Michigan Agreement to Form Partnership in Future to Conduct Business

Description

How to fill out Agreement To Form Partnership In Future To Conduct Business?

Are you in a circumstance where you require paperwork for either business or personal purposes almost every workday.

There are many legitimate document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of document templates, including the Michigan Agreement to Form Partnership in Future to Conduct Business, designed to fulfill federal and state requirements.

Once you find the correct form, click Purchase now.

Choose your preferred payment plan, fill in the necessary details to create your account, and complete your order using PayPal or a credit card. Select a convenient document format and download your copy. You can find all the document templates you have purchased in the My documents list. You can acquire an additional copy of the Michigan Agreement to Form Partnership in Future to Conduct Business at any time, if desired. Simply follow the required form to download or print the document template. Use US Legal Forms, the largest collection of legal documents, to save time and avoid errors. The service provides well-crafted legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Michigan Agreement to Form Partnership in Future to Conduct Business template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the document you need and make sure it is for the correct area/state.

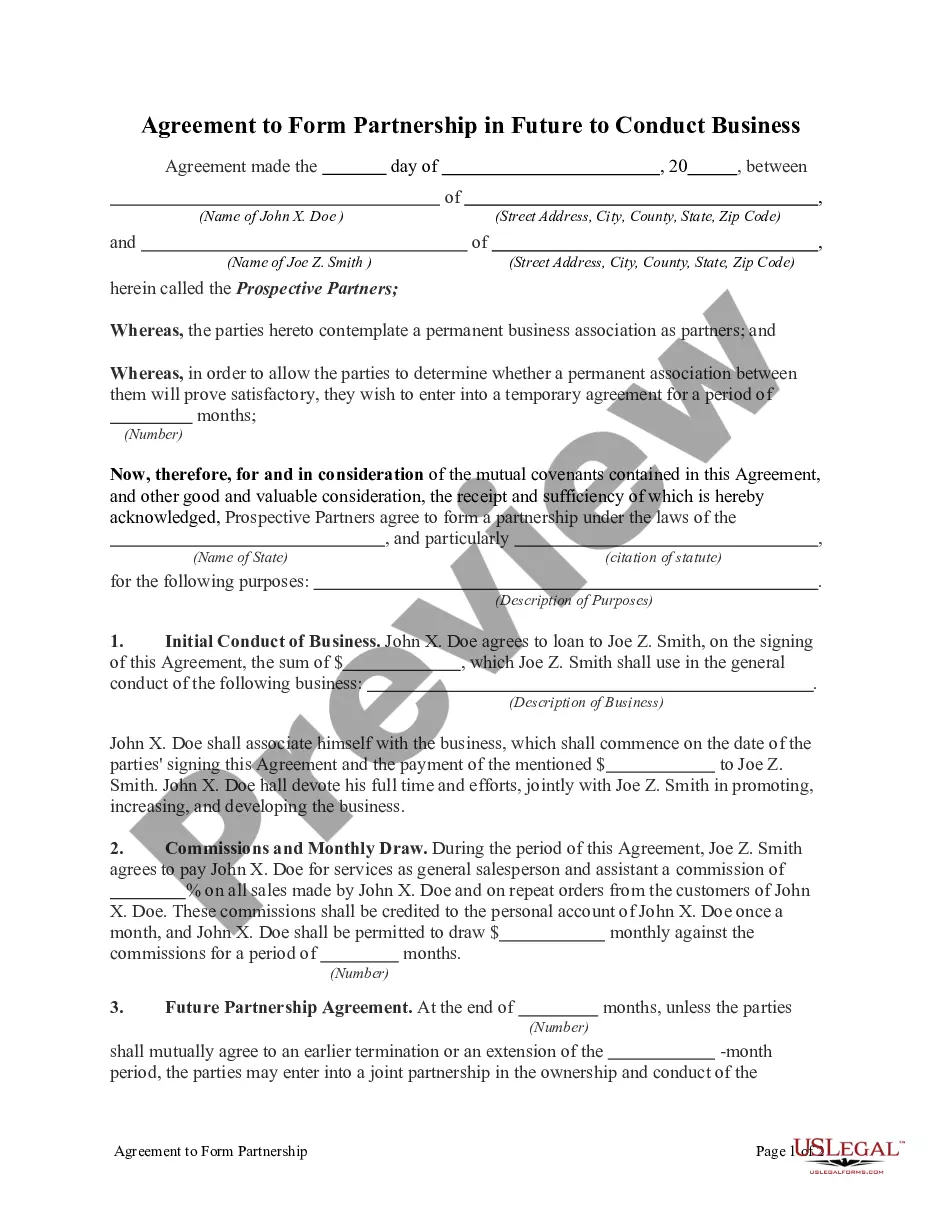

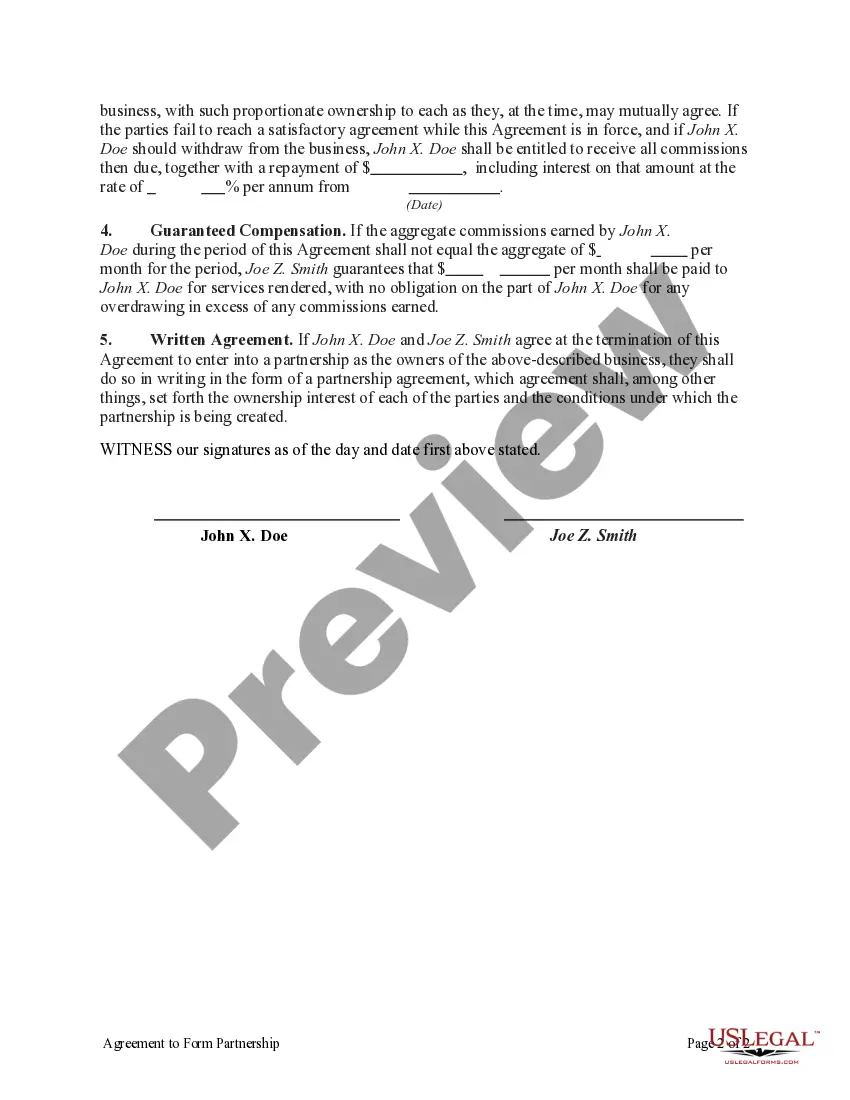

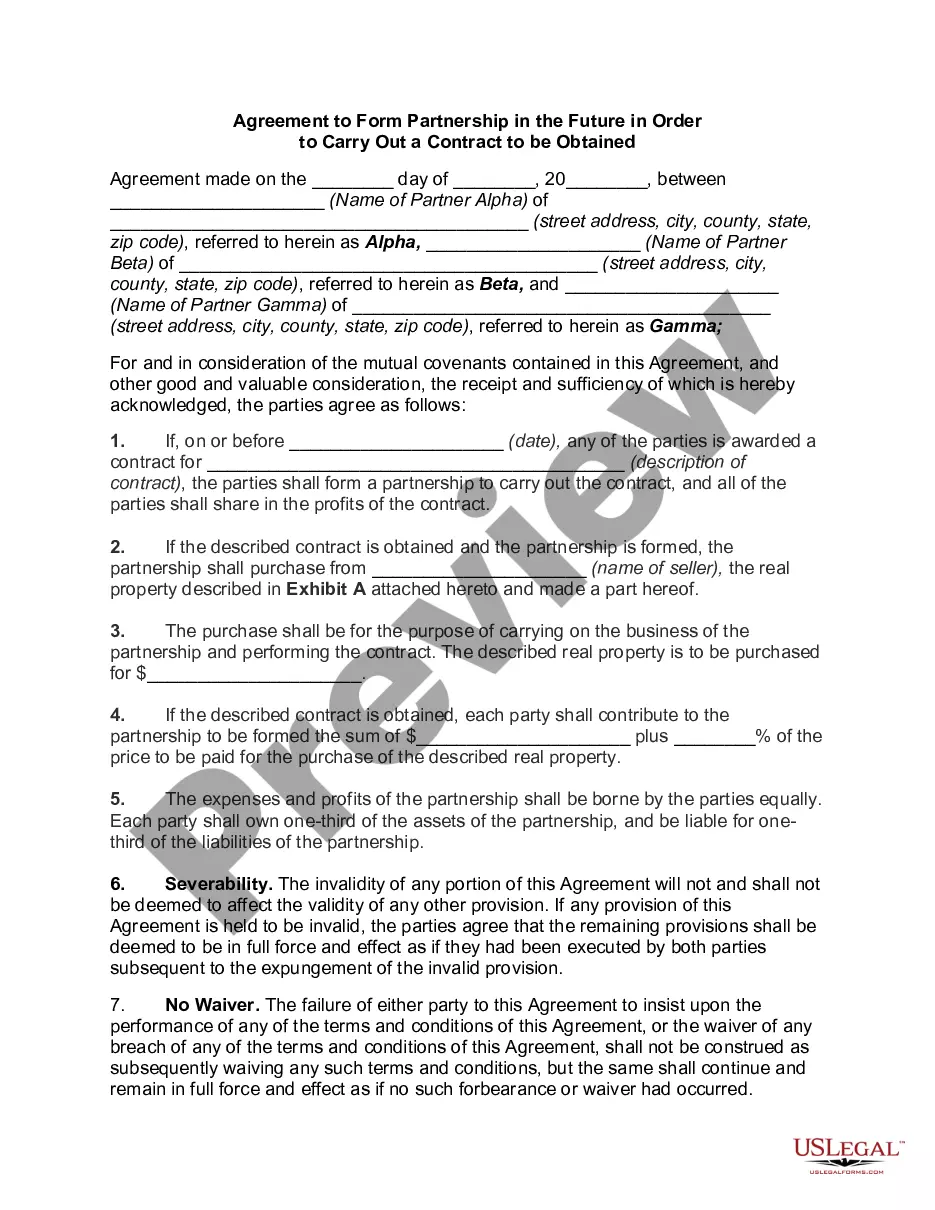

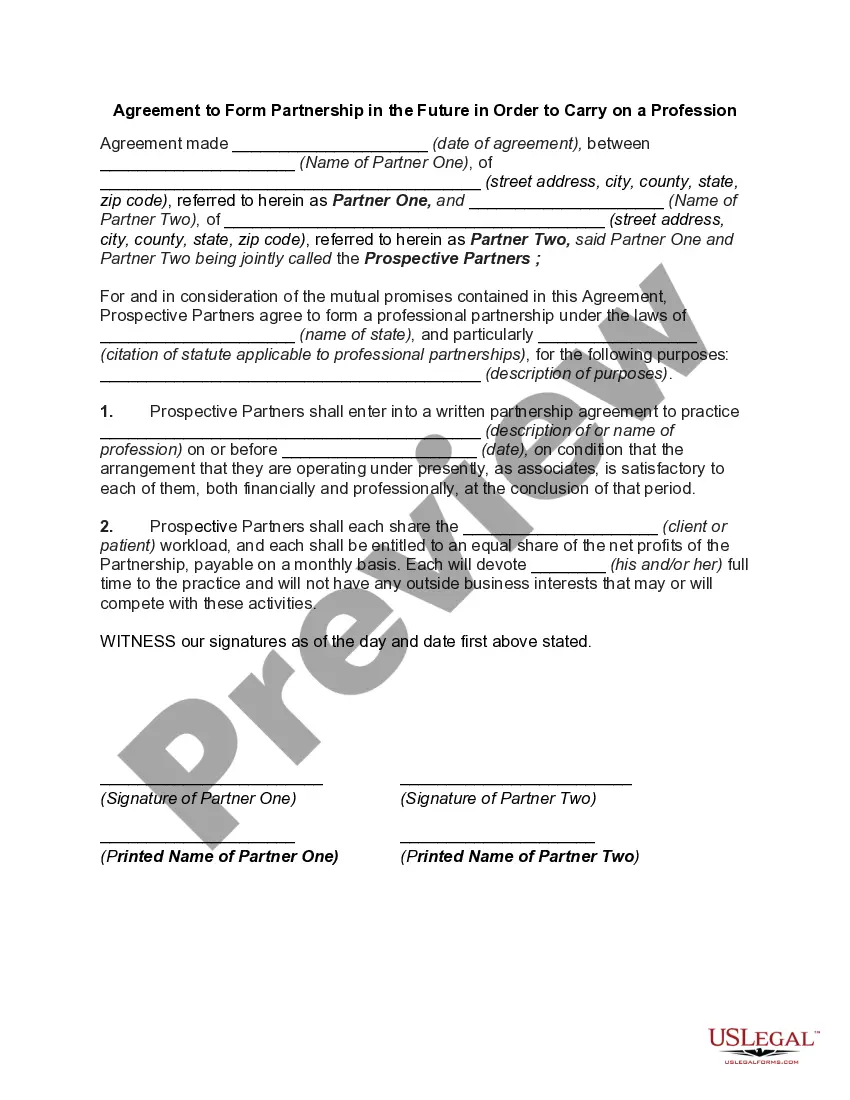

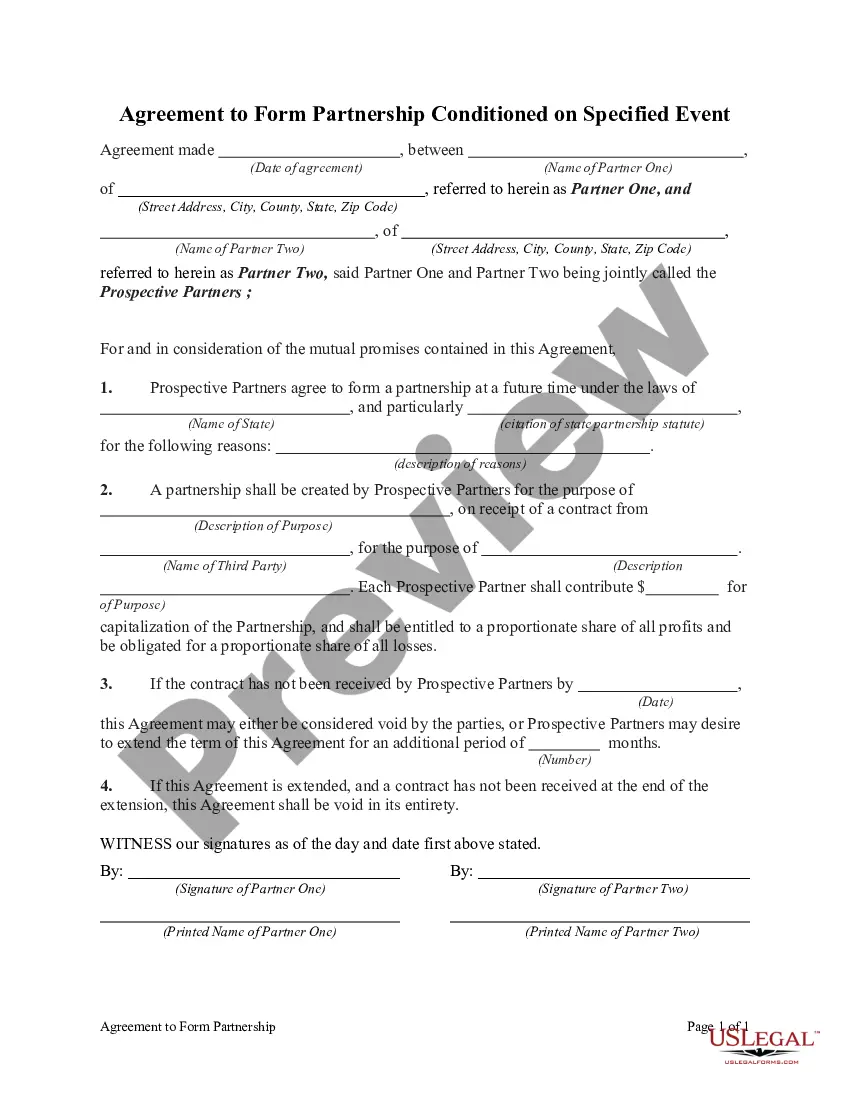

- Use the Preview button to review the form.

- Check the details to confirm that you have selected the right document.

- If the form is not what you require, utilize the Search field to find the document that meets your needs.

Form popularity

FAQ

While it's not legally required to have a written agreement to form a partnership in Michigan, it is highly recommended. A written agreement clearly outlines each partner's roles, responsibilities, and contributions, helping to prevent misunderstandings down the line. When you create a Michigan Agreement to Form Partnership in Future to Conduct Business, using a comprehensive written agreement can strengthen your partnership's foundation.

The four main types of partnerships include general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type has different implications regarding liability and management structure, essential to understand when forming a business. As you explore a Michigan Agreement to Form Partnership in Future to Conduct Business, identifying the right partnership type can support your strategic goals.

Yes, partnerships indeed have a filing requirement in Michigan. They must report their income and distribute it to the partners, who then report it on their personal tax returns. If you are addressing how to structure your enterprise, a Michigan Agreement to Form Partnership in Future to Conduct Business requires understanding these obligations to ensure compliance.

For businesses operating as partnerships in Michigan, the filing requirement includes submitting Form 5754, the Partnership Income Tax Return. This form must be filed by the due date, which is typically the 15th day of the fourth month following the close of the partnership's tax year. Being proactive about your filing obligations is essential when you establish a Michigan Agreement to Form Partnership in Future to Conduct Business.

In Michigan, partnerships are generally required to file an annual tax return. This filing reports the income generated by the partnership, as well as the individual partners' shares of that income. So, if you are involved in a Michigan Agreement to Form Partnership in Future to Conduct Business, keep this filing obligation in mind to avoid potential penalties.

To write a simple business partnership agreement, start by outlining the terms of the partnership, including the names of the partners and their respective contributions. Clearly define how profits and losses will be shared among partners. Additionally, include a Michigan Agreement to Form Partnership in Future to Conduct Business, which serves as a reliable reference for decision-making and dispute resolution in the future.

Creating a business partnership involves several clear steps. First, identify your business goals and find partners who share your vision. Next, discuss each partner’s roles, responsibilities, and contributions. Finally, formalize your understanding using a Michigan Agreement to Form Partnership in Future to Conduct Business to ensure clarity and legal protection.

To fill out a partnership form, you need to gather the necessary information, such as each partner's full name, roles, and contributions. Ensure you fill in details about the business's purpose and any financial arrangements. A Michigan Agreement to Form Partnership in Future to Conduct Business includes this information in a cohesive way, making it easy for partners to refer back to the original terms. Utilizing a reliable form template can streamline this process and ensure accuracy.

A partnership agreement should include partner names, business purpose, capital contributions, and profit and loss sharing methods. Additionally, outline decision-making procedures, dispute resolution mechanisms, and terms for dissolving the partnership. A comprehensive Michigan Agreement to Form Partnership in Future to Conduct Business covers these essential components, fostering a clear understanding among partners and minimizing the potential for conflict. Incorporating these elements can establish a strong foundation for your partnership.

To write a partnership agreement sample, start with an introduction that identifies the parties involved and the business purpose. Include sections on capital contributions, profit distribution, and the duration of the partnership. A well-structured Michigan Agreement to Form Partnership in Future to Conduct Business serves as a model that future partners can follow. Incorporating clear language helps ensure that all parties understand their rights and obligations.