Michigan Share Exchange Agreement between ZC Acquisition Corp., Zefer Corp. and the stockholders of Zefer Corp.

Description

How to fill out Share Exchange Agreement Between ZC Acquisition Corp., Zefer Corp. And The Stockholders Of Zefer Corp.?

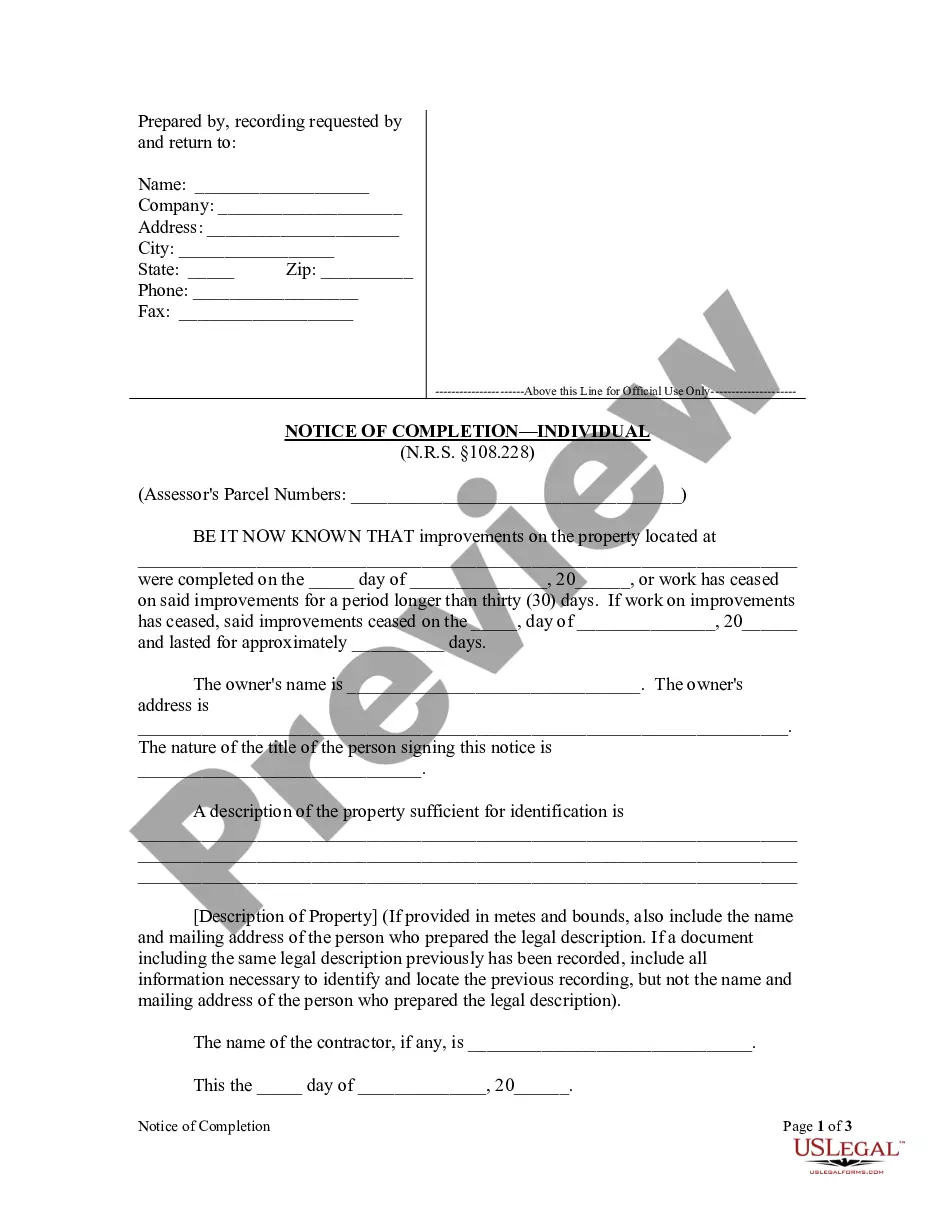

Have you been within a situation that you need to have papers for both enterprise or person purposes virtually every day time? There are a lot of authorized file themes available online, but locating types you can rely on isn`t effortless. US Legal Forms offers thousands of form themes, such as the Michigan Share Exchange Agreement between ZC Acquisition Corp., Zefer Corp. and the stockholders of Zefer Corp., that are published to satisfy state and federal demands.

Should you be presently acquainted with US Legal Forms site and also have an account, basically log in. Afterward, you may acquire the Michigan Share Exchange Agreement between ZC Acquisition Corp., Zefer Corp. and the stockholders of Zefer Corp. template.

If you do not provide an accounts and would like to begin using US Legal Forms, adopt these measures:

- Discover the form you want and make sure it is for your right area/region.

- Use the Preview option to analyze the form.

- See the information to ensure that you have selected the right form.

- If the form isn`t what you`re searching for, use the Look for area to discover the form that meets your needs and demands.

- Whenever you discover the right form, just click Get now.

- Pick the costs program you want, fill in the necessary information to create your account, and pay for the order making use of your PayPal or Visa or Mastercard.

- Choose a hassle-free document formatting and acquire your version.

Find all the file themes you might have purchased in the My Forms food list. You may get a more version of Michigan Share Exchange Agreement between ZC Acquisition Corp., Zefer Corp. and the stockholders of Zefer Corp. any time, if possible. Just select the necessary form to acquire or print the file template.

Use US Legal Forms, by far the most extensive variety of authorized kinds, in order to save efforts and prevent errors. The assistance offers skillfully produced authorized file themes that you can use for a selection of purposes. Produce an account on US Legal Forms and begin generating your life a little easier.

Form popularity

FAQ

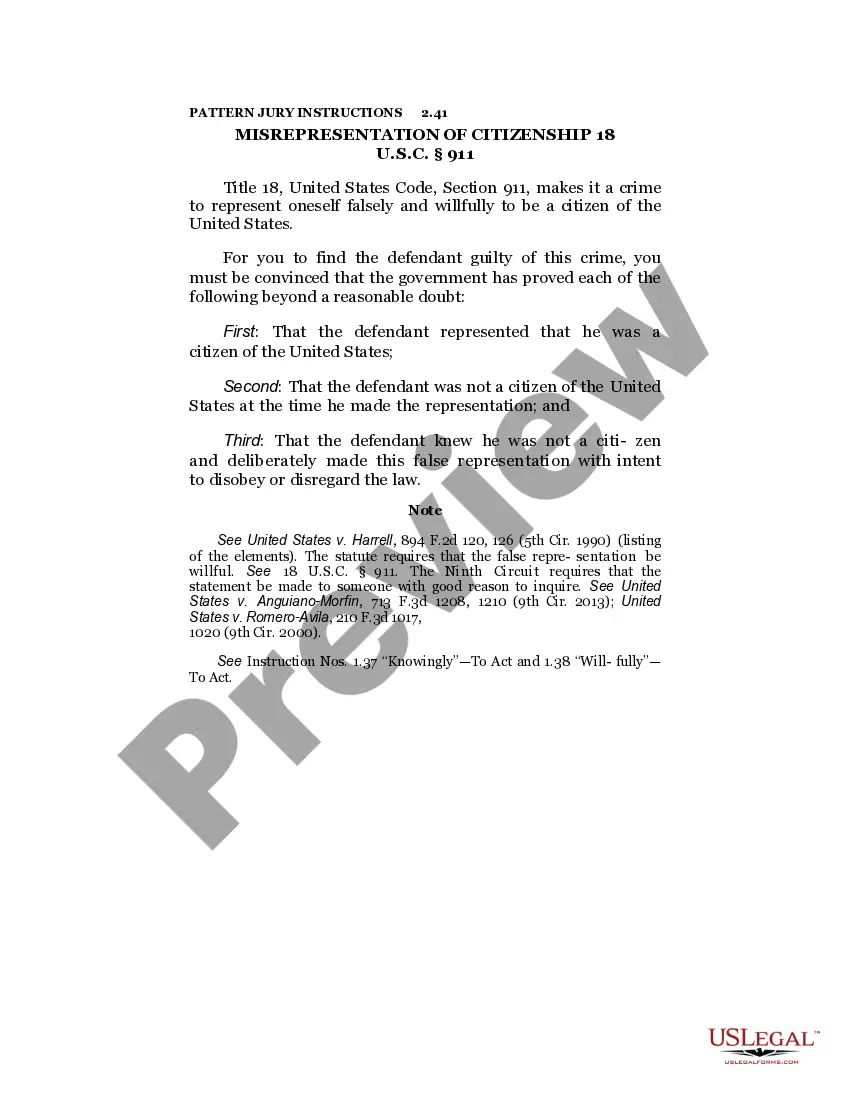

By Practical Law Corporate. This standard document is a short form agreement intended for use in an intra-group share purchase transaction where the consideration is to be satisfied by an issue of shares by the buyer to the seller.

Notable Stock Exchanges New York Stock Exchange (NYSE) Founded in 1792, the New York Stock Exchange is by far the largest exchange in the world. ... NASDAQ. Founded in 1971, NASDAQ is a US-based stock exchange. ... Shanghai Stock Exchange (SSE)

A common example of this is where a new holding company B is put on top of existing company A. Shareholders give their shares in the old company A to company B in exchange for shares in company B.

For example, say XYZ company issued stock and you purchased 10 shares of it. If each share represents 1% of ownership, you own 10% of the company. The company issued stock, and you bought shares of it. Another way to think of it is that you purchase shares of a stock, you don't buy stock.

For instance, if company X is acquiring Z company, and there is a swap ratio offered of , then it will give one share of their company (X) for every 5 shares of the Z company that is being acquired.

A share for share exchange is where one or more shareholders exchange shares they hold in one company for shares in another company. A common example of this is where a new holding company B is put on top of existing company A.