Michigan Payout Agreement

Description

How to fill out Payout Agreement?

Are you presently in a situation where you need to obtain documents for potential business or personal purposes nearly every day.

There are numerous legal document templates available online, but locating trustworthy ones is not easy.

US Legal Forms offers a wide variety of templates, such as the Michigan Payout Agreement, designed to meet state and federal regulations.

Select a convenient document format and download your copy.

You can find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Michigan Payout Agreement anytime, if needed. Just select the desired form to download or print the document template.

Utilize US Legal Forms, one of the largest collections of legal documents, to save time and prevent errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Michigan Payout Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and verify it is for the correct city/region.

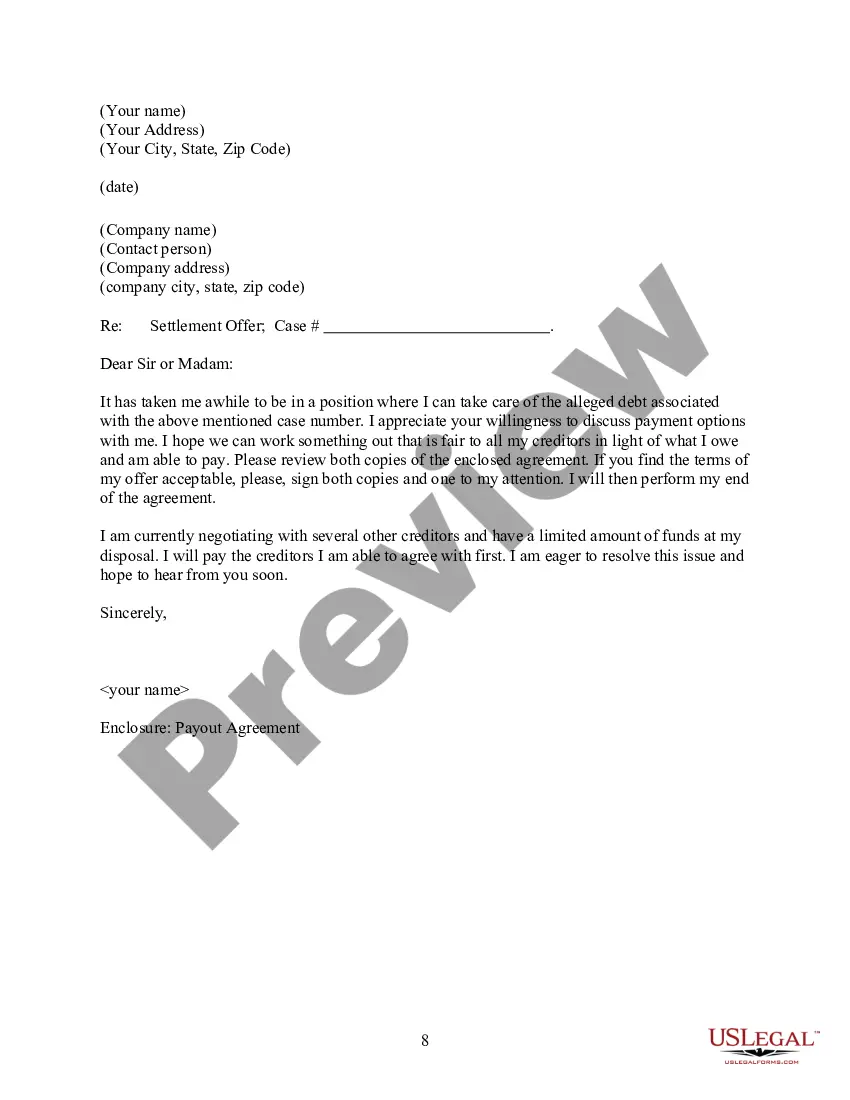

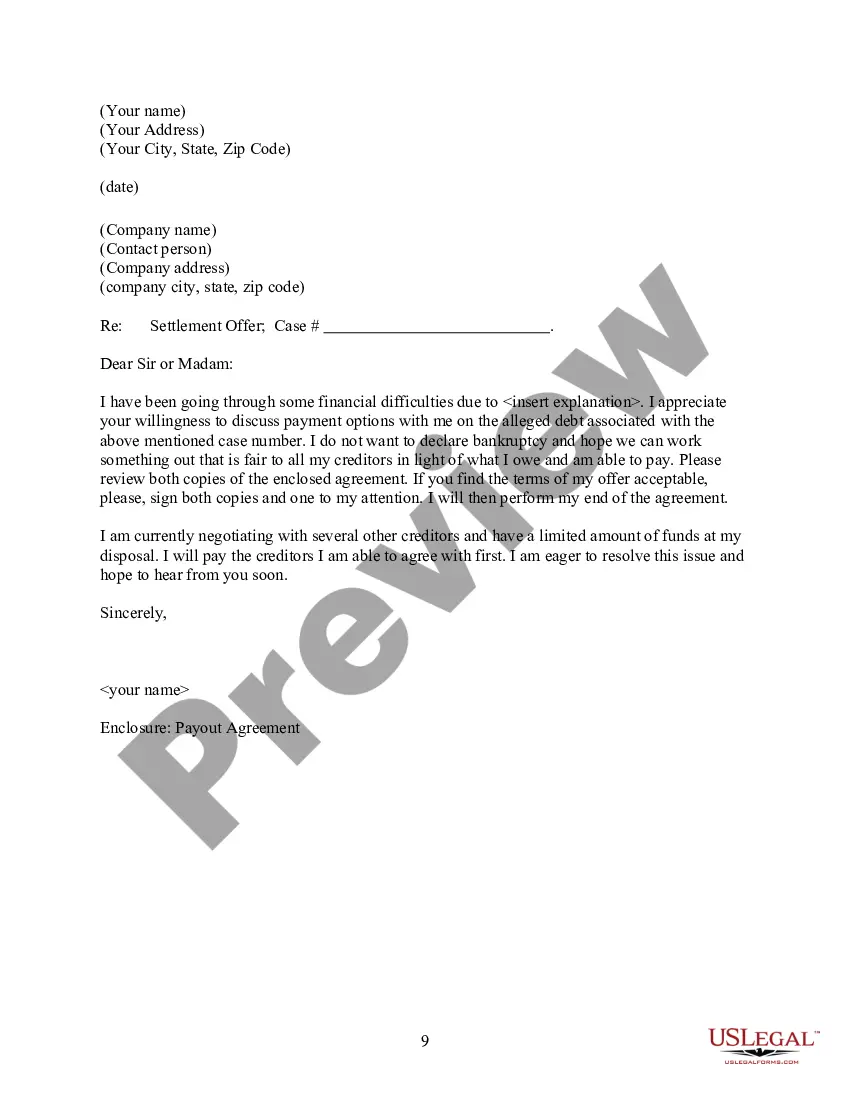

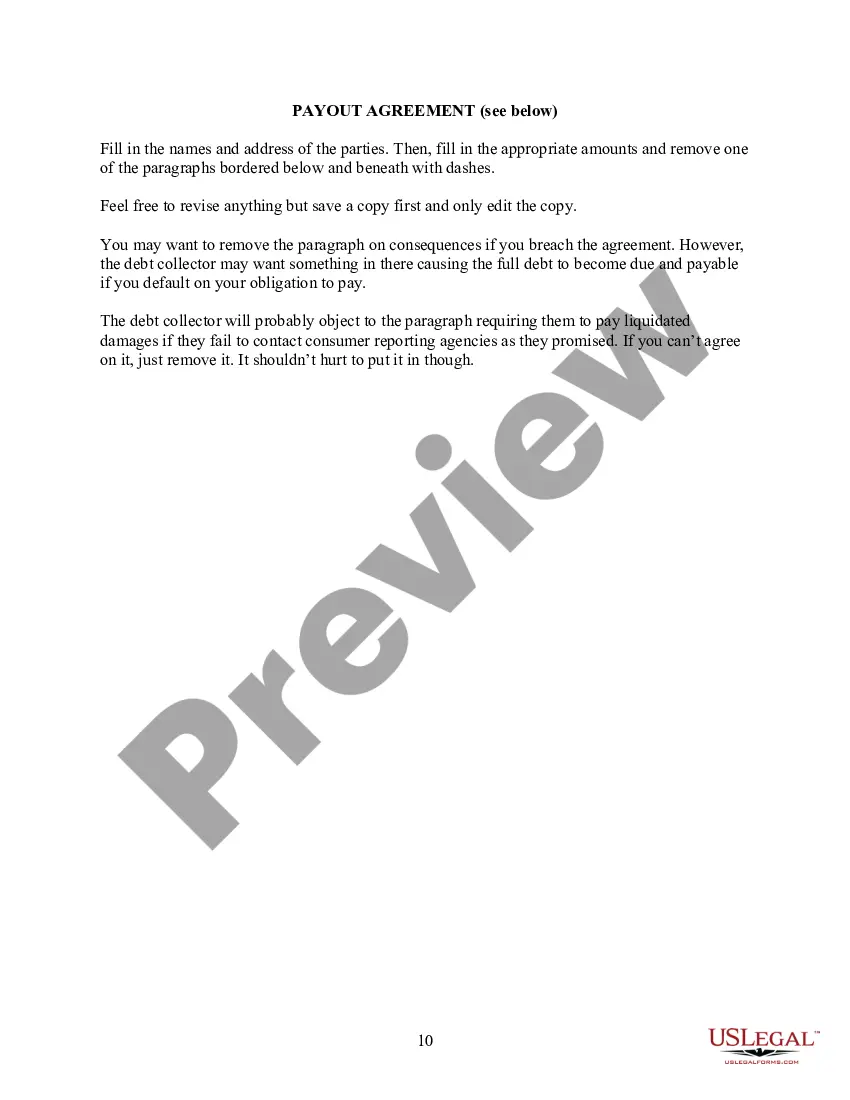

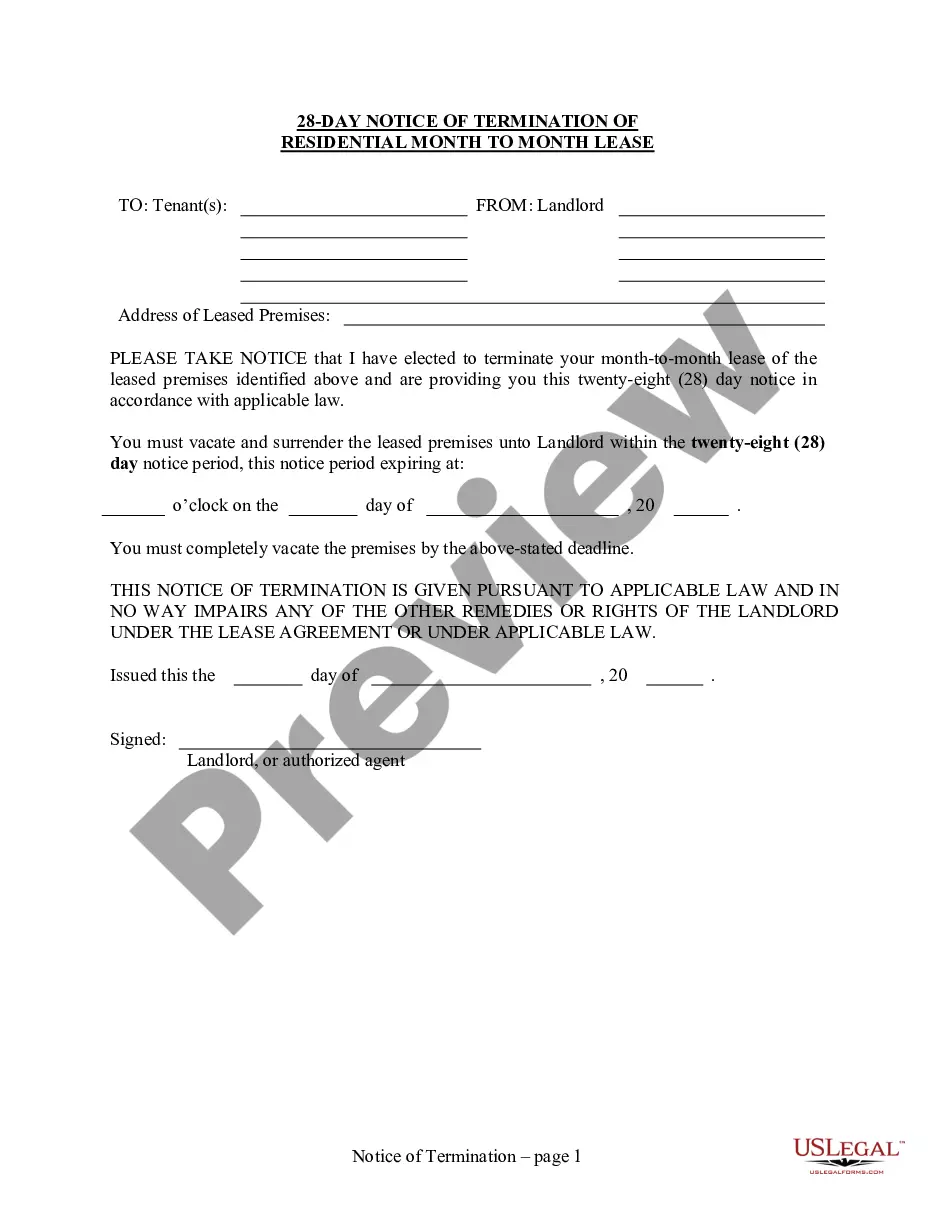

- Use the Preview button to check the form.

- Review the information to confirm that you have selected the appropriate form.

- If the form is not what you are looking for, use the Search field to find one that suits your needs.

- Once you locate the correct form, click on Buy now.

- Choose the payment plan you prefer, provide the necessary information to process your payment, and complete the transaction using your PayPal or Visa or Mastercard.

Form popularity

FAQ

Pay Tax Online200b200bStep-1. To pay taxes online, login to > Services > e-payment : Pay Taxes Online or click here on the tab "e-pay taxes" provided on the said website.Step-2. Select the relevant challan i.e.Step-3.Step-4.Step-5.Step-6.Step-7.

If you have a refund, credit or zero returns, mail your return to Michigan Department of Treasury, Lansing, MI 48956. If a payment is due, send your return to Michigan Department of Treasury, Lansing, MI 48929.

You may make estimated tax payments using Michigan Department of Treasury's e-Payments system or mail your estimated payment with a Michigan Estimated Tax voucher (MI-1040ES).

The Michigan Department of Treasury (DOT) offers installment agreements or payment plans. An installment agreement is simply a payment plan with the DOT that allows the taxpayer to make monthly payments on the taxes owed.

Payments can be made by using the Michigan Individual Income Tax e-Payments system. If you have received an assessment from the Michigan Department of Treasury's Collection Services Bureau, use the Collections e-Service payment system. Payments for 2020 tax due returns can be made using this system.

The easiest way to set up a payment plan with the state is to call Interface at 517-241-5060 or call Michigan Accounts Receivable Collection System (MARCS) at 800-950-6227.

If you are an individual, you may qualify to apply online if: Long-term payment plan (installment agreement): You owe $50,000 or less in combined tax, penalties and interest, and filed all required returns. Short-term payment plan: You owe less than $100,000 in combined tax, penalties and interest.

File and pay a paper returnComplete the applicable forms to be submitted by mail. For your convenience, fillable forms are available on the Forms and Instructions page. Submit your return by mail.

If your state of residence is Michigan and you are mailing a federal tax return/Form 1040 without a payment, you will mail it to Department of the Treasury Internal Revenue Service Fresno, CA 93888-0002.

Specifically, two years for eligible individuals and small businesses and four years for other taxpayers, from the day that the notice of assessment is issued. Note however that even though the tax assessment in question is in dispute, you are still expected to pay the outstanding tax amount by the due date.