Michigan General Guaranty and Indemnification Agreement

Description

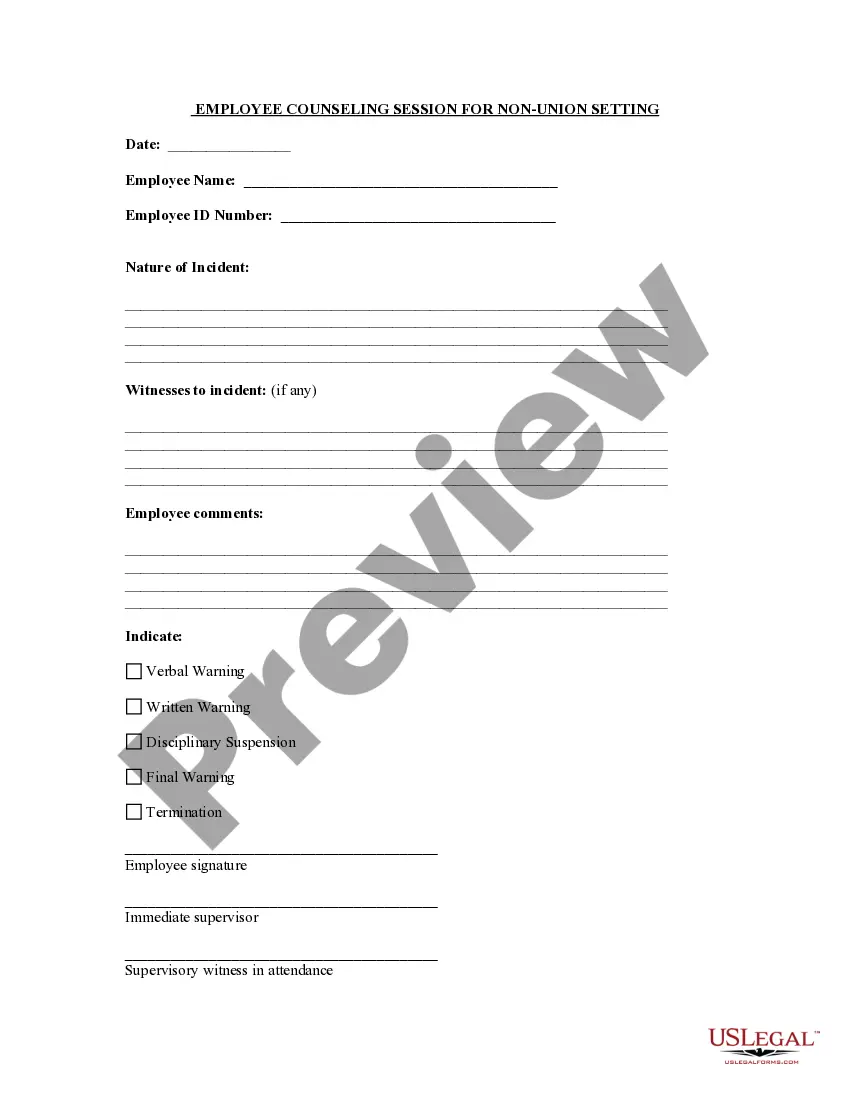

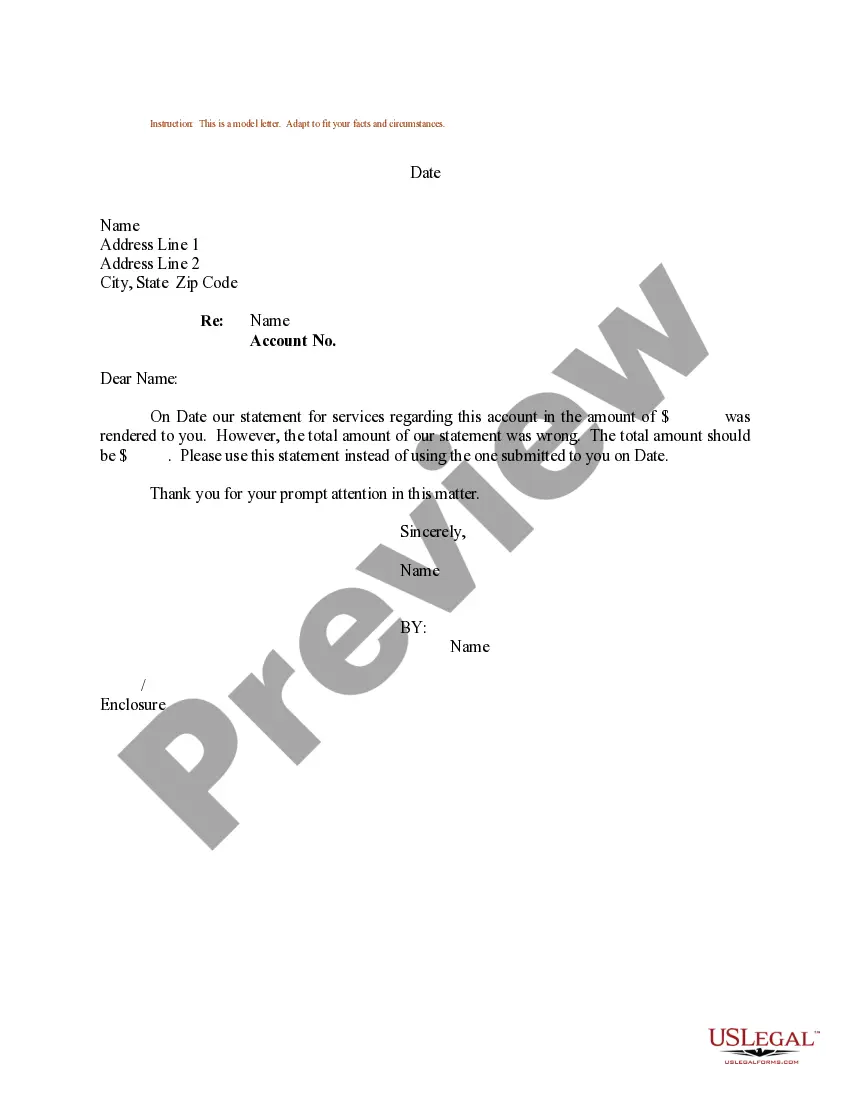

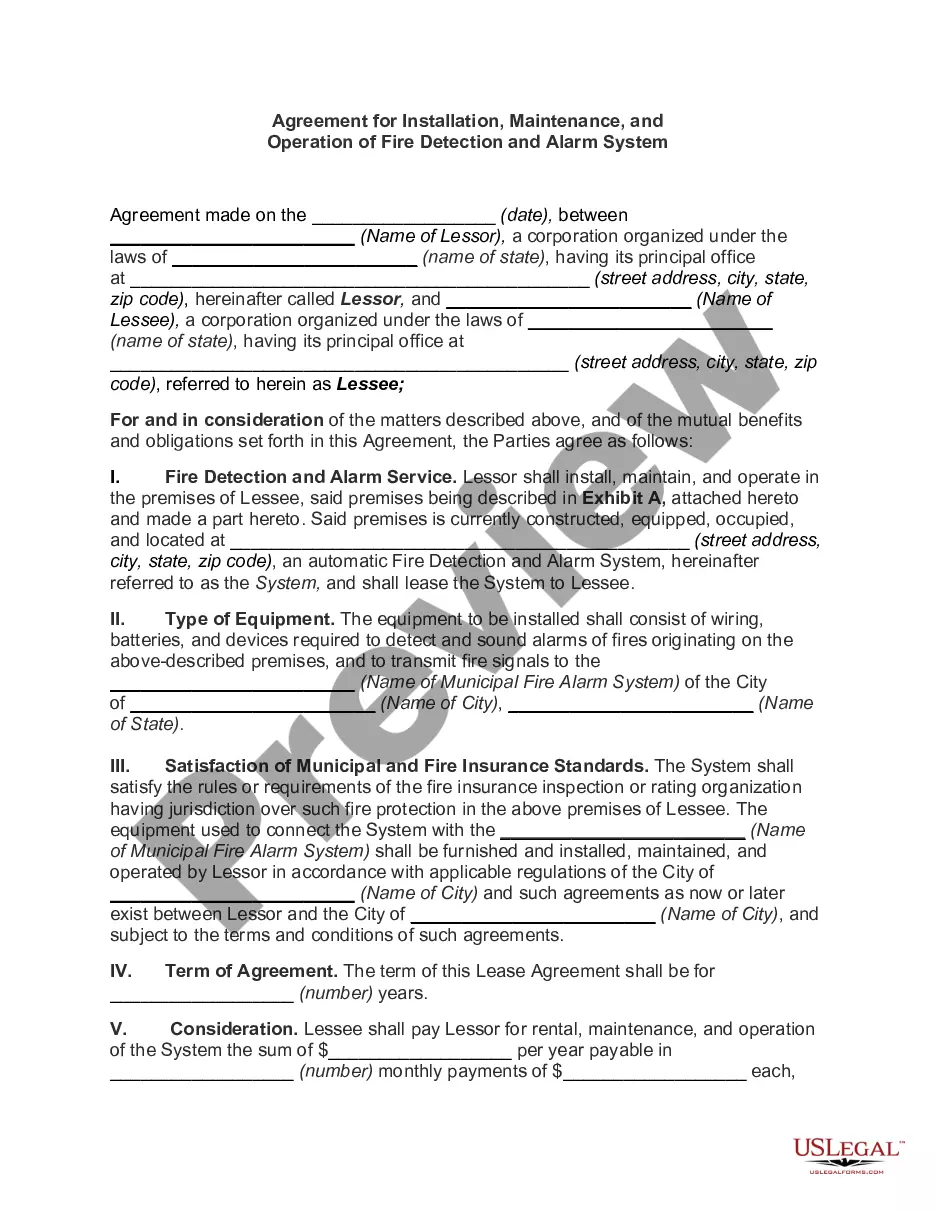

How to fill out General Guaranty And Indemnification Agreement?

Locating the suitable legal document template can be somewhat challenging.

Naturally, there exists a variety of templates accessible online, but how do you acquire the legal document you need.

Utilize the US Legal Forms website. The service offers a vast array of templates, including the Michigan General Guaranty and Indemnification Agreement, which can be utilized for both business and personal purposes.

You can examine the form using the Review button and read the description to ensure it is the right fit for you. If the document does not meet your needs, utilize the Search area to find the appropriate template.

- Each template is reviewed by experts and meets federal and state requirements.

- If you are already registered, Log In to your account and click on the Acquire button to locate the Michigan General Guaranty and Indemnification Agreement.

- Use your account to search for the legal documents you have previously purchased.

- Navigate to the My documents tab in your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, confirm that you have selected the correct document for your city/county.

Form popularity

FAQ

To have a guarantee and indemnity, you need three parties: Party One, Party Two, and a third party which can be a Guarantor and/or Indemnifier. Party One The person who enters the contract with Party Two.

The person who gives the guarantee is called the 'surety'; the person in respect of whose default the guarantee is given is called the 'principal debtor', and the person to whom the guarantee is given is called the 'creditor'. A guarantee may be either oral or written. "

The contract of indemnity is the contract where one person compensates for the loss of the other. Contract of guarantee is a contract between three people where the third person intervenes to pay the debt if the debtor is at default in paying back.

The key differences between guarantees and indemnities include: a guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

A guarantee is an agreement to meet someone else's agreement to do something usually to make a payment. An indemnity is an agreement to pay for a cost or reimburse a loss incurred by someone else.

In order for a guarantee to be valid it must meet certain requirements. There are no formal requirements for creating a valid indemnity, so it could be oral, or in writing but not signed.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

Indemnity is when one party promises to compensate the loss occurred to the other party, due to the act of the promisor or any other party. On the other hand, the guarantee is when a person assures the other party that he/she will perform the promise or fulfill the obligation of the third party, in case he/she default.

The key differences between guarantees and indemnities include: a guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

The person who gives the guarantee is called the "surety": the person in respect of whose default the guarantee is given is called the "principal debtor", and the person to whom the guarantee is given is called the "creditor".