Michigan Sample Letter for Replacement Check

Description

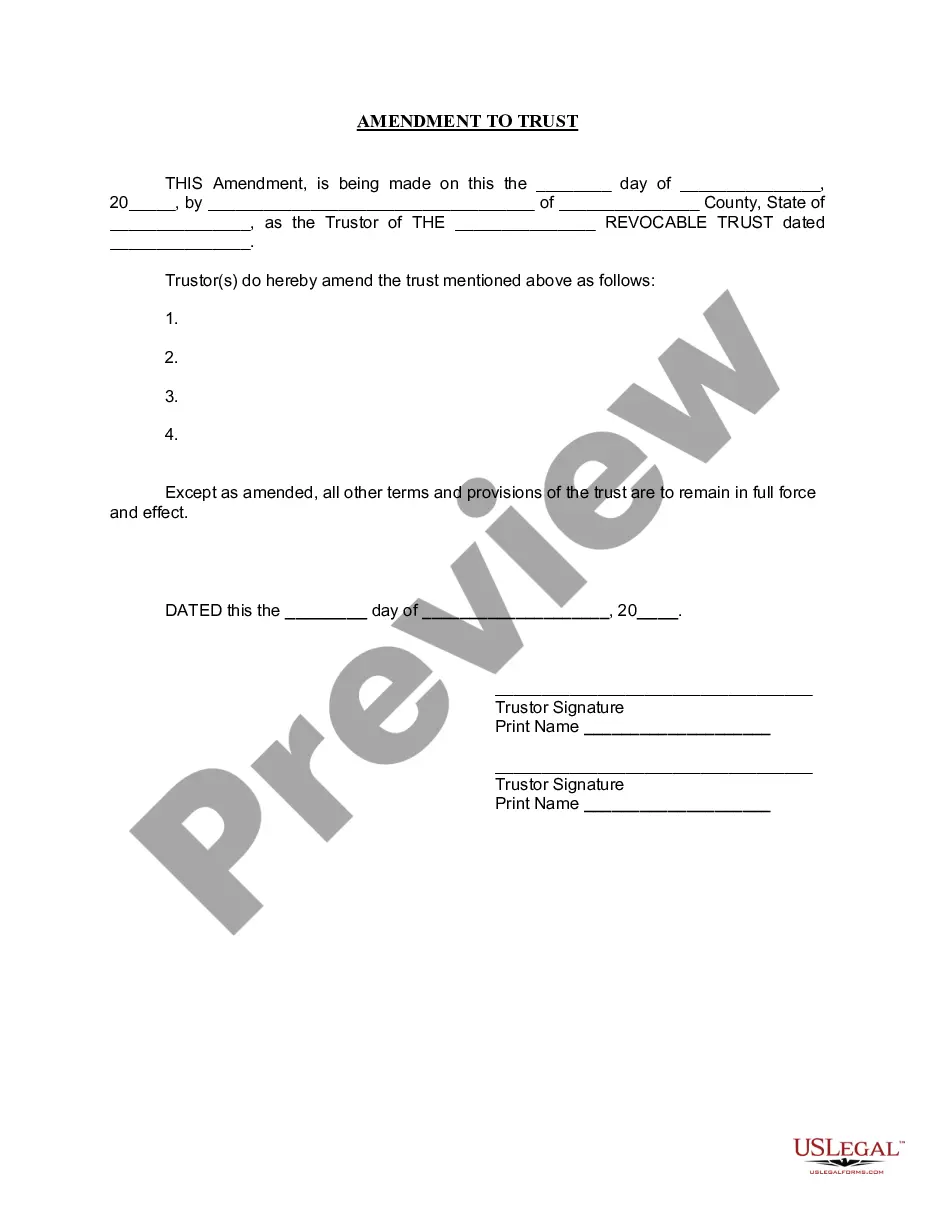

How to fill out Sample Letter For Replacement Check?

If you need to total, down load, or print legal papers themes, use US Legal Forms, the largest assortment of legal kinds, which can be found on the Internet. Use the site`s basic and handy search to find the papers you need. Various themes for enterprise and personal functions are sorted by groups and suggests, or key phrases. Use US Legal Forms to find the Michigan Sample Letter for Replacement Check in just a handful of clicks.

In case you are previously a US Legal Forms customer, log in to the account and click the Obtain button to have the Michigan Sample Letter for Replacement Check. You can even access kinds you formerly saved from the My Forms tab of your account.

If you are using US Legal Forms for the first time, follow the instructions below:

- Step 1. Ensure you have selected the form for that right city/nation.

- Step 2. Use the Review choice to check out the form`s articles. Never forget to read through the information.

- Step 3. In case you are unhappy together with the develop, make use of the Research industry on top of the monitor to locate other models of your legal develop format.

- Step 4. Upon having identified the form you need, click on the Get now button. Pick the rates prepare you like and add your credentials to register for an account.

- Step 5. Approach the deal. You can utilize your credit card or PayPal account to complete the deal.

- Step 6. Find the structure of your legal develop and down load it on the system.

- Step 7. Complete, modify and print or indicator the Michigan Sample Letter for Replacement Check.

Each and every legal papers format you acquire is the one you have eternally. You may have acces to each and every develop you saved inside your acccount. Go through the My Forms portion and choose a develop to print or down load again.

Contend and down load, and print the Michigan Sample Letter for Replacement Check with US Legal Forms. There are thousands of expert and express-specific kinds you can utilize for your enterprise or personal needs.

Form popularity

FAQ

Make your check payable to the "State of Michigan". Always write your unique identifier or federal identification number on your check. Write the type of tax and the tax year(s) you are paying on the check: Michigan Business tax (MBT); Income tax (IIT); Sales, Use or Withholding tax.

Prepare a cashier's check, personal check, or money order payable to State of Michigan. Include your name, last four digits of your Social Security number, and the invoice number on the remittance.

If you still have the remains of the check/draft, you can mail it to Michigan Department of Treasury with a request for a replacement. If you have moved, include your new address and daytime phone number. Allow 16 weeks for the replacement check/draft to be received.

All businesses are required to file an annual return each year. Remit withholding taxes on or before the same day as the federal payments regardless of the amount due. Payment must be made by EFT using an EFT Credit or EFT Debit payment method.

You can also submit any late or partial payments by check or money order to Michigan Department of Treasury, P.O. Box 30774, Lansing MI 48929. The check or money order should be made payable to 'State of Michigan'.

Make your check payable to the "State of Michigan". Always write your unique identifier or federal identification number on your check.

We will send a letter/notice if: You have an unpaid balance. You are due a larger or smaller refund. We have a question about your tax return. We need to verify your identity.

Individuals Include a copy of your notice, bill, or payment voucher. Make your check, money order, or cashier's check payable to Franchise Tax Board. Write either your FTB ID, SSN, or ITIN, and tax year on your payment. Mail to: Franchise Tax Board PO Box 942867. Sacramento CA 94267-0001.