Michigan Proposed amendment to the restated certificate of incorporation to authorize preferred stock

Description

How to fill out Proposed Amendment To The Restated Certificate Of Incorporation To Authorize Preferred Stock?

Have you been inside a situation that you need to have documents for sometimes business or specific uses almost every day? There are plenty of legal document layouts accessible on the Internet, but getting versions you can trust isn`t effortless. US Legal Forms offers a huge number of type layouts, like the Michigan Proposed amendment to the restated certificate of incorporation to authorize preferred stock, which can be written to meet federal and state specifications.

If you are presently familiar with US Legal Forms web site and also have a free account, merely log in. Next, you can obtain the Michigan Proposed amendment to the restated certificate of incorporation to authorize preferred stock template.

If you do not provide an accounts and want to start using US Legal Forms, follow these steps:

- Find the type you want and ensure it is for your correct city/state.

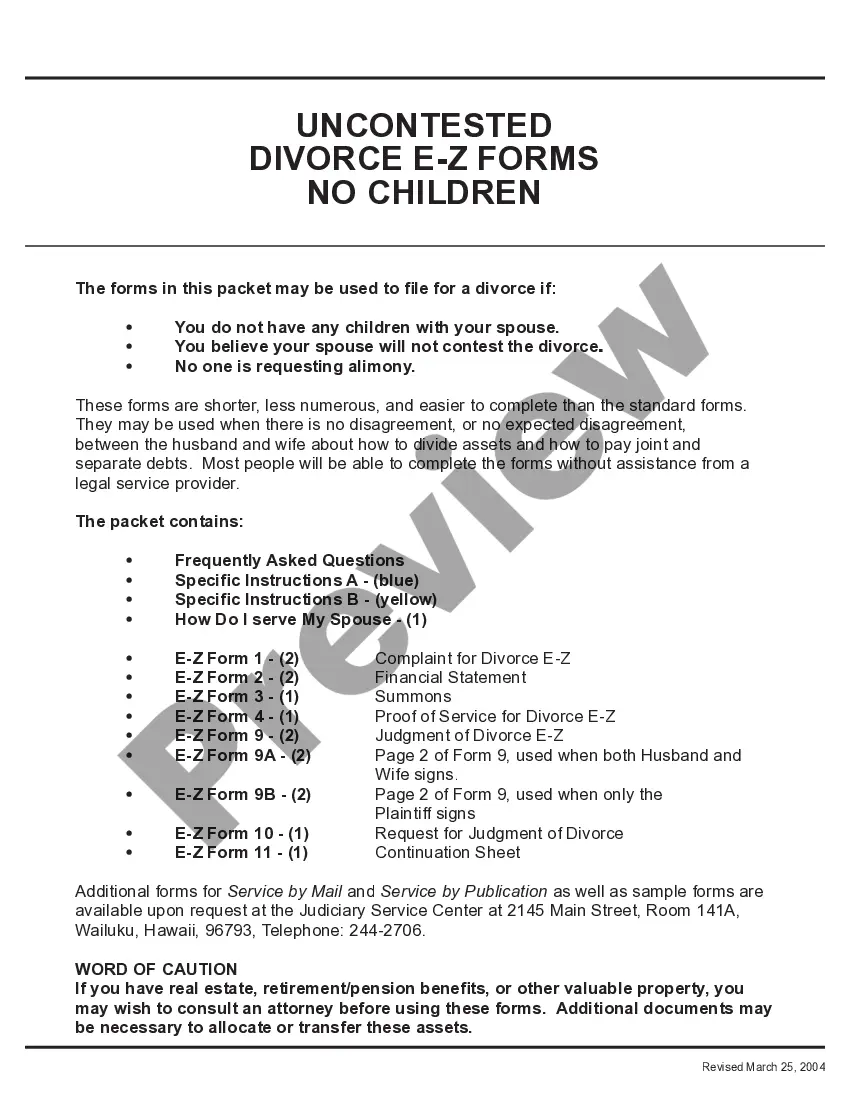

- Utilize the Review option to analyze the form.

- See the explanation to actually have selected the correct type.

- When the type isn`t what you`re searching for, utilize the Lookup area to get the type that fits your needs and specifications.

- Once you obtain the correct type, click Buy now.

- Select the prices prepare you would like, fill in the desired information and facts to create your bank account, and pay for an order making use of your PayPal or charge card.

- Pick a hassle-free paper formatting and obtain your version.

Get all of the document layouts you possess bought in the My Forms menus. You may get a further version of Michigan Proposed amendment to the restated certificate of incorporation to authorize preferred stock any time, if possible. Just click the necessary type to obtain or produce the document template.

Use US Legal Forms, by far the most considerable selection of legal types, in order to save some time and prevent mistakes. The service offers expertly made legal document layouts which you can use for a selection of uses. Create a free account on US Legal Forms and start producing your life a little easier.

Form popularity

FAQ

In order to change your LLC name, you must file a Certificate of Amendment to the Articles of Organization with the Michigan Department of Licensing and Regulatory Affairs. This officially updates your legal entity (your Limited Liability Company) on the state records.

Corporate bylaws are required in Michigan. ing to MI Comp L § 450.1231, ?the initial bylaws of a corporation shall be adopted? at the first organizational meeting following incorporation. In other words, bylaws are legally necessary to form a corporation in Michigan.

COFS (Corporations Online Filing System): This document may be completed and submitted online at .michigan.gov/corpfileonline. Fees may be paid by VISA, MasterCard, American Express, or Discover. 1. This form maybe used to draft your Certificate of Amendment to the Articles of Organization.

How to Transfer LLC Ownership in Michigan Consult your Michigan LLC operating agreement. ... Vote to transfer membership interest. ... Amend your operating agreement. ... Change your IRS responsible party.

The state of Michigan requires you to file a Certificate of Amendment to the Articles of Incorporation with the Corporations Division of LARA whenever you change your corporation's name, address, purpose, or resident agent. State law requires a properly filed amendment within 30 days of the changes.

Michigan corporations have to submit a Certificate of Amendment to the Articles of Incorporation to the Department of Licensing and Regulatory Affairs. You can use the state forms or draft your own. You can file through mail or in person. Filing of an amendment costs $10.