This form is used when the Owners, by unanimous consent, desire to amend the Operating Agreement.

Michigan Amendment to Operating Agreement

Description

How to fill out Amendment To Operating Agreement?

Choosing the right lawful record format could be a have difficulties. Naturally, there are a lot of web templates accessible on the Internet, but how would you get the lawful form you want? Use the US Legal Forms internet site. The support gives thousands of web templates, for example the Michigan Amendment to Operating Agreement, which you can use for business and personal needs. Every one of the types are checked by pros and meet up with state and federal needs.

If you are currently signed up, log in to your accounts and then click the Acquire switch to obtain the Michigan Amendment to Operating Agreement. Make use of your accounts to appear throughout the lawful types you may have purchased earlier. Visit the My Forms tab of your respective accounts and obtain another copy from the record you want.

If you are a new end user of US Legal Forms, here are straightforward instructions so that you can stick to:

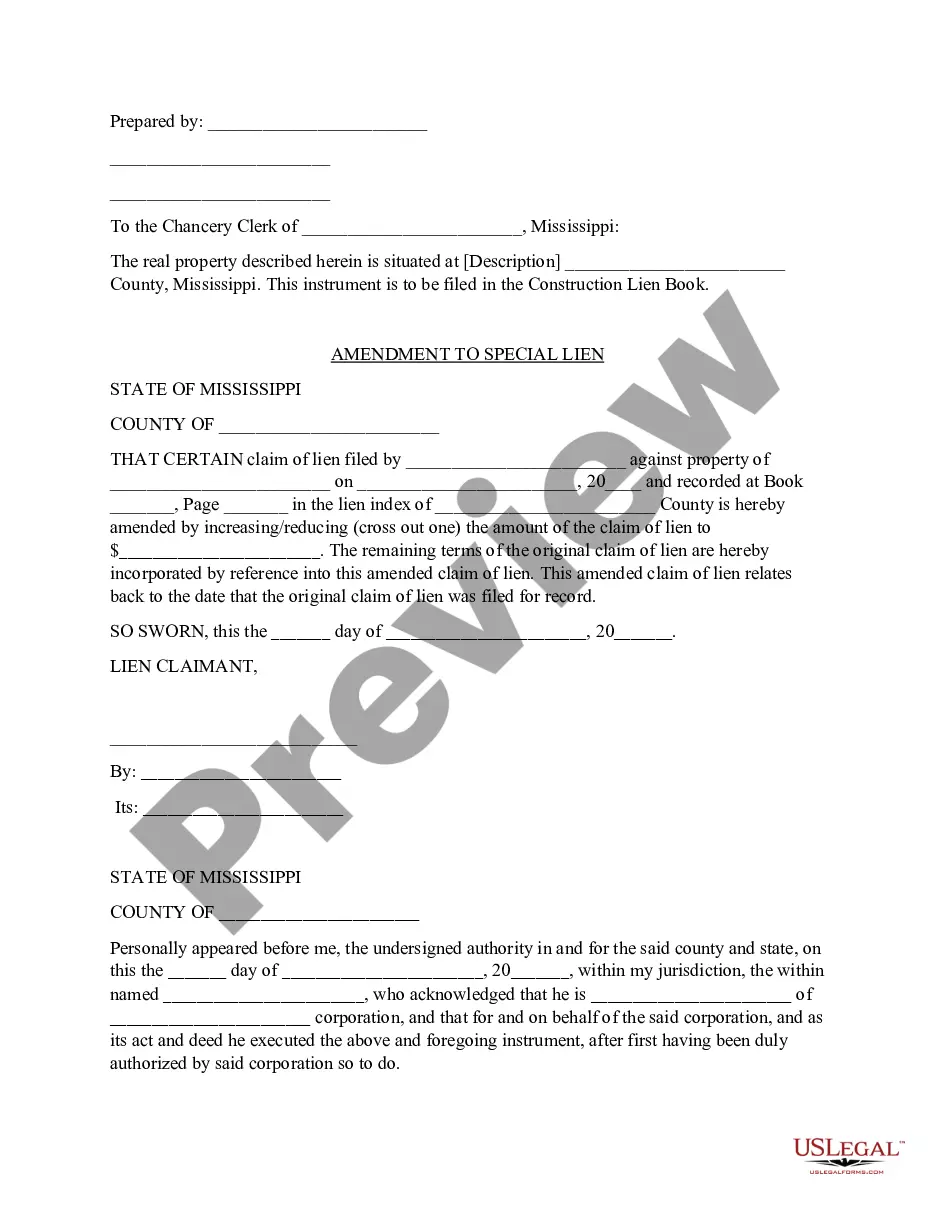

- Initial, be sure you have chosen the right form for your personal city/state. It is possible to check out the shape making use of the Preview switch and study the shape explanation to guarantee this is the best for you.

- If the form does not meet up with your needs, use the Seach area to discover the proper form.

- Once you are positive that the shape is suitable, click the Get now switch to obtain the form.

- Select the pricing plan you would like and enter the necessary information and facts. Build your accounts and pay money for your order using your PayPal accounts or credit card.

- Select the document formatting and acquire the lawful record format to your gadget.

- Complete, edit and printing and indication the acquired Michigan Amendment to Operating Agreement.

US Legal Forms may be the largest library of lawful types in which you can find various record web templates. Use the company to acquire appropriately-manufactured files that stick to state needs.

Form popularity

FAQ

AN ACT to provide for the organization and regulation of limited liability companies; to prescribe their duties, rights, powers, immunities, and liabilities; to prescribe the powers and duties of certain state departments and agencies; and to provide for penalties and remedies.

How to Transfer LLC Ownership in Michigan Consult your Michigan LLC operating agreement. ... Vote to transfer membership interest. ... Amend your operating agreement. ... Change your IRS responsible party.

A domestic LLC is created as a business entity legally separate from its owners and is formed within the state of Michigan. The articles of organization must obey the legal requirements of the state. These include: Registering a name using LLC or ?Limited Liability Company.?

Prepare and file with Michigan Michigan does not require you to submit an Operating Agreement to form your LLC.

Prepare and file with Michigan Michigan does not require you to submit an Operating Agreement to form your LLC.

AN ACT to define certain farm uses, operations, practices, and products; to provide certain disclosures; to provide for circumstances under which a farm shall not be found to be a public or private nuisance; to provide for certain powers and duties for certain state agencies and departments; and to provide for certain ...

Public Acts. Bills that have been approved by the Legislature and signed into law by the Governor, filed with the Secretary of State, and assigned a Public Act number.

You'll simply need to file a Certificate of Amendment to the Articles of Organization with the Michigan Department of Licensing and Regulatory Affairs (LARA). The use of the state-provided form is optional, which means you can draft your own amendments, provided you know how to do it correctly.