Michigan Subsidiary Guaranty Agreement

Description

How to fill out Subsidiary Guaranty Agreement?

Locating the appropriate legal document template can be a challenge. Of course, there are numerous templates available online, but how do you find the legal form you require.

Take advantage of the US Legal Forms website. The service offers thousands of templates, including the Michigan Subsidiary Guaranty Agreement, which you can utilize for both business and personal purposes. Each of the forms is reviewed by professionals and complies with federal and state requirements.

If you are already registered, Log In to your account and click on the Obtain button to acquire the Michigan Subsidiary Guaranty Agreement. Use your account to search through the legal forms you have previously purchased. Visit the My documents section of your account to download another copy of the document you need.

Complete, modify, print, and sign the acquired Michigan Subsidiary Guaranty Agreement. US Legal Forms is the largest collection of legal forms where you can find various document templates. Utilize the service to download properly crafted documents that adhere to state regulations.

- If you are a new user of US Legal Forms, here are simple steps that you can follow.

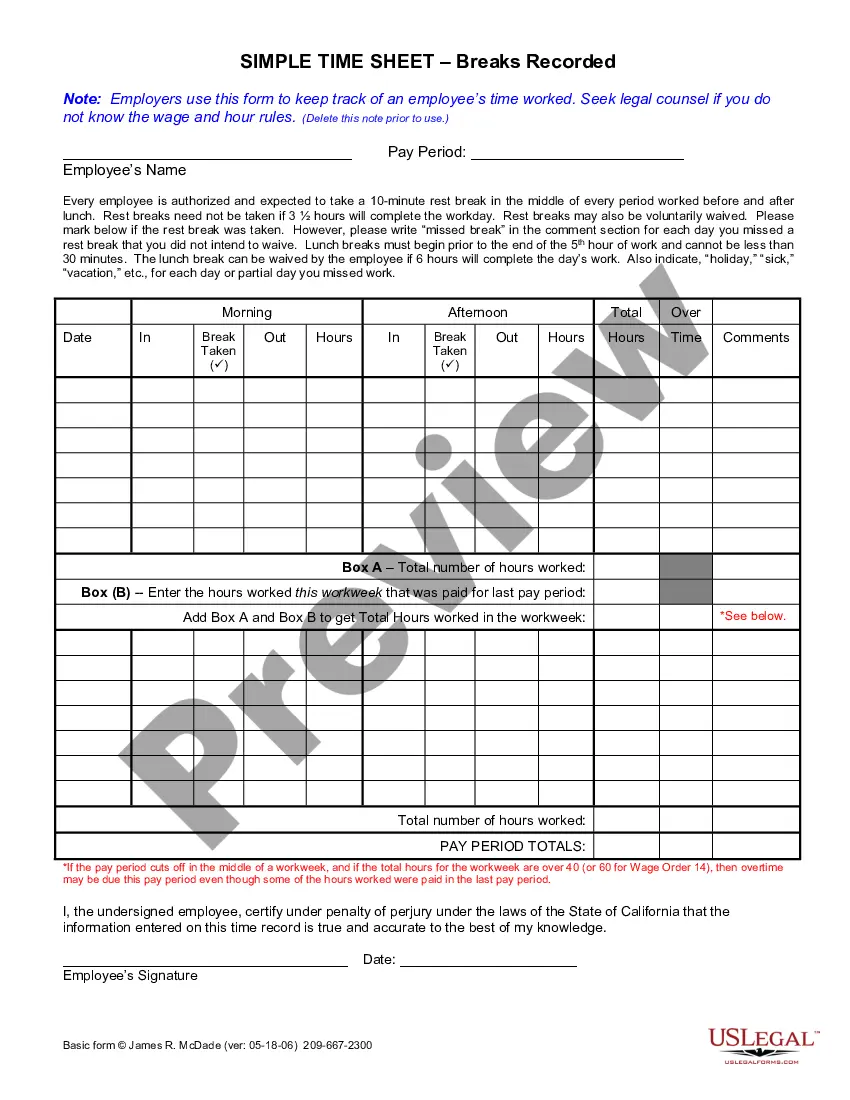

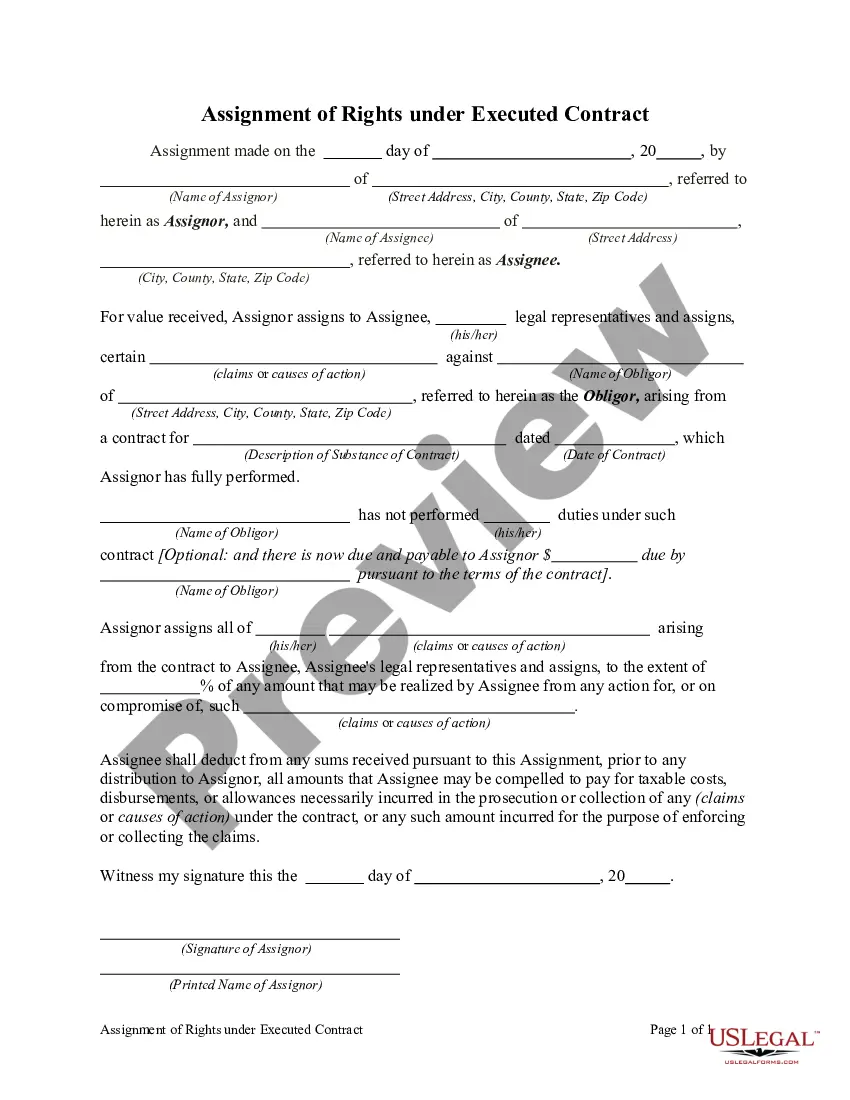

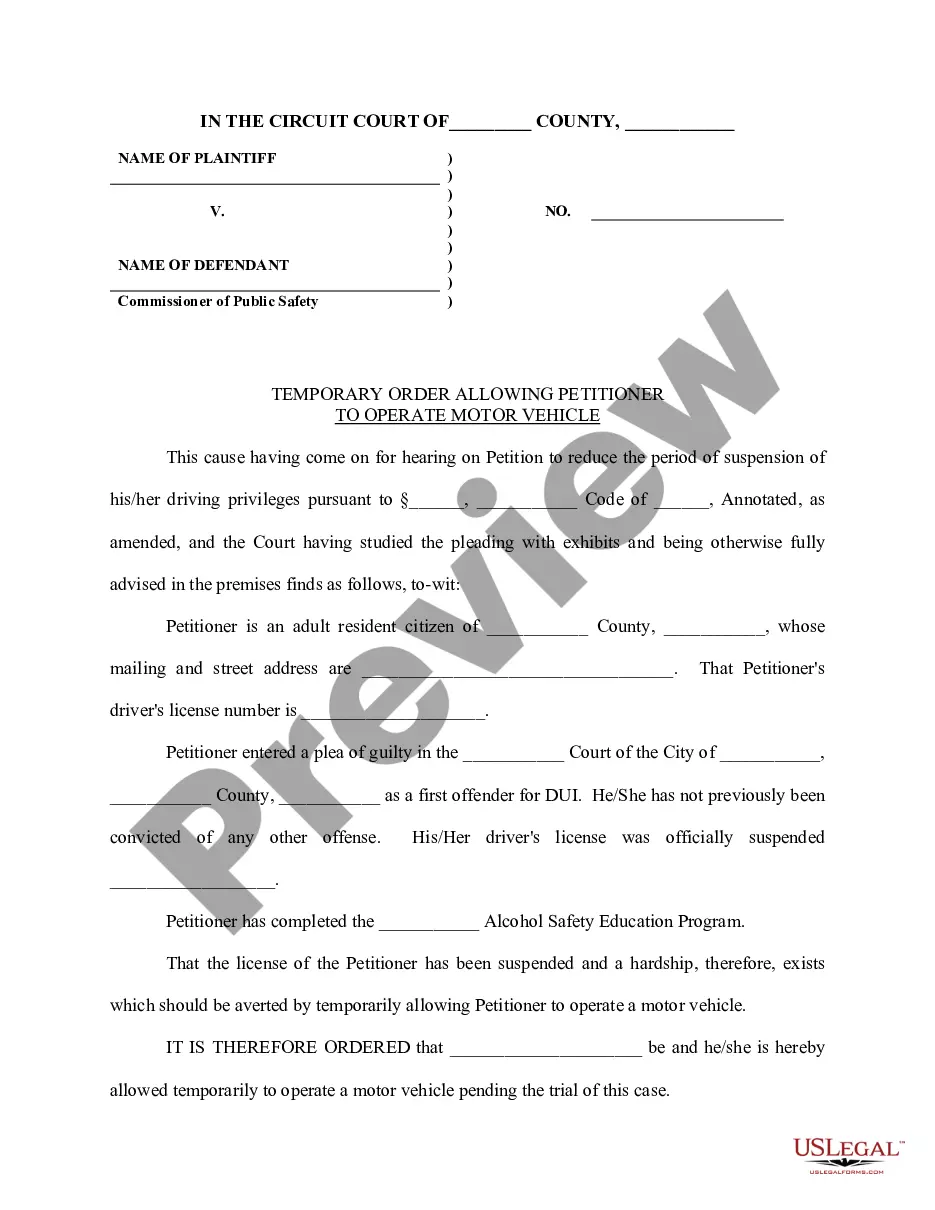

- First, ensure you have selected the correct form for your city/state. You can preview the form using the Review button and examine the form details to confirm it is suitable for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are confident that the form is right, click on the Buy now button to purchase the form.

- Select the pricing plan you want and fill in the required information. Create your account and pay for the transaction using your PayPal account or Visa or MasterCard.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

According to the Restatement, a party may enforce a guaranty under one of three theories: A promise to be surety for the performance of a contractual obligation, made to the obligee, is binding if: The promise is in writing and signed by the promisor and recites a purported consideration; or.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

A guarantor is a person, third party or organisation that agrees to guarantee your loan. The guarantee is a legal assurance given by the guarantor to pay the loan if the borrower defaults and is unable to pay.

A guarantee agreement definition is common in real estate and financial transactions. It concerns the agreement of a third party, called a guarantor, to provide assurance of payment in the event the party involved in the transaction fails to live up to their end of the bargain.

A guaranty agreement is a contract between two parties where one party agrees to pay a debt or perform a duty in the event that the original party fails to do so. The party who makes the guaranty is called the guarantor. An agreement of this nature is often used in real estate, insurance, or financial transactions.

A suretyship is an undertaking that the debt shall be paid; a guaranty, an undertaking that the debtor shall pay.

Guaranteed Loans vs. It's easy to confuse guaranteed loans with secured loans, but they aren't the same thing. Both types of loans are less risky to the lender, but the loans operate in different ways. A guaranteed loan is backed by a third party, and if the borrower defaults, the third party repays the loan.

A guaranty of payment is an independent agreement by a person or an entity to pay the loan when it goes into default. Even if the borrower is unable or unwilling to pay back the loan, the Bank can require the guarantor to pay it back.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

A guaranteed loan is a type of loan in which a third party agrees to pay if the borrower should default. A guaranteed loan is used by borrowers with poor credit or little in the way of financial resources; it enables financially unattractive candidates to qualify for a loan and assures that the lender won't lose money.