This form is a follow-up letter containing a warning that the debt collector's continued violation of the Fair Debt Collection Practices Act may result in a law suit being filed against the debt collector.

Michigan Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor

Description

How to fill out Second Notice To Debt Collector Of Harassment Or Abuse In Collection Activities Involving Threats To Use Violence Or Other Criminal Means To Harm The Physical Person, Reputation, And/or Property Of The Debtor?

Are you presently in a circumstance where you need documentation for either professional or personal reasons nearly every workday.

There are numerous authentic document templates obtainable online, but finding ones you can trust is challenging.

US Legal Forms offers a vast array of template documents, including the Michigan Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor, which can be crafted to meet state and federal regulations.

Choose a convenient file format and download your copy.

Find all of the document templates you have purchased in the My documents section. You can obtain another copy of the Michigan Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor whenever necessary. Just select the appropriate template to download or print.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Michigan Second Notice to Debt Collector of Harassment or Abuse in Collection Activities Involving Threats to Use Violence or other Criminal Means to Harm the Physical Person, Reputation, and/or Property of the Debtor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the template you need and ensure it is for the correct city/state.

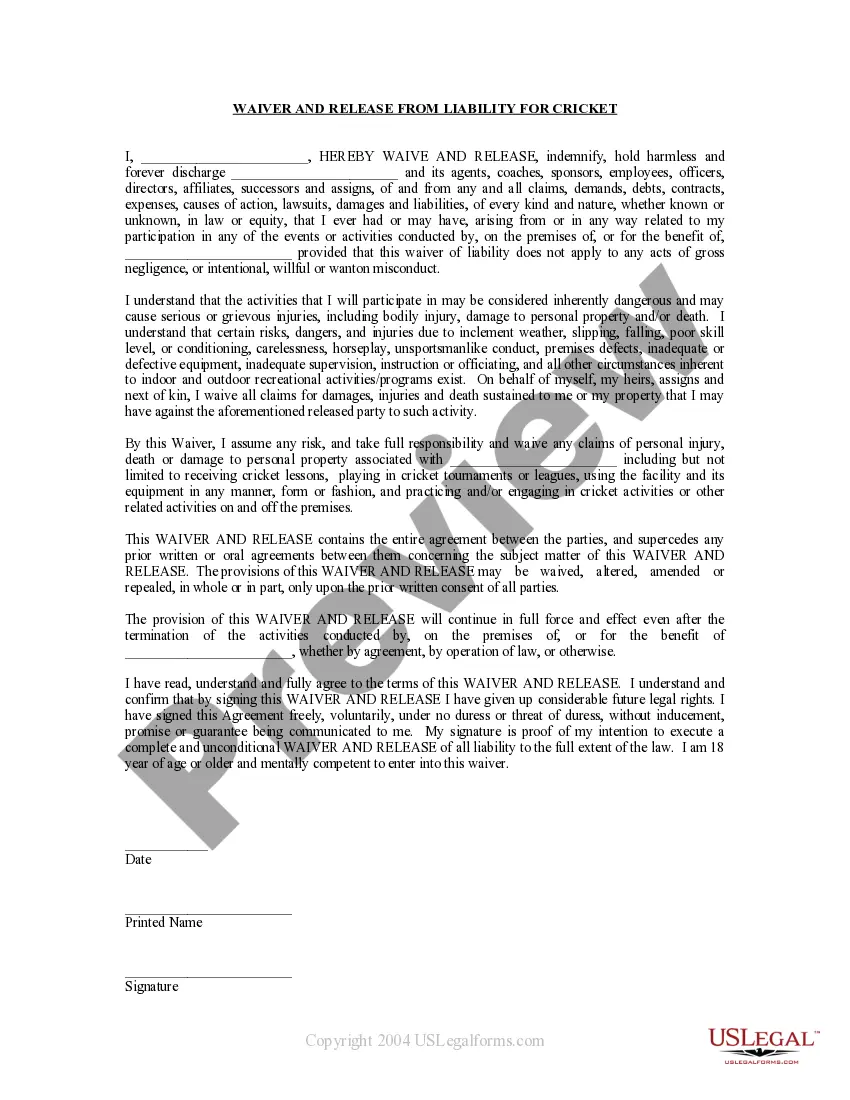

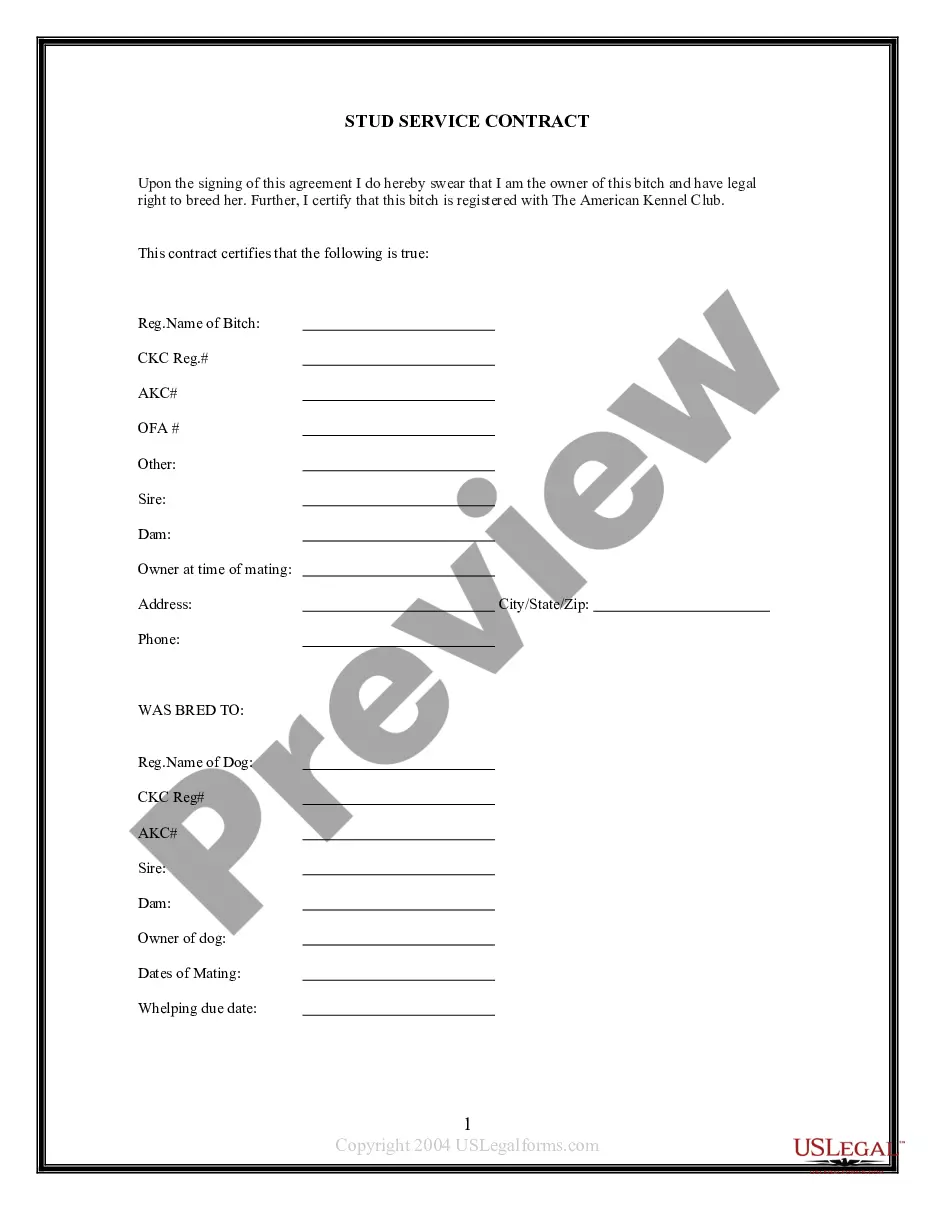

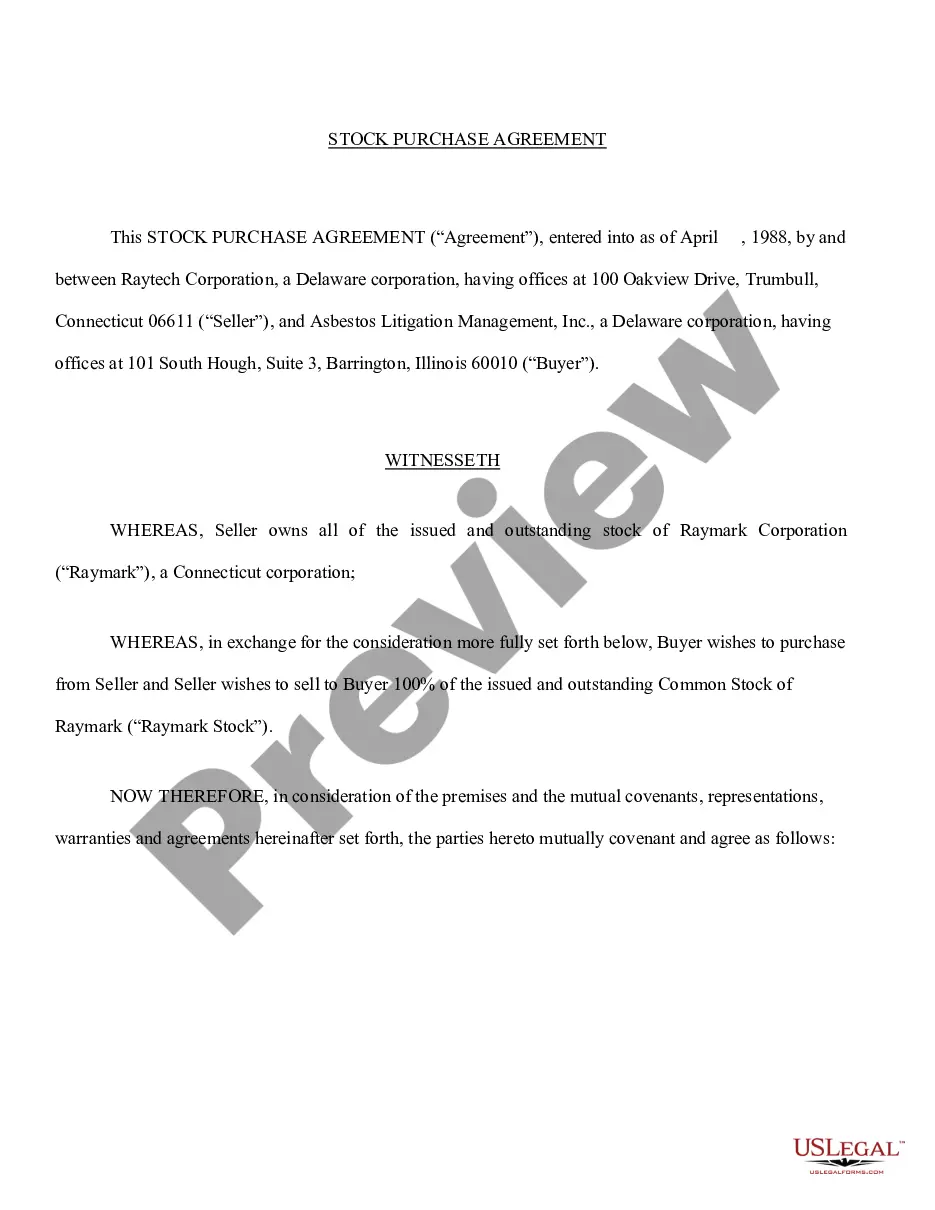

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the right document.

- If the template isn’t what you are looking for, use the Search field to find the form that meets your needs and criteria.

- If you locate the correct document, click Acquire now.

- Select the pricing option you want, complete the required information to process your payment, and purchase the order using your PayPal or credit card.

Form popularity

FAQ

You're protected from harassing or abusive practicesThe Fair Debt Collection Practices Act prohibits debt collectors from using any harassing or abusive practices in an attempt to collect the debt. Harassment is more than just repeatedly asking you to pay money, says bankruptcy attorney Jay Fleischman.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Problems Faced by Debt Collection Agents and How to Solve Them!Oral Contracts:Faulty Written Agreements:Money Recovery Issues:Collection Methods Are Not Real-Time:Mobile Borrowers:Too Many Calls:Contacting Wrong People:Customer Bankruptcy:More items...?30-Nov-2019

Many people are surprised to learn that debt collectors can sue debtors for the balance of any outstanding debt. Many times, debt collection agencies will bring a lawsuit for breach of contract because when individuals don't pay the debt they agreed to pay.

Try not to let all of the calls badgering you from a debt collector get to you. If you need to take a break, you can use this 11 word phrase to stop debt collectors: Please cease and desist all calls and contact with me, immediately. Here is what you should do if you are being contacted by a debt collector.

You have the right not to be contacted at work, and some local and state laws make it illegal for creditors to contact your place of employment if they have reason to know those calls are forbidden.

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16-Sept-2020