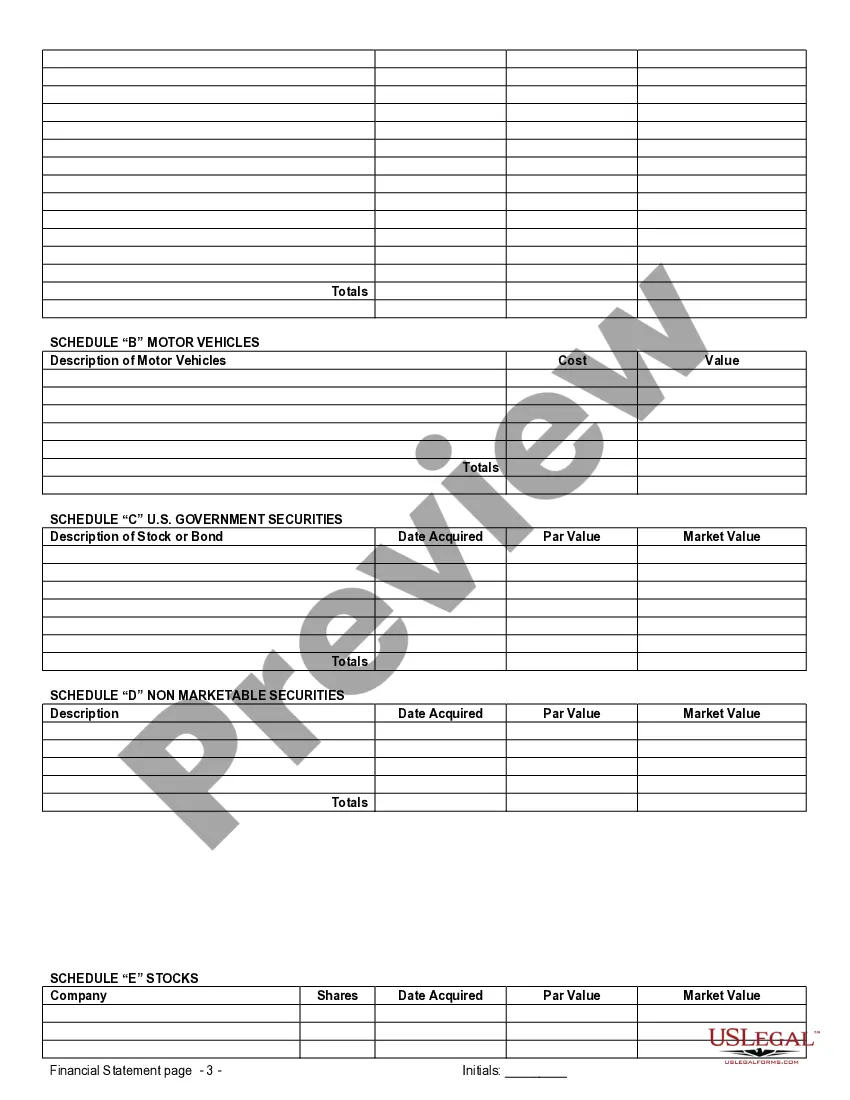

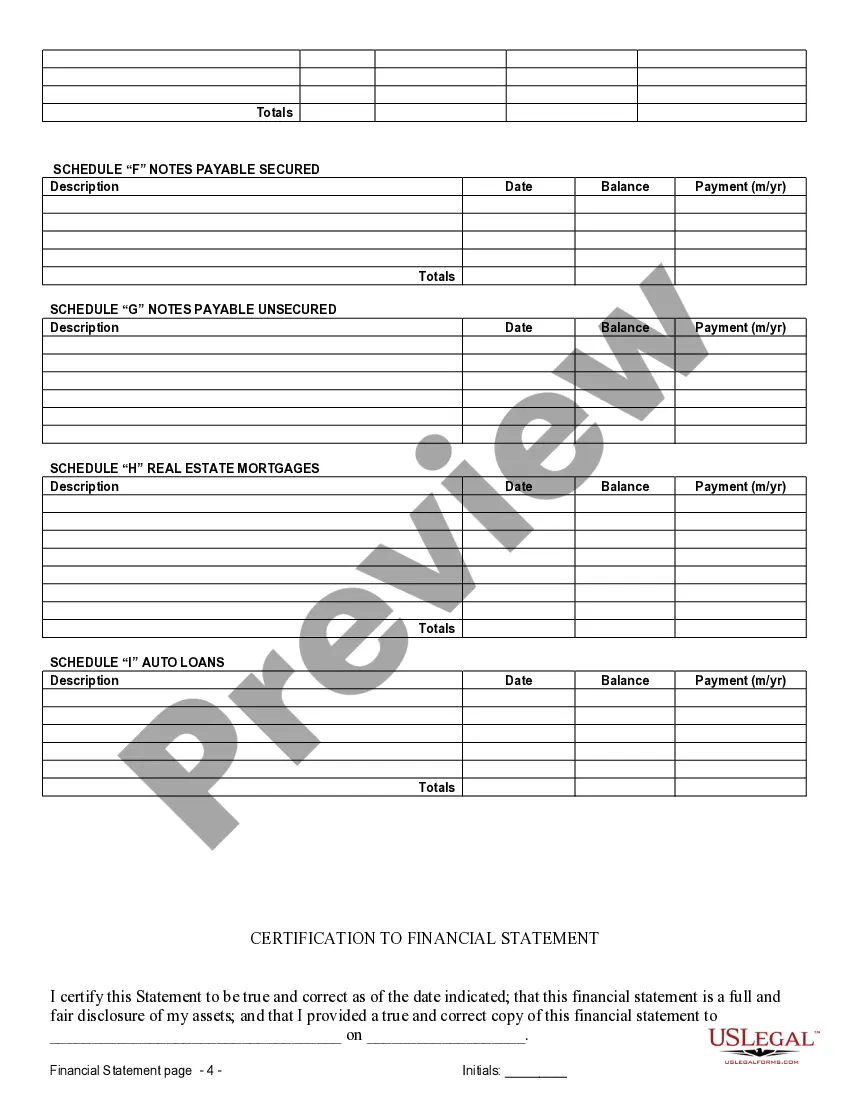

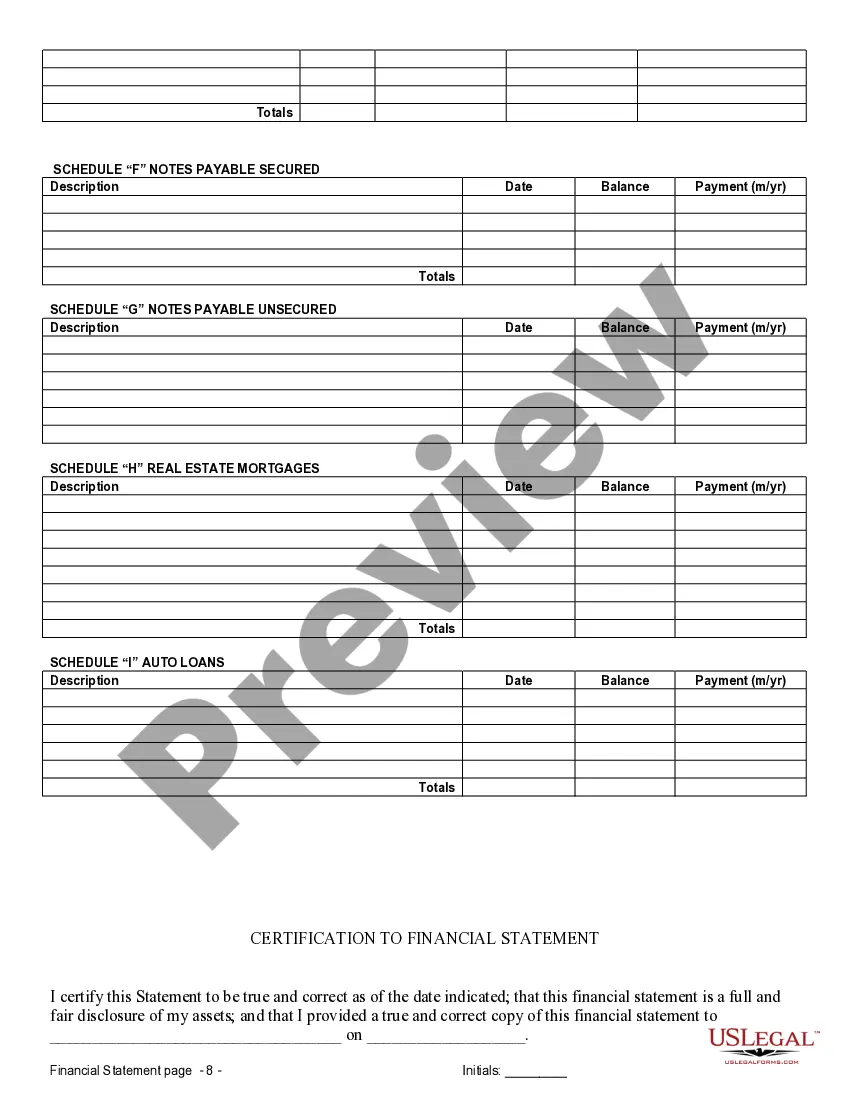

Yes, you generally need to disclose all your assets when creating a prenuptial agreement. Full transparency is crucial for ensuring that both parties understand their financial rights and obligations. By using Minnesota Financial Statements only in Connection with Prenuptial Premarital Agreement, you can accurately represent your financial situation. This helps prevent disputes later and supports the integrity of your agreement.

Yes, prenuptial agreements are enforceable in Minnesota, provided they meet certain legal standards. The agreement must be in writing, signed by both parties, and entered into voluntarily. Moreover, Minnesota Financial Statements only in Connection with Prenuptial Premarital Agreement can enhance the enforceability by providing clear financial data. Consulting with a legal professional can help ensure your prenup is valid and binding.

If your ex refuses to provide financial disclosure, it complicates the process of establishing a fair prenuptial agreement. You may need to explore legal options to compel disclosure in court. Utilizing Minnesota Financial Statements only in Connection with Prenuptial Premarital Agreement can help clarify financial situations, ensuring both parties disclose their assets. Platforms like USLegalForms can assist you in navigating these requirements.

Yes, a prenuptial agreement can keep finances separate when properly structured. It provides a formal framework for Minnesota Financial Statements only in Connection with Prenuptial Premarital Agreement, ensuring that each spouse's assets and debts are treated independently. This arrangement can simplify financial matters during a divorce, making it crucial for couples to consider. Consulting with a legal professional can help you draft an effective prenup that meets your goals.

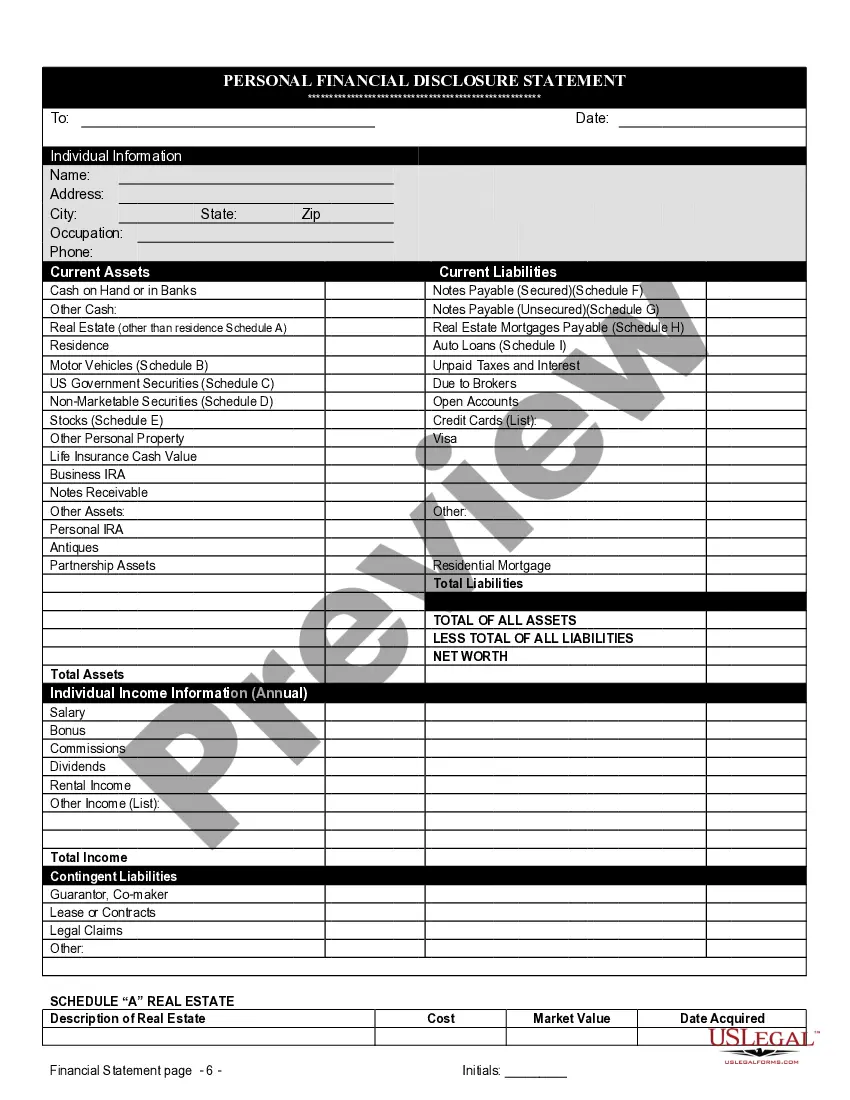

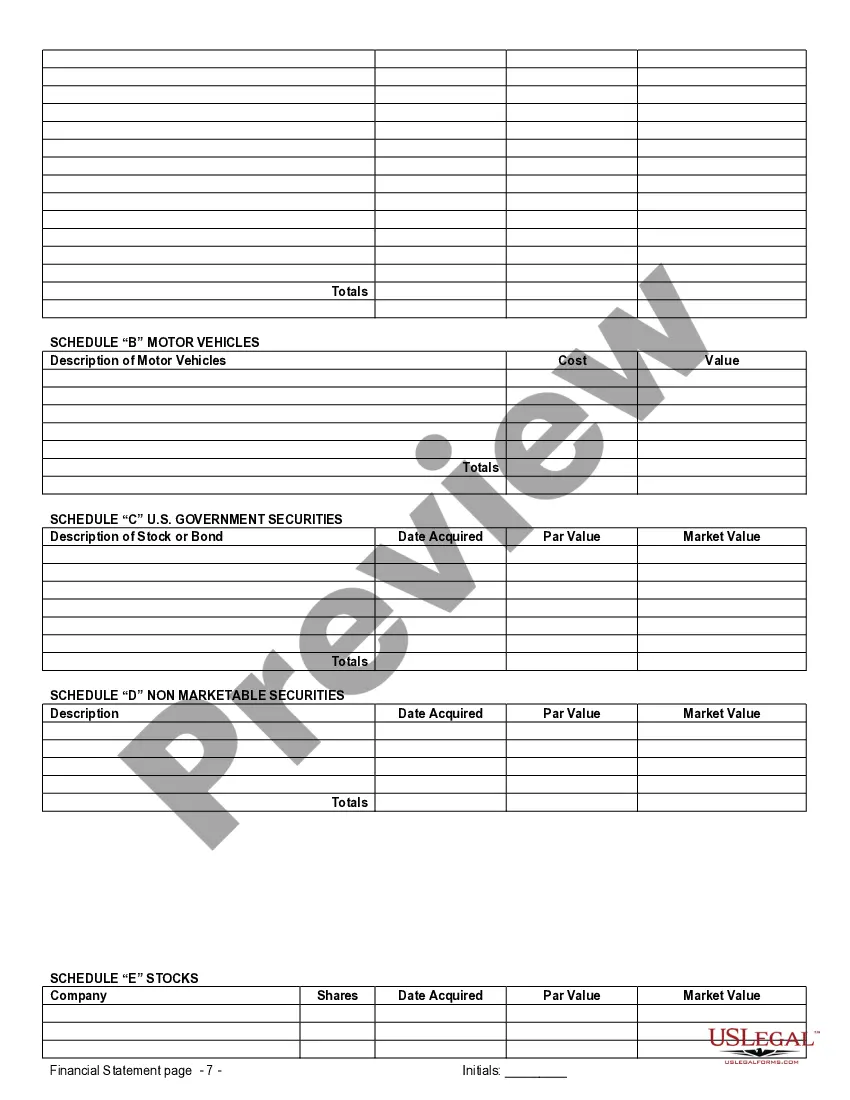

The financial statement of a prenuptial agreement details each party's financial positions, including income, assets, and liabilities. This document is critical for creating Minnesota Financial Statements only in Connection with Prenuptial Premarital Agreement, as it lays the groundwork for the agreement's terms. Clarity in these statements can help both parties understand their financial commitments. Our services can assist you in preparing accurate financial statements efficiently.

Yes, a prenuptial agreement can effectively keep finances separate. By clearly defining ownership of assets and debts, these agreements utilize Minnesota Financial Statements only in Connection with Prenuptial Premarital Agreement to outline individual financial responsibilities. This separation can provide peace of mind for both parties, ensuring that personal assets remain protected. Engaging with a qualified attorney can help tailor your prenup to your specific needs.

Financial disclosure in a prenuptial agreement involves revealing your assets, debts, and income. This is essential to create Minnesota Financial Statements only in Connection with Prenuptial Premarital Agreement, ensuring both parties fully understand their financial landscape. Accurate and honest disclosure can prevent future conflicts and foster trust. Using our platform, you can generate the necessary financial disclosures easily.

Yes, prenuptial agreements are enforceable in Minnesota, provided they meet specific legal requirements. This includes full financial disclosure, which is where Minnesota Financial Statements only in Connection with Prenuptial Premarital Agreement come into play. A well-drafted prenup can protect your assets and clarify financial responsibilities. Consulting with a legal expert can ensure that your agreement adheres to all necessary regulations.

Yes, submitting income statements is often necessary when preparing a prenuptial agreement. These Minnesota Financial Statements only in Connection with Prenuptial Premarital Agreement help provide a clear picture of each party's financial situation. This transparency can facilitate negotiations and protect both partners' interests. You can easily gather and submit these documents through platforms like uslegalforms.