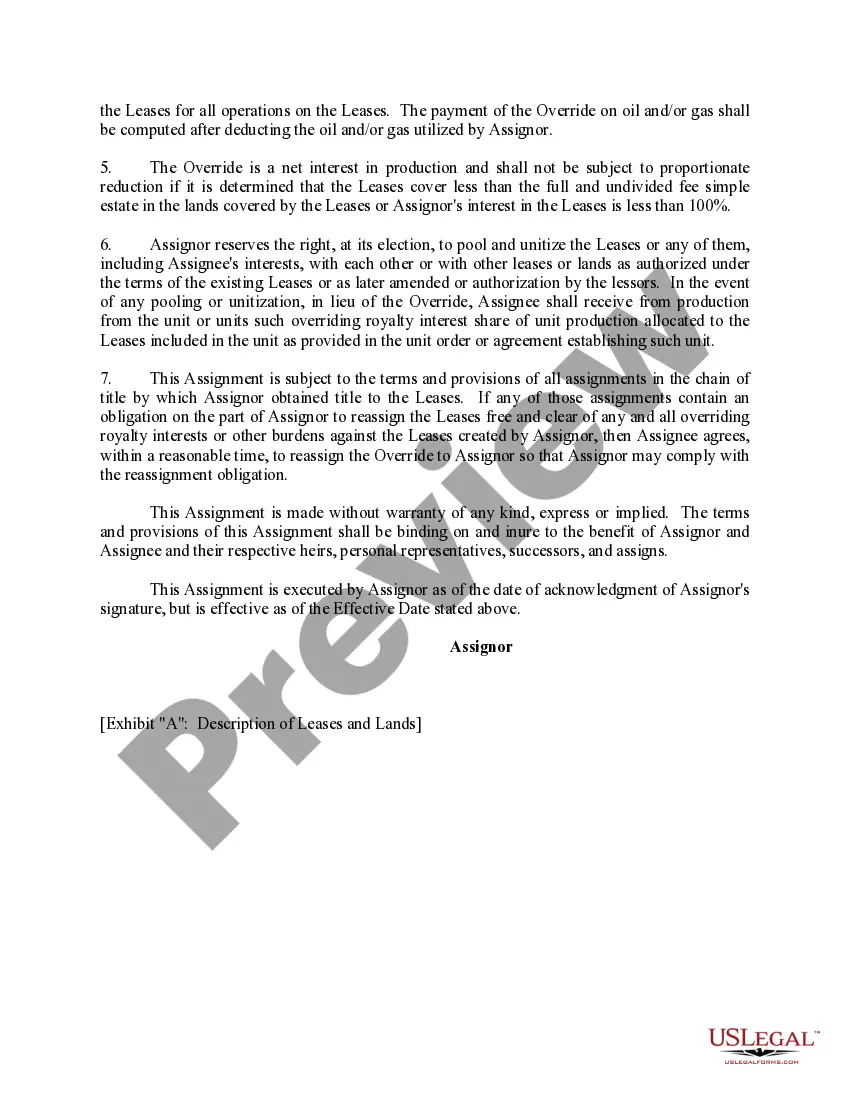

Michigan Assignment of Overriding Royalty Interest (No Proportionate Reduction)

Description

How to fill out Assignment Of Overriding Royalty Interest (No Proportionate Reduction)?

You are able to spend hours on-line attempting to find the legal record design which fits the state and federal requirements you want. US Legal Forms offers thousands of legal varieties that happen to be examined by specialists. You can actually download or produce the Michigan Assignment of Overriding Royalty Interest (No Proportionate Reduction) from my service.

If you already have a US Legal Forms bank account, you may log in and then click the Obtain key. Afterward, you may comprehensive, edit, produce, or sign the Michigan Assignment of Overriding Royalty Interest (No Proportionate Reduction). Every legal record design you purchase is the one you have eternally. To have one more backup of any bought develop, visit the My Forms tab and then click the related key.

Should you use the US Legal Forms site the first time, adhere to the basic directions below:

- Very first, make sure that you have chosen the correct record design for that region/city that you pick. Browse the develop outline to make sure you have picked the appropriate develop. If offered, take advantage of the Preview key to search through the record design as well.

- If you want to locate one more model of your develop, take advantage of the Lookup field to obtain the design that fits your needs and requirements.

- Upon having found the design you want, click Buy now to proceed.

- Select the pricing prepare you want, enter your references, and register for a merchant account on US Legal Forms.

- Total the deal. You can use your bank card or PayPal bank account to purchase the legal develop.

- Select the structure of your record and download it to your device.

- Make modifications to your record if possible. You are able to comprehensive, edit and sign and produce Michigan Assignment of Overriding Royalty Interest (No Proportionate Reduction).

Obtain and produce thousands of record themes making use of the US Legal Forms site, which provides the largest variety of legal varieties. Use specialist and express-certain themes to deal with your organization or individual requirements.

Form popularity

FAQ

Several things determine what the ORRI value is, including: Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.