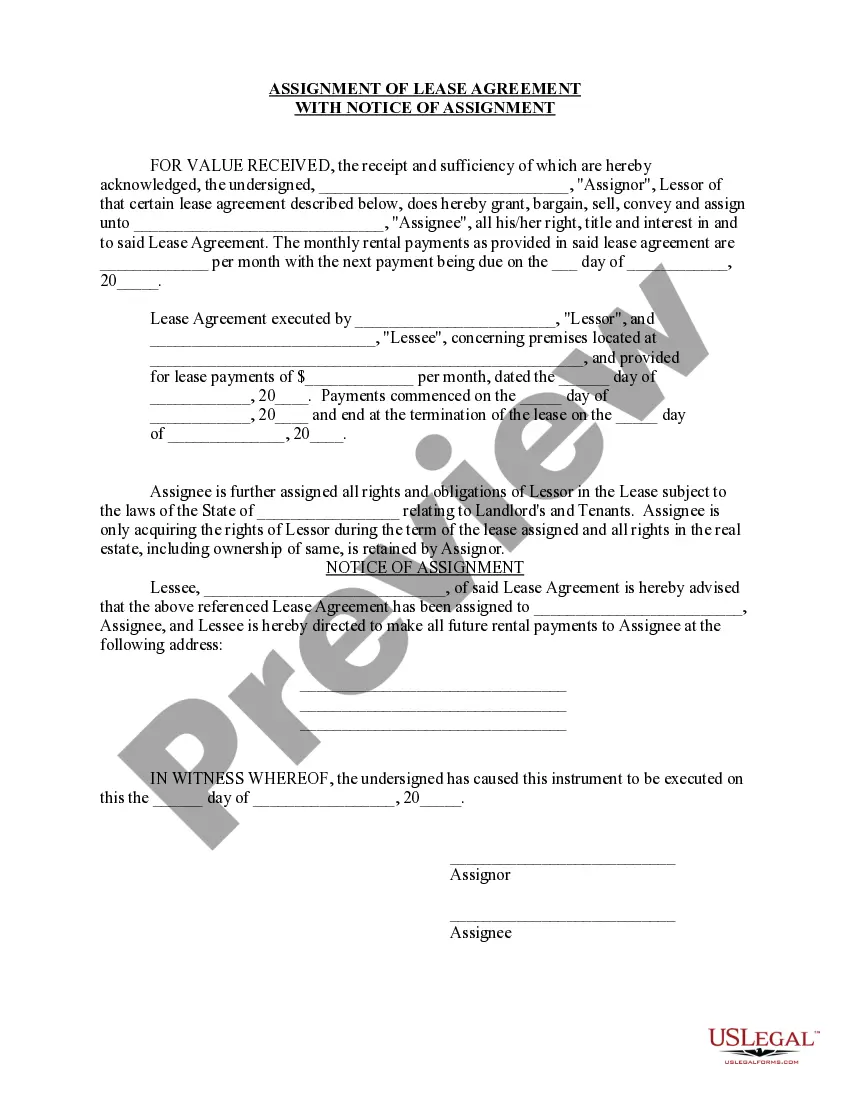

This form is used when an Assignor transfers, assigns, and conveys to Assignee an overriding royalty interest in the Leases and all oil, gas, and other minerals produced, saved, and marketed from the Lands and Leases equal to a percentage of 8/8 (the Override ).

Michigan Assignment of Overriding Royalty Interest for Multiple Leases with No Proportionate Reduction - Long Form

Description

How to fill out Assignment Of Overriding Royalty Interest For Multiple Leases With No Proportionate Reduction - Long Form?

US Legal Forms - one of many largest libraries of authorized types in the USA - offers a variety of authorized file templates you may acquire or printing. Using the web site, you will get thousands of types for company and personal reasons, sorted by groups, states, or search phrases.You will discover the most up-to-date versions of types like the Michigan Assignment of Overriding Royalty Interest for Multiple Leases with No Proportionate Reduction - Long Form within minutes.

If you currently have a membership, log in and acquire Michigan Assignment of Overriding Royalty Interest for Multiple Leases with No Proportionate Reduction - Long Form in the US Legal Forms library. The Obtain switch will appear on each and every kind you perspective. You have access to all earlier delivered electronically types inside the My Forms tab of the account.

If you wish to use US Legal Forms the first time, listed here are basic guidelines to help you began:

- Be sure you have picked out the best kind for your city/county. Go through the Preview switch to examine the form`s information. See the kind description to actually have selected the appropriate kind.

- In the event the kind does not suit your needs, utilize the Look for industry on top of the display to find the one who does.

- If you are happy with the shape, confirm your decision by visiting the Get now switch. Then, select the costs prepare you like and give your references to sign up for an account.

- Method the purchase. Utilize your charge card or PayPal account to perform the purchase.

- Find the structure and acquire the shape on the gadget.

- Make adjustments. Fill out, modify and printing and indication the delivered electronically Michigan Assignment of Overriding Royalty Interest for Multiple Leases with No Proportionate Reduction - Long Form.

Each web template you included in your account lacks an expiration date which is your own property for a long time. So, if you wish to acquire or printing another duplicate, just go to the My Forms section and click about the kind you require.

Obtain access to the Michigan Assignment of Overriding Royalty Interest for Multiple Leases with No Proportionate Reduction - Long Form with US Legal Forms, by far the most comprehensive library of authorized file templates. Use thousands of skilled and condition-particular templates that meet up with your business or personal demands and needs.

Form popularity

FAQ

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres. Net Royalty Acres Defined - Oil and Gas Lawyer Blog oilandgaslawyerblog.com ? net-royalty-acre... oilandgaslawyerblog.com ? net-royalty-acre...

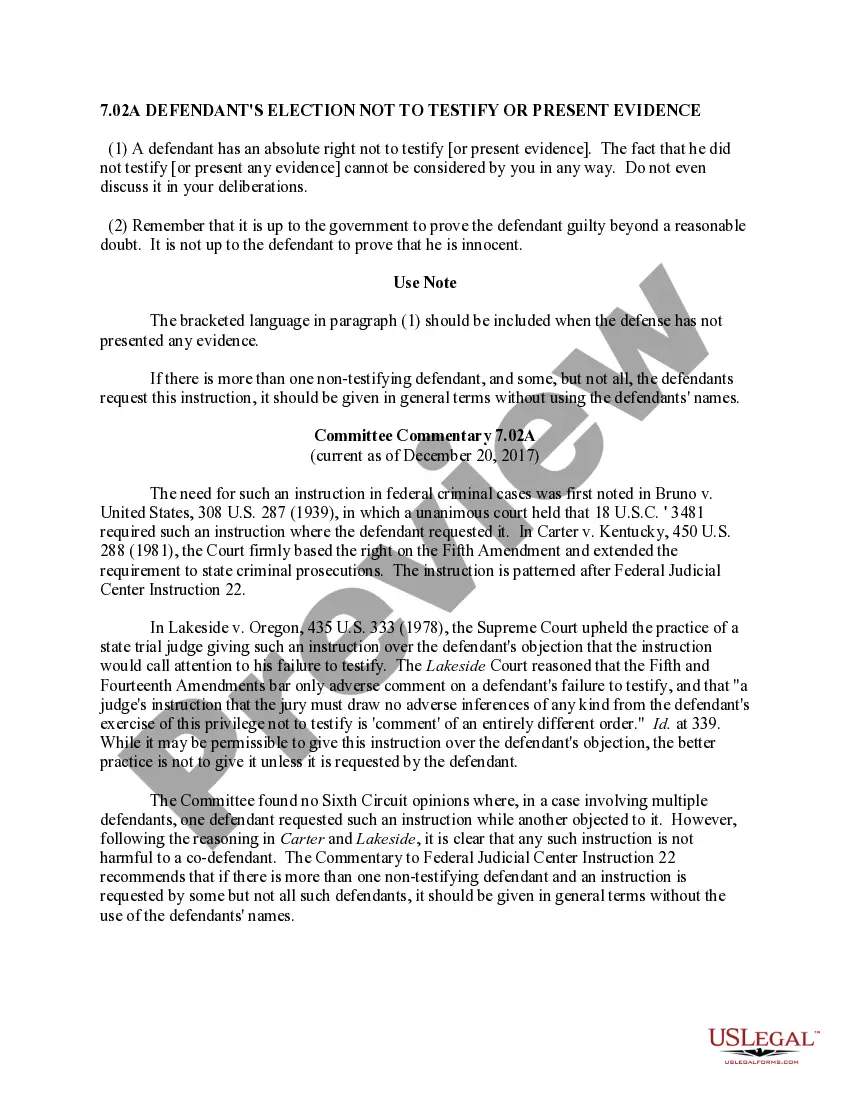

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties. Non-Participating Royalty Interest (NPRI) Endeavor Energy Resources, LP ? 2019/07 Endeavor Energy Resources, LP ? 2019/07 PDF

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12. Information and Procedures for Transferring Overriding Royalty ... blm.gov ? article ? Information-and-Procedu... blm.gov ? article ? Information-and-Procedu...

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to. How to Calculate Oil and Gas Royalty Payments? - Pheasant Energy pheasantenergy.com ? how-to-calculate-oil-... pheasantenergy.com ? how-to-calculate-oil-...

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.