Michigan Sample Letter for Request for Free Credit Report Based on Denial of Credit

Description

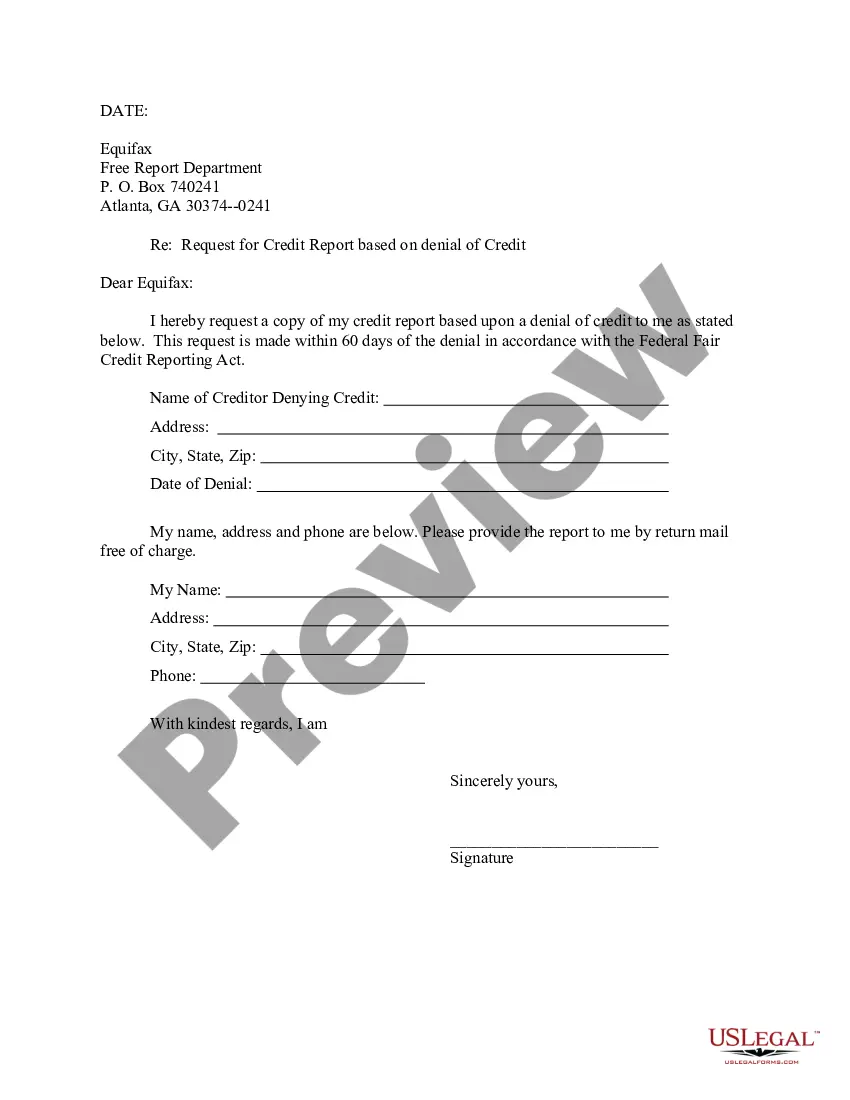

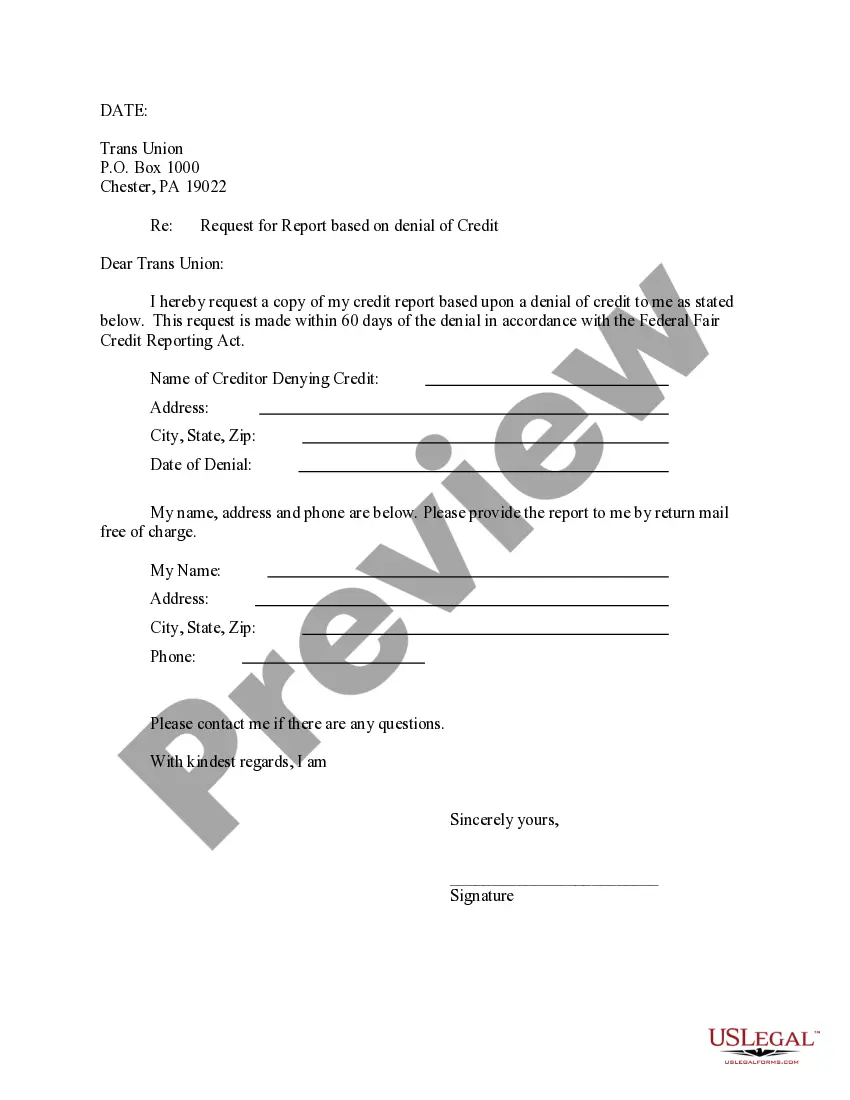

How to fill out Sample Letter For Request For Free Credit Report Based On Denial Of Credit?

If you wish to obtain, download, or print legitimate document templates, utilize US Legal Forms, the largest variety of legal forms available online.

Employ the site's straightforward and user-friendly search feature to locate the documents you require.

A selection of templates for business and personal purposes are organized by categories and states, or keywords.

Each legal document template you obtain is yours permanently. You have access to every form you downloaded in your account.

Click on the My documents section and select a form to print or download again.

- Use US Legal Forms to access the Michigan Sample Letter for Request for Free Credit Report Due to Denial of Credit with just a few clicks.

- If you are currently a US Legal Forms client, Log In to your account and click the Get button to find the Michigan Sample Letter for Request for Free Credit Report Due to Denial of Credit.

- You can also retrieve forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Make sure you have chosen the form for your correct city/state.

- Step 2. Use the Preview option to review the form's content. Don’t forget to check the outline.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. After you have located the form you need, click the Get now button. Select the pricing plan you prefer and fill in your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Michigan Sample Letter for Request for Free Credit Report Due to Denial of Credit.

Form popularity

FAQ

Yes, you can still get a free credit report when your application is declined, but you can only get a free report from the credit reporting company that provided the report upon which the decision was based.

Send a letter asking for the reasons behind your credit denial. Be sure to save a copy of the signed letter for proof in case they don't respond. Get the credit report. Every adverse action notice should include the identity of any credit bureau that provided credit information used to deny you credit.

The lender must give you instructions for requesting your credit report from that particular credit reporting company. Those instructions are usually included with the declination notice. If an Experian credit report was used, you can request your free report at .

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

You're entitled to one free copy of your credit report every 12 months from each of the three nationwide credit reporting companies. Order online from annualcreditreport.com, the only authorized website for free credit reports, or call 1-877-322-8228.

6 Things You Should Do If You've Been Denied CreditReview the Reason for the Denial.Plead Your Case.Check Your Credit Report and Credit Score.Address Credit Concerns.Apply With a Different Lender.Continue to Monitor Your Credit.Maintain a Long-Term Mindset.

A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It's named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices.

The credit report you get when you're denied credit is in addition to the annual credit report that you can order once a year from the three credit bureaus through AnnualCreditReport.com.

You are entitled to a free copy of your credit reportYou have the right to get a free copy of your credit report within 60 days of being denied credit. Simply contact the credit reporting agency that provided the credit report and ask for a free report. You can also get a free credit report every 12 months.