Michigan Child Care or Day Care Services Contract - Self-Employed

Description

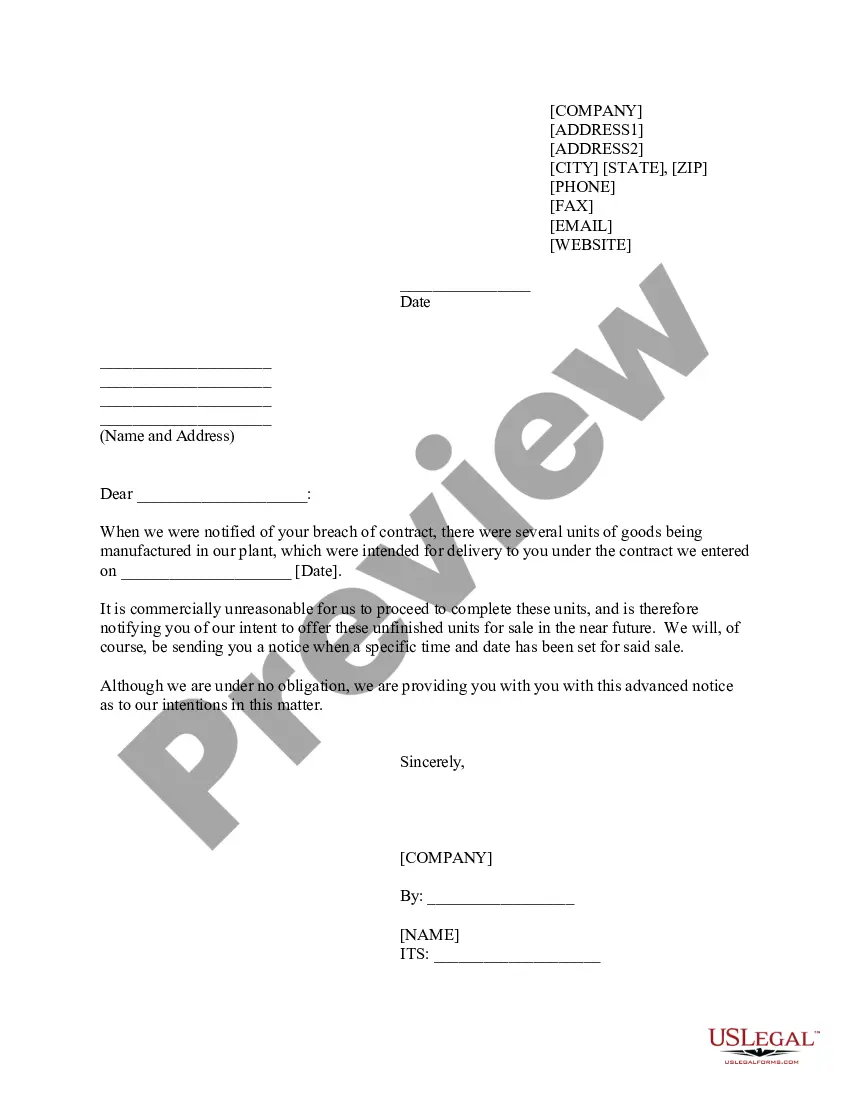

How to fill out Child Care Or Day Care Services Contract - Self-Employed?

You can spend hours online searching for the legal document template that fulfills the state and federal requirements you desire.

US Legal Forms offers thousands of legal documents that can be reviewed by experts.

You can obtain or create the Michigan Child Care or Day Care Services Contract - Self-Employed from my service.

If available, use the Review option to browse the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Download option.

- Subsequently, you can complete, modify, generate, or sign the Michigan Child Care or Day Care Services Contract - Self-Employed.

- Every legal document template you purchase belongs to you indefinitely.

- To acquire another copy of a purchased form, navigate to the My documents tab and select the corresponding option.

- If this is your first time using the US Legal Forms website, follow the simple instructions outlined below.

- First, ensure that you have chosen the correct document template for the region/town you select.

- Review the form details to confirm you have selected the correct form.

Form popularity

FAQ

The standard guideline in Michigan suggests a ratio of one adult for every six children in a home-based setting. This rule is important for maintaining safety and quality in child care. By adhering to these guidelines while operating under a Michigan Child Care or Day Care Services Contract - Self-Employed, you not only meet legal requirements but also provide a nurturing environment for children.

Legally, the number of children you can watch in Michigan varies depending on licensing status and the type of care provided. Without a license, you can care for up to six children, including your own. When engaging in a Michigan Child Care or Day Care Services Contract - Self-Employed, understanding these limits ensures you comply with state laws, which protects both you and the families you serve.

In Michigan, you can typically watch up to six children in your home without needing a formal license. This limit includes your own children, which counts toward the total. If you're considering offering services under a Michigan Child Care or Day Care Services Contract - Self-Employed, knowing this limit helps you plan your business model effectively.

In Michigan, babysitting for a small number of children in your home typically does not require a license. However, if you want to offer Michigan Child Care or Day Care Services Contract - Self-Employed on a larger scale, or if you care for more than six children, you must comply with licensing requirements. It is essential to understand the specific regulations to ensure that you operate legally and safely.

When applying for Medicaid, various sources of income contribute to the overall calculation. This includes wages, self-employment income, unemployment benefits, and certain other government assistance. For those working under the Michigan Child Care or Day Care Services Contract - Self-Employed, it’s essential to document all income sources accurately. Platforms like US Legal Forms can aid in organizing your financial records for a smooth application process.

The income limit for child care assistance in Michigan can vary based on family size and specific program criteria. Generally, this limit is calculated based on a percentage of the Federal Poverty Level. Understanding these limits is crucial for those seeking to apply for the Michigan Child Care or Day Care Services Contract - Self-Employed. For further clarity, consult local resources or consider professional guidance.

To provide proof of income as a self-employed individual, you can use various documents. Common options include your latest tax returns, profit and loss statements, and bank statements reflecting your earnings. Keeping accurate records of your income is essential for the Michigan Child Care or Day Care Services Contract - Self-Employed. Using platforms like US Legal Forms can help you generate the necessary documentation efficiently.

Yes, Medicaid thoroughly checks income to determine eligibility and benefits for applicants, including those who are self-employed. If you are working in Michigan Child Care or Day Care Services, expect Medicaid to review your financial documentation. They verify reported income to maintain program integrity and ensure that assistance goes to those who truly need it. Staying transparent with your earnings helps you avoid any potential conflicts with your Medicaid application.

As a self-employed person, proving your income involves presenting documents such as tax returns, bank statements, and invoices from clients. These documents serve as evidence of earnings when applying for financial assistance or Medicaid benefits. Having complete and organized financial records reassures state agencies about your income situation. This proof is vital for those involved in Michigan Child Care or Day Care Services to qualify for necessary support.

To report your self-employment income to Medicaid, collect all relevant financial documents, such as tax returns and profit statements. You can submit this information through your local Department of Health and Human Services office or during your Medicaid application process. Clear documentation demonstrates your financial situation, ensuring you receive appropriate benefits. Proper reporting is essential for any self-employed individual in Michigan Child Care or Day Care Services.