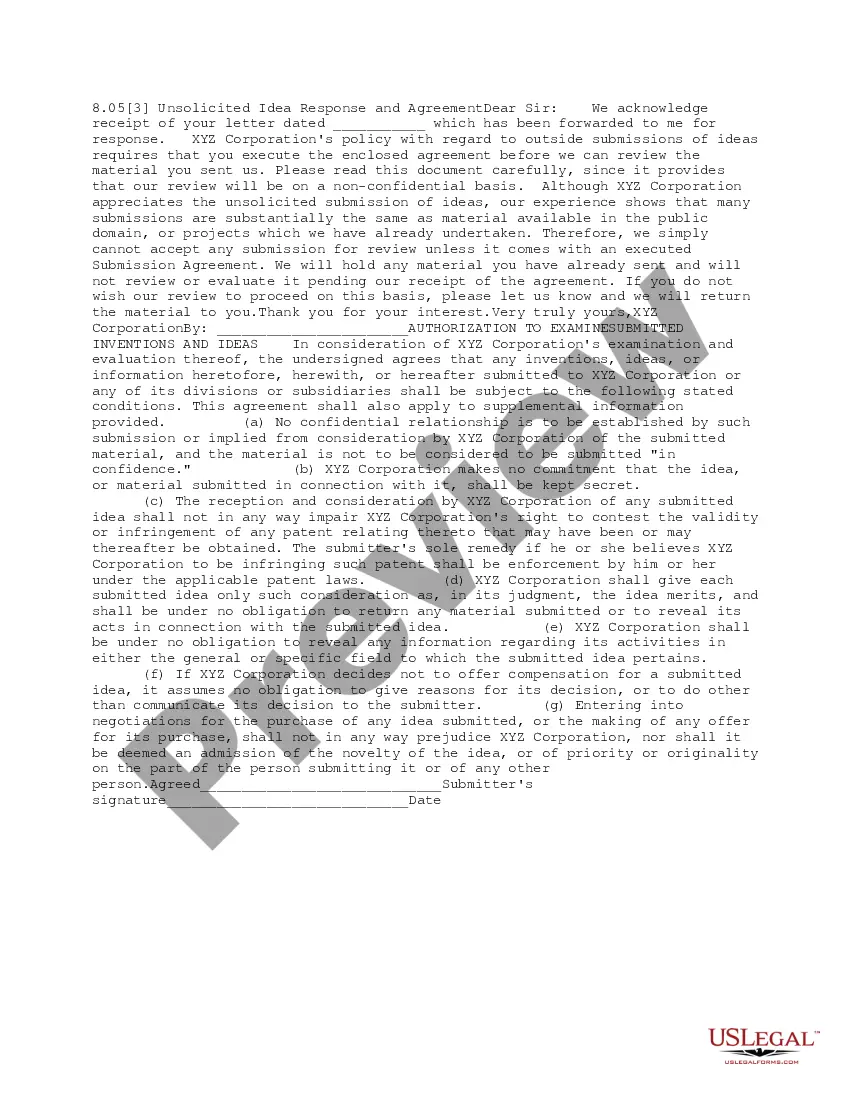

Michigan Sample Letter for Return of Documents

Description

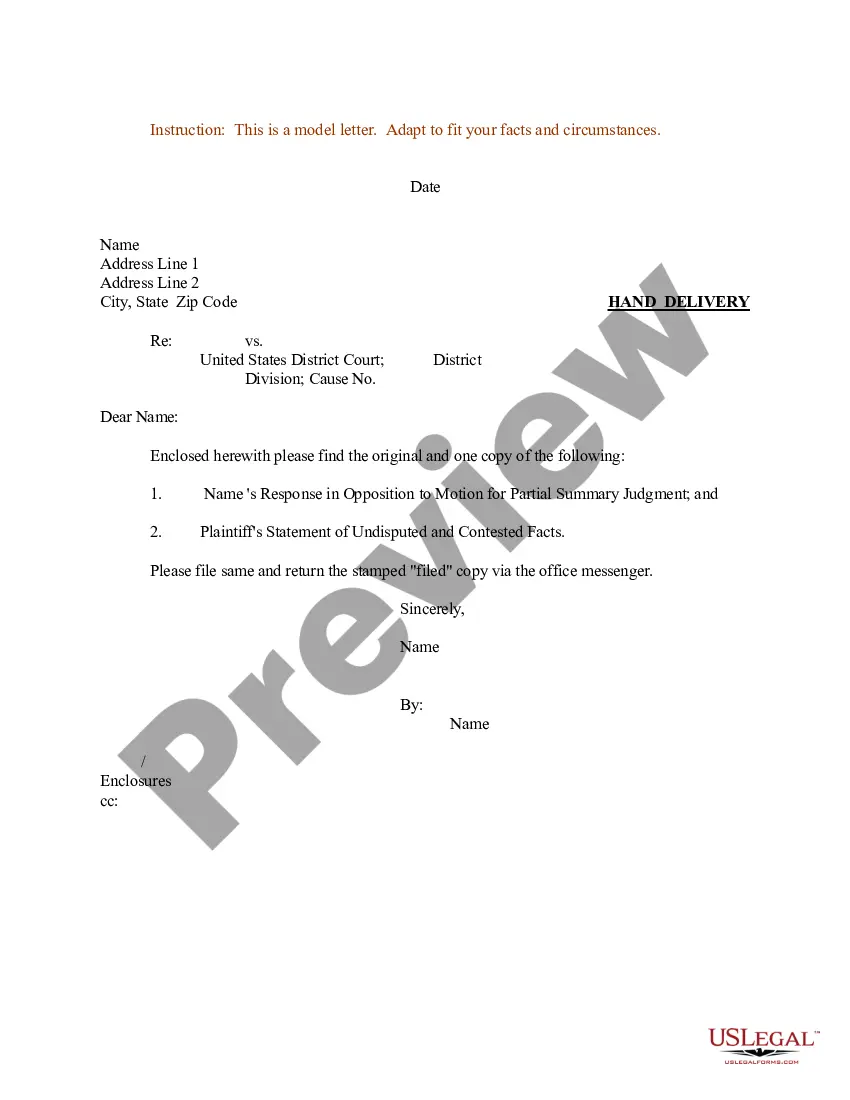

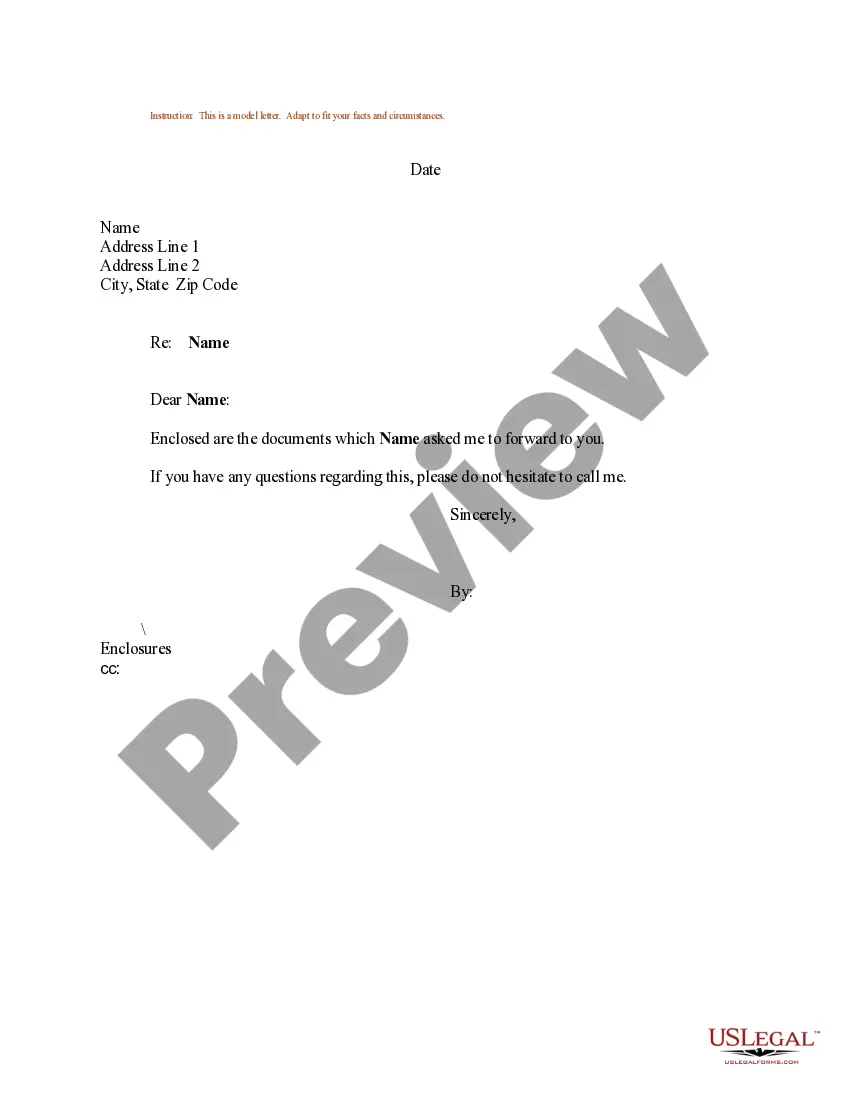

How to fill out Sample Letter For Return Of Documents?

Discovering the right legal record format can be a have a problem. Of course, there are a lot of layouts available on the Internet, but how would you obtain the legal develop you will need? Take advantage of the US Legal Forms web site. The services delivers a large number of layouts, like the Michigan Sample Letter for Return of Documents, which you can use for company and private needs. Every one of the kinds are checked by professionals and fulfill state and federal specifications.

When you are currently listed, log in for your accounts and click the Down load option to obtain the Michigan Sample Letter for Return of Documents. Utilize your accounts to appear throughout the legal kinds you might have ordered in the past. Go to the My Forms tab of the accounts and have an additional copy of the record you will need.

When you are a fresh user of US Legal Forms, here are simple instructions that you can follow:

- Initially, make sure you have chosen the correct develop to your metropolis/region. You are able to examine the form making use of the Review option and browse the form outline to guarantee it will be the best for you.

- If the develop will not fulfill your requirements, utilize the Seach industry to find the correct develop.

- Once you are certain that the form is acceptable, click on the Acquire now option to obtain the develop.

- Opt for the pricing strategy you would like and enter in the necessary information. Make your accounts and pay for an order utilizing your PayPal accounts or Visa or Mastercard.

- Opt for the submit structure and download the legal record format for your product.

- Comprehensive, change and print out and indicator the received Michigan Sample Letter for Return of Documents.

US Legal Forms is definitely the most significant library of legal kinds for which you will find a variety of record layouts. Take advantage of the company to download expertly-manufactured files that follow state specifications.

Form popularity

FAQ

The Michigan Department of Treasury withholds income tax refunds or credits for payment of certain debts, such as delinquent taxes, state agency debts, garnishments, probate or child support orders, overpayment of unemployment benefits and IRS levies on individual income tax refunds.

Taxes are calculated differently in each state, with some states having flat tax rates, some having no income tax but other taxes, and others using graduated tax rates. Reasons for owing state taxes can include changes in personal circumstances, job changes, side jobs, and eligibility for credits and deductions.

Payments can be made prior to receiving a Notice of Intent/Final Bill for Taxes Due by using the Michigan Individual Income Tax e-Payments system. You can also submit any late or partial payments by check or money order to Michigan Department of Treasury, P.O. Box 30774, Lansing MI 48929.

Every wage-earning person that lives or works in Michigan pays a flat 4.25% for Michigan state income tax. View more information about Michigan tax rates.

If you owe money to a federal agency and you did not pay it on time, you have a delinquent debt. You will receive a letter first from the agency to whom you owe the debt. If you do not pay the agency, the debt then goes to Treasury and we send you a letter about that debt.

We will send a letter/notice if: You have an unpaid balance. You are due a larger or smaller refund. We have a question about your tax return. We need to verify your identity.

To check the status of your Michigan state refund online, visit Michigan.gov. You may also call 1-517-636-4486. For e-filed returns: Allow two weeks from the date you received confirmation that your e-filed state return was accepted before checking for information.

Penalty is 5% of the total unpaid tax due for the first two months or portion thereof. After two months, 5% of the unpaid tax amount is assessed each month. The maximum late penalty is equal to 25% of the unpaid tax owed. What are the penalty charges for failure to file or pay?