Michigan Checklist - Possible Information System Strategies

Description

How to fill out Checklist - Possible Information System Strategies?

Are you presently in a situation where you require documentation for certain business or particular activities frequently? There are numerous legal document templates accessible online, but locating reliable ones can be challenging. US Legal Forms offers thousands of form templates, including the Michigan Checklist - Potential Information System Strategies, designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Michigan Checklist - Potential Information System Strategies template.

If you do not have an account and want to start using US Legal Forms, follow these instructions.

Access all of the document templates you have purchased in the My documents section. You can obtain an additional copy of the Michigan Checklist - Potential Information System Strategies at any time if needed. Just click on the required form to download or print the template.

Utilize US Legal Forms, one of the most extensive collections of legal documents, to save time and prevent mistakes. The service provides professionally created legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

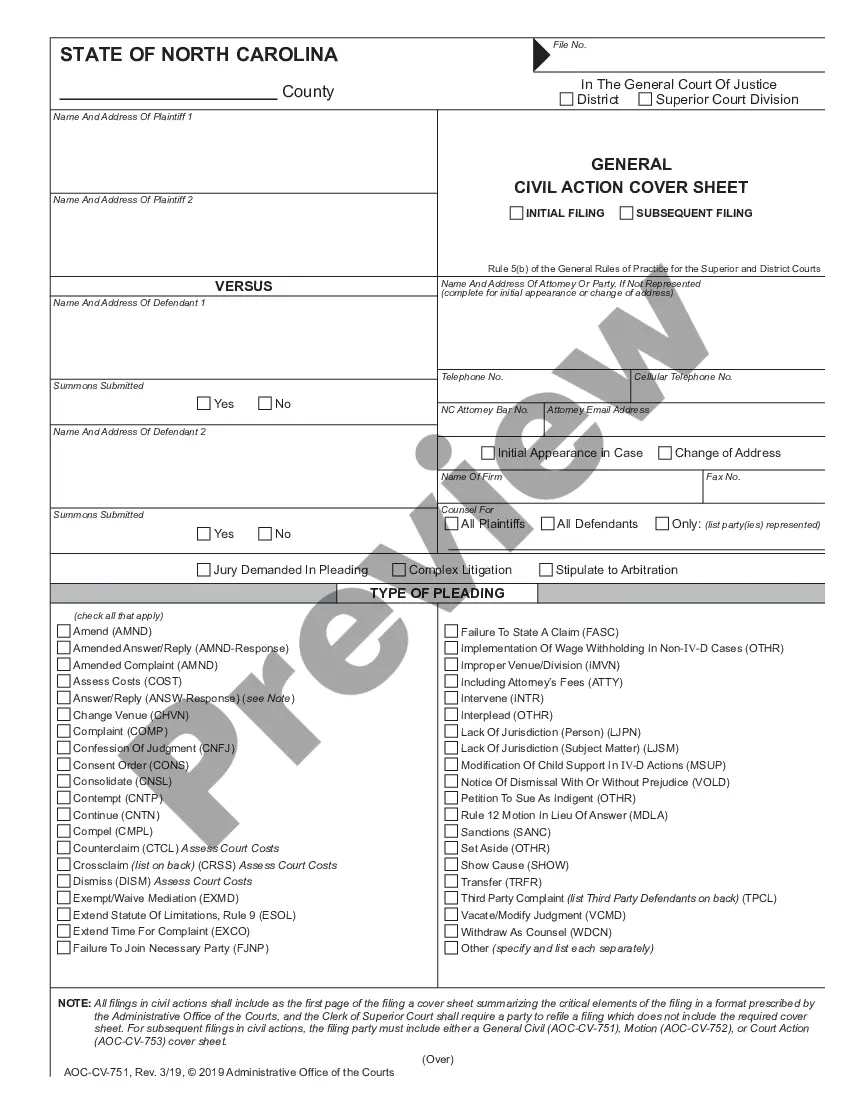

- Obtain the form you need and confirm it's for the correct state/region.

- Use the Review button to examine the form.

- Check the details to ensure you have selected the correct form.

- If the form isn't what you are after, use the Search area to find the form that suits your needs and requirements.

- Once you find the correct form, click on Buy now.

- Select the pricing plan you desire, fill in the necessary details to set up your account, and pay for the order using your PayPal or credit card.

- Choose a suitable file format and download your copy.

Form popularity

FAQ

Filing Form 163 in Michigan involves completing the form accurately and submitting it to the Michigan Department of Treasury. You can usually file this form electronically or by mailing a paper version, depending on your preference. For additional assistance with the entire filing process, uslegalforms can provide the necessary tools and templates. Don't forget to consult the Michigan Checklist - Possible Information System Strategies for best practices.

Yes, if you have made payments that require a 1099-NEC filing, you must submit this form to Michigan. This form is specifically for reporting nonemployee compensation, and it's essential for compliance with state tax laws. For more information on filing requirements, check out the resources from uslegalforms. They can assist you in understanding the Michigan Checklist - Possible Information System Strategies.

Yes, Michigan has a Freedom of Information Act (FOIA) that allows individuals to request access to public records. This act promotes transparency and accountability in government. If you are seeking specific information, you can use resources available through uslegalforms to guide you in your request. For a comprehensive view, refer to the Michigan Checklist - Possible Information System Strategies.

Yes, Michigan allows information filing for certain tax documents, which helps maintain compliance. This includes forms like 1099s and W-2s, which report various financial activities. Using the right filing processes can simplify your tax obligations, and platforms like uslegalforms can provide the assistance you need. For in-depth guidance, look into the Michigan Checklist - Possible Information System Strategies.

Filing requirements in Michigan depend on your income and tax situation. Generally, all residents and businesses must file if they meet certain income thresholds. To ensure you meet all requirements and deadlines, check out the tools and resources provided by uslegalforms, and always refer to the Michigan Checklist - Possible Information System Strategies for clarity.

Yes, Michigan offers e-file forms for various tax submissions, making it easier for you to file your returns electronically. Using the e-file option can save you time and help ensure accuracy. If you're managing multiple forms, uslegalforms can guide you on which e-file forms to use. This is all part of the Michigan Checklist - Possible Information System Strategies.

Filing Michigan flow through entity tax requires you to report your business income on Michigan tax forms. Generally, this involves submitting the appropriate forms with the Michigan Department of Treasury. You can find useful resources and instructions through uslegalforms, which can assist you in navigating the process. For a comprehensive understanding, refer to the Michigan Checklist - Possible Information System Strategies.