Michigan Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment

Description

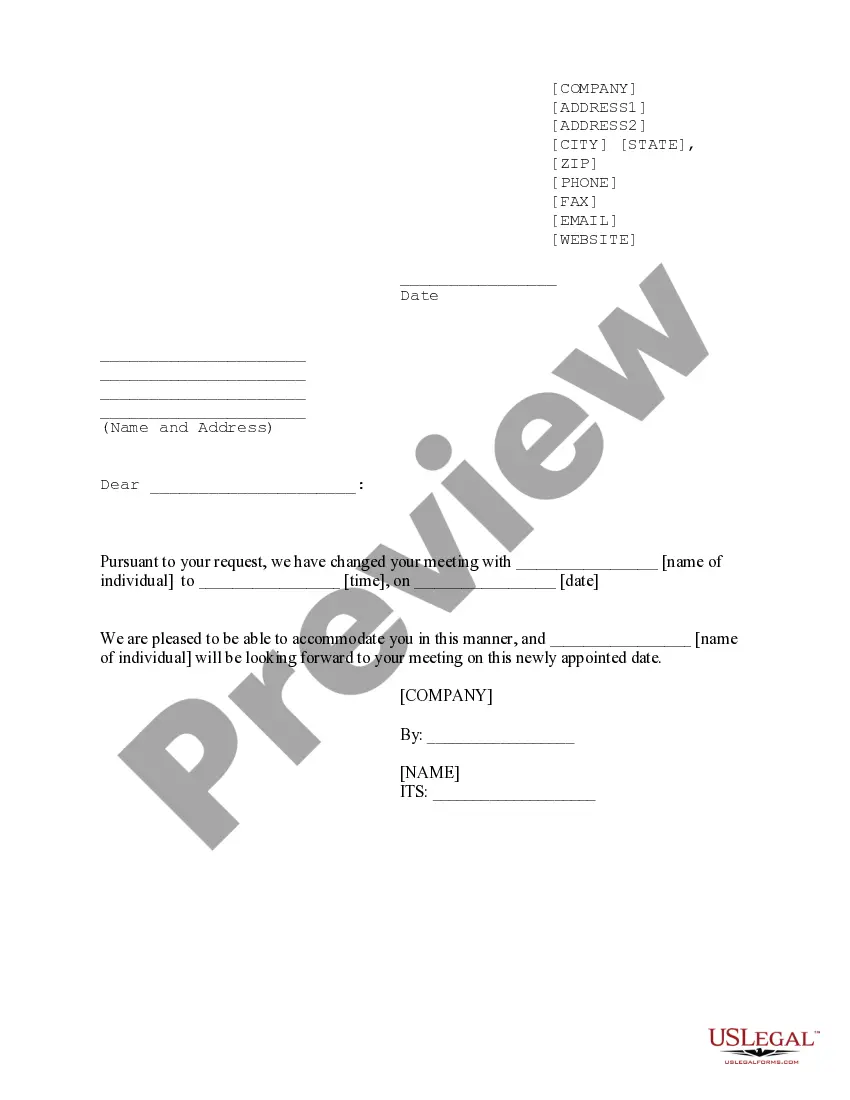

How to fill out Proposed Amendment To The Certificate Of Incorporation To Authorize Up To 10,000,000 Shares Of Preferred Stock With Amendment?

You can devote hrs online searching for the lawful record web template that suits the state and federal needs you need. US Legal Forms supplies a huge number of lawful forms which can be examined by specialists. It is possible to down load or printing the Michigan Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment from the support.

If you have a US Legal Forms accounts, you may log in and click the Download switch. Next, you may full, modify, printing, or sign the Michigan Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment. Every lawful record web template you acquire is your own for a long time. To get yet another version associated with a acquired develop, visit the My Forms tab and click the related switch.

If you use the US Legal Forms website the very first time, stick to the simple directions listed below:

- Very first, be sure that you have chosen the proper record web template to the area/city of your choice. See the develop outline to ensure you have selected the right develop. If offered, utilize the Preview switch to look through the record web template as well.

- If you wish to get yet another version from the develop, utilize the Look for area to obtain the web template that fits your needs and needs.

- Upon having located the web template you need, click Acquire now to carry on.

- Choose the costs program you need, type in your references, and register for a merchant account on US Legal Forms.

- Total the purchase. You can utilize your charge card or PayPal accounts to pay for the lawful develop.

- Choose the format from the record and down load it in your gadget.

- Make changes in your record if necessary. You can full, modify and sign and printing Michigan Proposed amendment to the certificate of incorporation to authorize up to 10,000,000 shares of preferred stock with amendment.

Download and printing a huge number of record web templates using the US Legal Forms Internet site, which offers the most important variety of lawful forms. Use expert and condition-certain web templates to deal with your organization or individual requirements.

Form popularity

FAQ

AN ACT to provide for the organization and regulation of corporations; to prescribe their duties, rights, powers, immunities and liabilities; to provide for the authorization of foreign corporations within this state; to prescribe the functions of the administrator of this act; to prescribe penalties for violations of ...

A stock corporation is a type of for-profit company. Each of its shareholders receives part ownership of the corporation through their shares of stock. 3 min read. A stock corporation is a type of for-profit company. Each of its shareholders receives part ownership of the corporation through their shares of stock.

Corporate bylaws are required in Michigan. ing to MI Comp L § 450.1231, ?the initial bylaws of a corporation shall be adopted? at the first organizational meeting following incorporation. In other words, bylaws are legally necessary to form a corporation in Michigan.

- Public corporations are those formed or organized for the government of a portion of the state. Private corporations are those formed for some private purpose, benefit, aim, or end, as distinguished from public corporations, which have for their purpose the general good and welfare.

stock corporation, under Section 3 of the Revised Corporation Code of the Philippines (RCCP), is any corporation not organized as a stock corporation. A stock corporation is one which has capital stock, held by shareholders, and dividends which are, from time to time, distributed to said shareholders.

Among the rights of the company's shareholders are: (1) to receive notices of and to attend shareholders' meetings; (2) to participate and vote on the basis of the one-share, one-vote policy; (3) nominate, elect, remove, and replace Board members (including via cumulative voting); (4) call for a special board meeting ...

Corporations which have capital stock divided into shares and are authorized to distribute to the holders of such shares dividends or allotments of the surplus profits on the basis of the shares held are stock corporations.

Hence, limited period of existence and centralized management are not typical characteristics of a corporation.