South Dakota Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation

Description

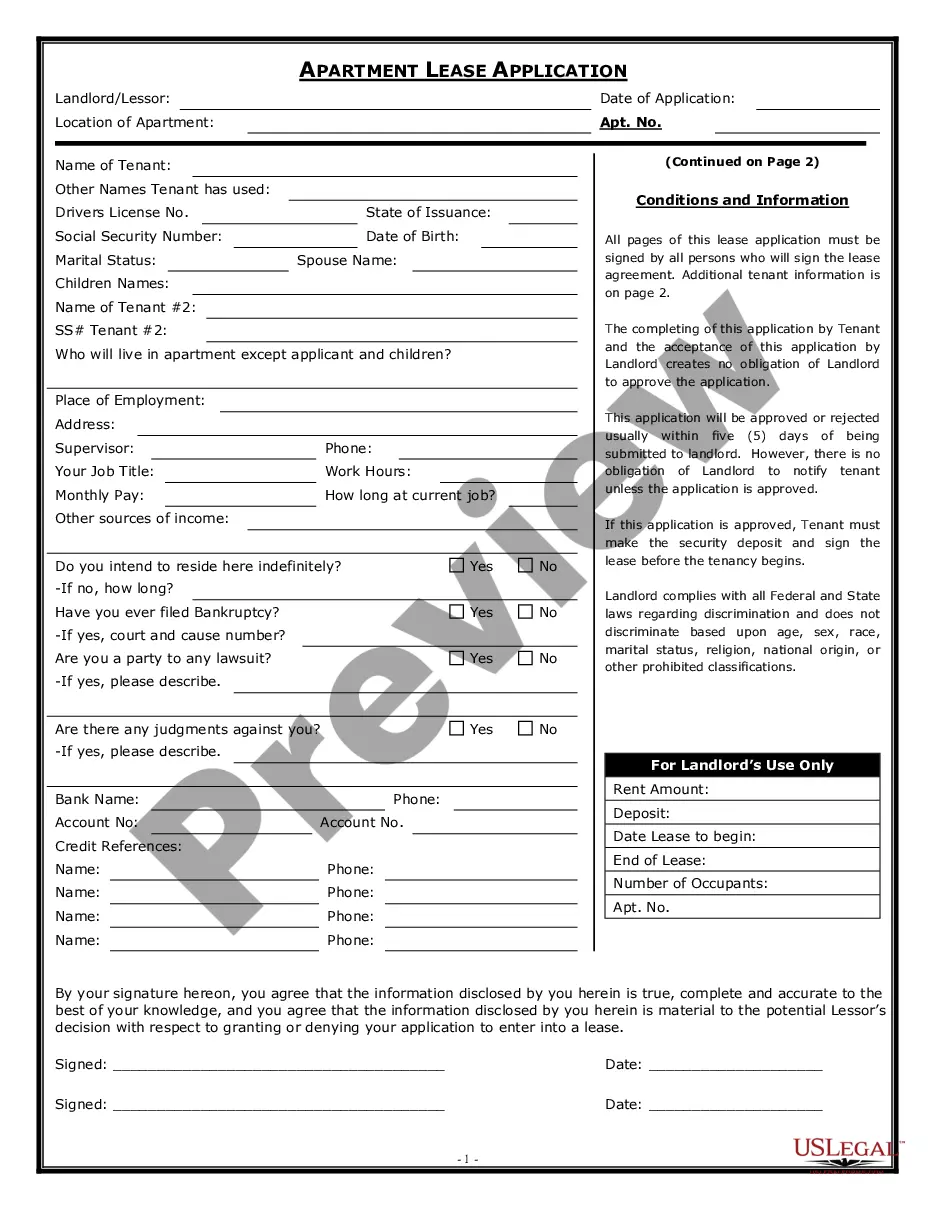

How to fill out Sample Stock Purchase Agreement For Purchase Of Common Stock Of Wholly-Owned Subsidiary By Separate Corporation?

US Legal Forms - one of several greatest libraries of authorized kinds in the United States - offers an array of authorized document layouts you are able to download or print out. Using the web site, you can get a huge number of kinds for business and specific reasons, categorized by types, claims, or keywords.You can find the newest models of kinds just like the South Dakota Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation within minutes.

If you currently have a membership, log in and download South Dakota Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation through the US Legal Forms library. The Down load option will appear on each and every develop you perspective. You get access to all earlier downloaded kinds in the My Forms tab of your profile.

If you want to use US Legal Forms the first time, here are easy directions to help you get started:

- Make sure you have picked out the best develop for the metropolis/area. Click the Preview option to examine the form`s content. See the develop information to actually have selected the appropriate develop.

- When the develop doesn`t match your specifications, utilize the Look for area at the top of the monitor to get the one that does.

- In case you are happy with the shape, validate your option by visiting the Buy now option. Then, pick the rates plan you favor and provide your credentials to register for an profile.

- Method the purchase. Utilize your credit card or PayPal profile to perform the purchase.

- Select the file format and download the shape on the gadget.

- Make changes. Fill up, change and print out and sign the downloaded South Dakota Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation.

Every single design you added to your bank account lacks an expiry particular date and it is yours eternally. So, in order to download or print out yet another copy, just check out the My Forms segment and then click about the develop you will need.

Obtain access to the South Dakota Sample Stock Purchase Agreement for Purchase of Common Stock of Wholly-Owned Subsidiary by Separate Corporation with US Legal Forms, one of the most comprehensive library of authorized document layouts. Use a huge number of expert and condition-distinct layouts that meet up with your small business or specific demands and specifications.

Form popularity

FAQ

A stock option is a contract between two parties, like a company and an employee, that gives the owner of the option the right, but not the obligation, to purchase or sell stocks at an agreed-upon price. Basically, if you own a stock option, you have the option to buy or sell the underlying stocks.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

Many companies allow you to buy or sell shares directly through a direct stock plan (DSP). You can also have the cash dividends you receive from the company automatically reinvested into more shares through a dividend reinvestment plan (DRIP).

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

Purchase rights are offers to existing shareholders to buy additional shares in proportion to the number of shares already owned. Purchase rights might allow shareholders to buy at a below-market price.

A stock option is a contract between two parties that gives the buyer the right to buy or sell underlying stocks at a predetermined price and within a specified time period. A seller of the stock option is called an option writer, where the seller is paid a premium from the contract purchased by the buyer.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

A stock is a security that represents a fractional ownership in a company. When you buy a company's stock, you're purchasing a small piece of that company, called a share. Investors purchase stocks in companies they think will go up in value. If that happens, the company's stock increases in value as well.