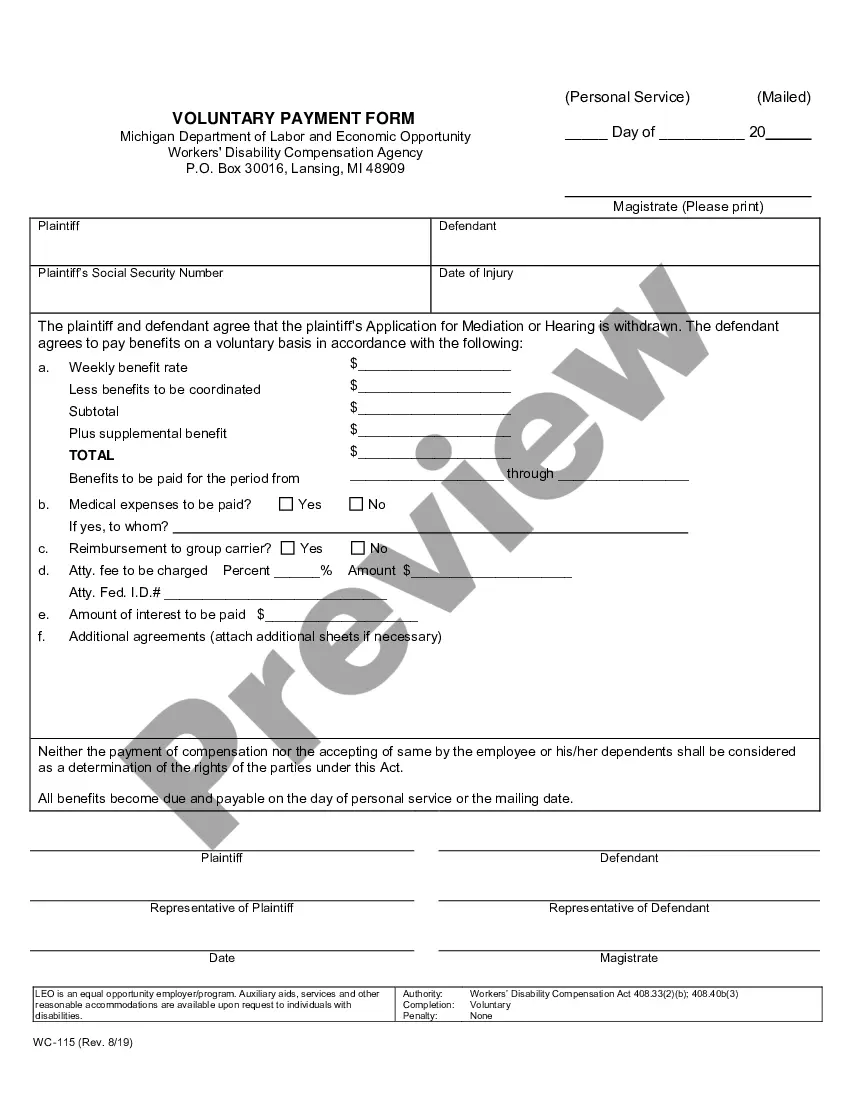

The Michigan Voluntary Payment Form (fill-in form) is a form used for individuals and businesses to make payments to the Michigan Department of Treasury. The form is designed to provide a convenient way for taxpayers to make payments to the Treasury. It can be used for payments to the State of Michigan and also for payments to other parties such as the IRS. There are two types of Michigan Voluntary Payment Form (fill-in form): 1. The Individual Voluntary Payment Form (fill-in form) is used by individuals to make payments to the Michigan Department of Treasury for taxes, fees, or other payments. This form requires the taxpayer to provide their name, address, Social Security number, payment information, and other information. 2. The Business Voluntary Payment Form (fill-in form) is used by businesses to make payments to the Michigan Department of Treasury. This form requires the business to provide their name, address, Federal ID number, payment information, and other information. Both forms require the taxpayer to sign and date the form. The form must be completed and sent to the Michigan Department of Treasury.

Michigan Voluntary Payment Form (fill-in form)

Description

How to fill out Michigan Voluntary Payment Form (fill-in Form)?

If you’re seeking a method to accurately finalize the Michigan Voluntary Payment Form (fill-in form) without enlisting a legal expert, then you’re exactly in the right place.

US Legal Forms has established itself as the most comprehensive and esteemed repository of official templates for every individual and business situation. Every document you discover on our online platform is crafted in compliance with federal and state regulations, so you can be assured that your paperwork is in order.

Another significant benefit of US Legal Forms is that you will never lose the documents you acquired - you can access any of your downloaded forms in the My documents tab of your profile whenever necessary.

- Verify that the document displayed on the page aligns with your legal circumstances and state laws by reviewing its text description or exploring the Preview mode.

- Enter the document name in the Search tab at the top of the page and select your state from the dropdown to find an alternative template if any discrepancies arise.

- Repeat the content verification and click Buy now when you are confident in the paperwork meeting all the requirements.

- Log in to your account and click Download. Register for the service and choose a subscription plan if you don’t already have one.

- Utilize your credit card or the PayPal option to settle your US Legal Forms subscription. The template will be ready for download immediately after.

- Decide the format in which you wish to receive your Michigan Voluntary Payment Form (fill-in form) and download it by clicking the relevant button.

- Add your template to an online editor to complete and sign it quickly or print it out to prepare your hard copy manually.

Form popularity

FAQ

New hires in Michigan need to complete several important forms to start their employment correctly. Among these, the Michigan Voluntary Payment Form (fill-in form) is crucial for payroll purposes. Additionally, they should also fill out federal tax forms and any state-specific documentation. Utilizing a service like USLegalForms can help streamline this process and ensure compliance with all requirements.

Employers should provide new employees with essential documents to facilitate a smooth onboarding experience. This includes the Michigan Voluntary Payment Form (fill-in form) for payroll setup, along with any company policies or handbooks. It's also important to provide tax forms and benefits information. Using USLegalForms can help you ensure that you distribute all required documents correctly.

In Michigan, new hires must complete various forms to comply with employment laws. Key documents include the Michigan Voluntary Payment Form (fill-in form), W-4 for tax withholding, and I-9 for employment eligibility verification. These forms ensure that both the employer and employee fulfill their legal responsibilities. To make the process efficient, consider using USLegalForms to access all necessary documents.

New hires typically need to complete several forms to ensure compliance with both federal and state regulations. In Michigan, this often includes the Michigan Voluntary Payment Form (fill-in form), which helps streamline payroll processes. Additionally, employees may need to fill out tax forms and provide identification documents. Using a platform like USLegalForms can simplify this process by providing easy access to all required forms.

In Michigan, certain individuals and businesses may be exempt from workers' compensation requirements. For instance, sole proprietors, partners, and certain corporate officers can qualify for exemption if they file the Michigan Voluntary Payment Form (fill-in form). Additionally, businesses with fewer than three employees may also fall under this exemption. Utilizing US Legal Forms can help you determine your eligibility and provide the necessary documentation to support your claim.

To obtain a workers' comp exemption in Michigan, you need to complete and submit the Michigan Voluntary Payment Form (fill-in form). First, ensure you meet the criteria for exemption, which typically includes specific business structures or employee counts. After filling out the form accurately, submit it to the appropriate state department for approval. By using the US Legal Forms platform, you can easily access the necessary templates and guidance to streamline this process.

To file for workman's comp, begin by notifying your employer about your injury. Then, complete the Michigan Voluntary Payment Form (fill-in form) to capture essential information about your incident. This form will make it easier for your employer and their insurance to process your claim efficiently. Remember, submitting this form accurately is crucial for receiving the benefits you deserve.

In Michigan, you generally have 90 days from the date of your injury to file a workers' comp claim. It's important to act quickly and submit the Michigan Voluntary Payment Form (fill-in form) within this timeframe. Delaying your claim could affect your eligibility for benefits. By filing promptly, you ensure that you receive the support you need during your recovery.

Filing a workers' comp claim in Michigan involves several steps. First, inform your employer of your injury right away. Then, use the Michigan Voluntary Payment Form (fill-in form) to provide a detailed account of your situation. This form allows you to clearly outline your claim, which will help facilitate communication with your employer and their insurance company.

To file a workman's comp claim in Michigan, start by reporting your injury to your employer as soon as possible. Next, complete the Michigan Voluntary Payment Form (fill-in form) to document your claim. This form helps ensure that you provide all necessary details to support your case. After you submit the form, your employer will notify their insurance provider to initiate the claims process.