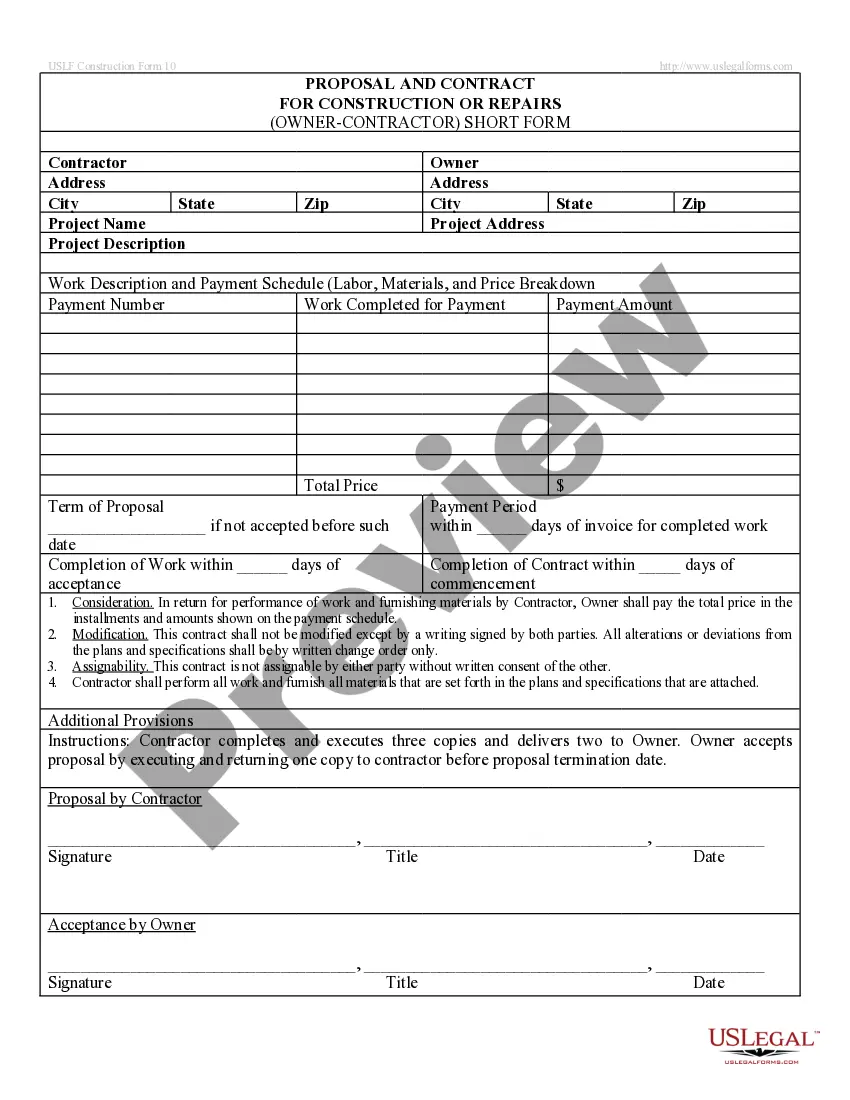

Michigan Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Self-Employed Independent Contractor Payment Schedule?

If you wish to compile, download, or print legal document templates, utilize US Legal Forms, the largest array of legal forms available online. Take advantage of the site's straightforward and convenient search to find the documents you need. A range of templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to acquire the Michigan Self-Employed Independent Contractor Payment Schedule with just a few clicks. If you are already a US Legal Forms user, Log Into your account and click the Obtain button to locate the Michigan Self-Employed Independent Contractor Payment Schedule. You can also retrieve forms you previously saved from the My documents tab in your account.

If you are using US Legal Forms for the first time, follow the steps below: Step 1. Ensure you have selected the form for your relevant city/state. Step 2. Use the Preview option to review the form's content. Don’t forget to read the description. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form format. Step 4. Once you have found the form you need, click the Buy now button. Select the pricing plan you prefer and enter your credentials to register for an account. Step 5. Process the transaction. You can utilize your credit card or PayPal account to complete the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Michigan Self-Employed Independent Contractor Payment Schedule.

- Every legal document template you purchase is yours permanently.

- You will have access to every form you saved in your account.

- Click the My documents section and select a form to print or download again.

- Complete and download, and print the Michigan Self-Employed Independent Contractor Payment Schedule with US Legal Forms.

- There are numerous professional and state-specific forms you can use for your business or personal needs.

Form popularity

FAQ

The typical payment term for contractors often ranges from net 30 to net 60 days, meaning payment is due within 30 to 60 days after invoicing. However, a Michigan Self-Employed Independent Contractor Payment Schedule can specify different terms based on project scope and client needs. Establishing these terms helps ensure that both parties understand their financial commitments. You can find templates on US Legal Forms to help you craft the perfect payment schedule.

Payment terms for independent contractors can vary widely based on the agreement between the contractor and the client. Typically, the Michigan Self-Employed Independent Contractor Payment Schedule outlines specific terms, such as payment frequency and methods. Many contractors prefer to establish clear terms upfront to ensure timely payments. Utilizing a platform like US Legal Forms can help you draft a solid agreement that protects your interests.

To collect payments as a contractor, establish clear terms upfront and communicate them effectively. You may want to use a Michigan Self-Employed Independent Contractor Payment Schedule to specify payment due dates and methods. Sending invoices promptly and following up on overdue payments can streamline your collection process. Additionally, consider using tools from uslegalforms to generate invoices and payment reminders.

Yes, you can provide an independent contractor with a payment schedule that outlines when and how they will receive payments. A clear Michigan Self-Employed Independent Contractor Payment Schedule helps both parties understand expectations. This not only fosters a good working relationship but also ensures timely payments for services rendered. Using platforms like uslegalforms can help you create a professional payment schedule easily.

The $600 reporting rule refers to the requirement for businesses to report payments made to independent contractors totaling $600 or more in a calendar year. This rule is essential for your Michigan Self-Employed Independent Contractor Payment Schedule. By complying with this rule, you ensure proper tax reporting and avoid potential penalties. You can utilize platforms like uslegalforms to streamline your reporting process and stay organized.

Payments to contractors are not considered wages. Instead, they are categorized as independent contractor payments. This distinction is crucial for understanding your Michigan Self-Employed Independent Contractor Payment Schedule. When you hire an independent contractor, you typically do not withhold taxes, which differentiates these payments from traditional employee wages.

To report payments made to independent contractors, maintain accurate records of all transactions throughout the year. Utilize accounting software or spreadsheets to track expenses and payments made. It's crucial to report these payments correctly to the IRS using Form 1099-MISC, when applicable. The US Legal platform can assist you with the necessary documentation to ensure your Michigan Self-Employed Independent Contractor Payment Schedule complies with legal requirements.

Receiving payments as an independent contractor involves providing clients with your payment details, such as bank account or payment platform information. Make sure to send invoices promptly and consider setting up automatic reminders for overdue payments. Utilizing US Legal services can help you create professional invoices that align with the Michigan Self-Employed Independent Contractor Payment Schedule standards.

To accept payments effectively, independent contractors should establish a clear payment method before starting any project. Common options include PayPal, Venmo, and direct deposits. It is essential to communicate the chosen method to clients upfront to avoid any confusion. US Legal forms can provide useful templates to outline your payment terms in your Michigan Self-Employed Independent Contractor Payment Schedule.

Contractors can accept payments through several methods, including bank transfers, checks, and electronic payment platforms. Each method offers unique benefits, such as convenience and security. Choosing the right method often depends on the contractor's preferences and the client's expectations. Consider leveraging tools from the US Legal platform to help manage your Michigan Self-Employed Independent Contractor Payment Schedule efficiently.