Michigan Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits

Description

How to fill out Assignment Of Overriding Royalty Interests Of A Percentage Of Assignor's Net Revenue Interest, After Deductions Of Certain Costs - Effectively A Net Profits?

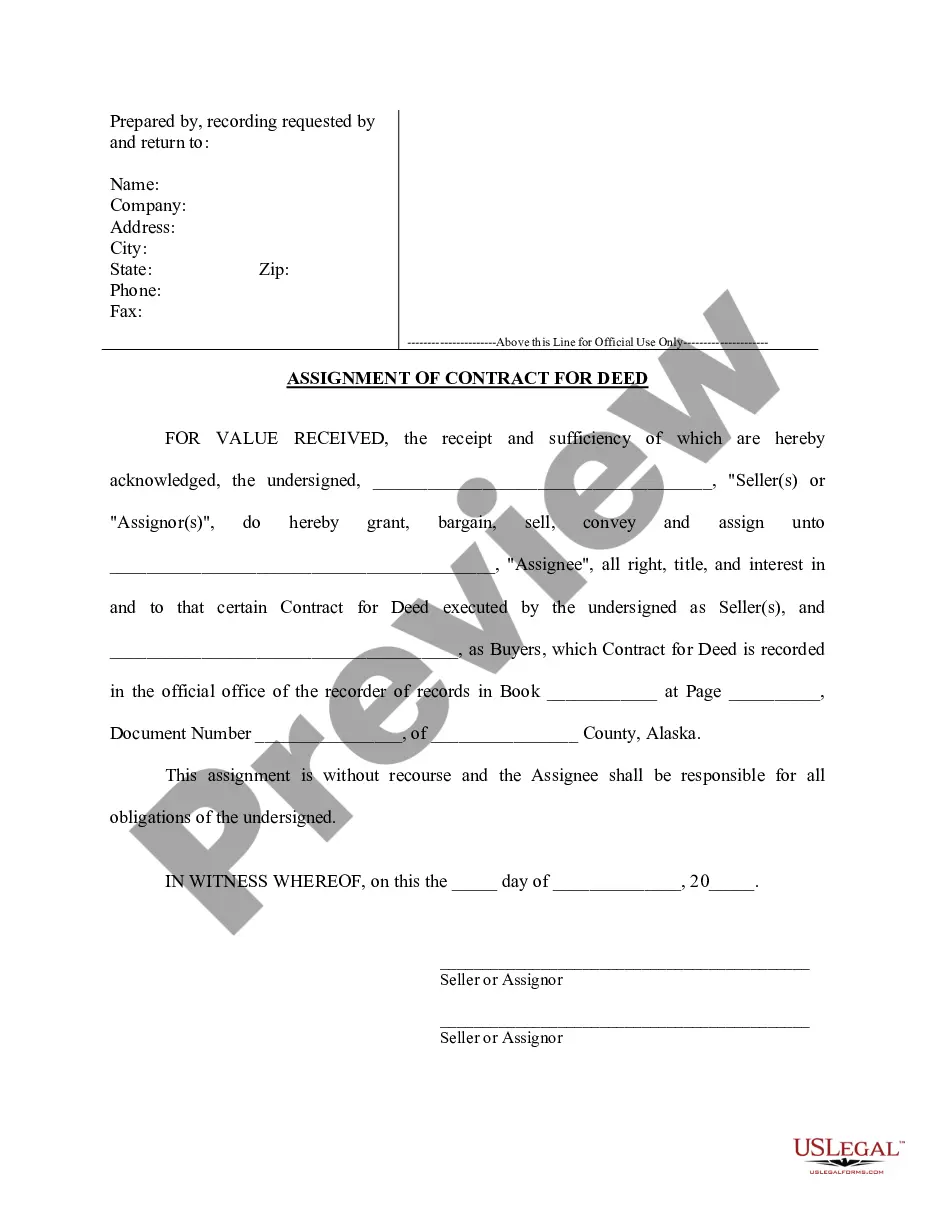

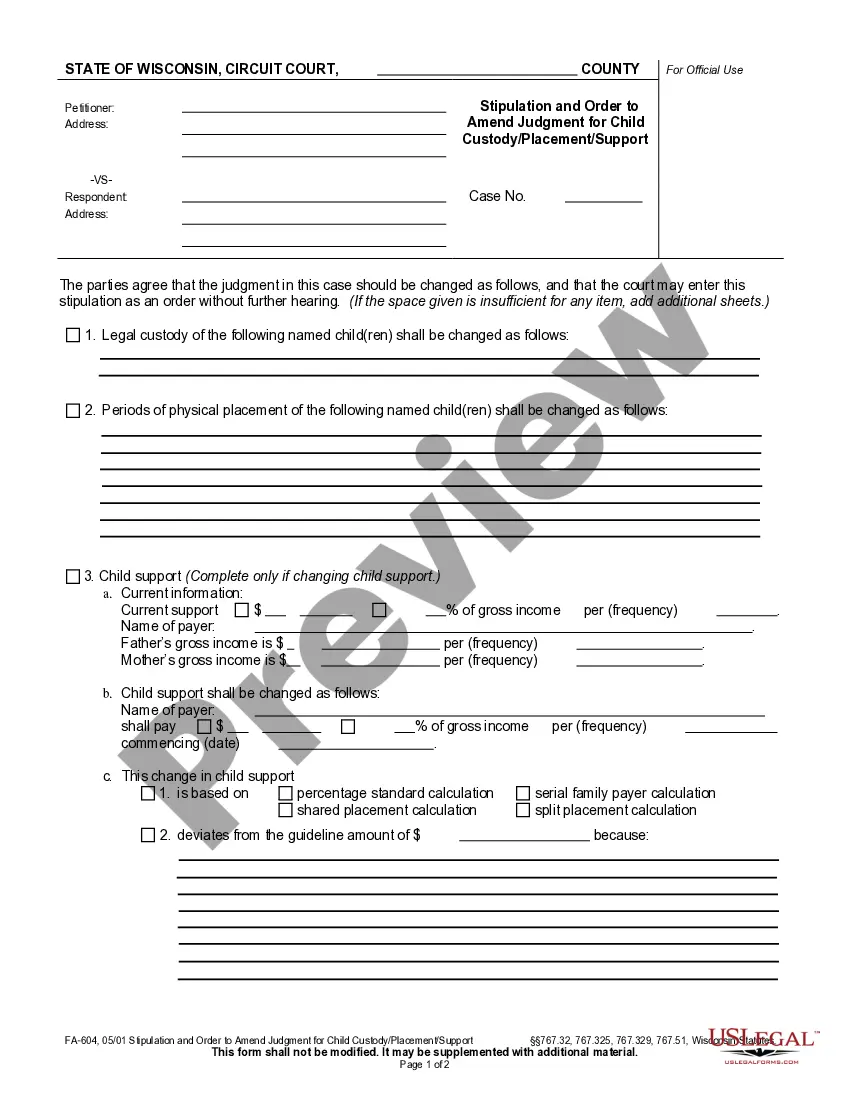

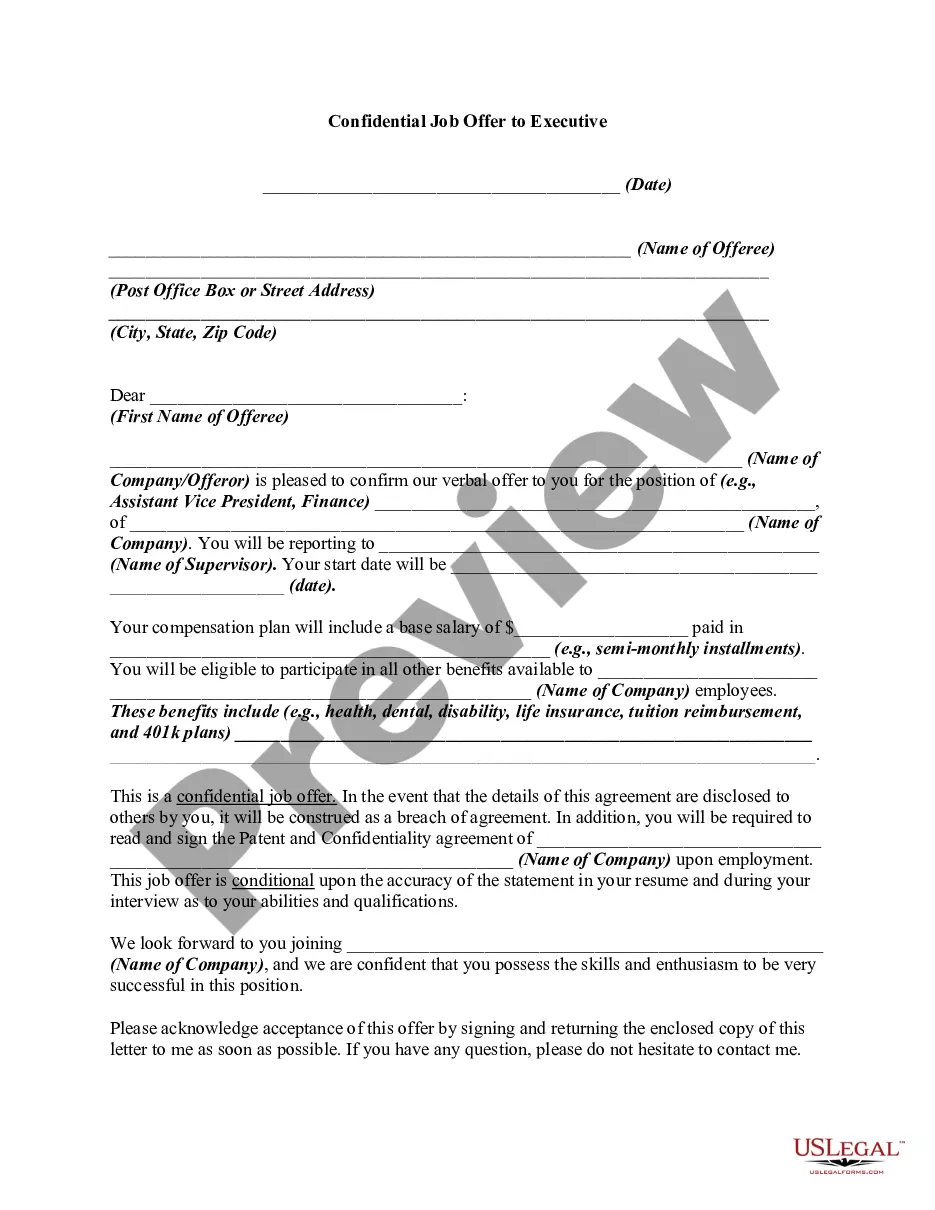

Are you currently inside a position where you need to have papers for possibly company or personal functions almost every working day? There are a lot of legal document themes available online, but discovering kinds you can rely on isn`t easy. US Legal Forms offers thousands of form themes, just like the Michigan Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits, which are composed to meet federal and state needs.

If you are presently acquainted with US Legal Forms site and also have an account, basically log in. Next, it is possible to obtain the Michigan Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits web template.

Should you not provide an bank account and want to start using US Legal Forms, follow these steps:

- Get the form you need and ensure it is to the right metropolis/county.

- Utilize the Preview switch to review the shape.

- See the outline to ensure that you have chosen the proper form.

- When the form isn`t what you`re trying to find, take advantage of the Search field to obtain the form that fits your needs and needs.

- When you get the right form, click on Buy now.

- Opt for the prices prepare you desire, submit the specified info to create your account, and buy the transaction making use of your PayPal or Visa or Mastercard.

- Choose a handy document formatting and obtain your duplicate.

Get every one of the document themes you may have bought in the My Forms menu. You can get a further duplicate of Michigan Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits whenever, if required. Just click the needed form to obtain or print out the document web template.

Use US Legal Forms, by far the most considerable collection of legal forms, to save time and prevent errors. The service offers professionally manufactured legal document themes which can be used for an array of functions. Produce an account on US Legal Forms and start producing your lifestyle a little easier.

Form popularity

FAQ

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.