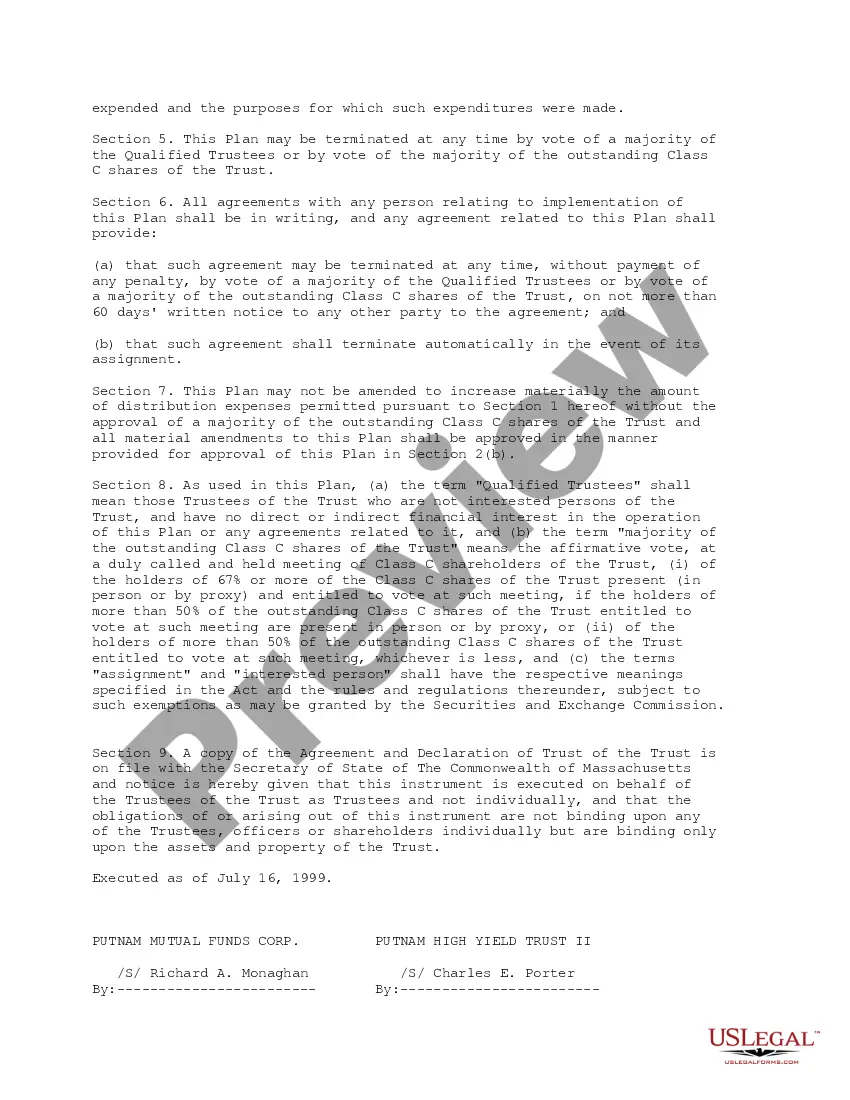

Michigan Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II

Description

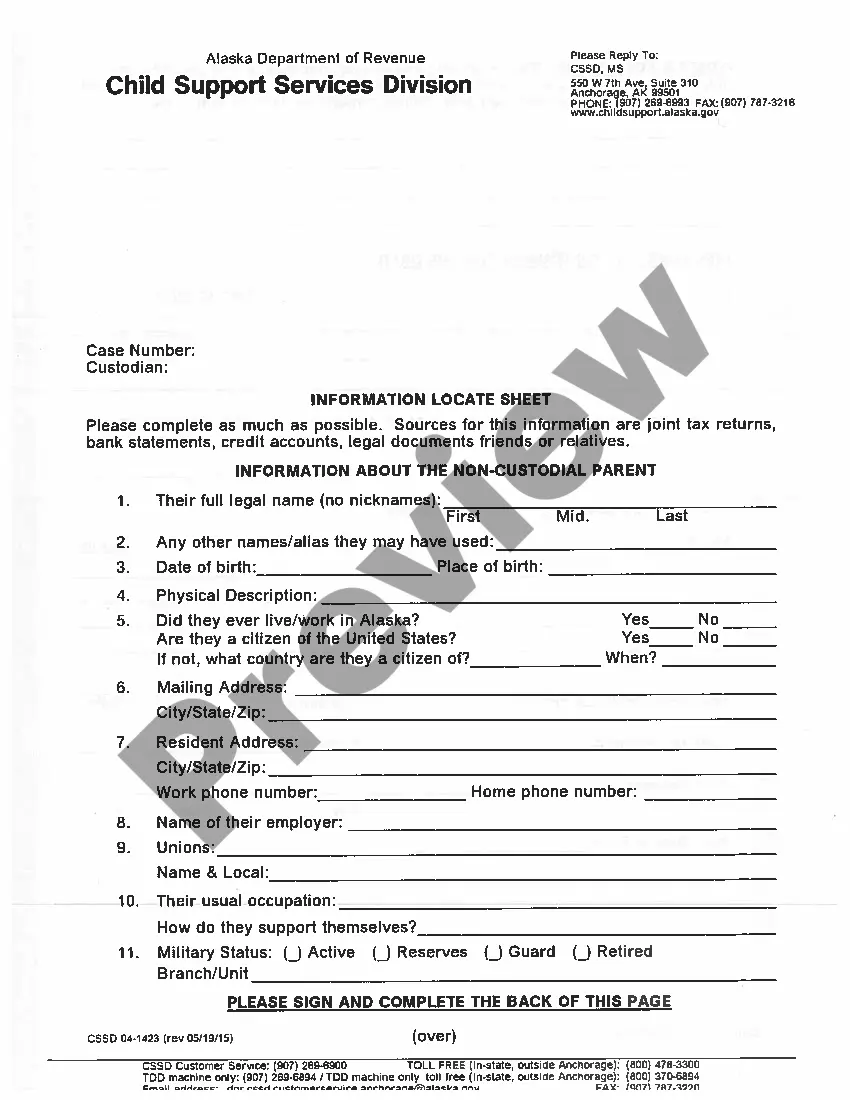

How to fill out Class C Distribution Plan And Agreement Between Putnam Mutual Funds Corp And Putnam High Yield Trust II?

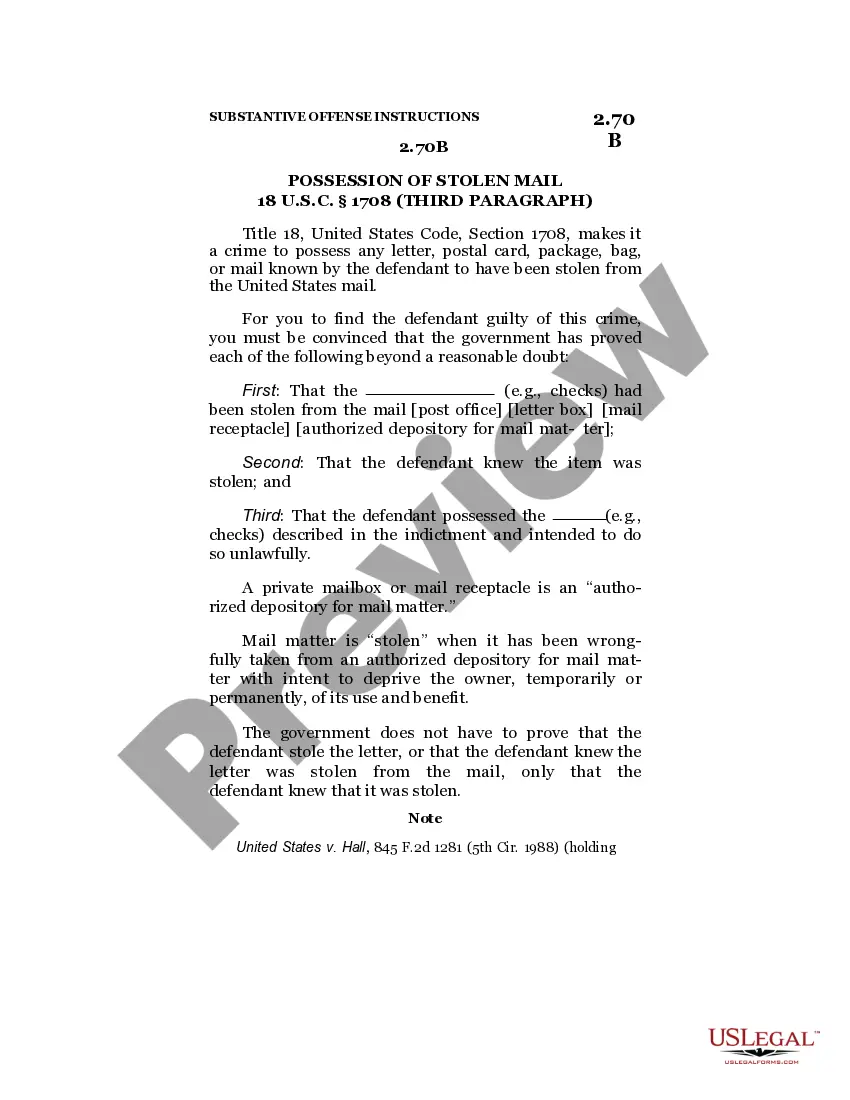

If you have to complete, acquire, or print authorized file layouts, use US Legal Forms, the most important collection of authorized forms, that can be found on the web. Use the site`s easy and convenient look for to get the documents you want. Various layouts for enterprise and specific functions are categorized by types and states, or key phrases. Use US Legal Forms to get the Michigan Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II within a few clicks.

If you are already a US Legal Forms customer, log in in your accounts and click on the Down load option to get the Michigan Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II. Also you can entry forms you in the past saved inside the My Forms tab of your accounts.

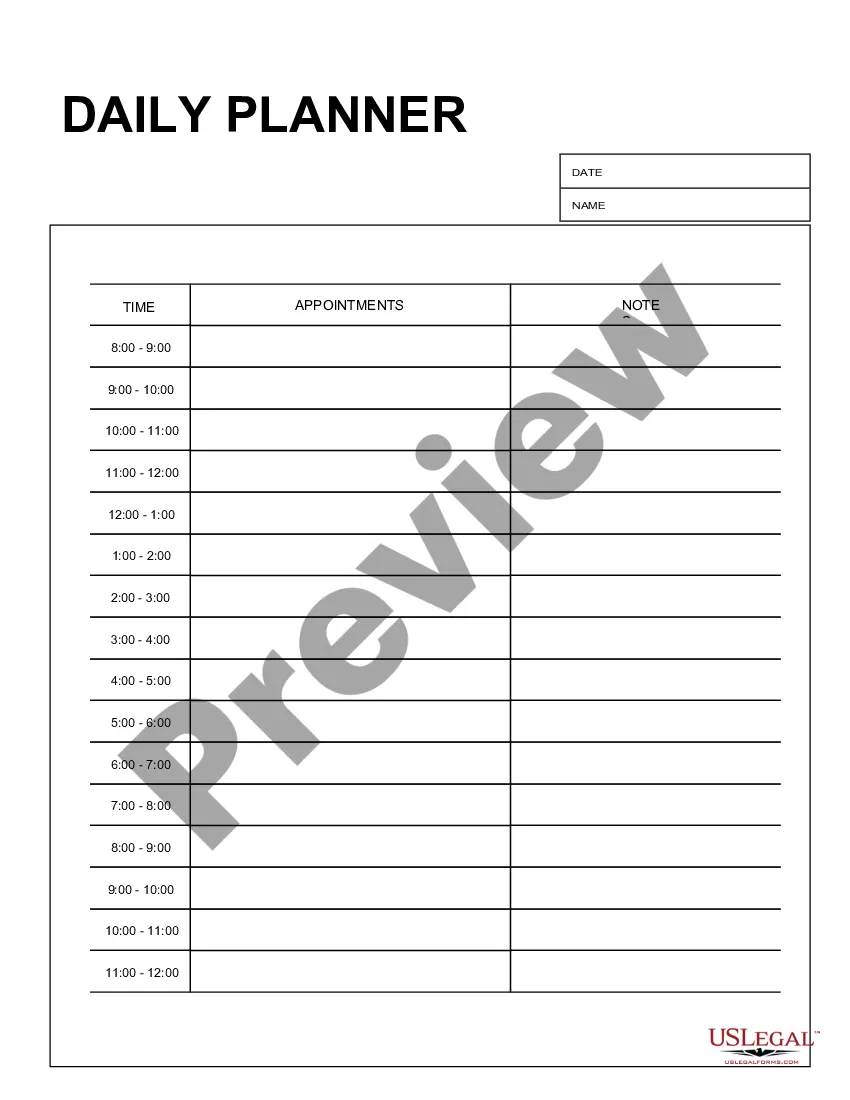

If you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape to the correct metropolis/region.

- Step 2. Utilize the Preview method to look through the form`s content material. Don`t forget about to see the outline.

- Step 3. If you are unhappy together with the kind, utilize the Research discipline near the top of the display screen to find other models of the authorized kind design.

- Step 4. Once you have discovered the shape you want, click on the Purchase now option. Choose the rates prepare you favor and put your accreditations to sign up for an accounts.

- Step 5. Method the financial transaction. You can utilize your Мisa or Ьastercard or PayPal accounts to accomplish the financial transaction.

- Step 6. Select the structure of the authorized kind and acquire it in your gadget.

- Step 7. Complete, change and print or indication the Michigan Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II.

Every authorized file design you get is your own permanently. You possess acces to every kind you saved with your acccount. Click on the My Forms segment and select a kind to print or acquire once again.

Contend and acquire, and print the Michigan Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II with US Legal Forms. There are millions of skilled and express-certain forms you can use for your personal enterprise or specific requires.

Form popularity

FAQ

Class C shares don't impose a front-end sales charge on the purchase, so the full dollar amount that you pay is invested. Often Class C shares impose a small charge (often 1 percent) if you sell your shares within a short time, usually one year. Mutual Funds | FINRA.org finra.org ? investing ? investment-products finra.org ? investing ? investment-products

Class C shares are level-load shares that don't impose a sales charge unless you sell too soon after your purchase (usually a period of a year). Instead, mutual funds charge an ongoing annual fee. C shares are probably best for short term investors of beyond one year and no more than three years.

Class C shares are a class of mutual fund share characterized by a level load that includes annual charges for fund marketing, distribution, and servicing, set at a fixed percentage. These fees amount to a commission for the firm or individual helping the investor decide on which fund to own.

Founded in 1937, Putnam is a global asset management firm with $136 billion3 in AUM as of April 2023. Putnam has offices in Boston, London, Munich, Tokyo, Singapore and Sydney. Franklin Templeton to Acquire Putnam Investments franklintempleton.com ? news-room ? frank... franklintempleton.com ? news-room ? frank...

Long-term investors (more than five years, at least, and preferably more than 10) will do best with class A share funds. Even though the front load may seem high, the ongoing, internal expenses of class A share funds tend to be lower than those of B and C shares.

Class A shares involve paying a fee when you purchase your shares. Class B shares impose a fee when you sell your shares. Class C shares impose a fee while holding the shares, such as 0.5% of the value of the share per period. Class A vs. Class B vs. Class C Mutual Fund Shares - The Balance thebalancemoney.com ? is-it-best-to-buy-a-... thebalancemoney.com ? is-it-best-to-buy-a-...

Class C shares are often purchased by investors who have less than $1 million in assets to invest in a fund family and who have a shorter-term investment horizon, because during those first years Class C shares will generally be more economical to purchase, hold and sell than Class A shares.