Michigan Sample Letter for Corrections to Credit Report

Description

How to fill out Sample Letter For Corrections To Credit Report?

Have you ever found yourself in a situation where you require documents for both professional and personal purposes almost every day.

There are many legal document templates available online, but finding forms you can rely on isn’t easy.

US Legal Forms offers thousands of form templates, including the Michigan Sample Letter for Corrections to Credit Report, which are designed to comply with state and federal regulations.

Choose a suitable document format and download your copy.

Retrieve all the document templates you have purchased in the My documents section. You can download another copy of the Michigan Sample Letter for Corrections to Credit Report anytime if needed. Simply select the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Next, you can download the Michigan Sample Letter for Corrections to Credit Report template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/region.

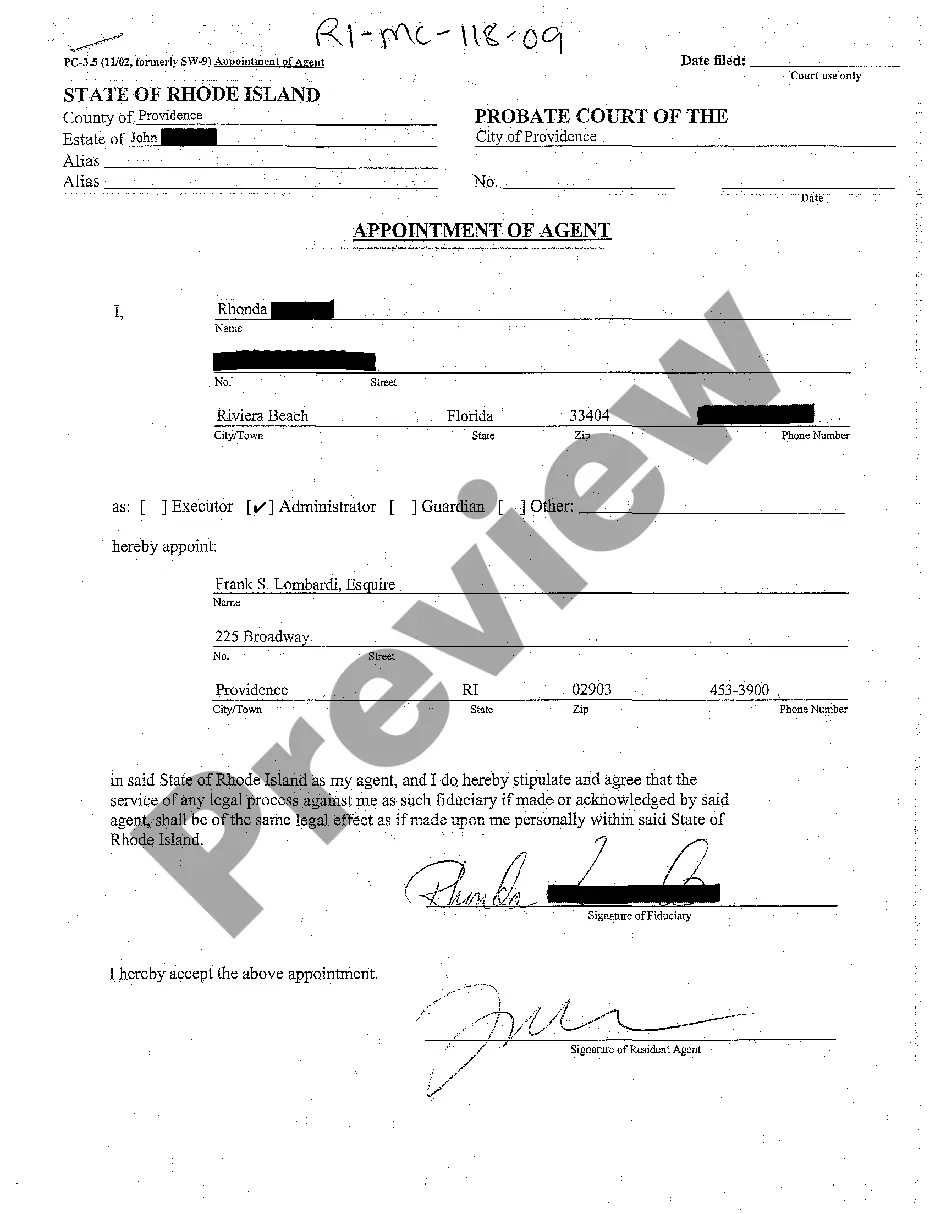

- Use the Review feature to check the form.

- Examine the details to confirm you have selected the appropriate form.

- If the form isn’t what you require, utilize the Search field to locate the form that meets your needs and requirements.

- Once you find the correct form, click Acquire now.

- Select the pricing plan you prefer, fill out the necessary information to create your account, and pay for your order using your PayPal or Visa/MasterCard.

Form popularity

FAQ

To write a letter disputing a credit report, start by gathering your credit report and identifying errors. Clearly explain the inaccuracies in your letter and provide any supporting documentation. Incorporating a Michigan Sample Letter for Corrections to Credit Report can streamline this process, as it offers a clear template and format to help present your case effectively.

To remove collections from your credit report, you can write a dispute letter to the credit reporting agency. In this letter, it’s essential to provide clear details about the collection item you believe is inaccurate. By using a Michigan Sample Letter for Corrections to Credit Report, you gain access to a proven format that increases your chances of successfully removing these negative items from your report.

A 623 letter is a formal letter you use to request the correction of inaccurate information based on the 623 credit law. This letter typically includes your identifying information, details about the disputed item, and a request for correction. Using a Michigan Sample Letter for Corrections to Credit Report as a guide can help you structure your letter effectively, ensuring you include all necessary information.

The 623 credit law refers to a part of the Fair Credit Reporting Act that gives consumers the right to dispute inaccurate information in their credit reports. Under this law, data furnishers must investigate disputes and provide accurate information. By utilizing a Michigan Sample Letter for Corrections to Credit Report, you can effectively assert your rights and compel credit reporting agencies and furnishers to rectify errors.

A strong reason to dispute a credit report is the presence of incorrect information, such as outdated accounts or identity errors. When you use a Michigan Sample Letter for Corrections to Credit Report, you can effectively communicate the inaccuracies you’ve found. Additionally, make sure to include any necessary documentation that backs your claim. This approach increases your chances of a successful correction.

The best dispute reason for a collection often centers around the validity of the debt. If you can argue that the debt is not yours, or if it has already been settled, you can build a strong case. Incorporating a Michigan Sample Letter for Corrections to Credit Report into your strategy can enhance the presentation of your dispute. Supporting your claim with documentation will further strengthen your position.

When you dispute a collection, it is helpful to clearly state that you believe the collection is incorrect. Reference specific details, like the account number and the reasons for your dispute. Leveraging a Michigan Sample Letter for Corrections to Credit Report can help you articulate your points effectively. This clarity fosters a more straightforward resolution process.

To write a letter disputing an item on your credit report, begin with a clear statement of your dispute. Utilize a Michigan Sample Letter for Corrections to Credit Report as a template to guide your writing. Include your personal information, details about the item you are disputing, and any supporting documentation. Lastly, keep your tone professional and concise to enhance your credibility.

To make corrections to your credit report, start by obtaining a copy of your report from a credit agency. Identify any errors, and then use a Michigan Sample Letter for Corrections to Credit Report to formally dispute these inaccuracies. Send your letter, along with any supporting documents, to the relevant credit bureau. This process ensures that your report reflects accurate information.

Adding a notice of correction to your credit report involves contacting the credit reporting agency and providing them with a formal request. This notice will explain any discrepancies and provide context for future lenders. Using the Michigan Sample Letter for Corrections to Credit Report from uslegalforms can make this task easier, ensuring you include all relevant information.