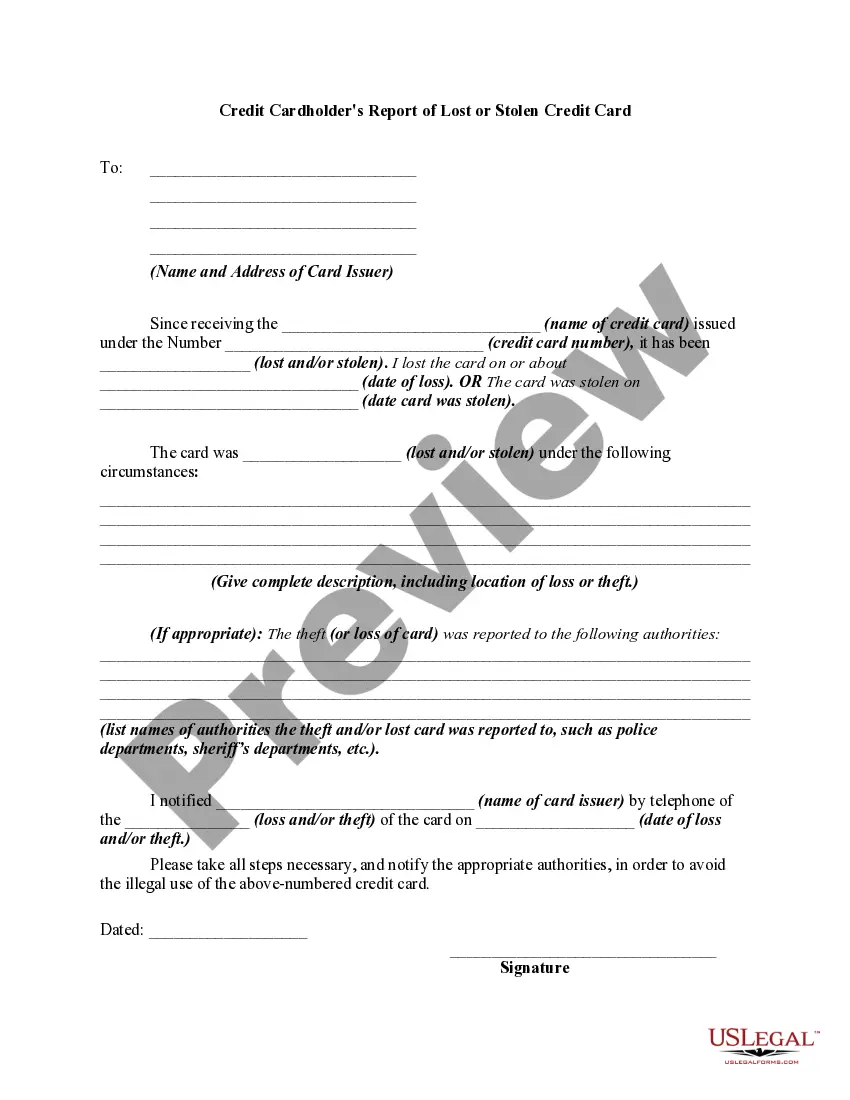

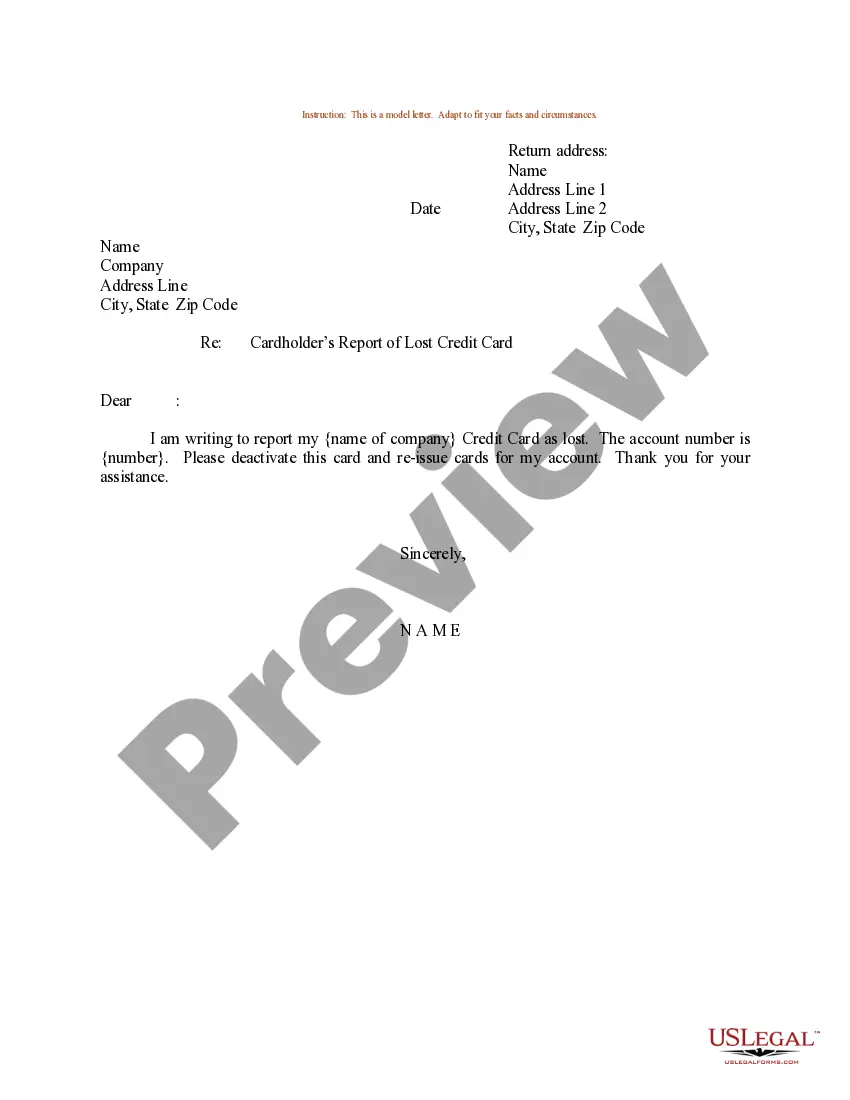

Michigan Sample Letter for Cardholder's Report of Lost Credit Card

Description

How to fill out Sample Letter For Cardholder's Report Of Lost Credit Card?

If you require extensive, acquire, or producing legal document templates, utilize US Legal Forms, the largest selection of legal forms, available online.

Leverage the website's quick and convenient search to locate the documents you need. Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Utilize US Legal Forms to find the Michigan Sample Letter for Cardholder's Report of Lost Credit Card with just a few clicks.

Every legal document format you purchase is yours indefinitely. You have access to every document you acquired with your account. Check the My documents section and choose a document to print or download again.

Complete and obtain, and print the Michigan Sample Letter for Cardholder's Report of Lost Credit Card with US Legal Forms. There are countless professional and state-specific forms you can utilize for your business or personal needs.

- If you are a US Legal Forms customer, Log In to your account and hit the Acquire button to get the Michigan Sample Letter for Cardholder's Report of Lost Credit Card.

- You can also access forms you have previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have chosen the form for the relevant city/region.

- Step 2. Use the Review option to examine the document's content. Remember to check the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other types in the legal document format.

- Step 4. Once you have found the necessary form, click on the Purchase now button. Select your preferred pricing plan and enter your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, edit and print or sign the Michigan Sample Letter for Cardholder's Report of Lost Credit Card.

Form popularity

FAQ

Quicker Is Better. To be subject only to the $50 liability, you have to report the loss or theft of a credit card within 60 days of receiving the statement on which fraudulent charges appear. Reporting the theft of your credit card quickly helps decrease your headaches.

If you lost your Capital One credit card, you should call them as soon as possible to report it at (800) 227-4825.

Key Takeaways. Replacing a lost or stolen credit card does not hurt your credit score, as the account age and other information is simply transferred to a new account. Most credit card issuers will not hold the cardholder responsible for fraudulent charges.

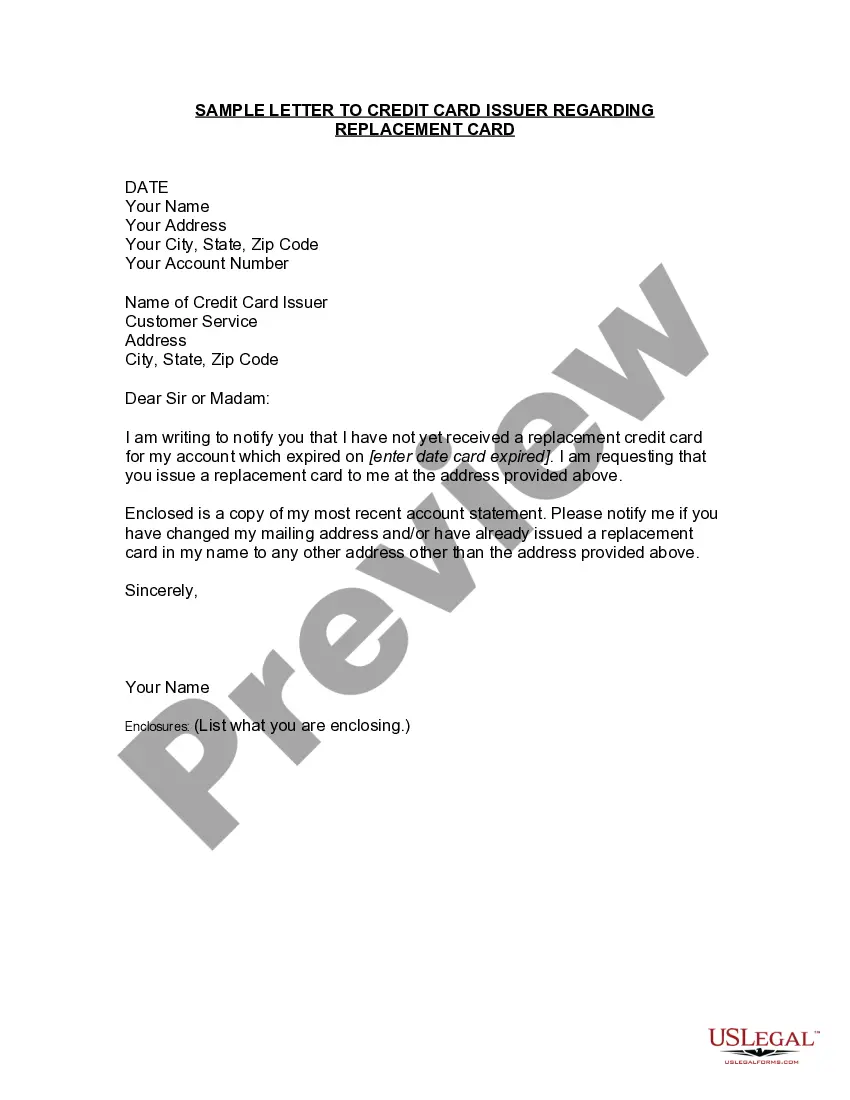

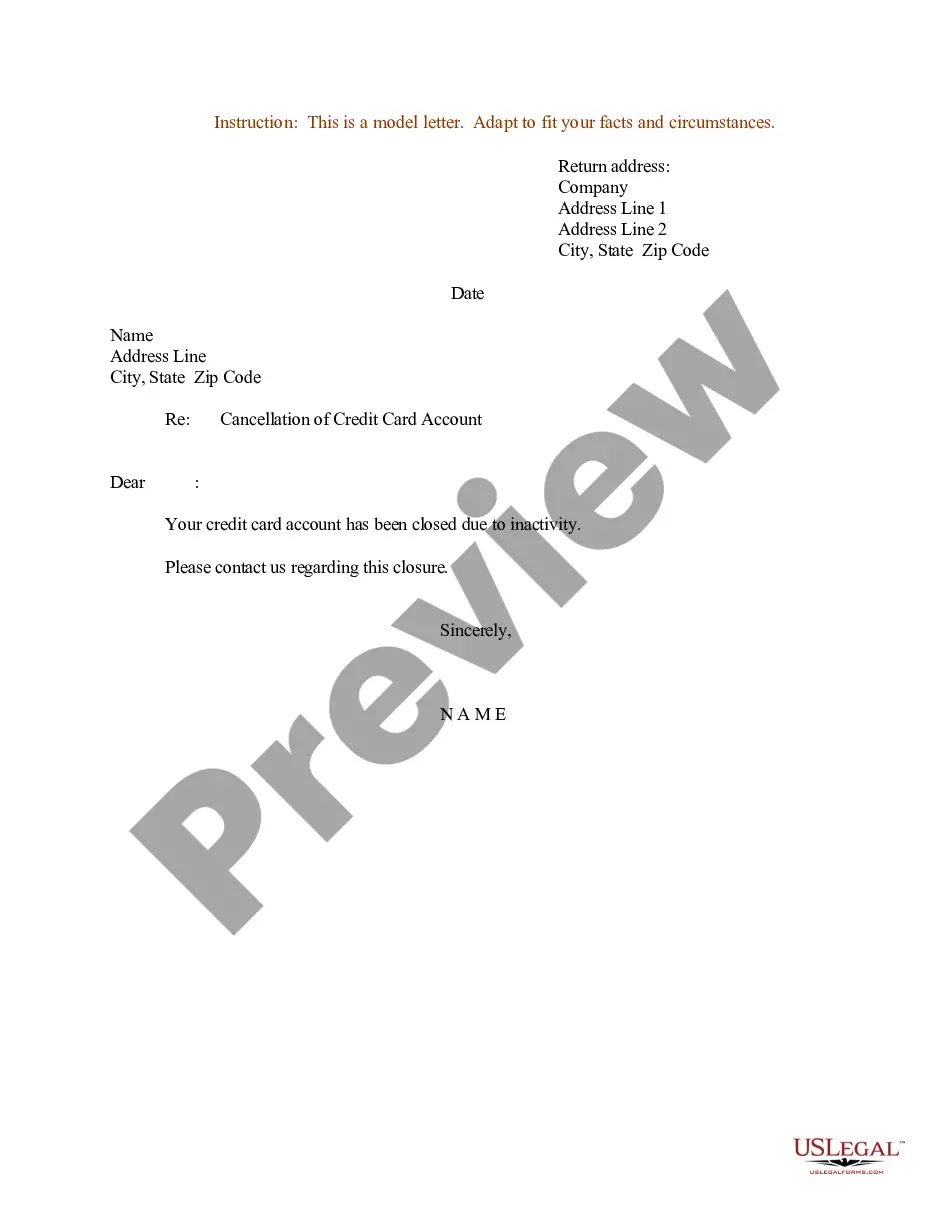

Your issuer will cancel your account and mail you a new credit card with a new account number. Make sure to update your mobile wallet if it also includes the lost card as a means of payment. Getting your lost card replaced should have no effect on your credit report or credit score.

This is to inform you that I recently lost or misplaced my ATM Card which is connected with my savings account with A/c No.: 02/123456. The lost card bore the number 1234 1234 1234 1234. I request you to please cancel that card and issue me a replacement card as early as possible.

I am writing to dispute a charge of $ to my credit or debit card account on date of the charge. The charge is in error because explain the problem briefly. For example, the items weren't delivered, I was overcharged, I returned the items, I did not buy the items, etc..

Reporting the Credit Card Fraud to Law Enforcement To begin this process, visit the Federal Trade Commission's IdentityTheft.gov website. The site will then give you the opportunity to file an identity theft report, which is used by law enforcement agencies in their investigation.

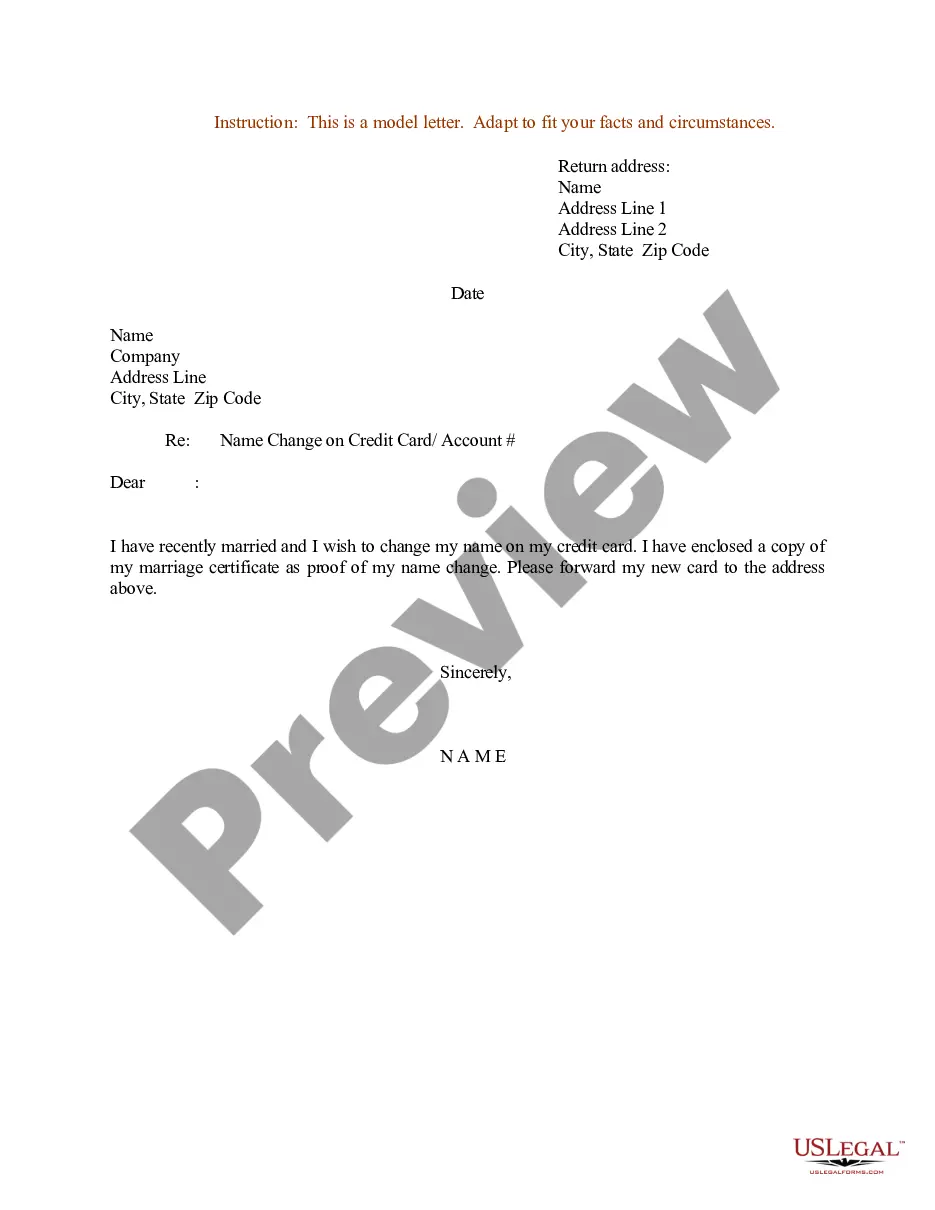

This is to inform you that I (Name) having a (name of credit card) credit card with your bank has lost the credit card bearing number (credit card number). I request you to kindly deactivate the card and stop all the transactions through the card to avoid misuse.

Firstly, inform the bank of the damaged Credit Card. You can call the Customer Care number and report that your Credit Card has been damaged. The bank will then hotlist the damaged Credit Card. Once you report the damaged Credit Card, you can raise a request with the bank to replace damaged Credit Card with a new one.

Call your credit card issuer Call your credit card issuer immediately to report the loss or theft of your missing card. Typically, you would check the back of the card for the telephone number to call. That's not an option when your card has been lost or stolen. Don't panic.