This form is used to resolve any question as to how royalty is to be paid to the Parties in the event of production, under the Lease, on any part of the Lands. The Parties are entering into this Agreement to stipulate and agree to the ownership of each Party's respective share of the royalty reserved in the Lease payable for production attributable to their Interests from a well located anywhere on the Lands.

Michigan Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

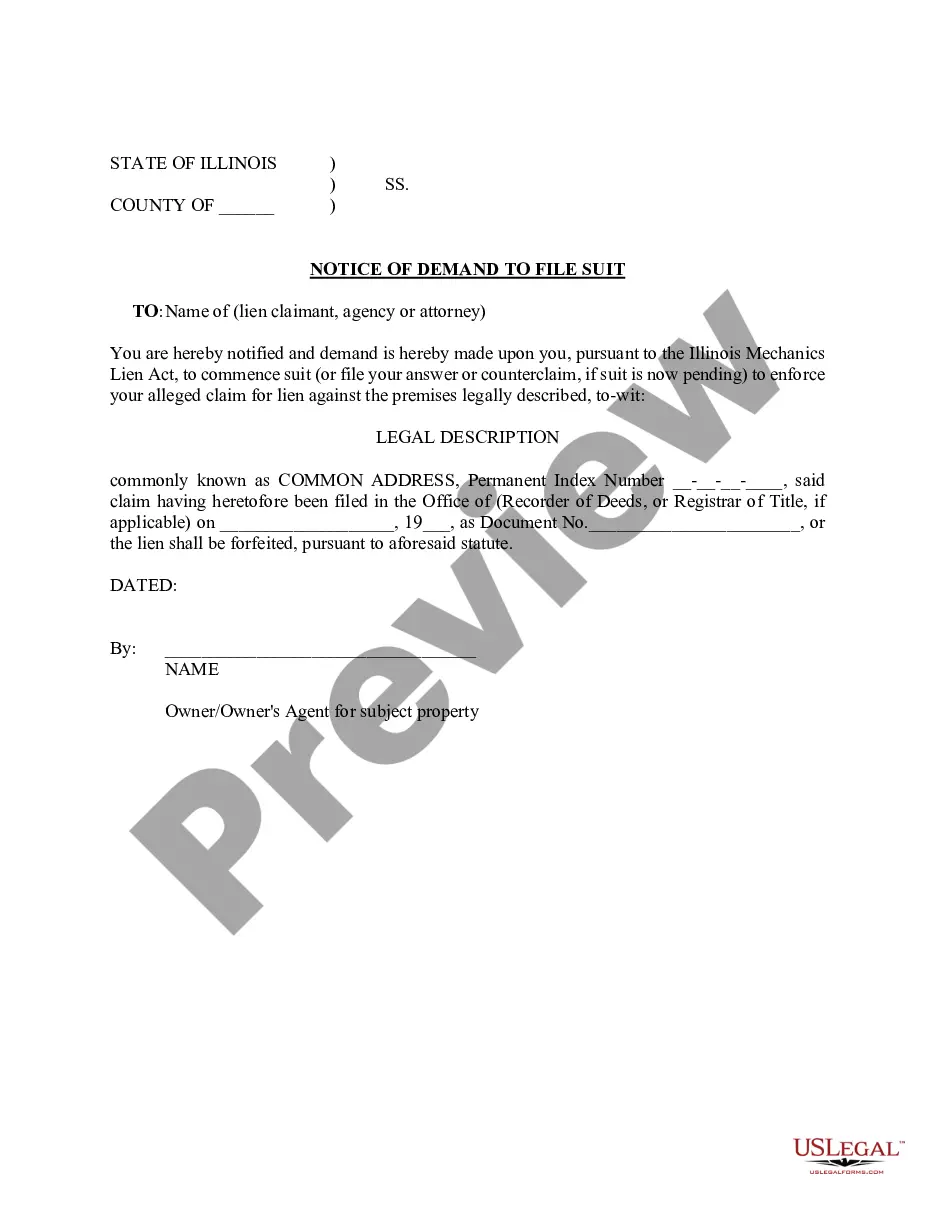

How to fill out Agreement Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

If you need to total, acquire, or produce authorized papers templates, use US Legal Forms, the greatest selection of authorized types, which can be found on-line. Utilize the site`s easy and practical search to obtain the paperwork you want. Various templates for business and individual purposes are sorted by classes and says, or key phrases. Use US Legal Forms to obtain the Michigan Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease within a few mouse clicks.

When you are presently a US Legal Forms client, log in in your profile and click on the Download option to find the Michigan Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease. Also you can gain access to types you earlier downloaded from the My Forms tab of your own profile.

If you work with US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for the proper town/nation.

- Step 2. Use the Preview choice to examine the form`s content material. Do not overlook to read through the description.

- Step 3. When you are unsatisfied with all the form, use the Search discipline on top of the display to locate other models from the authorized form design.

- Step 4. Once you have located the shape you want, go through the Get now option. Opt for the costs strategy you prefer and add your credentials to register on an profile.

- Step 5. Approach the transaction. You may use your bank card or PayPal profile to perform the transaction.

- Step 6. Find the structure from the authorized form and acquire it in your gadget.

- Step 7. Total, change and produce or signal the Michigan Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease.

Each and every authorized papers design you buy is your own eternally. You possess acces to every form you downloaded with your acccount. Click the My Forms section and choose a form to produce or acquire once again.

Compete and acquire, and produce the Michigan Agreement Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease with US Legal Forms. There are many specialist and condition-distinct types you can utilize for your personal business or individual requirements.

Form popularity

FAQ

Royalty rate is shown as either a gross royalty rate between 1-9% of gross revenues, or a net royalty rate between 25% to 40% of net revenues, depending on if the project is pre- or post-payout and the current WTI price in Canadian dollars.

Royalty Clause There are two types of royalties, a net and a gross royalty. Normally, the oil and gas lease contains a net royalty. If the lease provides for a net royalty, this means that post-production deductions will be taken from the royalty.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

1. n. [Oil and Gas Business] Ownership in a share of production, paid to an owner who does not share in the right to explore or develop a lease, or receive bonus or rental payments. It is free of the cost of production, and is deducted from the royalty interest.

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

Generally, the standard royalty rates for authors is under 10% for traditional publishing and up to 70% with self-publishing.