Michigan Debt Adjustment Agreement with Creditor

Description

How to fill out Debt Adjustment Agreement With Creditor?

Selecting the optimal legal document format can be quite challenging.

Certainly, there is an array of designs accessible online, but how can you acquire the legal document you need.

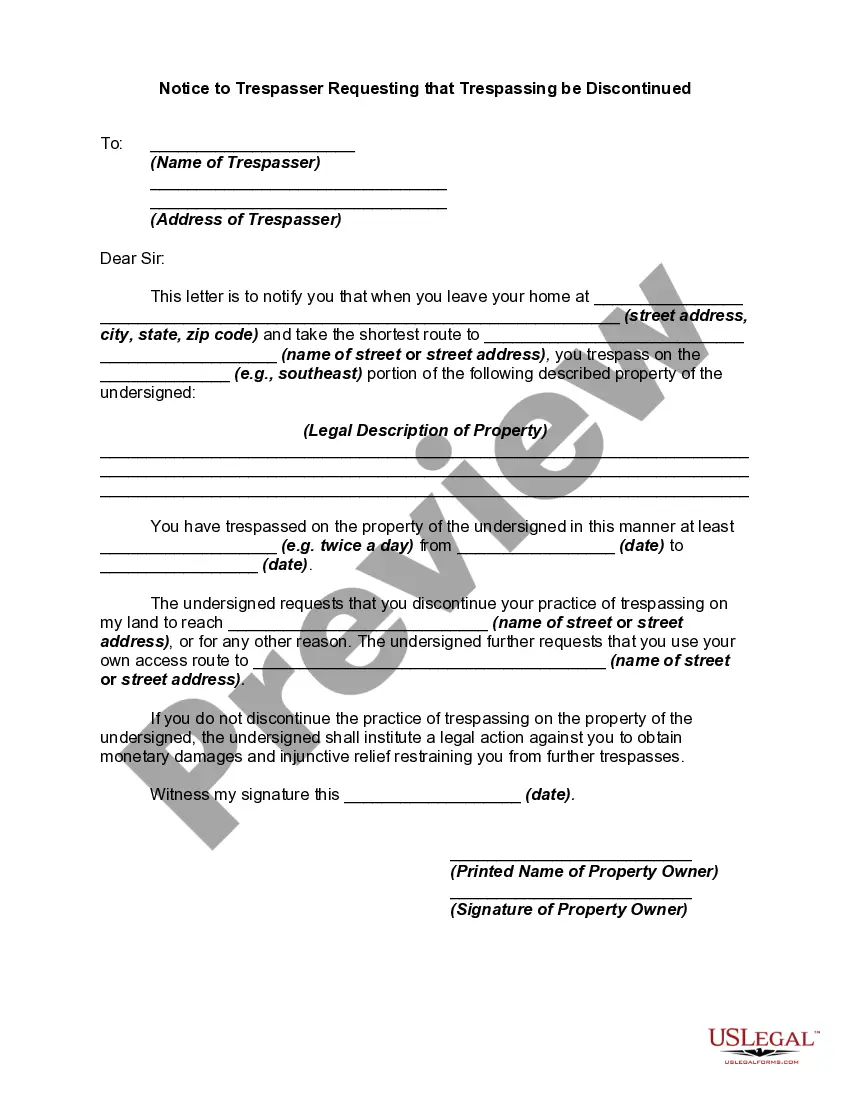

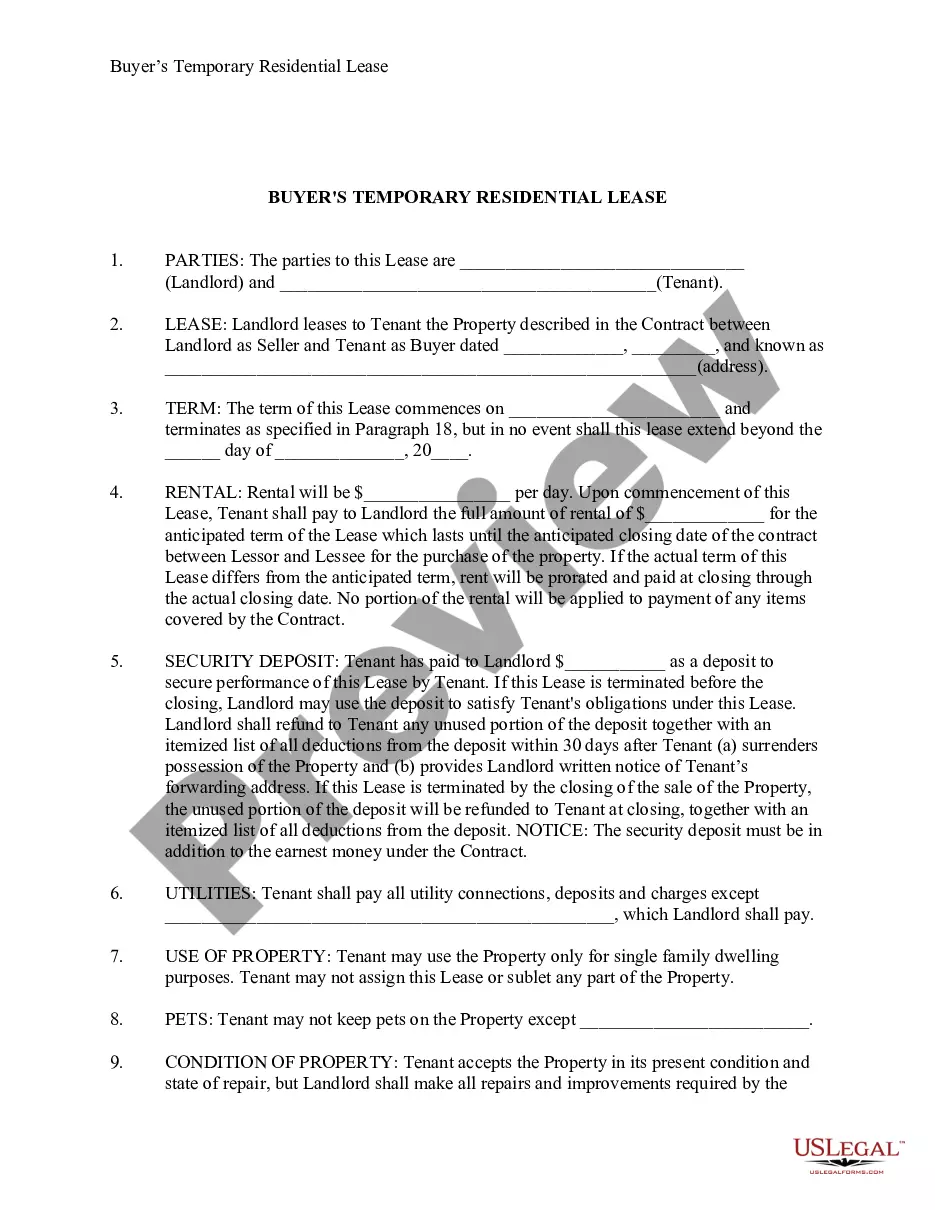

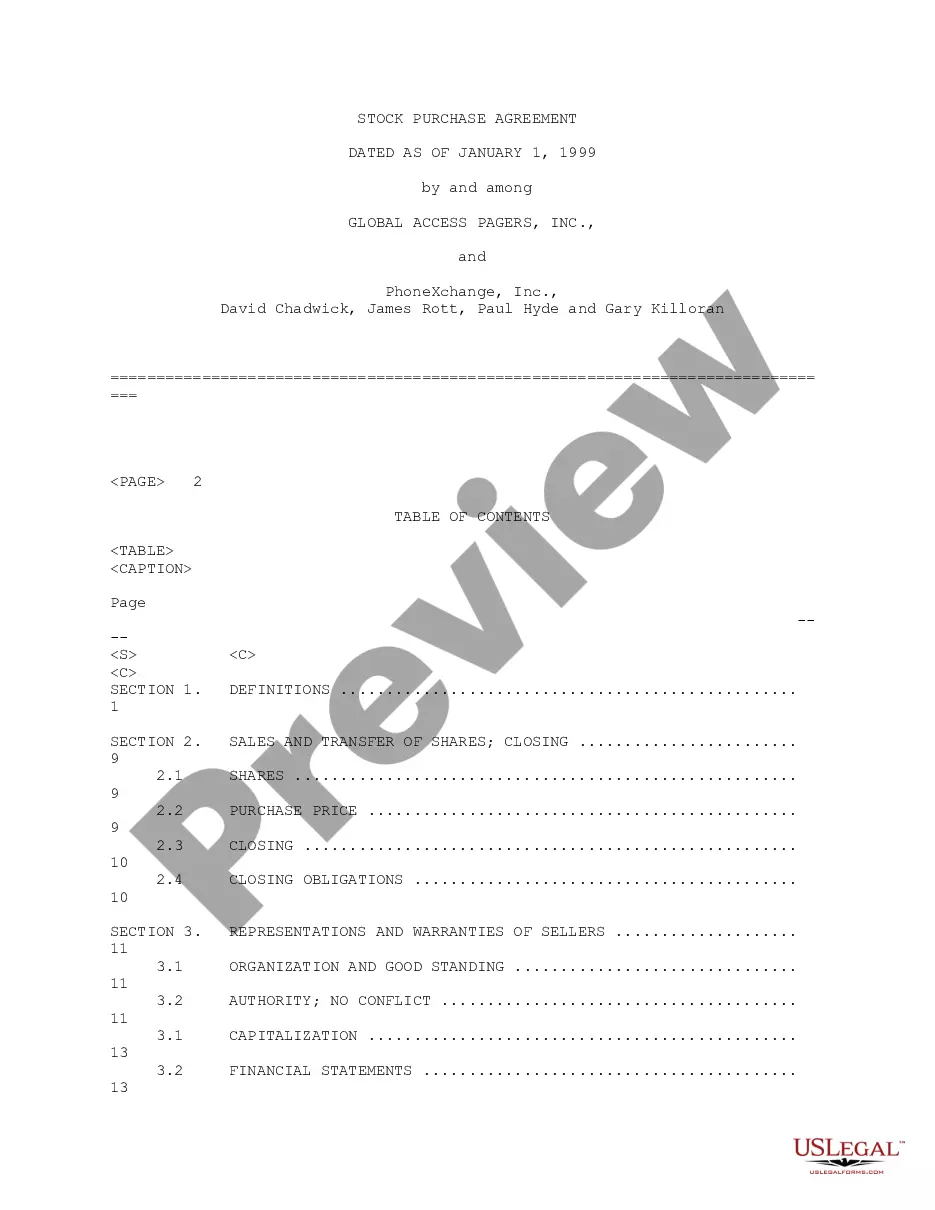

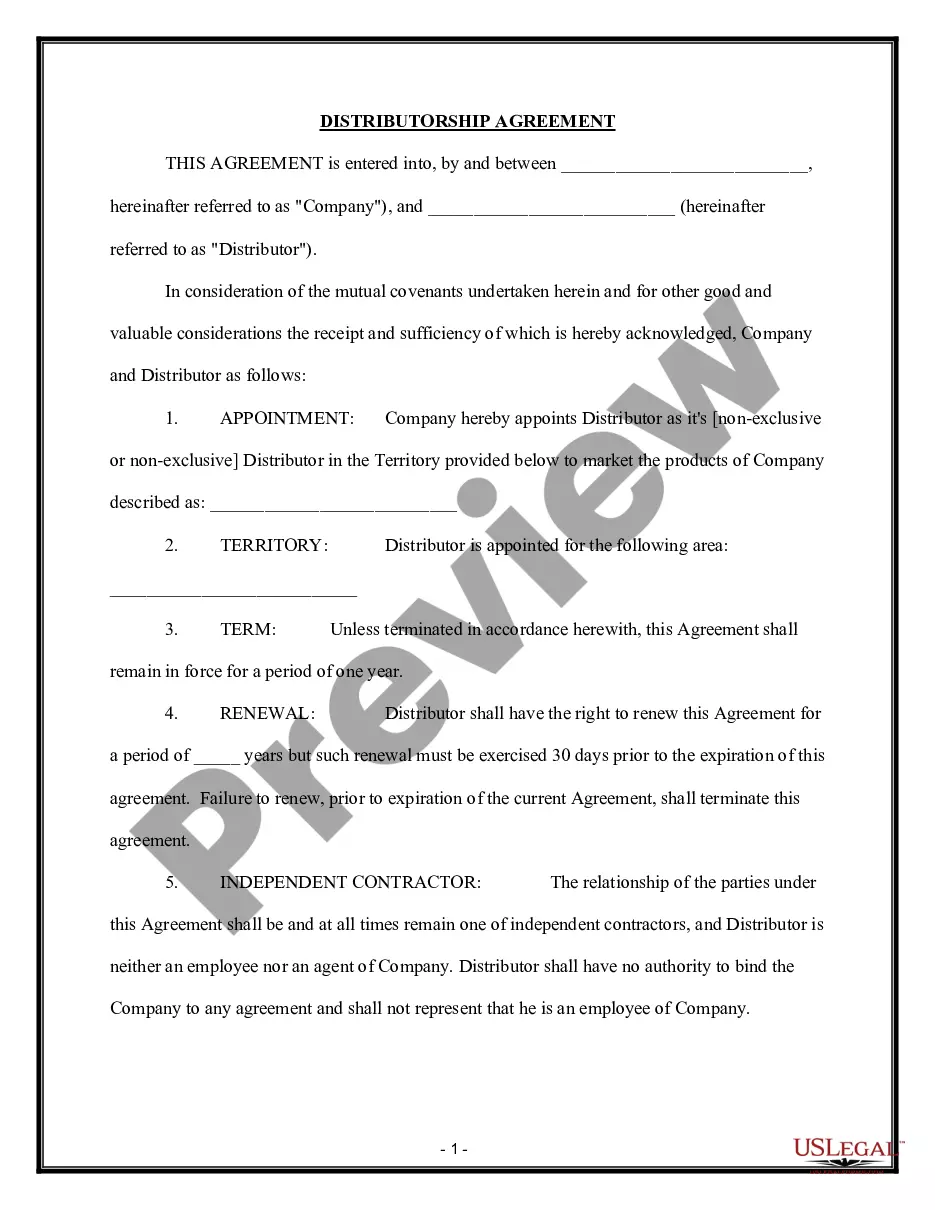

Utilize the US Legal Forms website. The service offers thousands of templates, including the Michigan Debt Adjustment Agreement with Creditor, which can be utilized for business and personal purposes.

If the form does not satisfy your requirements, use the Search feature to find the appropriate form. Once you are certain the form is suitable, click on the Purchase now button to obtain the form. Choose the payment plan you prefer and enter the required information. Create your account and make your purchase using your PayPal account or credit card. Select the file format and download the legal document format to your device. Complete, modify, print, and sign the received Michigan Debt Adjustment Agreement with Creditor. US Legal Forms is the largest repository of legal forms where you can explore various document designs. Take advantage of the service to obtain properly crafted documents that meet state requirements.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click the Download button to locate the Michigan Debt Adjustment Agreement with Creditor.

- Use your account to search for the legal forms you have previously ordered.

- Visit the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/region. You can preview the form using the Review option and check the form details to confirm it is suitable for you.

Form popularity

FAQ

Lenders typically agree to a debt settlement of between 30% and 80%. Several factors may influence this amount, such as the debt holder's financial situation and available cash on hand.

Can creditors refuse your DMP? Yes. Creditors are not obliged to accept a debt solution but they could accept a Debt Management Plan if they feel this is the best way for them to recover the money owed to them.

Michigan has a statute of limitations of six years, which applies to all types of debts. This means that if a debt is more than six years overdue or hasn't been paid in more than six years, creditors cannot take legal action.

With do-it-yourself debt settlement, you negotiate directly with your creditors in an effort to settle your debt for less than you originally owed. The strategy works best for debts that are already delinquent.

Creditors are not obliged to accept a debt solution but they could accept a Debt Management Plan if they feel this is the best way for them to recover the money owed to them. You will have to put forward a firm and fair offer of payment to your creditors and outline how much you can afford to pay back each month.

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

When you work with a credit counseling agency, you'll meet with a counselor who will review your financial situation and help you understand your options. If a DMP is a good fit, the counselor can negotiate with your creditors on your behalf to create new payment plans.

Your creditors are not obligated to accept your offer at any point. They can keep on refusing your payment offers as well as your requests to freeze interest.

Your creditors do not have to accept your offer of payment or freeze interest. If they continue to refuse what you are asking for, carry on making the payments you have offered anyway. Keep trying to persuade your creditors by writing to them again.

Debt settlement is an agreement made between a creditor and a consumer in which the total debt balance owed is reduced and/or fees are waived, and the reduced debt amount is paid in a lump sum instead of revolving monthly.